Answer the following problems

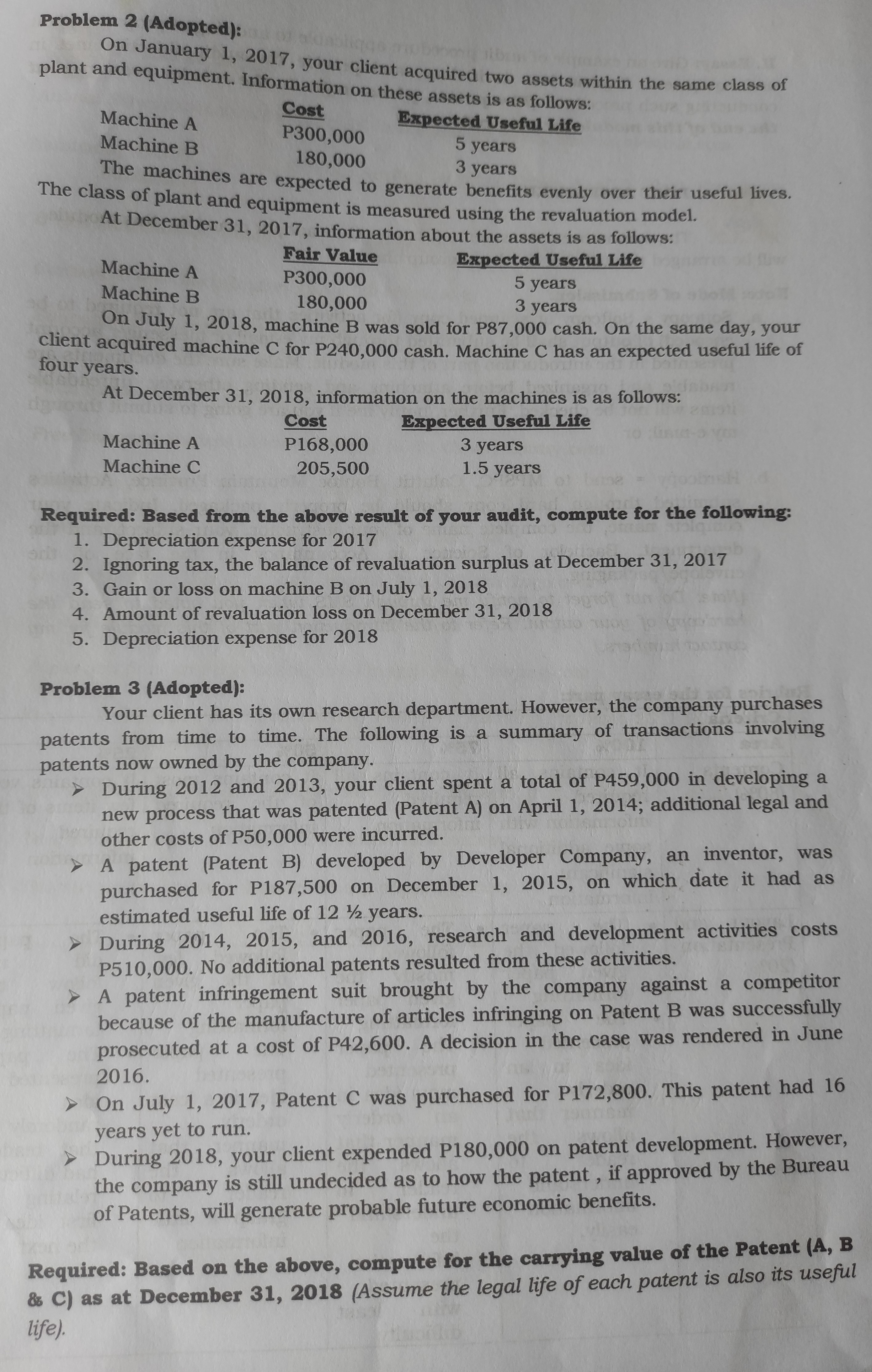

Problem 2 (Adopted): On January 1, 2017, your client acquired two assets within the same class of plant and equipment. Information on these assets is as follows: Machine A Cost Machine B P300,000 Expected Useful Life 5 years 180,000 3 years The machines are expected to generate benefits evenly over their useful lives. The class of plant and equipment is measured using the revaluation model. At December 31, 2017, information about the assets is as follows: Fair Value Machine A Expected Useful Life P300,000 Machine B 5 years 180,000 3 years On July 1, 2018, machine B was sold for P87,000 cash. On the same day, your client acquired machine C for P240,000 cash. Machine C has an expected useful life of four years. At December 31, 2018, information on the machines is as follows: Cost Expected Useful Life Machine A P168,000 3 years Machine C 205,500 1.5 years Required: Based from the above result of your audit, compute for the following: 1. Depreciation expense for 2017 2. Ignoring tax, the balance of revaluation surplus at December 31, 2017 3. Gain or loss on machine B on July 1, 2018 4. Amount of revaluation loss on December 31, 2018 5. Depreciation expense for 2018 Problem 3 (Adopted): Your client has its own research department. However, the company purchases patents from time to time. The following is a summary of transactions involving patents now owned by the company. During 2012 and 2013, your client spent a total of P459,000 in developing a new process that was patented (Patent A) on April 1, 2014; additional legal and other costs of P50,000 were incurred. D A patent (Patent B) developed by Developer Company, an inventor, was purchased for P187,500 on December 1, 2015, on which date it had as estimated useful life of 12 1/2 years. During 2014, 2015, and 2016, research and development activities costs P510,000. No additional patents resulted from these activities. > A patent infringement suit brought by the company against a competitor because of the manufacture of articles infringing on Patent B was successfully prosecuted at a cost of P42,600. A decision in the case was rendered in June 2016. D On July 1, 2017, Patent C was purchased for P172,800. This patent had 16 years yet to run. During 2018, your client expended P180,000 on patent development. However, the company is still undecided as to how the patent , if approved by the Bureau of Patents, will generate probable future economic benefits. Required: Based on the above, compute for the carrying value of the Patent (A, B & C) as at December 31, 2018 (Assume the legal life of each patent is also its useful life)