answer the following question and show the solution

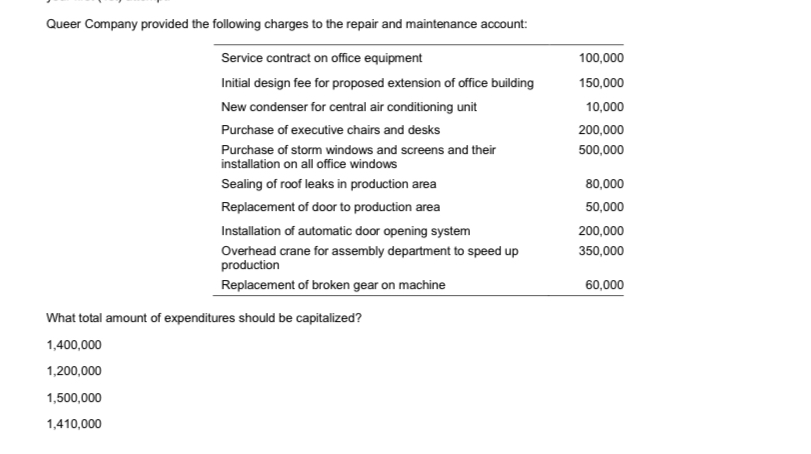

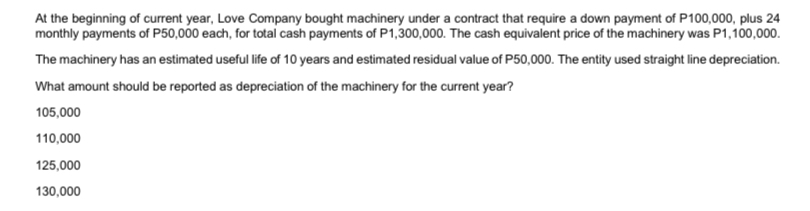

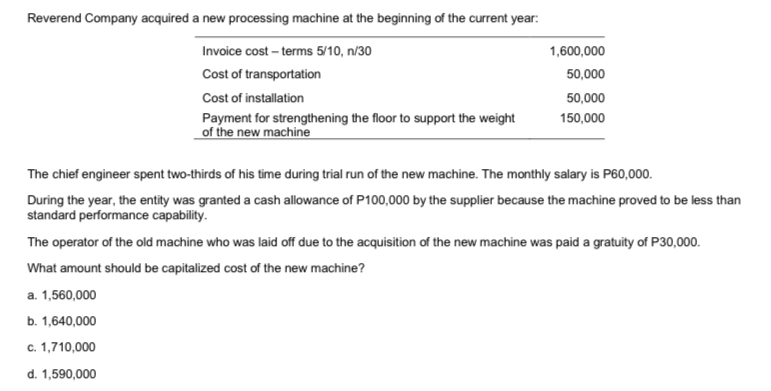

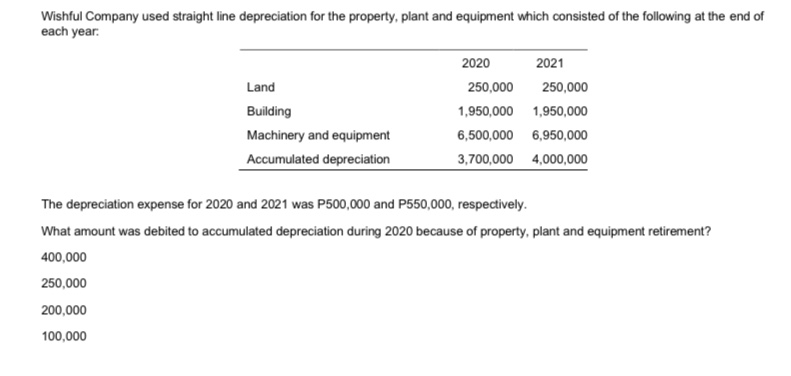

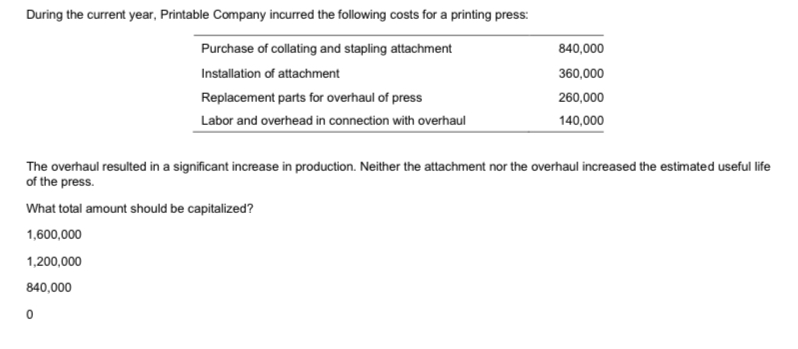

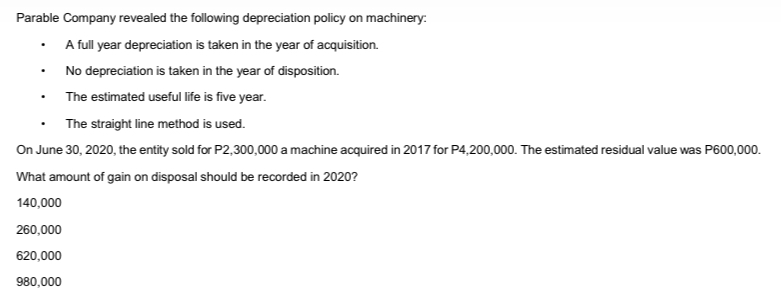

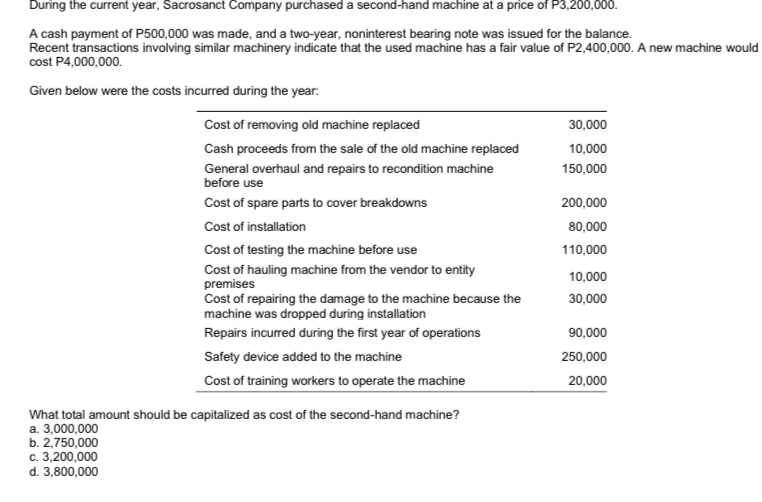

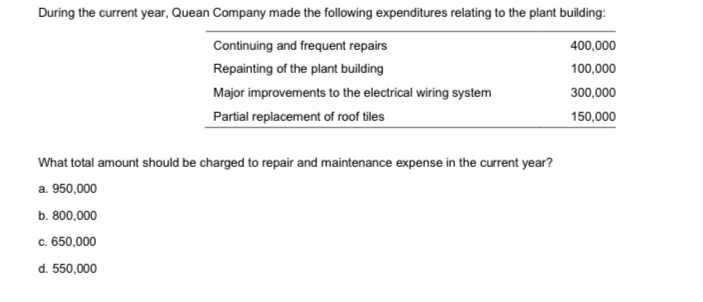

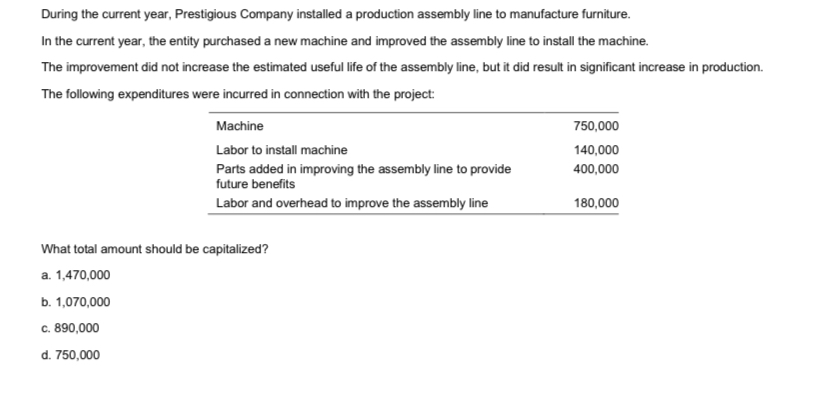

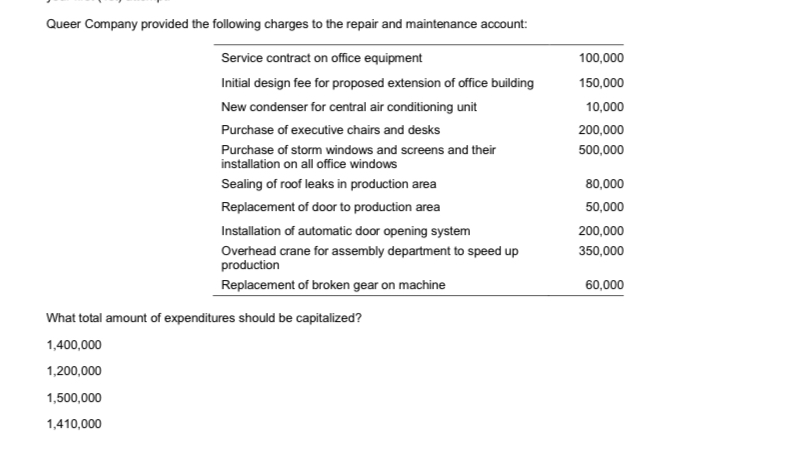

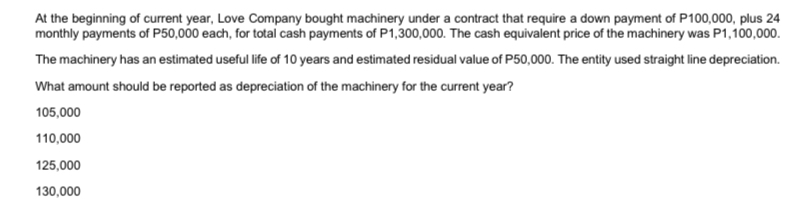

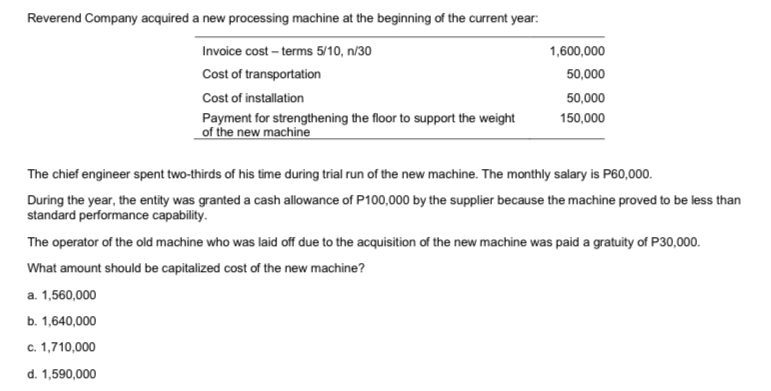

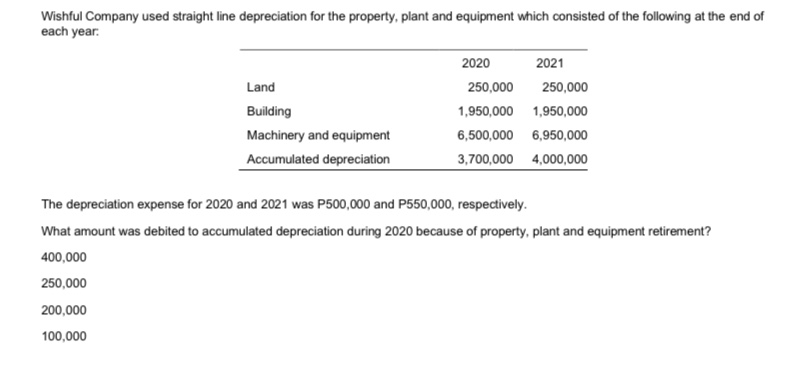

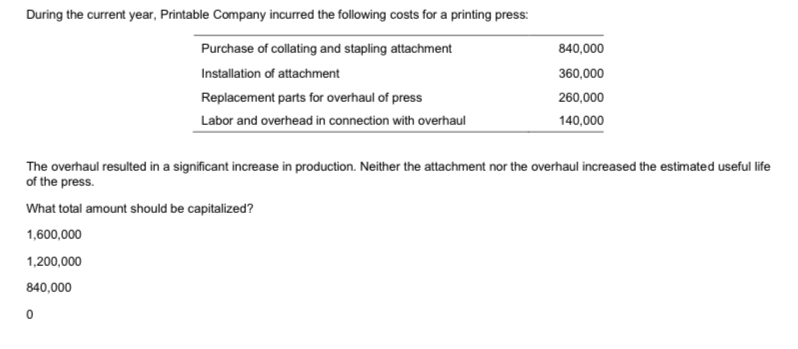

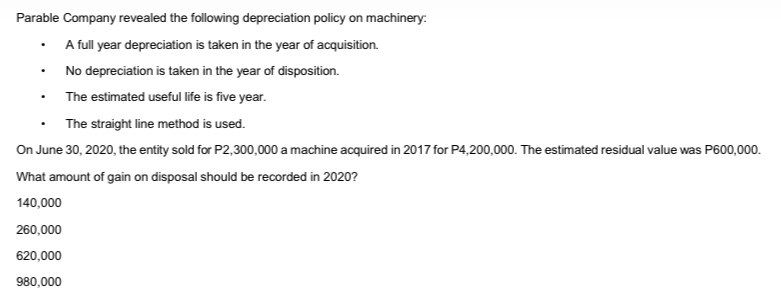

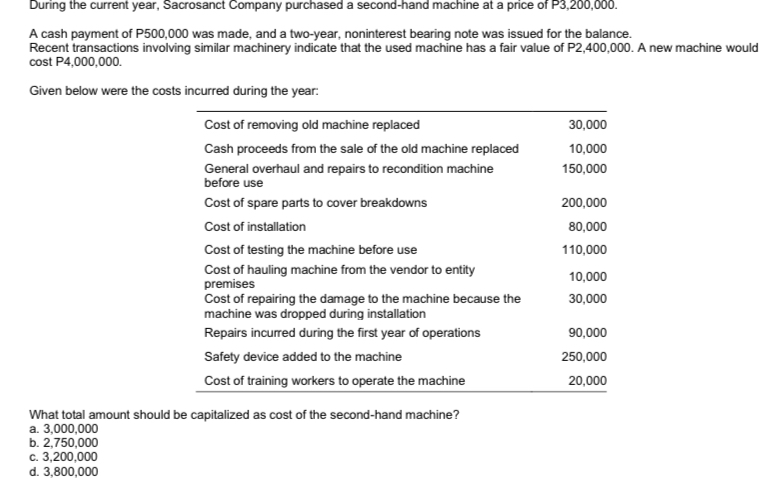

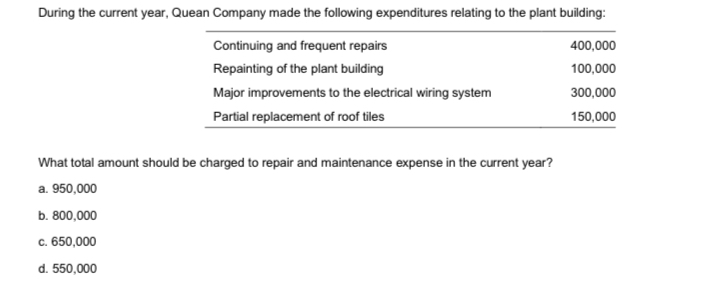

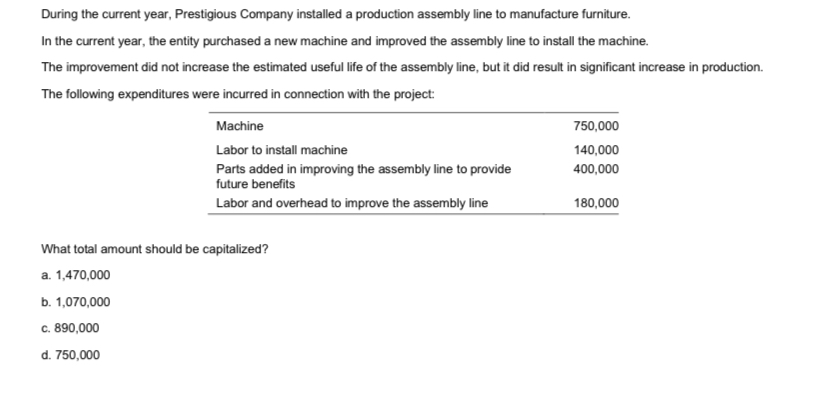

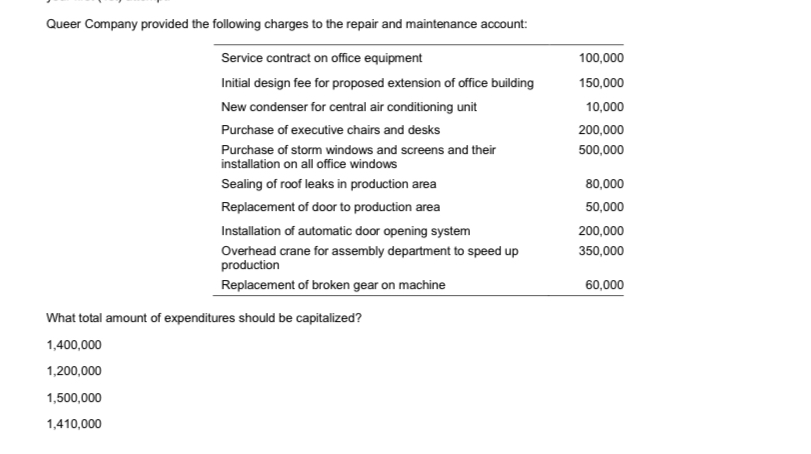

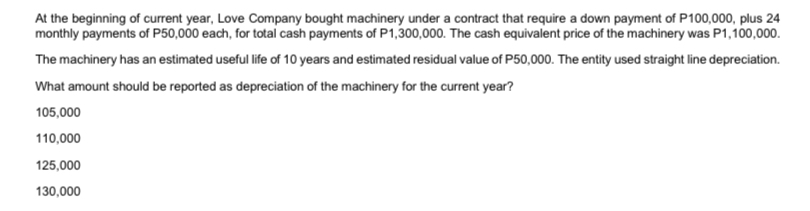

