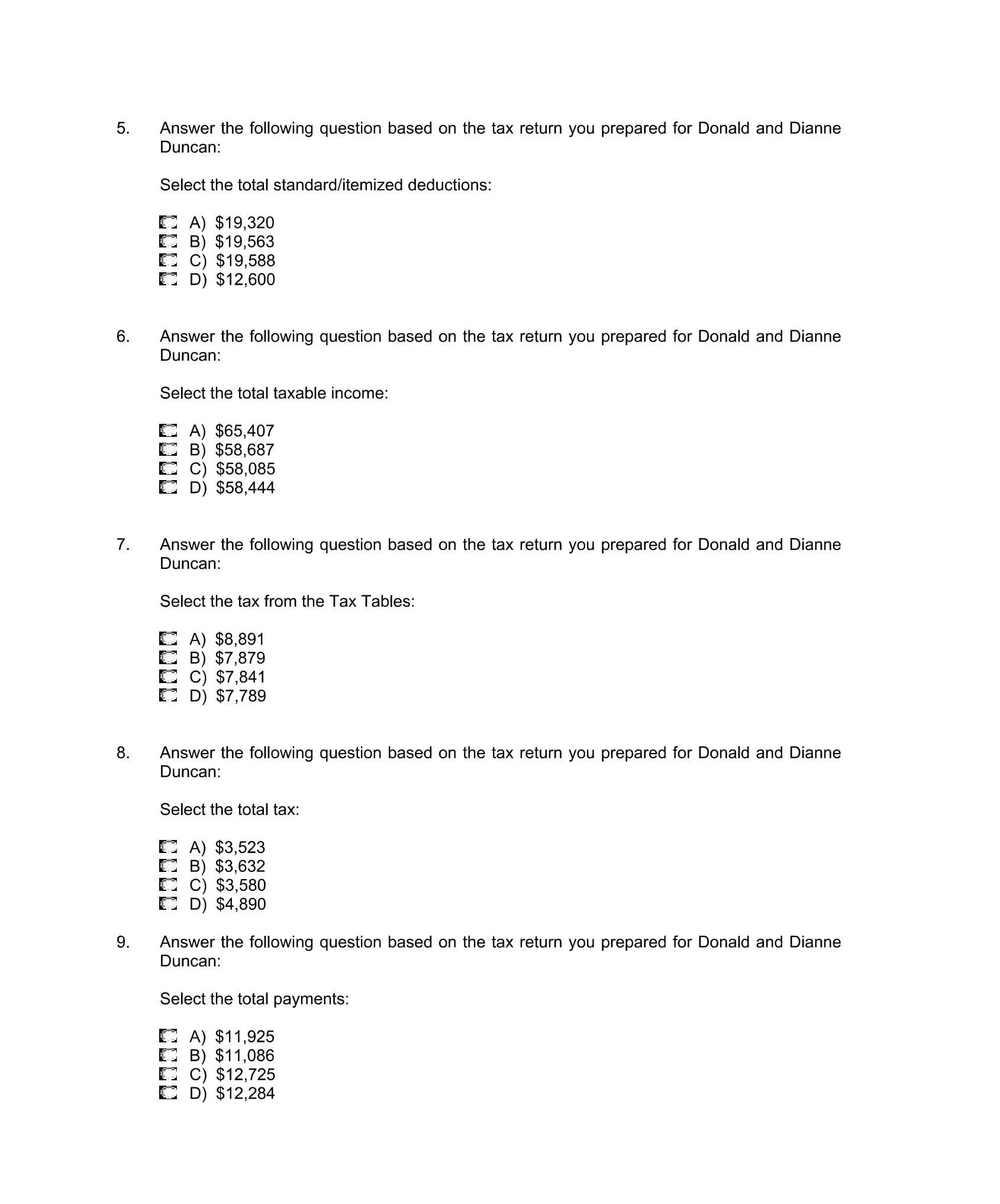

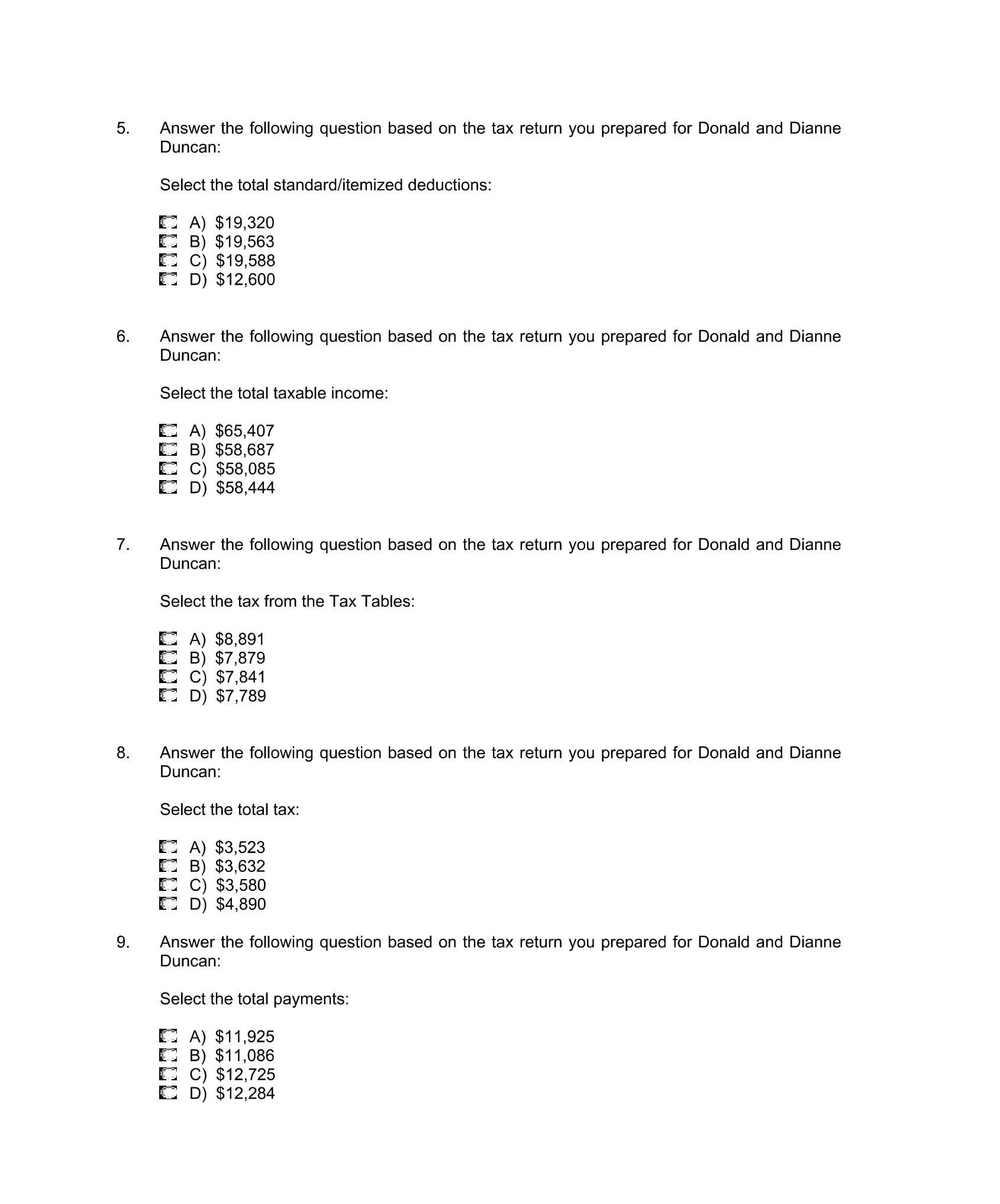

