Answer the following problem and show the solution

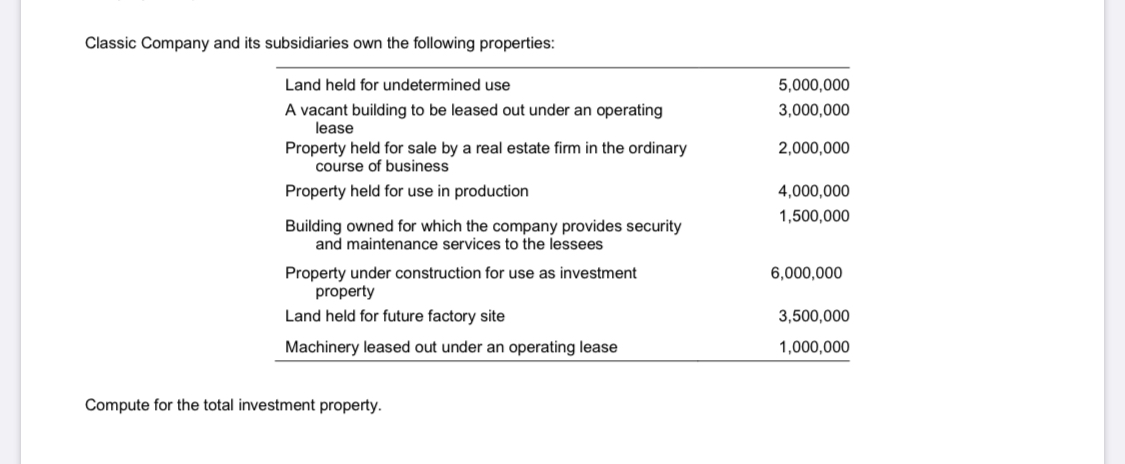

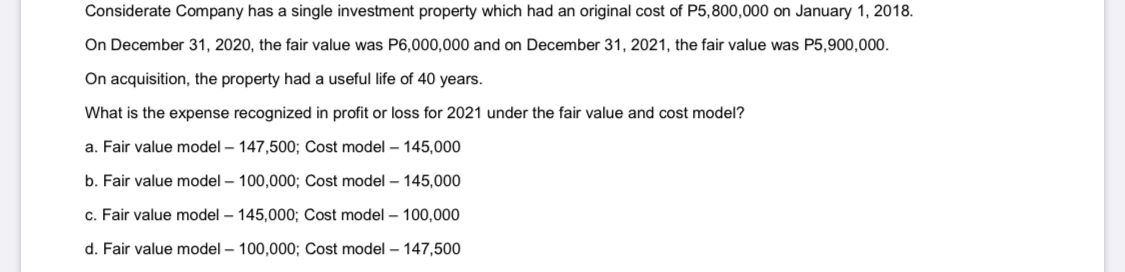

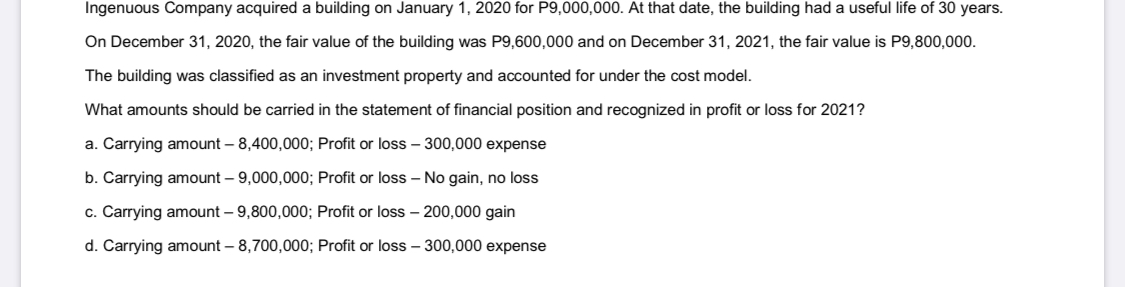

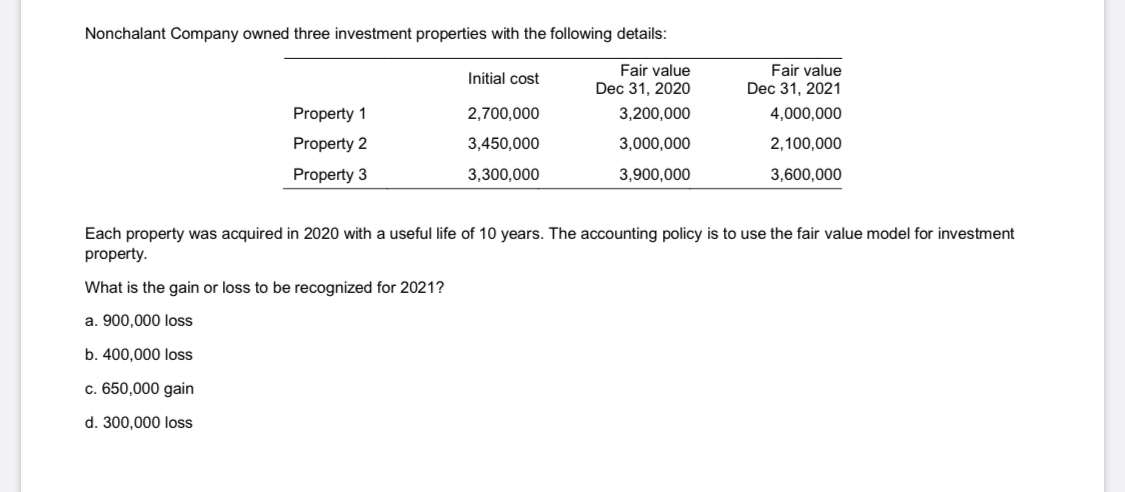

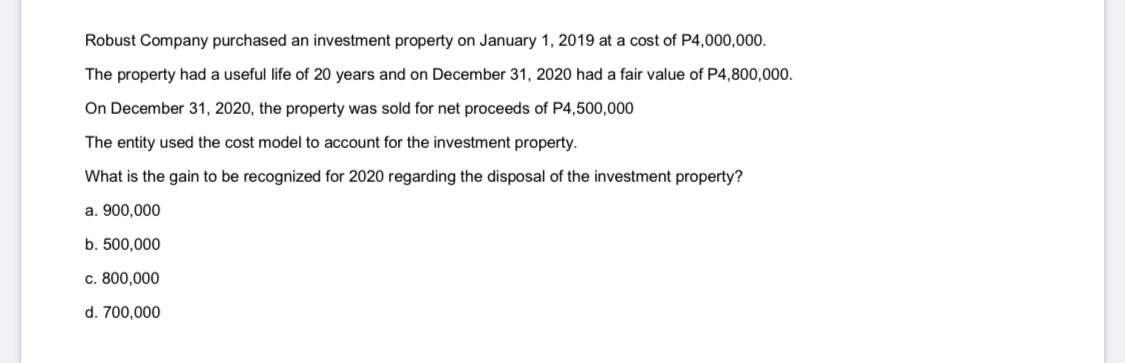

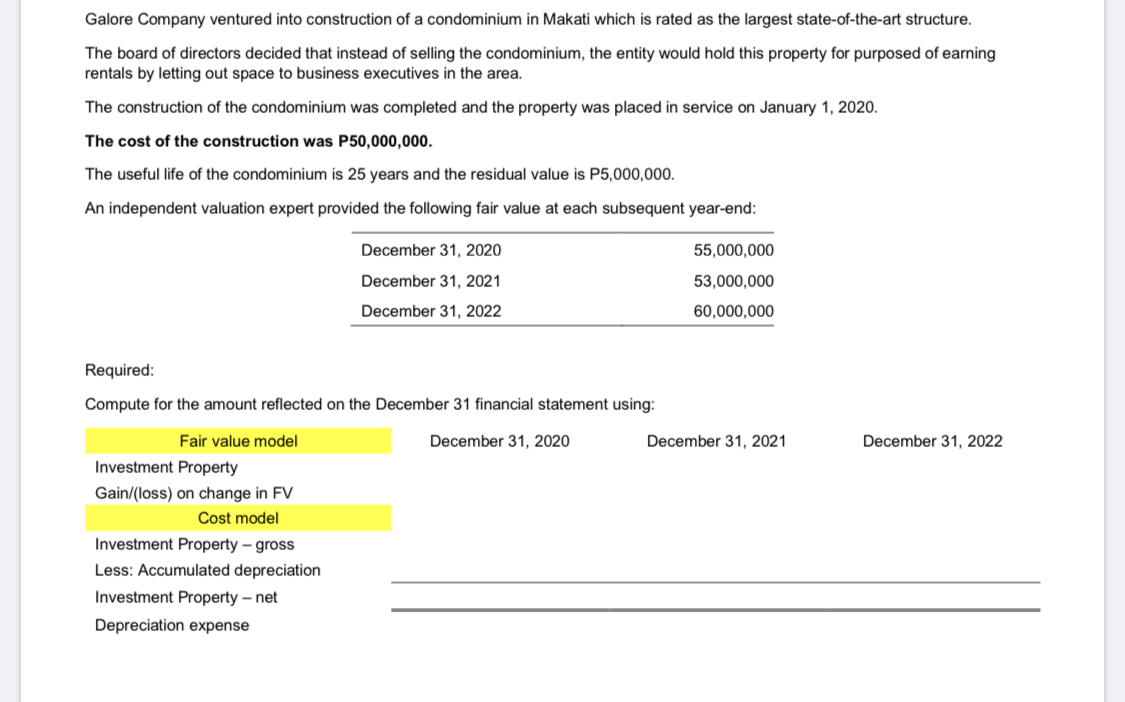

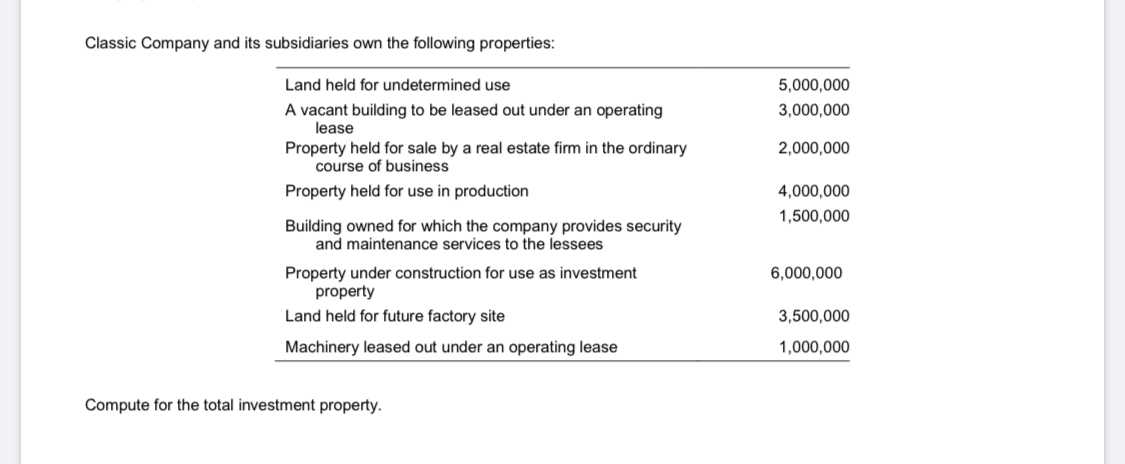

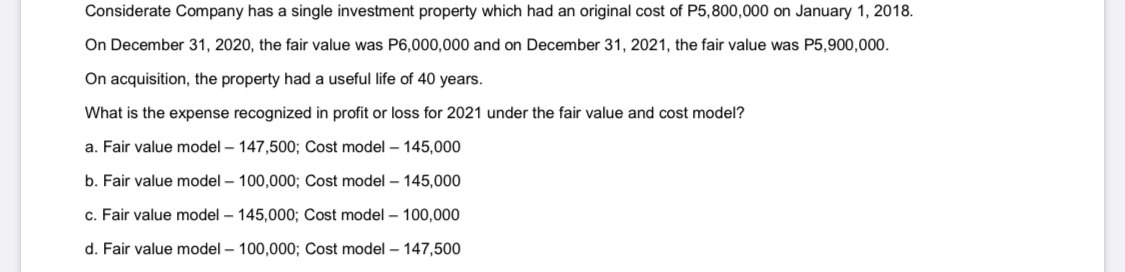

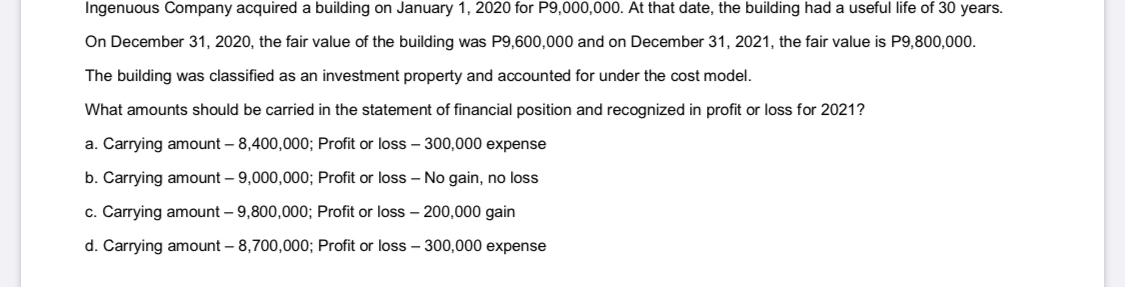

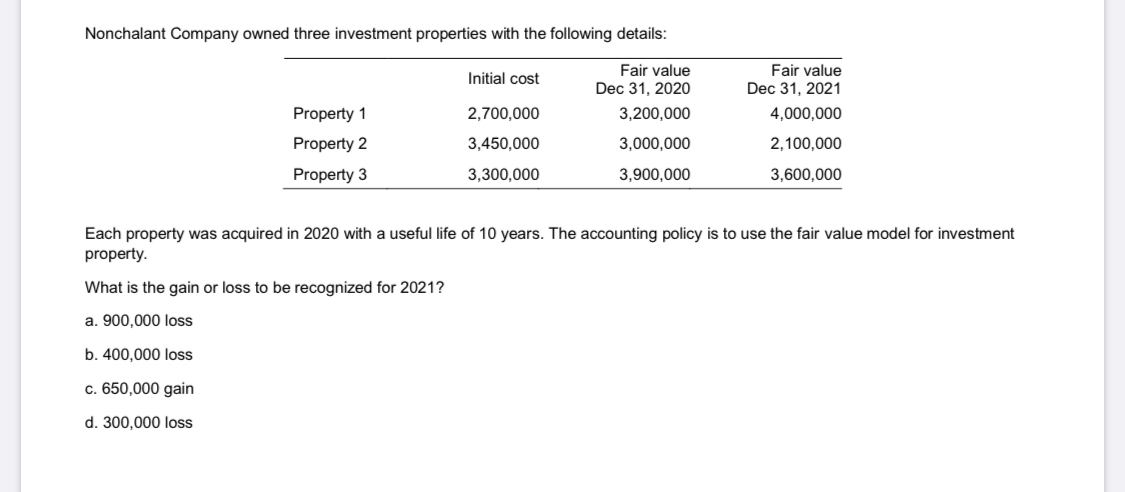

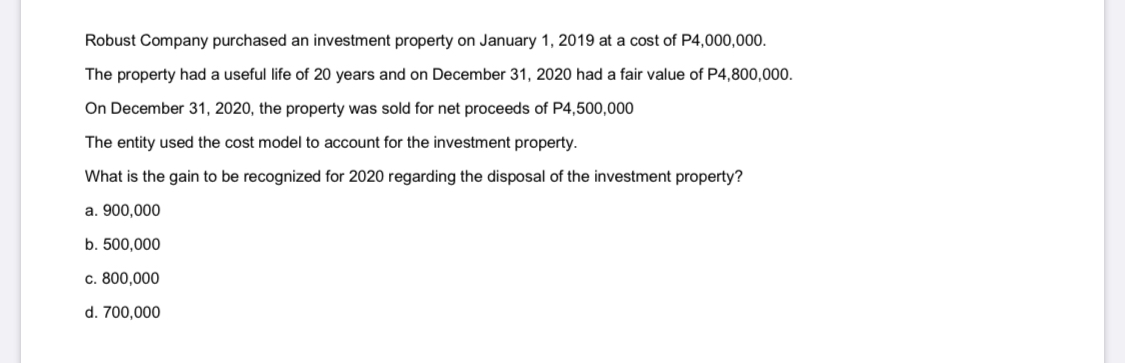

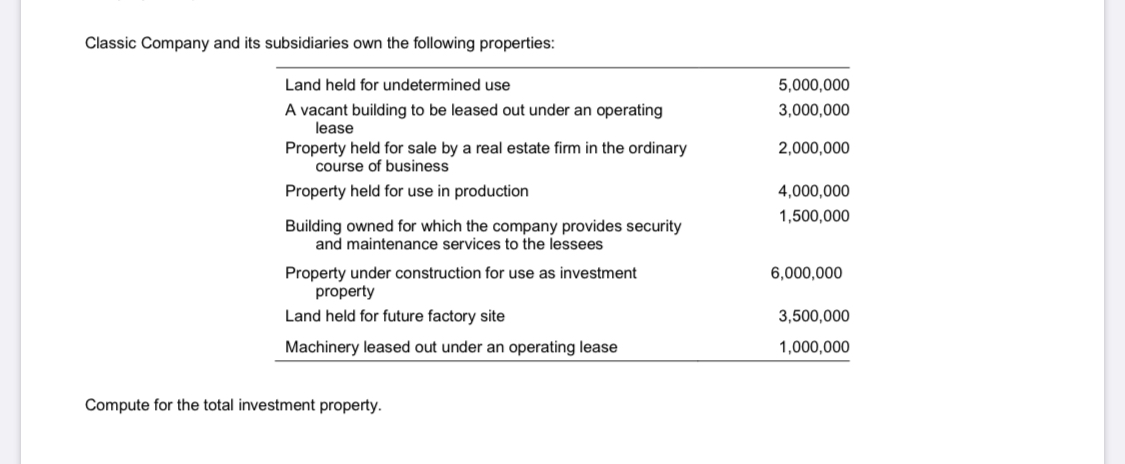

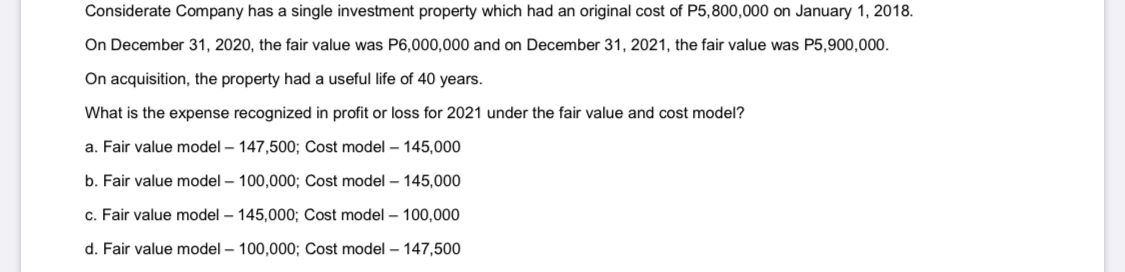

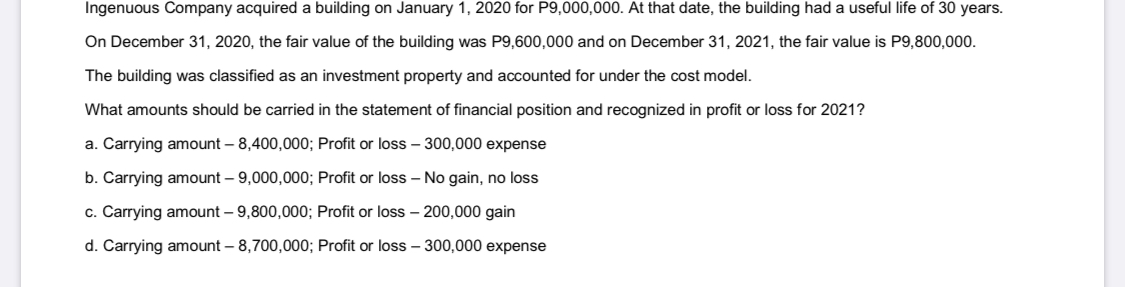

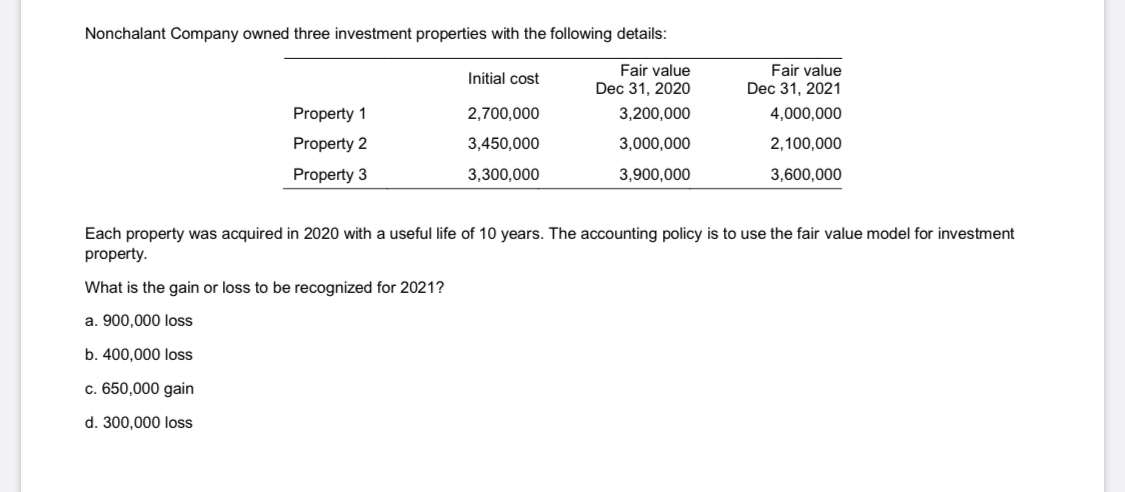