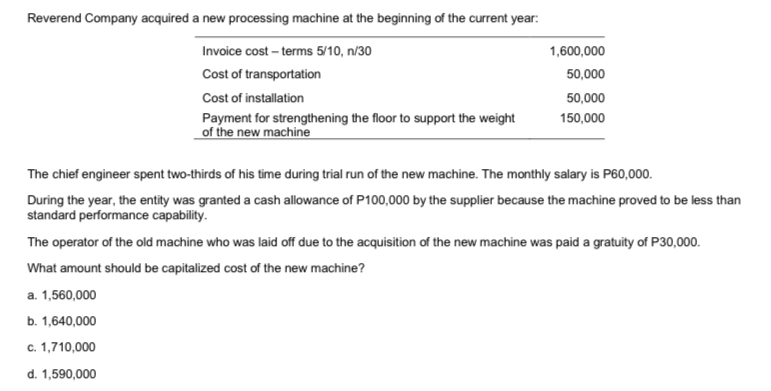

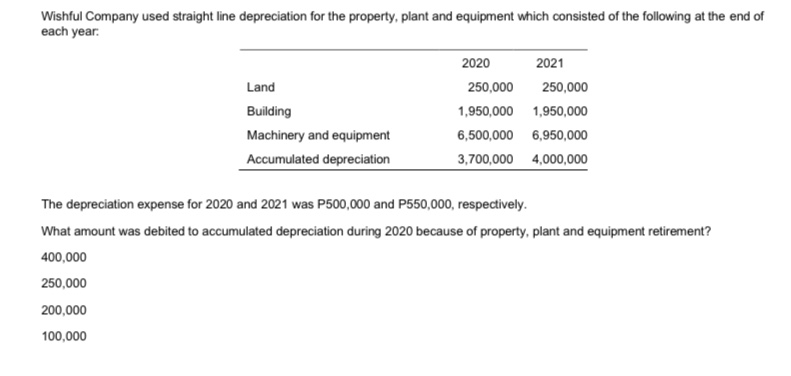

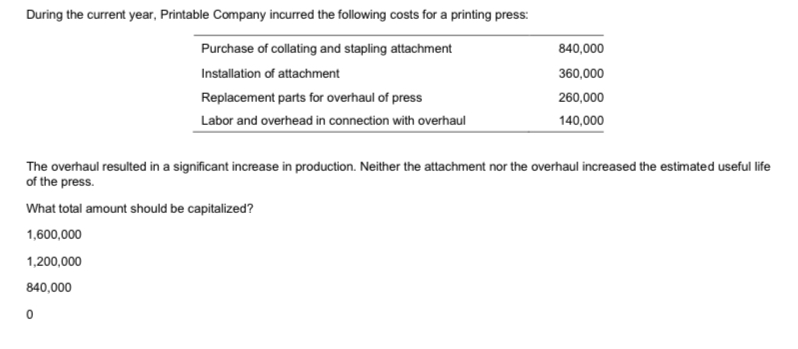

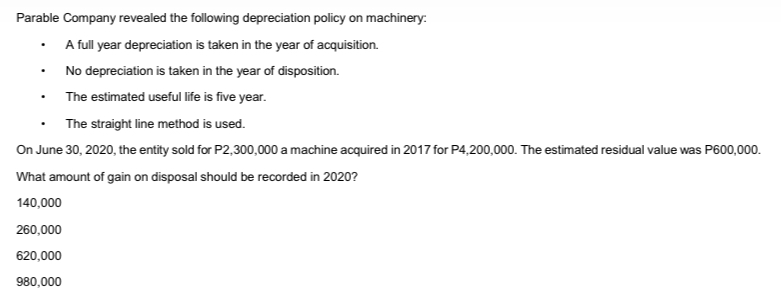

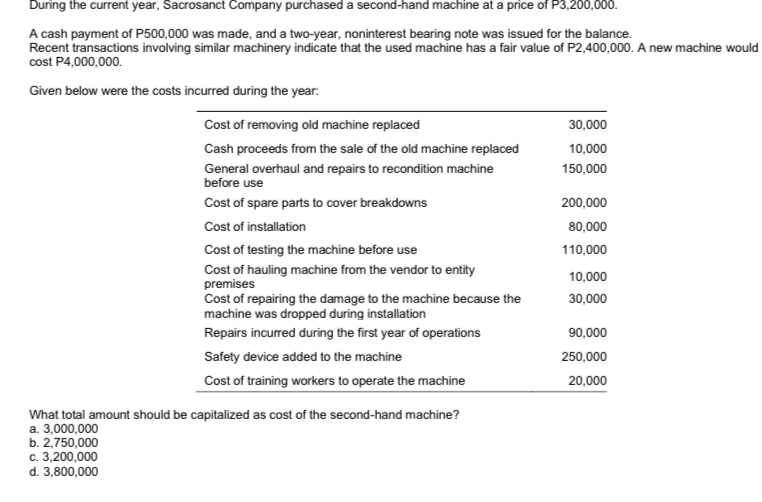

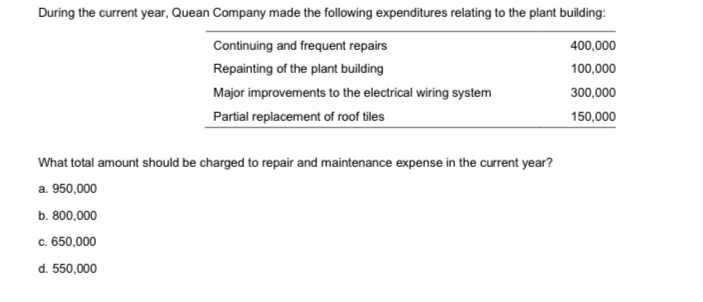

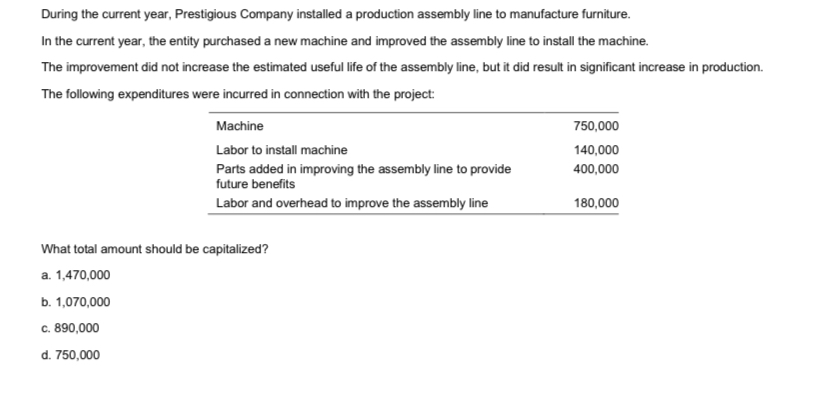

Queer Company provided the following charges to the repair and maintenance account: Service contract on office equipment 100,000 Initial design fee for proposed extension of office building 150,000 New condenser for central air conditioning unit 10,000 Purchase of executive chairs and desks 200,000 Purchase of storm windows and screens and their 500,000 installation on all office windows Sealing of roof leaks in production area 80,000 Replacement of door to production area 50,000 Installation of automatic door opening system 200,000 Overhead crane for assembly department