Question

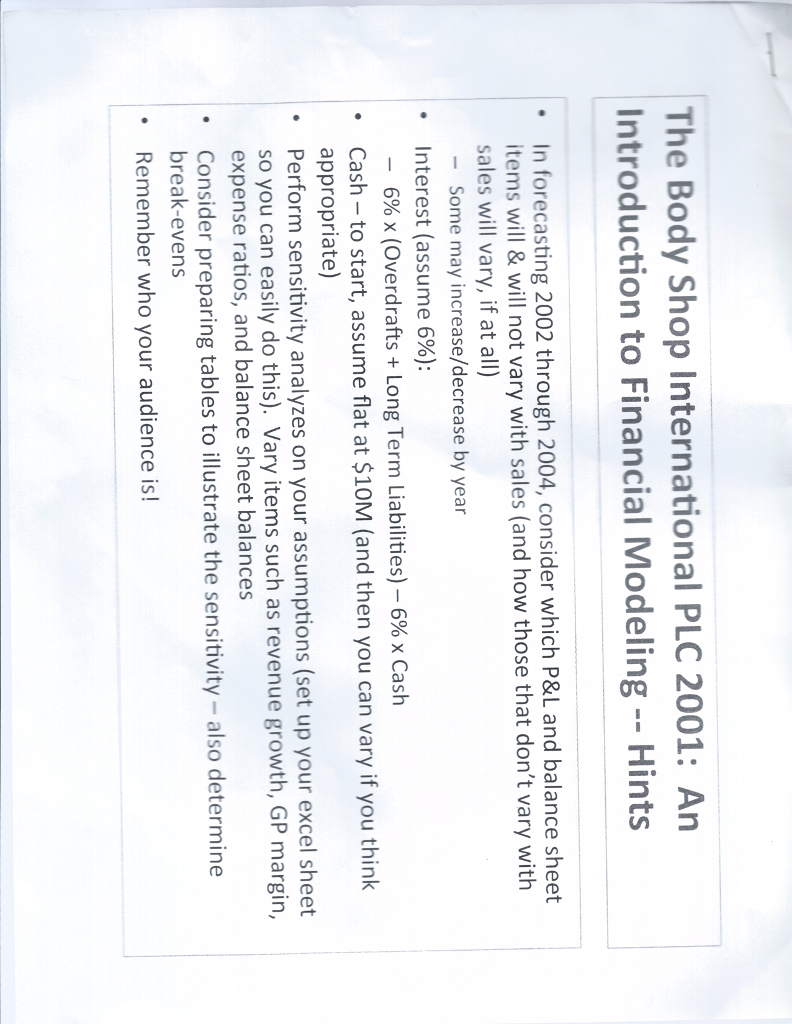

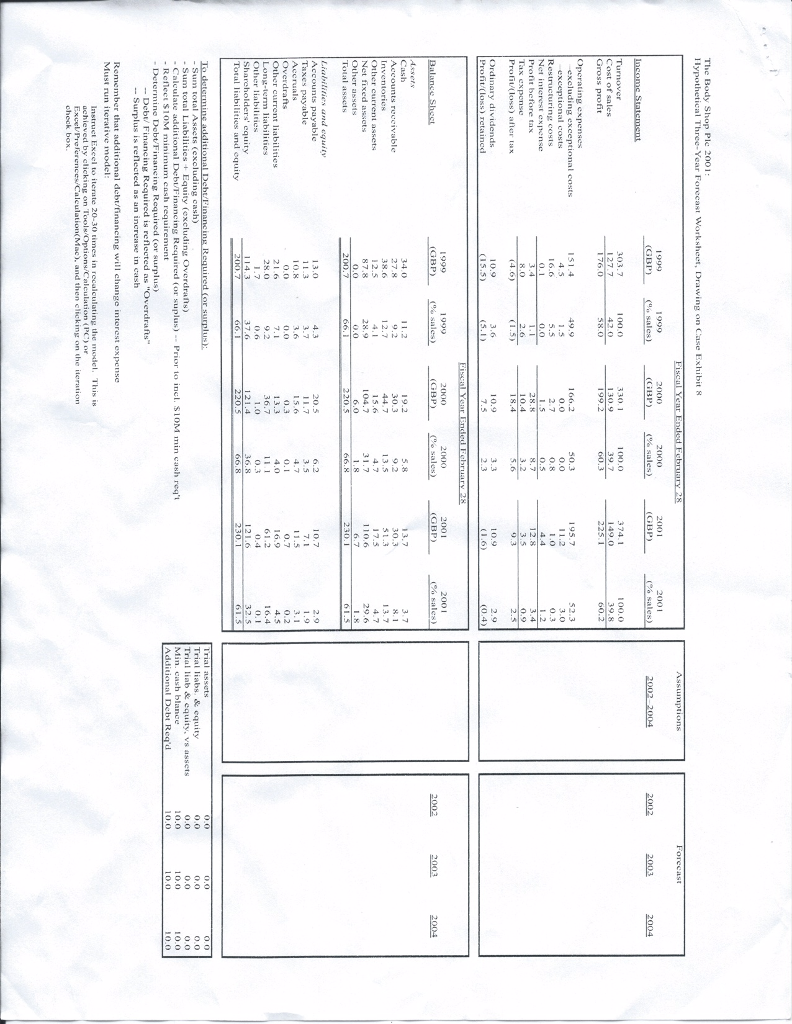

Answer the following problem, imperative to explain your assumptions to complete the forecast for 2002,2003 and 2004. Take also into consideration the instructions on how

Answer the following problem, imperative to explain your assumptions to complete the forecast for 2002,2003 and 2004. Take also into consideration the instructions on how to determined additional debt/financing required or surplus on bottom of page with spreadsheet plus formula to calculate interest on the first page. (for example increase or decrease sales by 10% each year, increase inventories etc for your assumptions) When it comes to the Debt/Financing surplus depending on you assumptions you will have a surplus in cash or a deficit, compute that in the spreadsheet.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started