Answer the following question based on the tax return you prepared for Donald and Dianne Duncan: Select the total payments: A) $11,925 B) $11,086 C) $12,725 D) $12,284

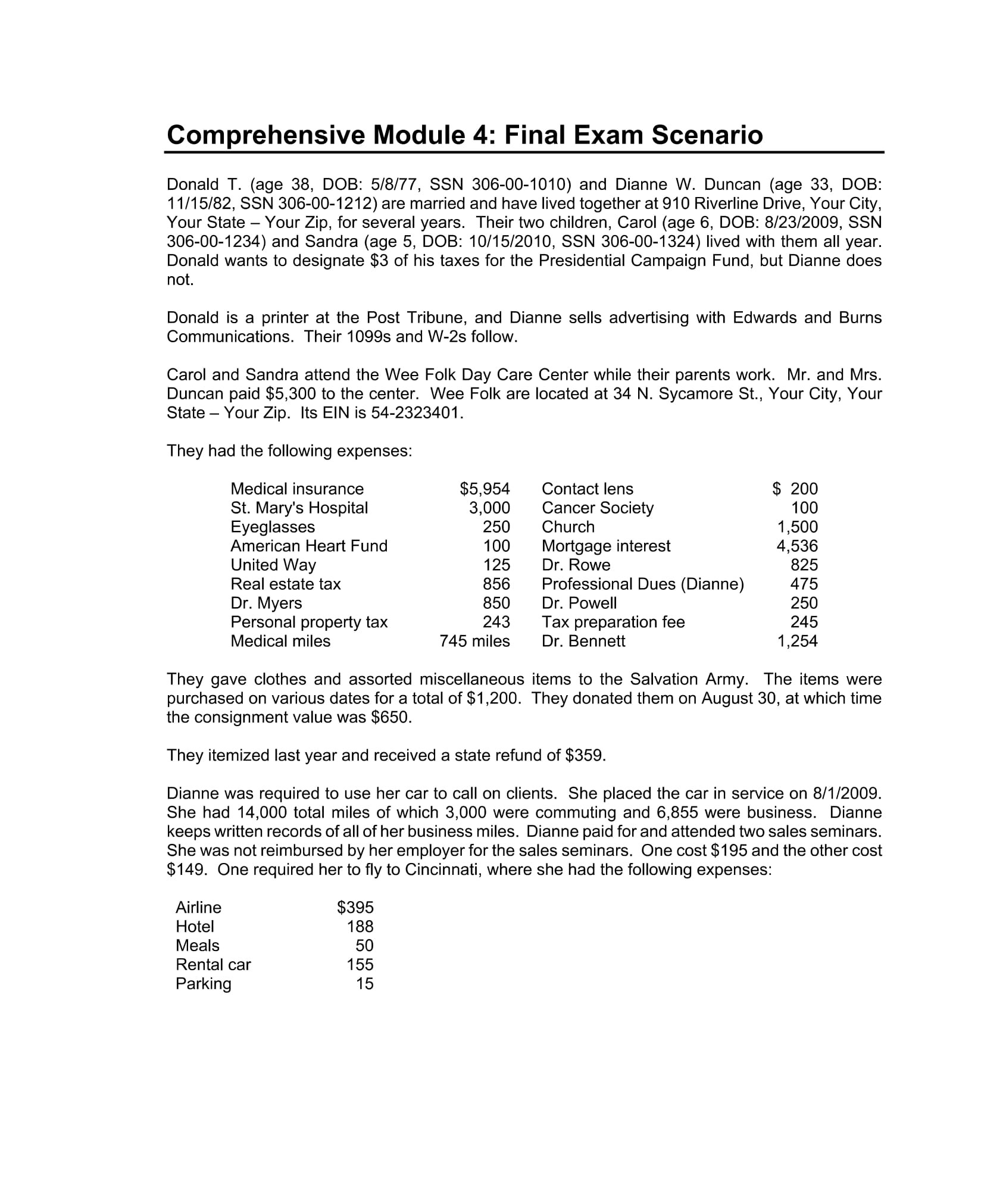