to speed up 350,000 production Replacement of broken gear on machine 60,000 What total amount of expenditures should be capitalized? 1,400,000 1,200,000 1,500,000 1,410,000At the beginning of current year, Love Company bought machinery under a contract that require a down payment of P100,000, plus 24 monthly payments of P50,000 each, for total cash payments of P1,300,000. The cash equivalent price of the machinery was P1, 100,000. The machinery has an estimated useful life of 10 years and estimated residual value of P50,000. The entity used straight line depreciation. What amount should be reported as depreciation of the machinery for the current year? 105,000 110,000 125,000 130,000Reverend Company acquired a new processing machine at the beginning of the current year: Invoice cost - terms 5/10, n/30 1,600,000 Cost of transportation 50,000 Cost of installation 50,000 Payment for strengthening the floor to support the weight 150,000 of the new machine The chief engineer spent two-thirds of his time during trial run of the new machine. The monthly salary is P60,000. During the year, the entity was granted a cash allowance of P100,000 by the supplier because the machine proved to be less than standard performance capability. The operator of the old machine who was laid off due to the acquisition of the new machine was paid a gratuity of P30,000. What amount should be capitalized cost of the new machine? a. 1,560.000 b. 1,640,000 c. 1,710,000 d. 1,590,000Wishful Company used straight line depreciation for the property, plant and equipment which consisted of the following at the end of each year. 2020 2021 Land 250,000 250,000 Building 1,950,000 1,950,000 Machinery and equipment 6,500,000 6,950,000 Accumulated depreciation 3,700,000 