Question

Answer the following problems as noted in the assignment. For each, you should download the corresponding Excel spreadsheet to enter the problem parameters. Info on

Answer the following problems as noted in the assignment. For each, you should download the corresponding Excel spreadsheet to enter the problem parameters.

Info on Excel sheet:

Applications Problems Chapter 2

Problems 1, 2

Input boxes in tan

Output boxes in yellow

Given data in blue

Calculations in red

Answers in green

NOTE: Some functions used in these spreadsheets may require that the "Analysis ToolPak" or "Solver Add-in" be installed in Excel. To install these, click on "Tools|Add-Ins" and select "Analysis ToolPak" and "Solver Add-In."

Some problems require you to also make comments and provide narrative explanation and comment.Be sure they are also included on the spreadsheet prior to you saving and making your submission.Problems and explanations should be on the spreadsheet.

Chapter 2: Homework for Module One:

Problem 1: Market Values and Book Values:

Gregory Tankers. Inc., purchased new milling machinery three years ago for $9.6 million. The machinery can be sold to the their competitor today for $6.4 million. Gregory's current balance sheet shows net fixed assets of $4.9 million, current liabilities of $2.2 million, and net working capital of $850.000. If all the current accounts were liquidated today, the company would receive $2. 7 million cash.

- What is the book value of Gregory's assets today? What is the sum of NWC and market value of fixed assets?

- Cash Flow to Creditors Tile 2018 balance sheet of Amy's Golf Shop, Inc., showed long-term debt of $1.565 million, and the 2019 balance sheet showed long-term debt of $1.645 million. The 2019 income statement showed an interest expense of $170,000.

- What was tile firm's cash flow to creditors during 2019?

Problem 2: Calculating Cash Flows

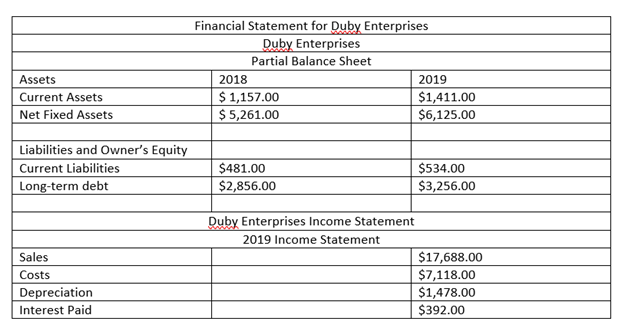

Consider the following abbreviated financial statements for Duby Enterprises:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started