Answer the following problems.

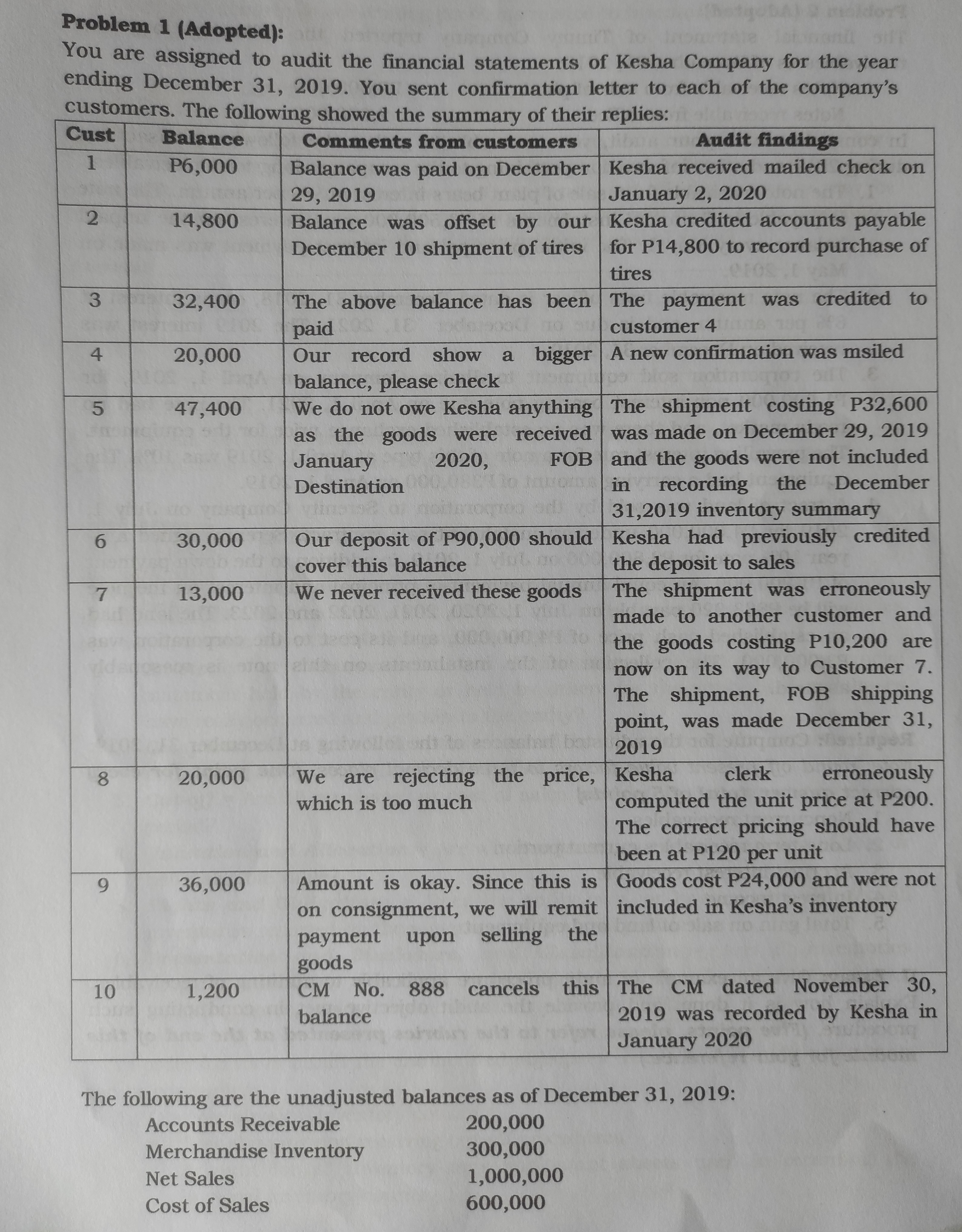

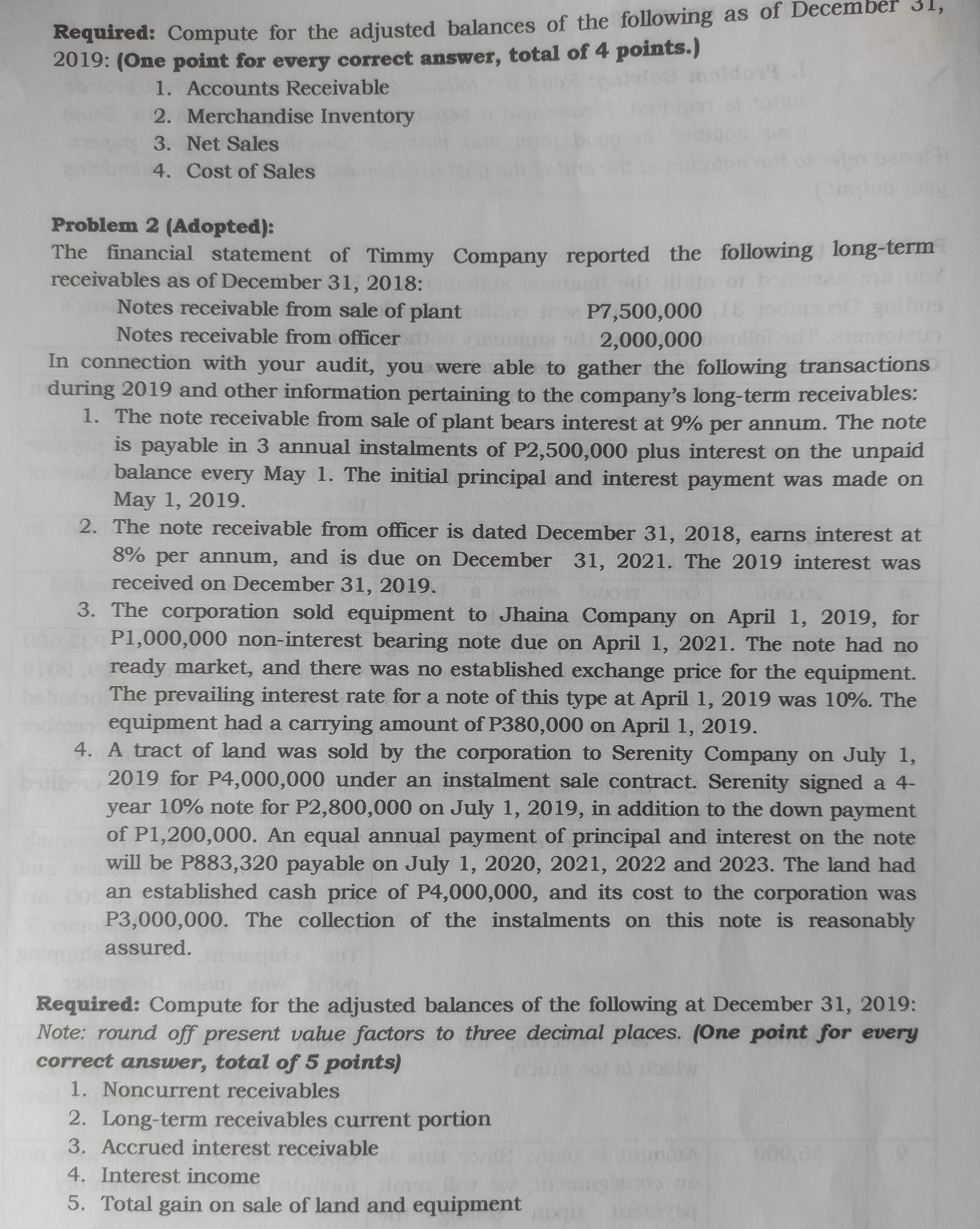

Problem 1 (Adopted): You are assigned to audit the financial statements of Kesha Company for the year ending December 31, 2019. You sent confirmation letter to each of the company's customers. The following showed the summary of their replies: Cust Balance Comments from customers Audit findings P6,000 Balance was paid on December Kesha received mailed check on 29, 2019 January 2, 2020 2 14,800 Balance was offset by our Kesha credited accounts payable December 10 shipment of tires for P14,800 to record purchase of tires 3 32,400 The above balance has been The payment was credited to paid customer 4 4 20,000 Our record show a bigger A new confirmation was mailed balance, please check 5 47,400 We do not owe Kesha anything The shipment costing P32,600 as the goods were received was made on December 29, 2019 January 2020, FOB and the goods were not included Destination in recording the December 31,2019 inventory summary 6 30,000 Our deposit of P90,000 should Kesha had previously credited cover this balance the deposit to sales 7 13,000 We never received these goods The shipment was erroneously made to another customer and the goods costing P10,200 are now on its way to Customer 7. The shipment, FOB shipping point, was made December 31, 2019 8 20,000 We are rejecting the price, Kesha clerk erroneously which is too much computed the unit price at P200. The correct pricing should have been at P120 per unit 9 36,000 Amount is okay. Since this is Goods cost P24,000 and were not on consignment, we will remit included in Kesha's inventory payment upon selling the goods 10 1,200 CM No. 888 cancels this The CM dated November 30, balance 2019 was recorded by Kesha in January 2020 The following are the unadjusted balances as of December 31, 2019: Accounts Receivable 200,000 Merchandise Inventory 300,000 Net Sales 1,000,000 Cost of Sales 600,000Required: Compute for the adjusted balances of the following as of December ol, 2019: (One point for every correct answer, total of 4 points.) 