Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer the following case questions: 1. What are the primary issues faced by a small- or medium-sized company when it begins to export? 2. What

Answer the following case questions:

Answer the following case questions:

1. What are the primary issues faced by a small- or medium-sized company when it begins to export?

2. What are the primary objectives of Bruno & Company and the bottlenecks to achieving these objectives?

3. What are the financial needs of Bruno & Company?

4. What are the financial alternatives for Bruno & Company? Evaluate the pros and cons of each alternative?

5. Should the company continue to price its product only in US dollars?

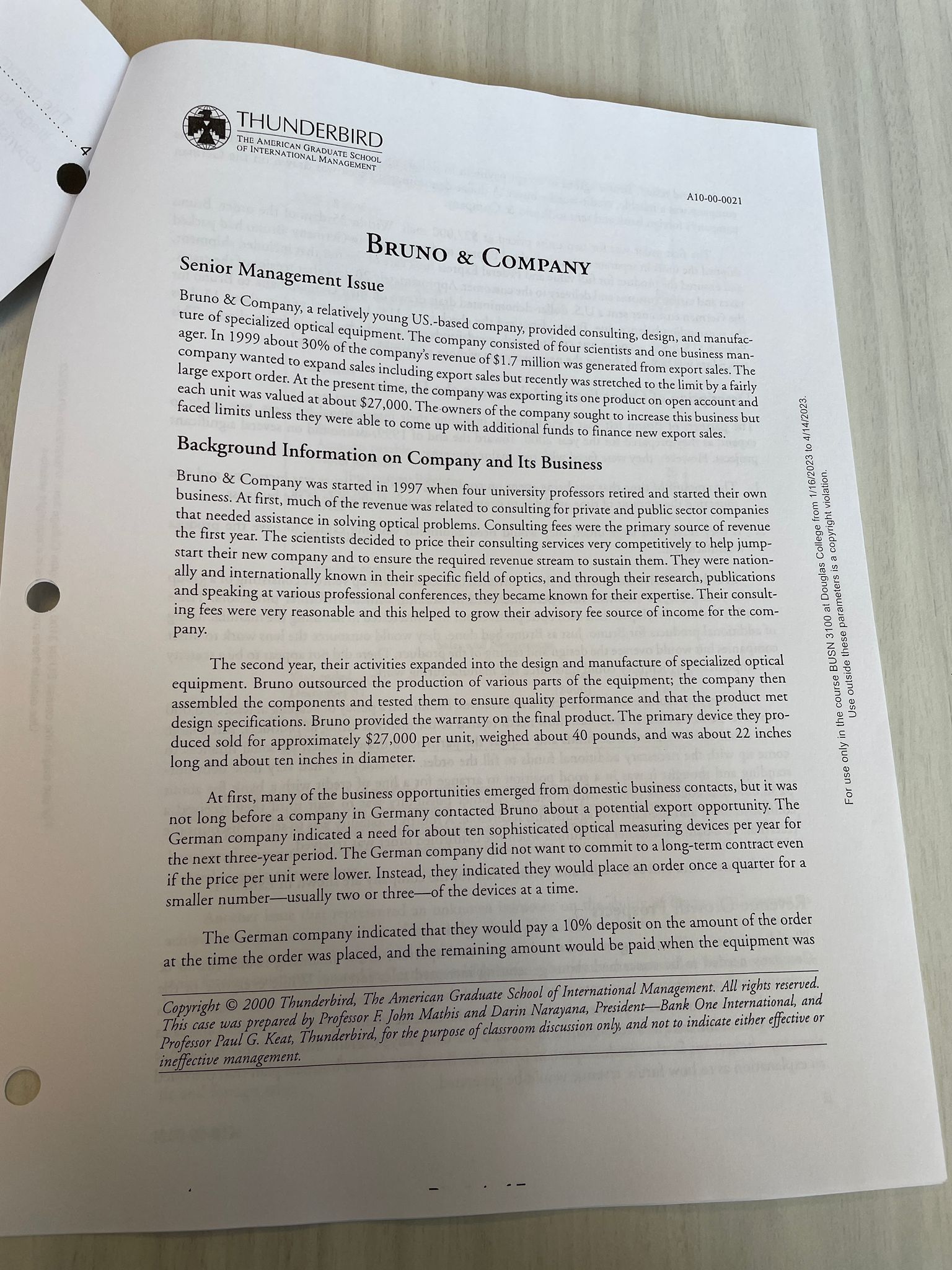

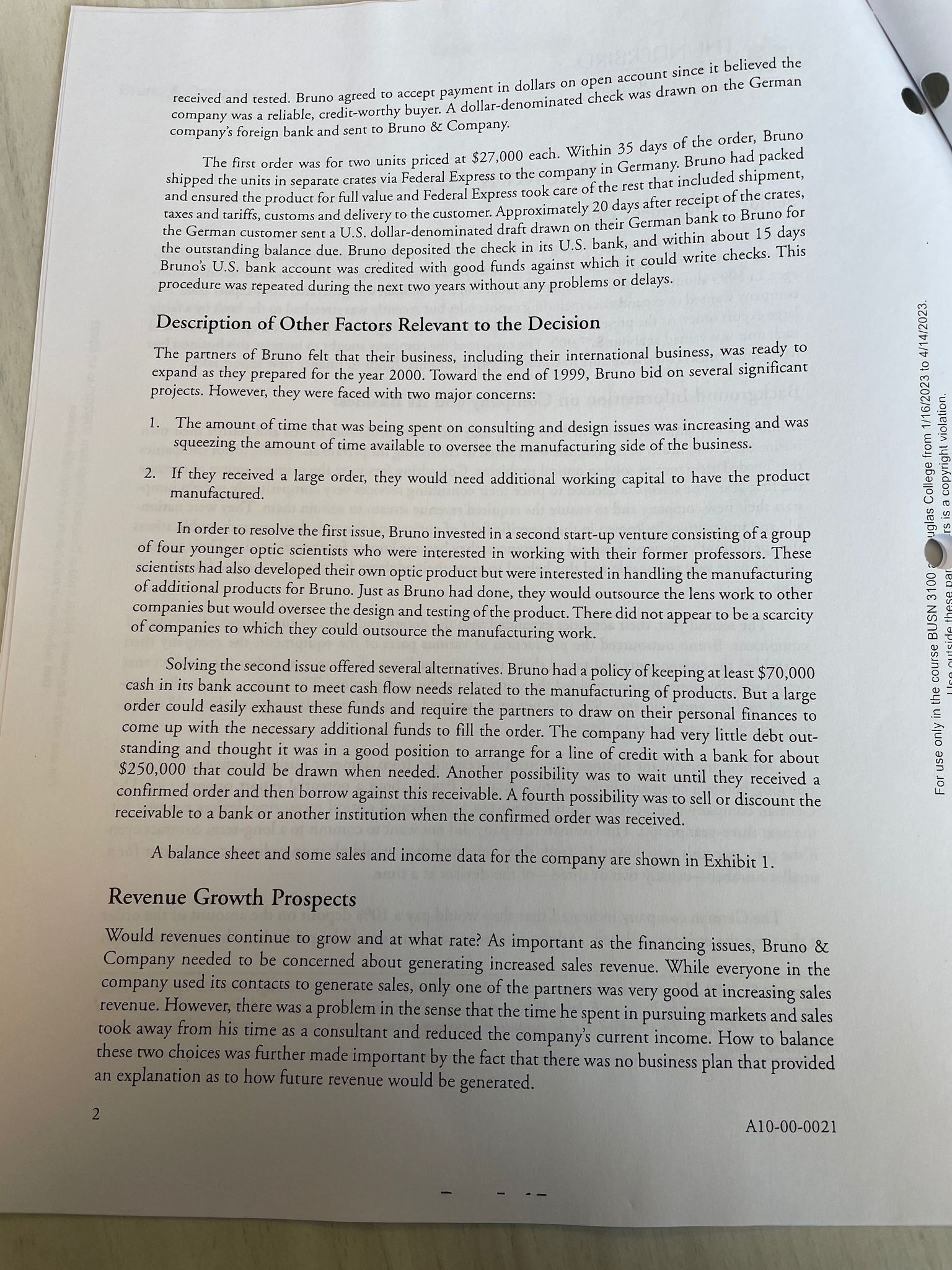

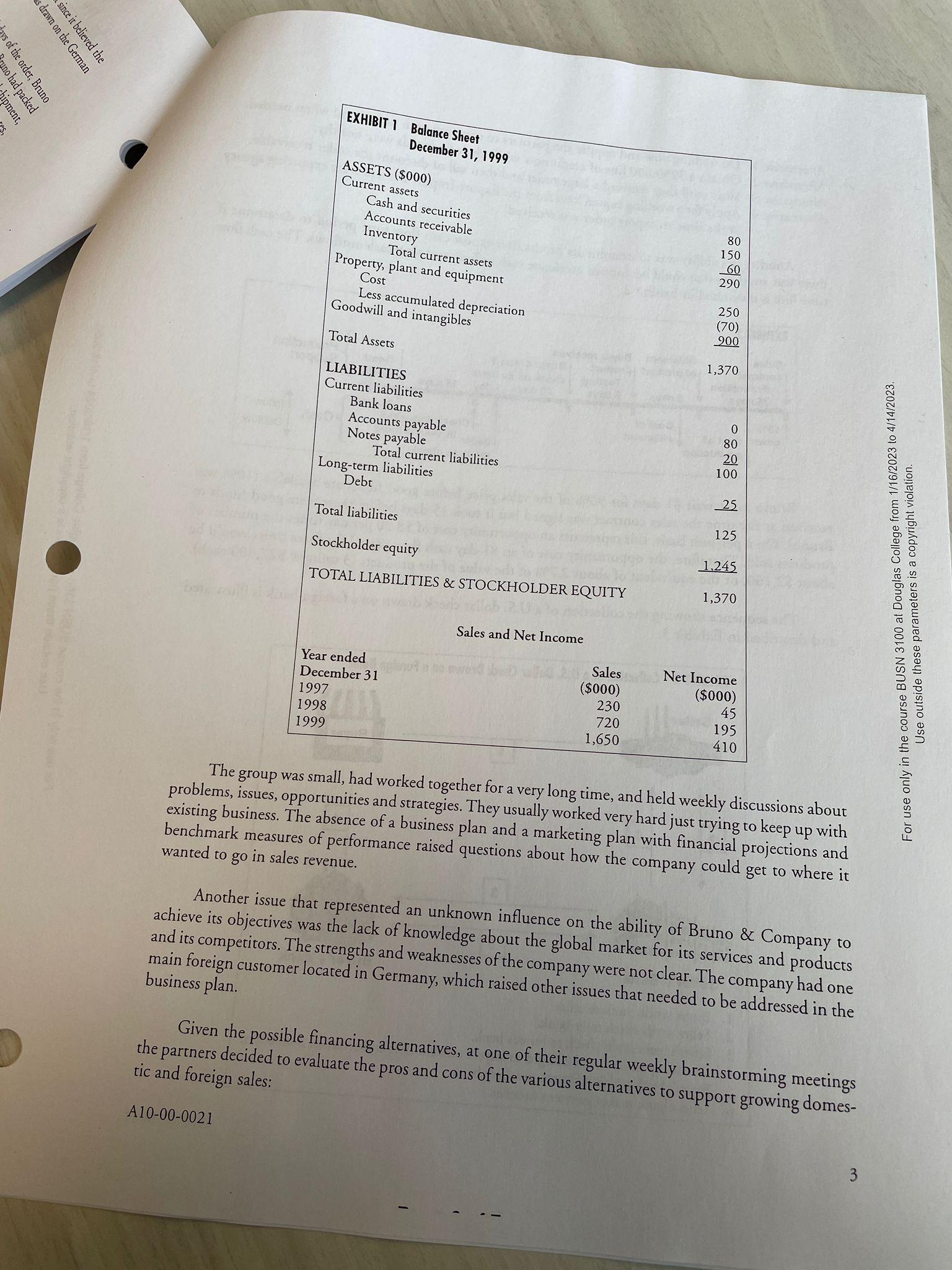

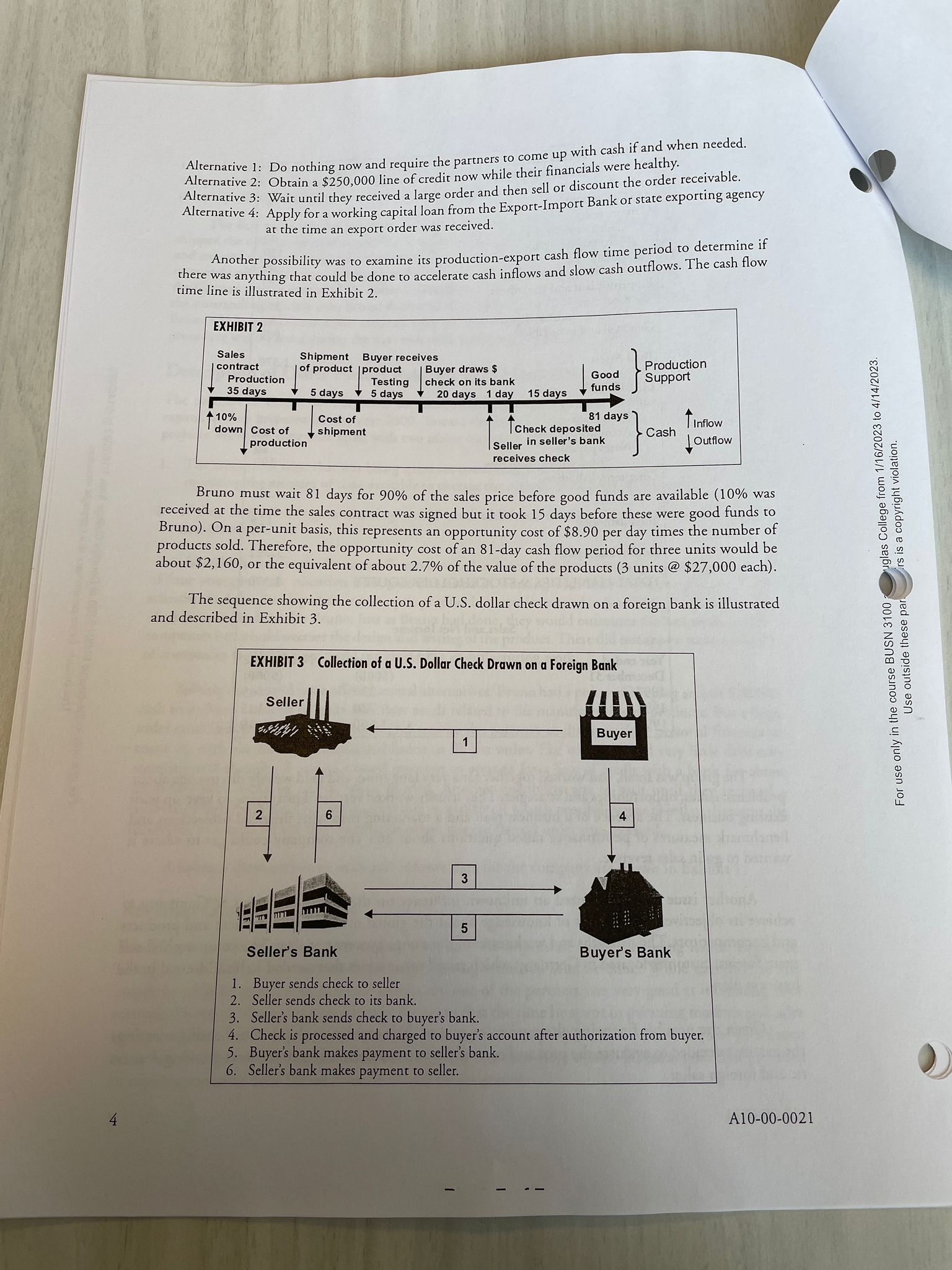

BRUNO \& COMPANY Senior Management Issue Bruno \& Company, a relatively young US.-based company, provided consulting, design, and manufacture of specialized optical equipment. The company consisted of four scientists and one business manager. In 1999 about 30% of the company's revenue of $1.7 million was generated from export sales. The large export order. At the present timeluding export sales but recently was stretched to the limit by a fairly each unit was valued at abresent time, the company was exporting its one product on open account and faced limits unless they were $27,000. The owners of the company sought to increase this business but to to finance new export sales. Bruno \& Company was started in 1997 when four university professors retired and started their own business. At first, much of the revenue was related to consulting for private and public sector companies that needed assistance in solving optical problems. Consulting fees were the primary source of revenue the first year. The scientists decided to price their consulting services very competitively to help jumpstart their new company and to ensure the required revenue stream to sustain