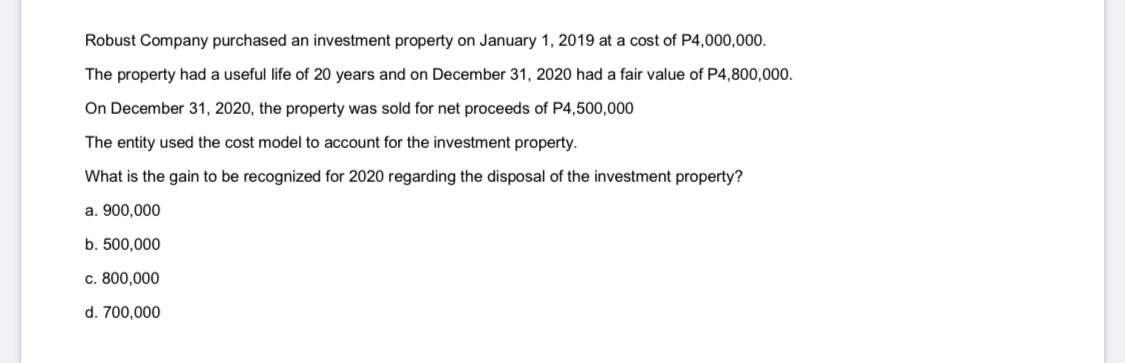

Galore Company ventured into construction of a condominium in Makati which is rated as the largest state-of-the-art structure. The board of directors decided that instead of selling the condominium, the entity would hold this property for purposed of earning rentals by letting out space to business executives in the area. The construction of the condominium was completed and the property was placed in service on January 1, 2020. The cost of the construction was P50,000,000. The useful life of the condominium is 25 years and the residual value is P5,000,000. An independent valuation expert provided the following fair