1. Accounts Receivable 2. Merchandise Inventory 3. Net Sales 4. Cost of Sales Problem 2 (Adopted): The financial statement of Timmy Company reported the following long-term receivables as of December 31, 2018: Notes receivable from sale of plant P7,500,000 Notes receivable from officer 2,000,000 In connection with your audit, you were able to gather the following transactions during 2019 and other information pertaining to the company's long-term receivables: 1. The note receivable from sale of plant bears interest at 9% per annum. The note is payable in 3 annual instalments of P2,500,000 plus interest on the unpaid balance every May 1. The initial principal and interest payment was made on May 1, 2019. 2. The note receivable from officer is dated December 31, 2018, earns interest at 8% per annum, and is due on December 31, 2021. The 2019 interest was received on December 31, 2019. 3. The corporation sold equipment to Jhaina Company on April 1, 2019, for P1,000,000 non-interest bearing note due on April 1, 2021. The note had no ready market, and there was no established exchange price for the equipment. The prevailing interest rate for a note of this type at April 1, 2019 was 10%. The equipment had a carrying amount of P380,000 on April 1, 2019. 4. A tract of land was sold by the corporation to Serenity Company on July 1, 2019 for P4,000,000 under an instalment sale contract. Serenity signed a 4- year 10% note for P2,800,000 on July 1, 2019, in addition to the down payment of P1,200,000. An equal annual payment of principal and interest on the note will be P883,320 payable on July 1, 2020, 2021, 2022 and 2023. The land had an established cash price of P4,000,000, and its cost to the corporation was P3,000,000. The collection of the instalments on this note is reasonably assured. Required: Compute for the adjusted balances of the following at December 31, 2019: Note: round off present value factors to three decimal places. (One point for every correct answer, total of 5 points) 1. Noncurrent receivables 2. Long-term receivables current portion 3. Accrued interest receivable 4. Interest income 5. Total gain on sale of land and equipment