them. They were nationally and internationally known in their specific field of optics, and through their research, publications and speaking at various professional conferences, they became known for their expertise. Their consulting fees were very reasonable and this helped to grow their advisory fee source of income for the company. The second year, their activities expanded into the design and manufacture of specialized optical equipment. Bruno outsourced the production of various parts of the equipment; the company then assembled the components and tested them to ensure quality performance and that the product met design specifications. Bruno provided the warranty on the final product. The primary device they produced sold for approximately $27,000 per unit, weighed about 40 pounds, and was about 22 inches long and about ten inches in diameter. At first, many of the business opportunities emerged from domestic business contacts, but it was not long before a company in Germany contacted Bruno about a potential export opportunity. The German company indicated a need for about ten sophisticated optical measuring devices per year for the next three-year period. The German company did not want to commit to a long-term contract even if the price per unit were lower. Instead, they indicated they would place an order once a quarter for a smaller number - usually two or three - of the devices at a time. The German company indicated that they would pay a 10% deposit on the amount of the order at the time the order was placed, and the remaining amount would be paid when the equipment was Copyright (C) 2000 Thunderbird, The American Graduate School of International Management. All rights reserved. This case was prepared by Professor F. John Mathis and Darin Narayana, President-Bank One International, and Professor Paul G. Keat, Thunderbird, for the purpose of classroom discussion only, and not to indicate either effective or ineffective management. received and tested. Bruno agreed to accept payment in dollars on open account