4,000,000 The depreciation expense for 2020 and 2021 was P500,000 and P550,000, respectively. What amount was debited to accumulated depreciation during 2020 because of property, plant and equipment retirement? 400.000 250,000 200,000 100,000During the current year, Printable Company incurred the following costs for a printing press: Purchase of collating and stapling attachment 840,000 Installation of attachment 360,000 Replacement parts for overhaul of press 260,000 Labor and overhead in connection with overhaul 140,000 The overhaul resulted in a significant increase in production. Neither the attachment nor the overhaul increased the estimated useful life of the press. What total amount should be capitalized? 1,600,000 1,200,000 840,000 0Parable Company revealed the following depreciation policy on machinery: A full year depreciation is taken in the year of acquisition. . No depreciation is taken in the year of disposition. The estimated useful life is five year. The straight line method is used. On June 30, 2020, the entity sold for P2,300,000 a machine acquired in 2017 for P4,200,000. The estimated residual value was P600,000. What amount of gain on disposal should be recorded in 2020? 140,000 260,000 620,000 980,000During the current year, Sacrosanct Company purchased a second-hand machine at a price of P3,200,000. A cash payment of P500,000 was made, and a two-year, noninterest bearing note was issued for the balance. Recent transactions involving similar machinery indicate that the used machine has a fair value of P2,400,000. A new machine would cost P4,000,000. Given below were the costs incurred during the year: Cost of removing old machine replaced 30,000 Cash proceeds from the sale of the old machine replaced 10,000 General