Answer the following problem. Supporting details are indicated. Make a complete solution.

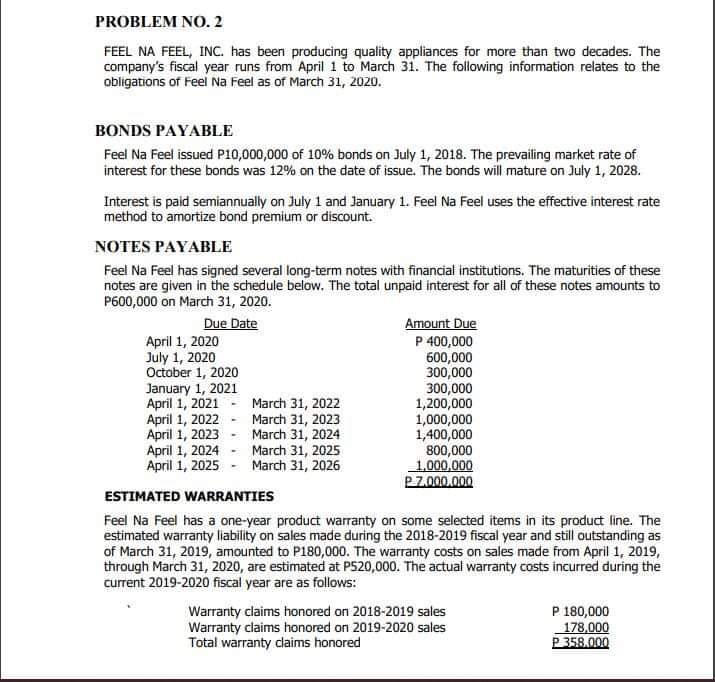

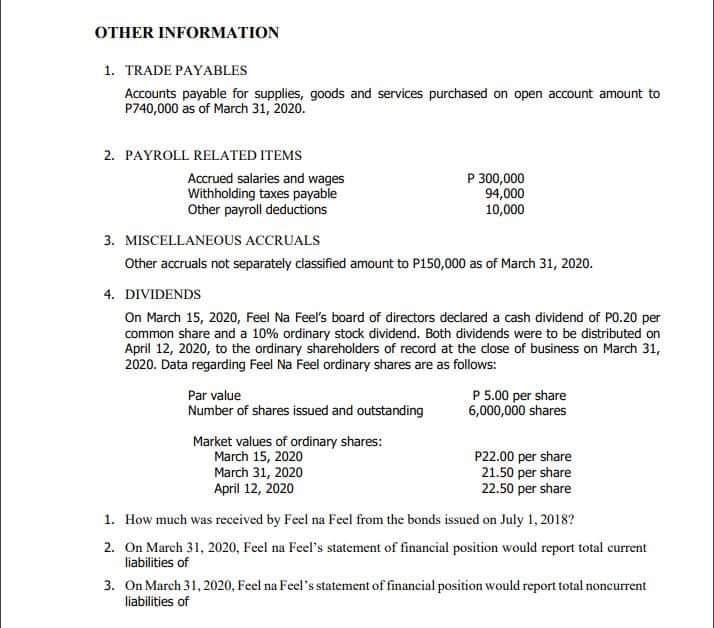

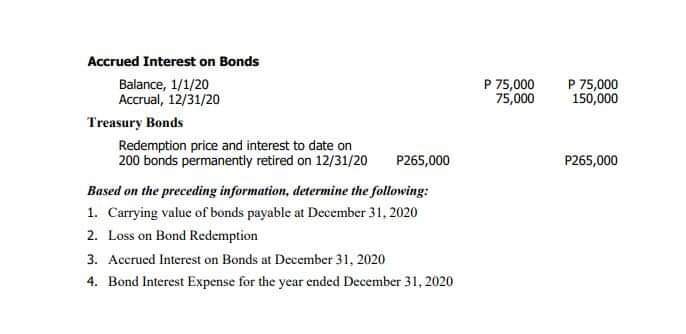

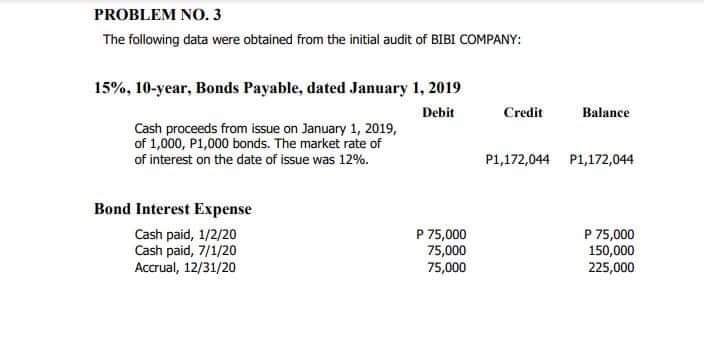

PROBLEM NO. 2 FEEL NA FEEL, INC. has been producing quality appliances for more than two decades. The company's fiscal year runs from April 1 to March 31. The following information relates to the obligations of Feel Na Feel as of March 31, 2020. BONDS PAYABLE Feel Na Feel issued P10,000,000 of 10% bonds on July 1, 2018. The prevailing market rate of interest for these bonds was 12% on the date of issue. The bonds will mature on July 1, 2028. Interest is paid semiannually on July 1 and January 1. Feel Na Feel uses the effective interest rate method to amortize bond premium or discount. NOTES PAYABLE Feel Na Feel has signed several long-term notes with financial institutions. The maturities of these notes are given in the schedule below. The total unpaid interest for all of these notes amounts to P600,000 on March 31, 2020. Due Date Amount Due April 1, 2020 P 400,000 July 1, 2020 600,000 October 1, 2020 300,000 January 1, 2021 300,000 April 1, 2021 March 31, 2022 1,200,000 April 1, 2022 March 31, 2023 1,000,000 April 1, 2023 March 31, 2024 1,400,000 April 1, 2024 March 31, 2025 800,000 April 1, 2025 - March 31, 2026 1,000,000 P.Z.000.000 ESTIMATED WARRANTIES Feel Na Feel has a one-year product warranty on some selected items in its product line. The estimated warranty liability on sales made during the 2018-2019 fiscal year and still outstanding as of March 31, 2019, amounted to P180,000. The warranty costs on sales made from April 1, 2019, through March 31, 2020, are estimated at P520,000. The actual warranty costs incurred during the current 2019-2020 fiscal year are as follows: Warranty claims honored on 2018-2019 sales P 180,000 Warranty claims honored on 2019-2020 sales 178,000 Total warranty claims honored P 358.000OTHER INFORMATION 1. TRADE PAYABLES Accounts payable for supplies, goods and services purchased on open account amount to P740,000 as of March 31, 2020. 