since it believed the company was a reliable, credit-worthy buyer. A dollar-denominated check was drawn on the German company's foreign bank and sent to Bruno \& Company. The first order was for two units priced at $27,000 each. Within 35 days of the order, Bruno shipped the units in separate crates via Federal Express to the company in Germany. Bruno had packed and ensured the product for full value and Federal Express took care of the rest that included shipment, taxes and tariffs, customs and delivery to the customer. Approximately 20 days after receipt of the crates, the German customer sent a U.S. dollar-denominated draft drawn on their German bank to Bruno for the outstanding balance due. Bruno deposited the check in its U.S. bank, and within about 15 days Bruno's U.S. bank account was credited with good funds against which it could write checks. This procedure was repeated during the next two years without any problems or delays. Description of Other Factors Relevant to the Decision The partners of Bruno felt that their business, including their international business, was ready to expand as they prepared for the year 2000. Toward the end of 1999 , Bruno bid on several significant projects. However, they were faced with two major concerns: 1. The amount of time that was being spent on consulting and design issues was increasing and was squeezing the amount of time available to oversee the manufacturing side of the business. 2. If they received a large order, they would need additional working capital to have the product manufactured. In order to resolve the first issue, Bruno invested in a second start-up venture consisting of a group of four younger optic scientists who were interested in working with their former professors. These scientists had also developed their own optic product but were interested in handling the manufacturing of additional products for Bruno. Just as Bruno had done, they would outsource the lens work to other companies but would oversee the design and testing of the product. There did not