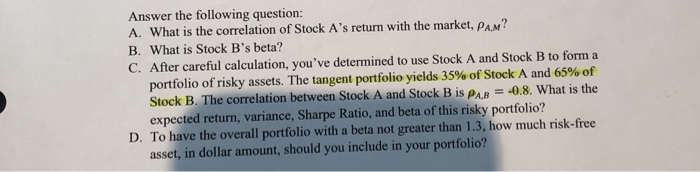

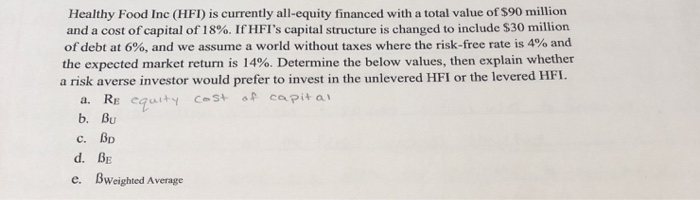

Answer the following question: A. What is the correlation of Stock A's return with the market. PAM?! B. What is Stock B's beta? C. After careful calculation, you've determined to use Stock A and Stock B to form a portfolio of risky assets. The tangent portfolio yields 35% of Stock A and 65% of Stock B. The correlation between Stock A and Stock B is PAB = -0.8. What is the expected return, variance, Sharpe Ratio, and beta of this risky portfolio? D. To have the overall portfolio with a beta not greater than 1.3, how much risk-free asset, in dollar amount, should you include in your portfolio? Healthy Food Inc (HFI) is currently all-equity financed with a total value of $90 million and a cost of capital of 18%. IF HFI's capital structure is changed to include $30 million of debt at 6%, and we assume a world without taxes where the risk-free rate is 4% and the expected market return is 14%. Determine the below values, then explain whether a risk averse investor would prefer to invest in the unlevered HFI or the levered HFI. a. Re equity cost of capital b. Bu C. Bp d. BE e. Bweighted Average Answer the following question: A. What is the correlation of Stock A's return with the market. PAM?! B. What is Stock B's beta? C. After careful calculation, you've determined to use Stock A and Stock B to form a portfolio of risky assets. The tangent portfolio yields 35% of Stock A and 65% of Stock B. The correlation between Stock A and Stock B is PAB = -0.8. What is the expected return, variance, Sharpe Ratio, and beta of this risky portfolio? D. To have the overall portfolio with a beta not greater than 1.3, how much risk-free asset, in dollar amount, should you include in your portfolio? Healthy Food Inc (HFI) is currently all-equity financed with a total value of $90 million and a cost of capital of 18%. IF HFI's capital structure is changed to include $30 million of debt at 6%, and we assume a world without taxes where the risk-free rate is 4% and the expected market return is 14%. Determine the below values, then explain whether a risk averse investor would prefer to invest in the unlevered HFI or the levered HFI. a. Re equity cost of capital b. Bu C. Bp d. BE e. Bweighted Average