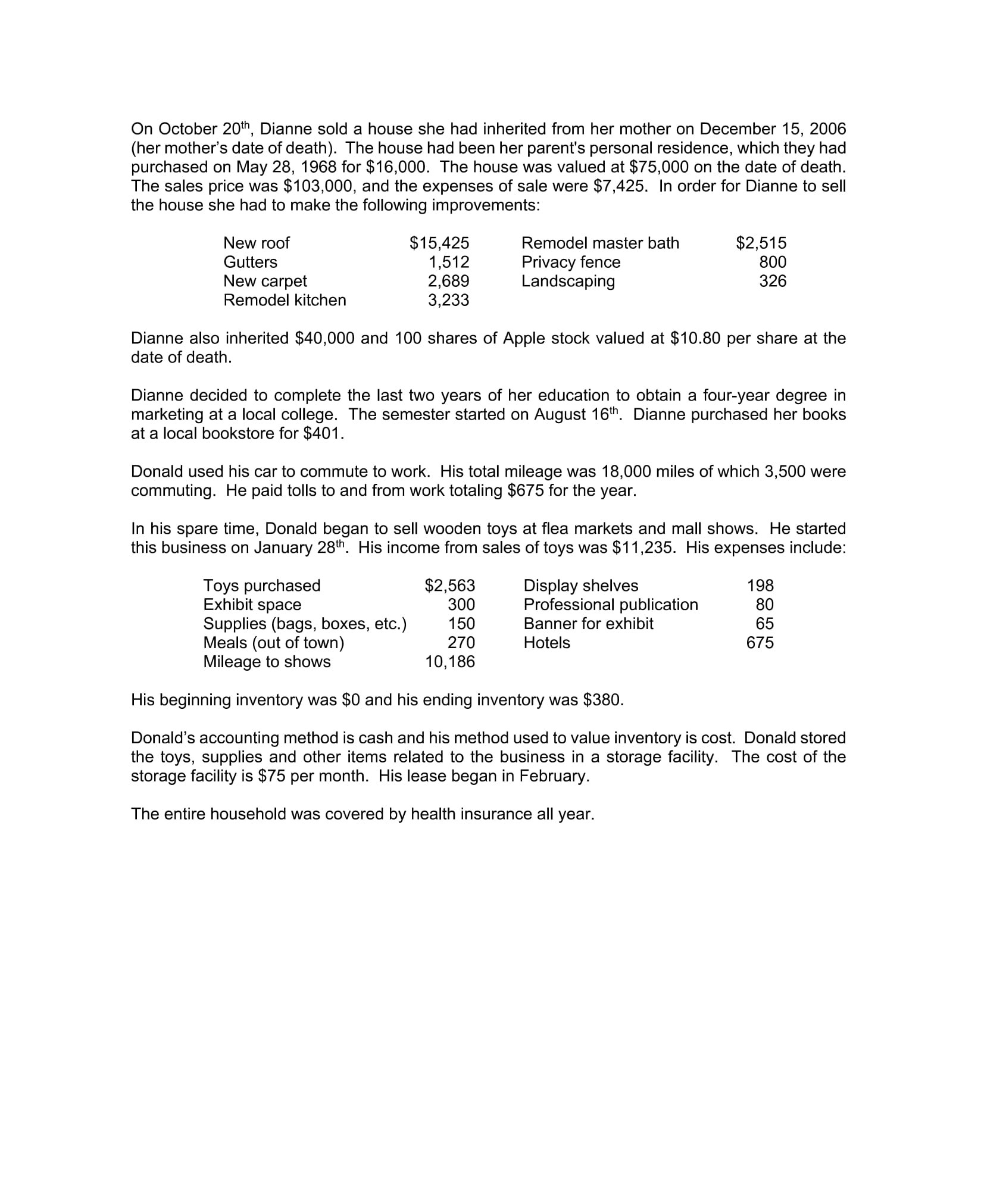

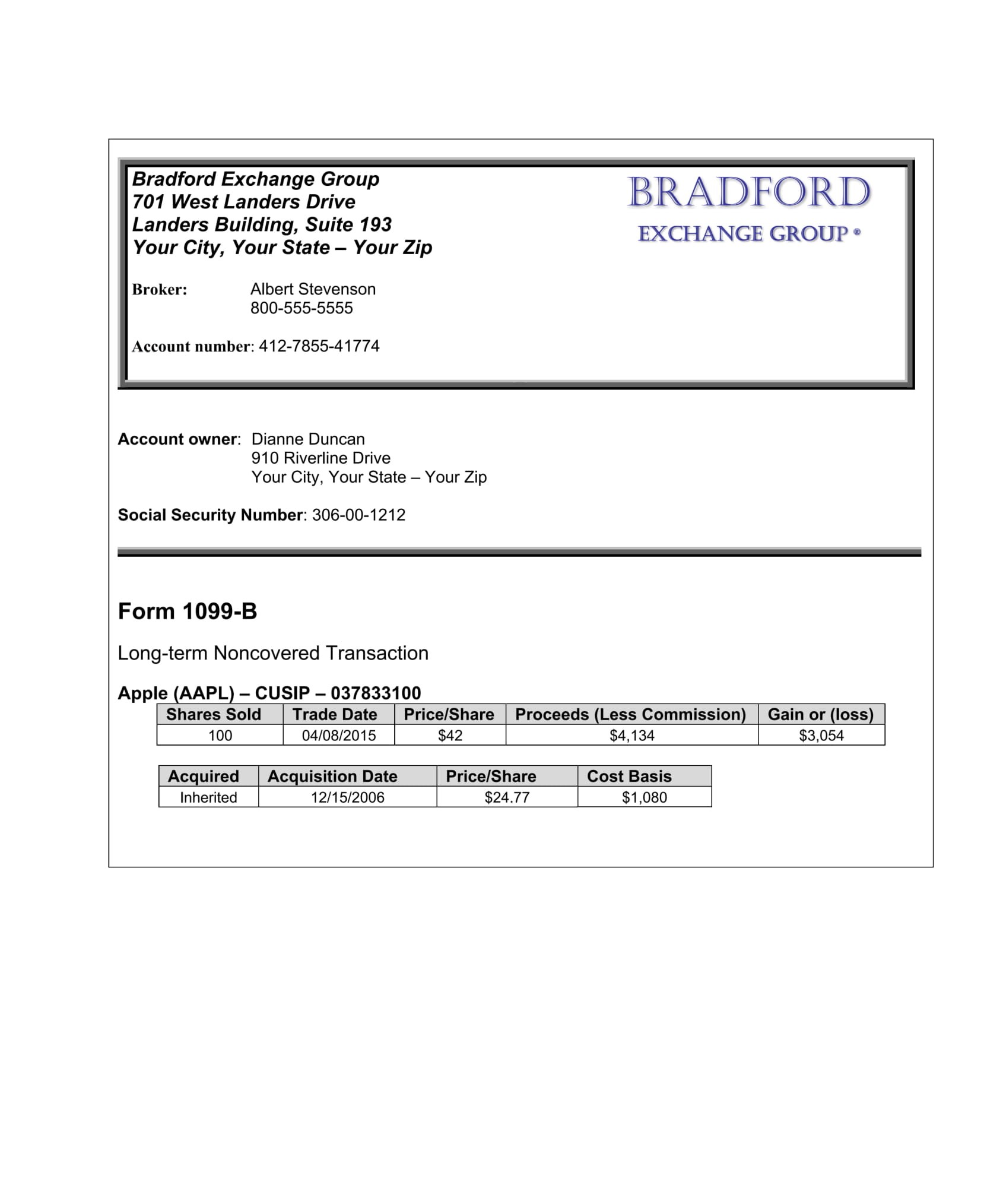