appear to be a scarcity of companies to which they could outsource the manufacturing work. Solving the second issue offered several alternatives. Bruno had a policy of keeping at least $70,000 cash in its bank account to meet cash flow needs related to the manufacturing of products. But a large order could easily exhaust these funds and require the partners to draw on their personal finances to come up with the necessary additional funds to fill the order. The company had very little debt outstanding and thought it was in a good position to arrange for a line of credit with a bank for about $250,000 that could be drawn when needed. Another possibility was to wait until they received a confirmed order and then borrow against this receivable. A fourth possibility was to sell or discount the receivable to a bank or another institution when the confirmed order was received. A balance sheet and some sales and income data for the company are shown in Exhibit 1. Revenue Growth Prospects Would revenues continue to grow and at what rate? As important as the financing issues, Bruno \& Company needed to be concerned about generating increased sales revenue. While everyone in the company used its contacts to generate sales, only one of the partners was very good at increasing sales revenue. However, there was a problem in the sense that the time he spent in pursuing markets and sales took away from his time as a consultant and reduced the company's current income. How to balance these two choices was further made important by the fact that there was no business plan that provided an explanation as to how future revenue would be generated. 2 A10-00-0021 The group was small, had worked together for a very long time, and held weekly discussions about problems, issues, opportunities and strategies. They usually worked very hard just trying to keep up with benchmark measures of performance raised plan and a marketing plan with financial projections and wanted to go in sales revenue. Another issue that represented an unknown influence on