overhaul and repairs to recondition machine 150,000 before use Cost of spare parts to cover breakdowns 200,000 Cost of installation 80,000 Cost of testing the machine before use 110,000 Cost of hauling machine from the vendor to entity premises 10,000 Cost of repairing the damage to the machine because the 30,000 machine was dropped during installation Repairs incurred during the first year of operations 90,000 Safety device added to the machine 250,000 Cost of training workers to operate the machine 20,000 What total amount should be capitalized as cost of the second-hand machine? a. 3,000,000 b. 2,750,000 c. 3,200,000 d. 3,800,000During the current year, Quean Company made the following expenditures relating to the plant building: Continuing and frequent repairs 400,000 Repainting of the plant building 100,000 Major improvements to the electrical wiring system 300,000 Partial replacement of roof tiles 150,000 What total amount should be charged to repair and maintenance expense in the current year? a. 950,000 b. 800,000 c. 650,000 d. 550,000During the current year, Prestigious Company installed a production assembly line to manufacture furniture. In the current year, the entity purchased a new machine and improved the assembly line to install the machine. The improvement did not increase the estimated useful life of the assembly line, but it did result in significant increase in production. The following expenditures were incurred in connection with the project: Machine 750,000 Labor to install machine 140,000 Parts added in improving the assembly line to provide 400,000 future benefits Labor and overhead to improve the assembly line 180,000 What total amount should be capitalized? a. 1,470,000 b. 1,070,000 c. 890,000 d. 750,000