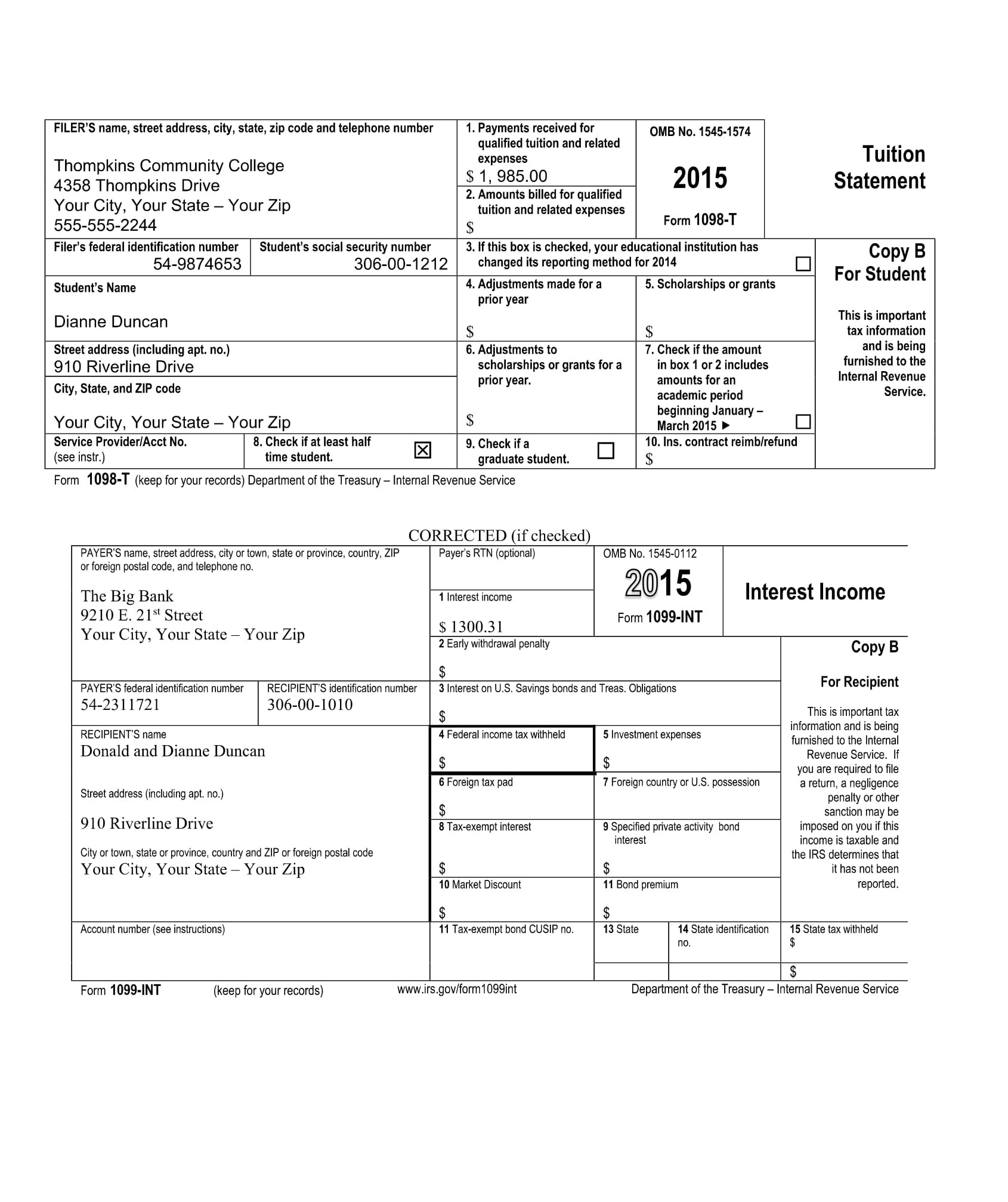

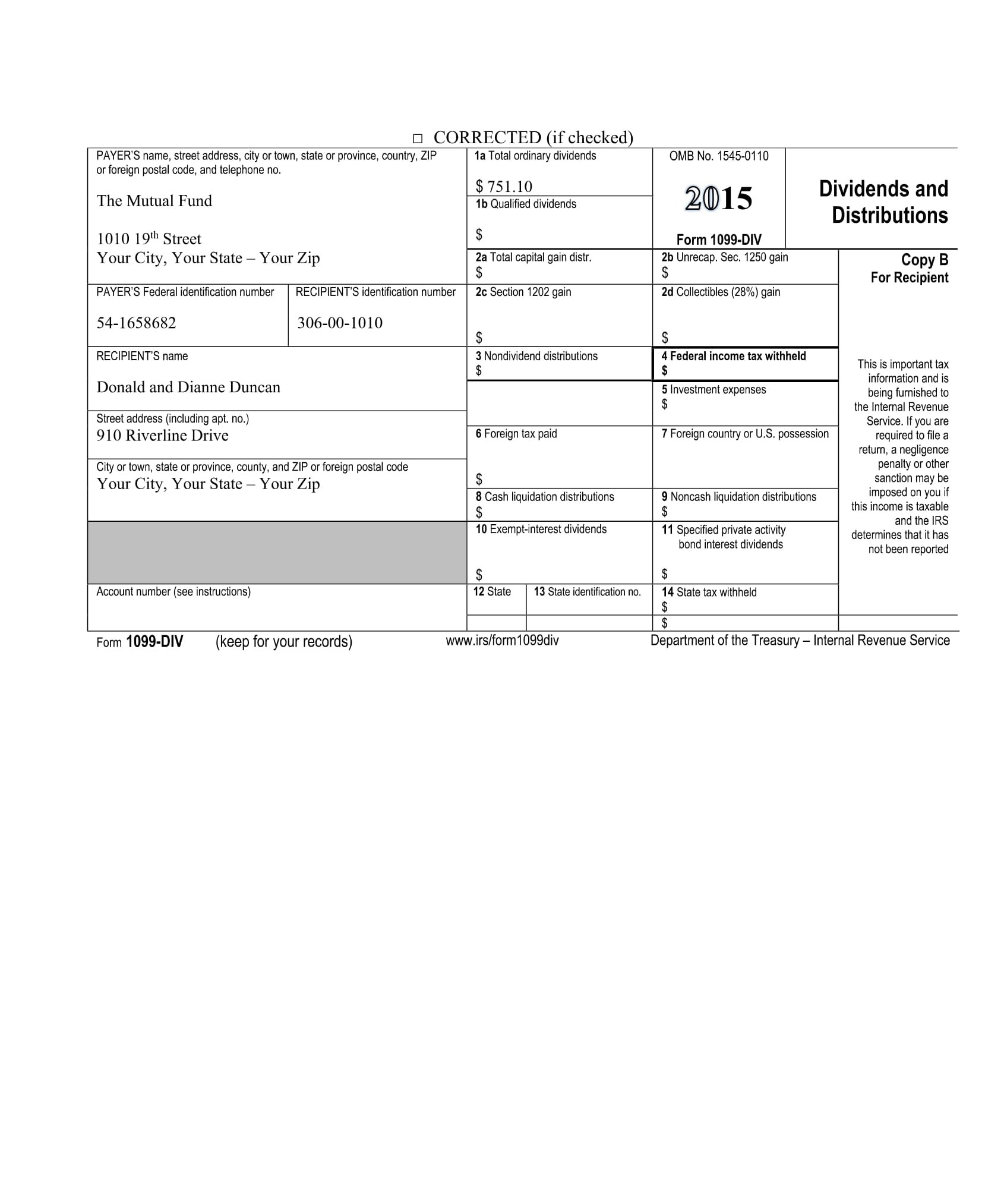