value at each subsequent year-end: December 31, 2020 55,000,000 December 31, 2021 53,000,000 December 31, 2022 60,000,000 Required: Compute for the amount reflected on the December 31 financial statement using: Fair value model December 31, 2020 December 31, 2021 December 31, 2022 Investment Property Gain/(loss) on change in FV Cost model Investment Property - gross Less: Accumulated depreciation Investment Property - net Depreciation expenseClassic Company and its subsidiaries own the following properties: Land held for undetermined use 5,000,000 A vacant building to be leased out under an operating 3,000,000 lease Property held for sale by a real estate firm in the ordinary 2,000,000 course of business Property held for use in production 4,000,000 Building owned for which the company provides security 1,500,000 and maintenance services to the lessees Property under construction for use as investment 6,000,000 property Land held for future factory site 3,500,000 Machinery leased out under an operating lease 1,000,000 Compute for the total investment property.Considerate Company has a single investment property which had an original cost of P5,800,000 on January 1, 2018. On December 31, 2020, the fair value was P6,000,000 and on December 31, 2021, the fair value was P5,900,000. On acquisition, the property had a useful life of 40 years. What is the expense recognized in profit or loss for 2021 under the fair value and cost model? a. Fair value model - 147,500; Cost model - 145,000 b. Fair value model - 100,000; Cost model - 145,000 c. Fair value model - 145,000; Cost model - 100,000 d. Fair value model - 100,000; Cost model - 147,500Ingenuous Company acquired a building on January 1, 2020 for P9,000,000. At that date, the building had a useful life of 30 years. On December 31, 2020, the fair value of the building was P9,600,000 and on December 31, 2021, the fair value is P9,800,000. The building was classified as an investment property and accounted for under the cost model. What amounts should