2. PAYROLL RELATED ITEMS Accrued salaries and wages P 300,000 Withholding taxes payable 94,000 Other payroll deductions 10,000 3. MISCELLANEOUS ACCRUALS Other accruals not separately classified amount to P150,000 as of March 31, 2020. 4. DIVIDENDS On March 15, 2020, Feel Na Feel's board of directors declared a cash dividend of P0.20 per common share and a 10% ordinary stock dividend. Both dividends were to be distributed on April 12, 2020, to the ordinary shareholders of record at the close of business on March 31, 2020. Data regarding Feel Na Feel ordinary shares are as follows: Par value P 5.00 per share Number of shares issued and outstanding 6,000,000 shares Market values of ordinary shares: March 15, 2020 P22.00 per share March 31, 2020 21.50 per share April 12, 2020 22.50 per share 1. How much was received by Feel na Feel from the bonds issued on July 1, 2018? 2. On March 31, 2020, Feel na Feel's statement of financial position would report total current liabilities of 3. On March 31, 2020, Feel na Feel's statement of financial position would report total noncurrent liabilities ofAccrued Interest on Bonds Balance, 1/1/20 P 75,000 P 75,000 Accrual, 12/31/20 75,000 150,000 Treasury Bonds Redemption price and interest to date on 200 bonds permanently retired on 12/31/20 P265,000 P265,000 Based on the preceding information, determine the following: 1. Carrying value of bonds payable at December 31, 2020 2. Loss on Bond Redemption 3. Accrued Interest on Bonds at December 31. 2020 4. Bond Interest Expense for the year ended December 31, 2020PROBLEM NO. 3 The following data were obtained from the initial audit of BIBI COMPANY: 15%, 10-year, Bonds Payable, dated January 1, 2019 Debit Credit Balance Cash proceeds from issue on January 1, 2019, of 1,000, P1,000 bonds. The market rate of of interest on the date of issue was 12%. P1,172,044 P1,172,044 Bond Interest Expense Cash paid, 1/2/20 P 75,000 P 75,000 Cash paid, 7/1/20 75,000 150,000 Accrual, 12/31/20 75,000 225,000