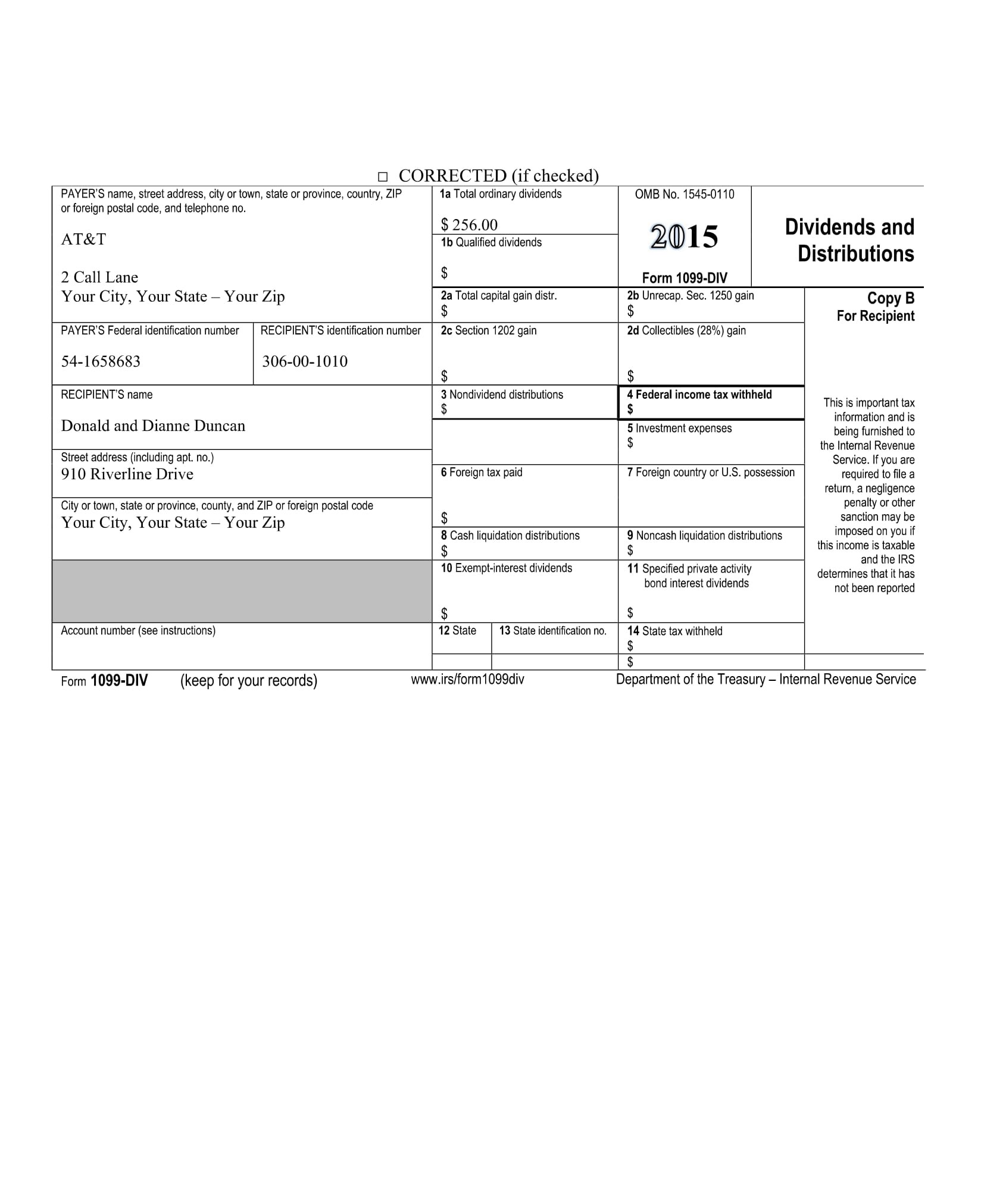

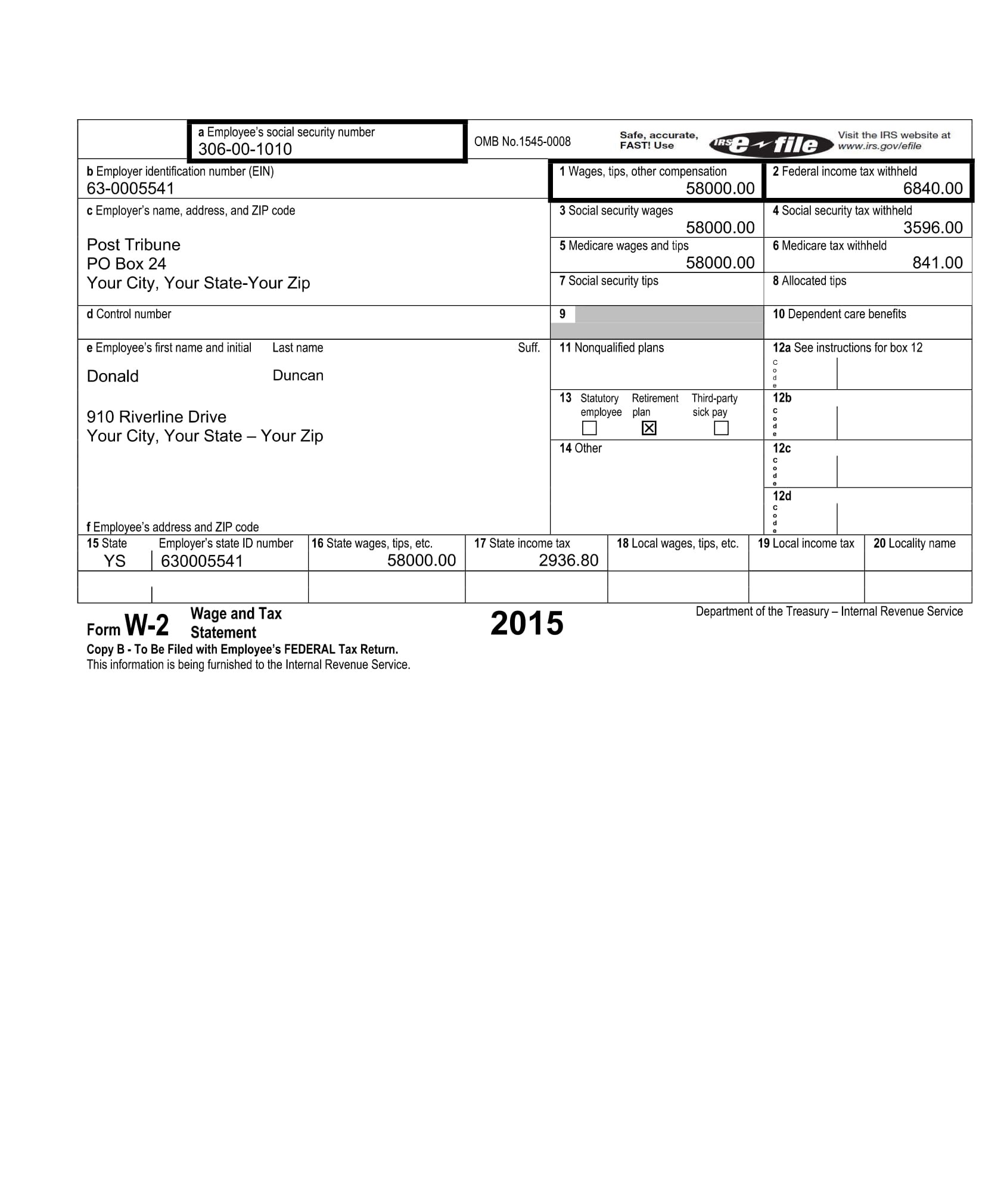

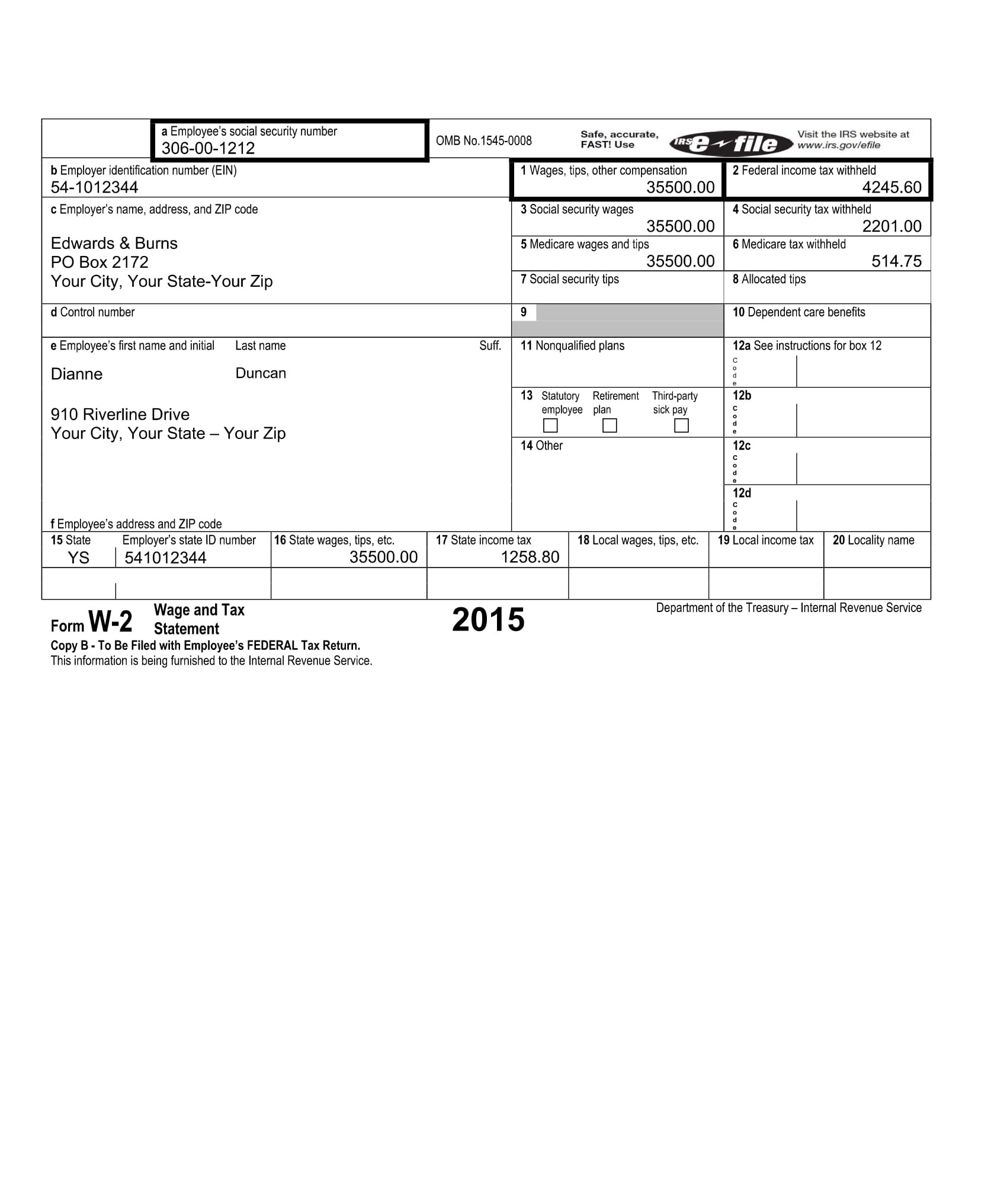