the ability of Bruno \& Company to achieve its objectives was the lack of knowledge about the global market for its services and products main foreign customer located in Germany, whes of the company were not clear. The company had one which raised other issues that needed to be addressed in the Given the possible financing alternatives, at one of their regular weekly brainstorming meetings A10-00-0021 Alternative 1: Do nothing now and require the partners to come up with cash if and when needed. Alternative 2: Obtain a $250,000 line of credit now while their financials were healthy. Alternative 3: Wait until they received a large order and then sell or discount the order receivable. Alternative 4: Apply for a working capital loan from the Export-Import Bank or state exporting agency at the time an export order was received. Another possibility was to examine its production-export cash flow time period to determine if there was anything that could be done to accelerate cash inflows and slow cash outflows. The cash flow time line is illustrated in Exhibit 2. Bruno must wait 81 days for 90% of the sales price before good funds are available 10% was received at the time the sales contract was signed but it took 15 days before these were good funds to Bruno). On a per-unit basis, this represents an opportunity cost of $8.90 per day times the number of products sold. Therefore, the opportunity cost of an 81-day cash flow period for three units would be about $2,160, or the equivalent of about 2.7% of the value of the products ( 3 units @$27,000 each). The sequence showing the collection of a U.S. dollar check drawn on a foreign bank is illustrated and described in Exhibit 3. 1. Buyer sends check to seller 2. Seller sends check to its bank. 3. Seller's bank sends check to buyer's bank. 4. Check is processed and charged to buyer's account after authorization from buyer. 5. Buyer's bank makes payment to seller's bank. 6. Seller's bank makes payment to seller. A10-00-0021Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started