be carried in the statement of financial position and recognized in profit or loss for 2021? a. Carrying amount - 8,400,000; Profit or loss - 300,000 expense b. Carrying amount - 9,000,000; Profit or loss - No gain, no loss c. Carrying amount - 9,800,000; Profit or loss - 200,000 gain d. Carrying amount - 8,700,000; Profit or loss - 300,000 expenseNonchalant Company owned three investment properties with the following details: Initial cost Fair value Fair value Dec 31, 2020 Dec 31, 2021 Property 1 2,700,000 3,200,000 4,000,000 Property 2 3,450,000 3,000,000 2, 100,000 Property 3 3,300,000 3,900,000 3,600,000 Each property was acquired in 2020 with a useful life of 10 years. The accounting policy is to use the fair value model for investment property. What is the gain or loss to be recognized for 2021? a. 900,000 loss b. 400,000 loss c. 650,000 gain d. 300,000 lossRobust Company purchased an investment property on January 1. 2019 at a cost of 94,000,000. The property had a use\" life of 20 years and on December 31, 2020 had a fair value of 94,000,000. On December 31, 2020, the property was said for net proceeds of P4.500.000 The entity used the cost model to account for the 'Iwestment property. What is the gain to be recognized {or 2020 regarding the disposal of the investment property? a. 900,000 b. 500,000 c. 300.000 d. 700,000