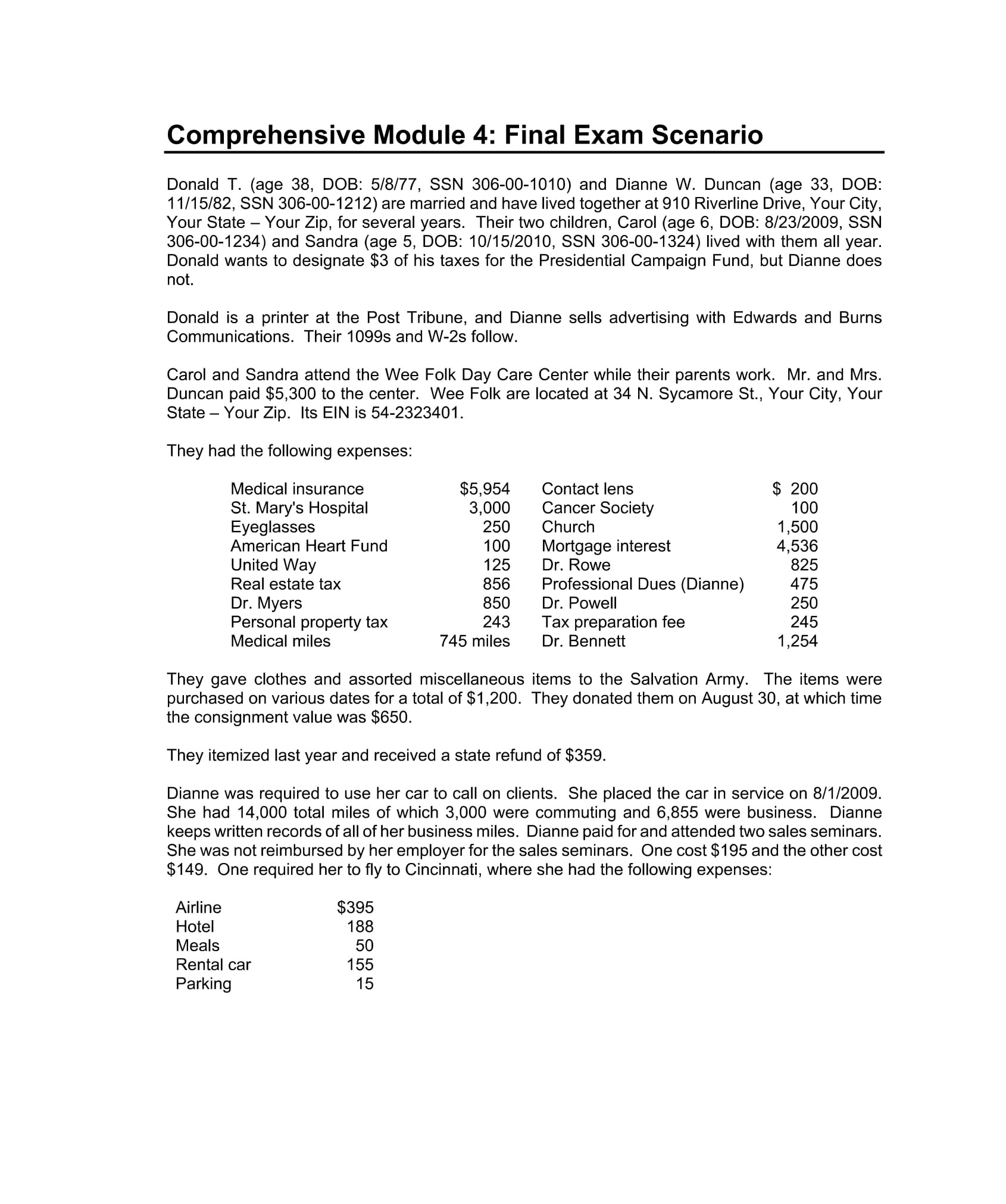

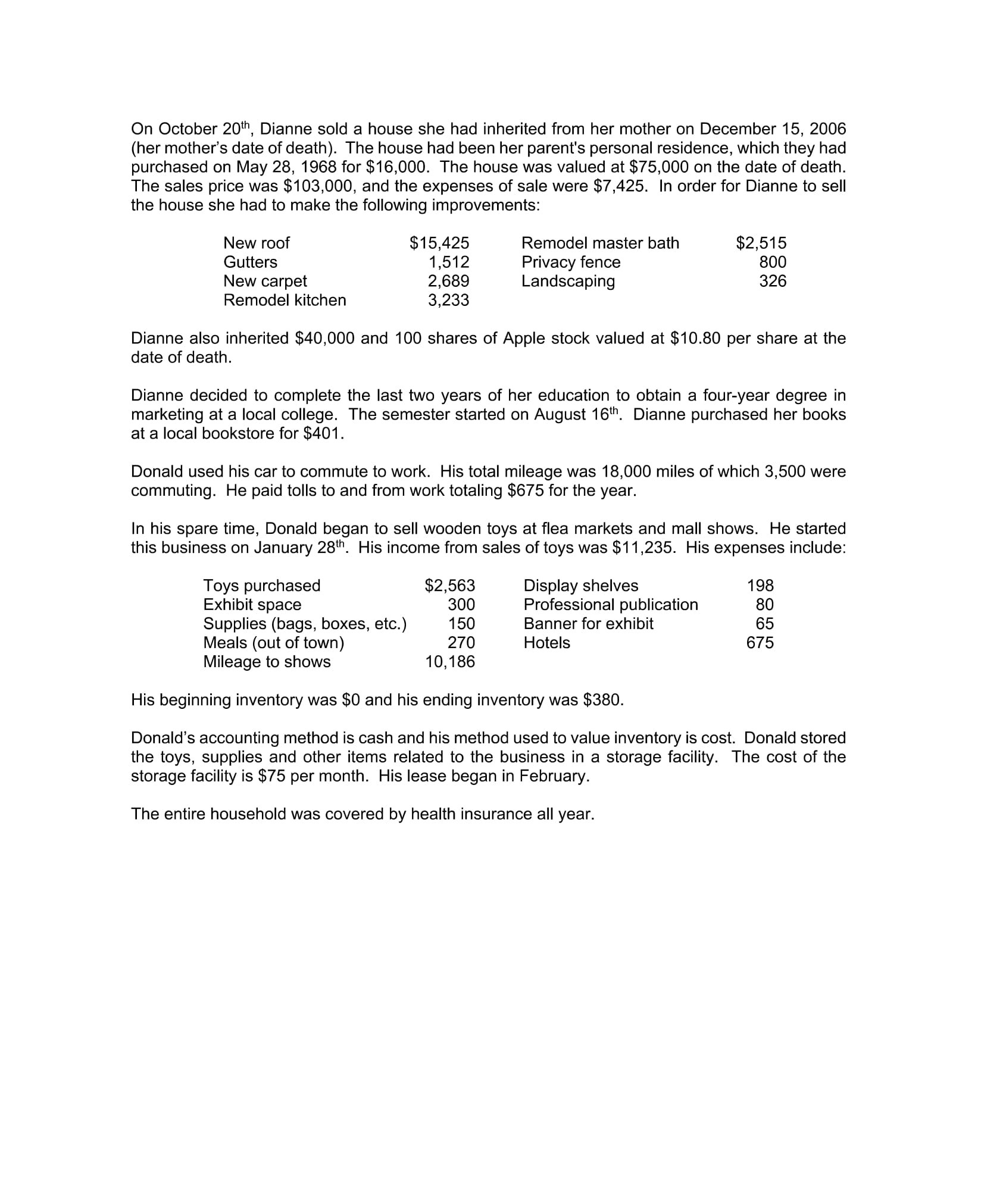

