Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer the following case study ADDITIONAL INFORMATION: On 1 April 2 0 2 2 Aladdin Limited received its tax assessment for income tax for the

Answer the following case study

ADDITIONAL INFORMATION:

On April Aladdin Limited received its tax assessment for income tax for the year ended February which reflected an assessed amount of R The accountant calculated and provided income tax for the tax year as R The accountant agreed with the tax assessment and made the final payment on the same day to settle the amount due for the tax year.

Their accountant correctly calculated a Profit BEFORE tax of R but needs your help with the tax computation.

Included in Profit before tax are the following transactions for the year ended February :

tableTRANSACTIONNOTE,RANDDividends received,Exempt from tax,Donations paid,Not tax deductible,Profit on sale of machinery,See Additional Information Depreciation on machinery,See Additional Information Depreciation on admin buildings,tableNo wear and tear allowanceallowed by SAR.Depreciation on motor vehicles,tableAll vehicles were in use for thefull financial year.Note: A section e wearand tear allowance of Rper annum was allowed bySARS

A machinery was sold during the year. All disposal entries have been correctly recorded by the accountant. Details of the affected machine at the date of sale are as follows:

tableNoncapital profit,Capital gain,Taxable capital gain,Recoupment

The wear and tear allowance allowed by SARS for the current financial year relating the machinery amounts to R This is correctly calculated after taking into account the sale of the machine.

The following prepaid expenses, accrued expenses, income received in advance and accrued income appeared in the statement of financial position of Aladdin Limited at February These amounts were found to be taken correctly into account in the calculation of the profit before tax of RAs shown in

tableRANDPrepaid Expenses Water & Electricity,R Accrued Expenses Telephone,R Income Received in Advance Rent,R Accrued Income Interest on fixed deposit,R

Dividends paid by the company amounted to R for the year. Ignore dividend tax

Income tax and the inclusion rate for capital gains tax:

The tax rate was for the past two years. There are no temporary or permanent differences other than those which are apparent from the given information.

The inclusion rate for capital gains purposes is

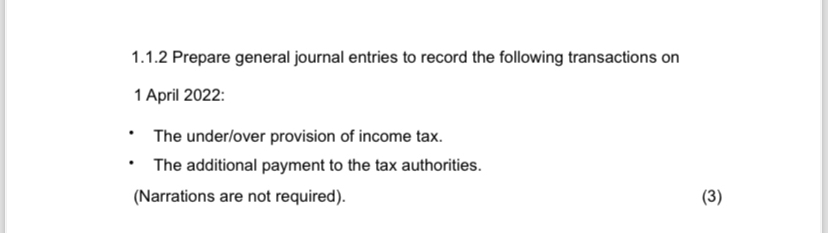

Prepare general journal entries to record the following transactions on

April :

The underover provision of income tax.

The additional payment to the tax authorities.

Narrations are not required according to SA law Financial Accounting

Aladdin Limited is a dynamic company at the forefront of the health and safety industry, specializing in the manufacture and sale of disinfecting sprays, foggers, and other sanitizing equipment. The emergence of global health crises in recent years has highlighted the importance of effective and efficient sanitization methods, propelling companies like Lockdown Limited to the center stage of public and private health defence strategies.

The company's financial year concludes on the th of February, aligning its reporting period with the end of the winter season in many regions, a critical time for the deployment of sanitizing solutions due to the increased incidence of communicable diseases.

During the fiscal year ending February Aladdin Limited faced a unique set of challenges and opportunities. The year was marked by a gradual decrease in global pandemicrelated restrictions, leading to varied demand fluctuations for sanitizing products across different markets. T

hese dynamics forced Aladdin Limited to reassess its manufacturing and distribution strategies to remain competitive and profitable.

The following is an extract from the Statement of Financial Position of Aladdin Limited for the year ended February :

tableRandCurrent assets:,Prepaid Expenses Water & Electricity,Accrued Income Interest on fixed deposit,Noncurrent liabilities:,Deferred tax,Current liabilities:,Current tax payable: Income tax,Income Received in Advance Rent,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started