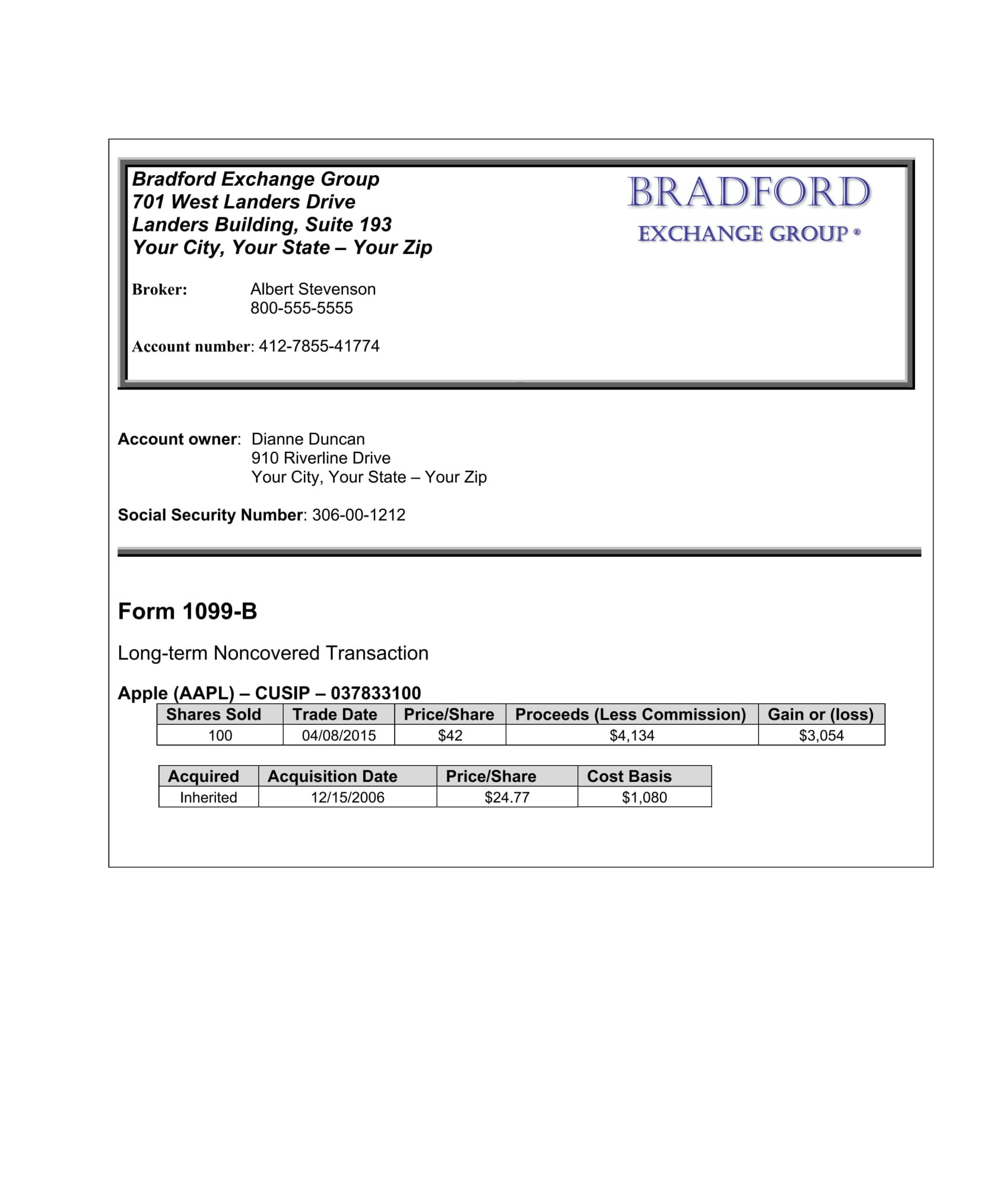

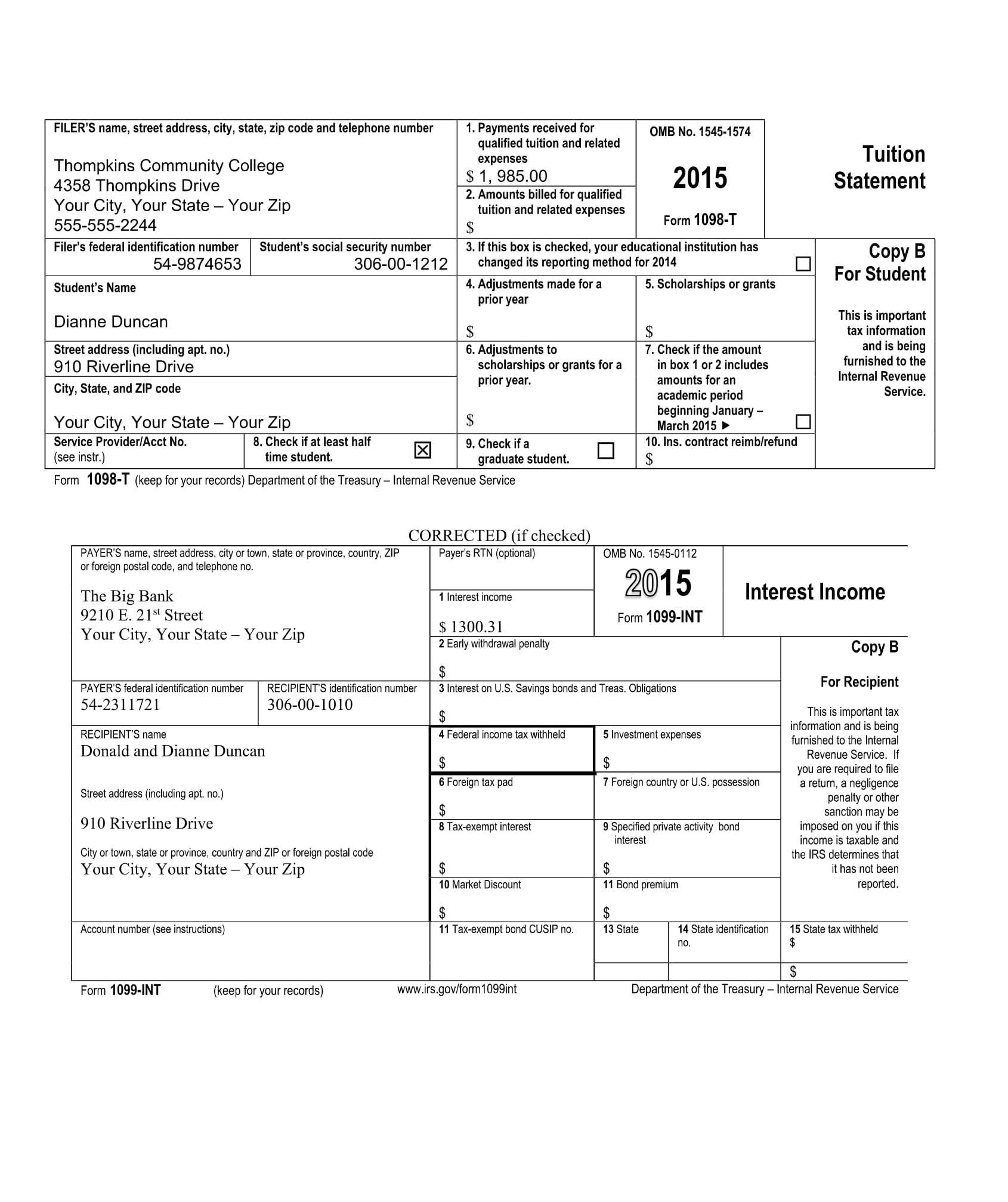

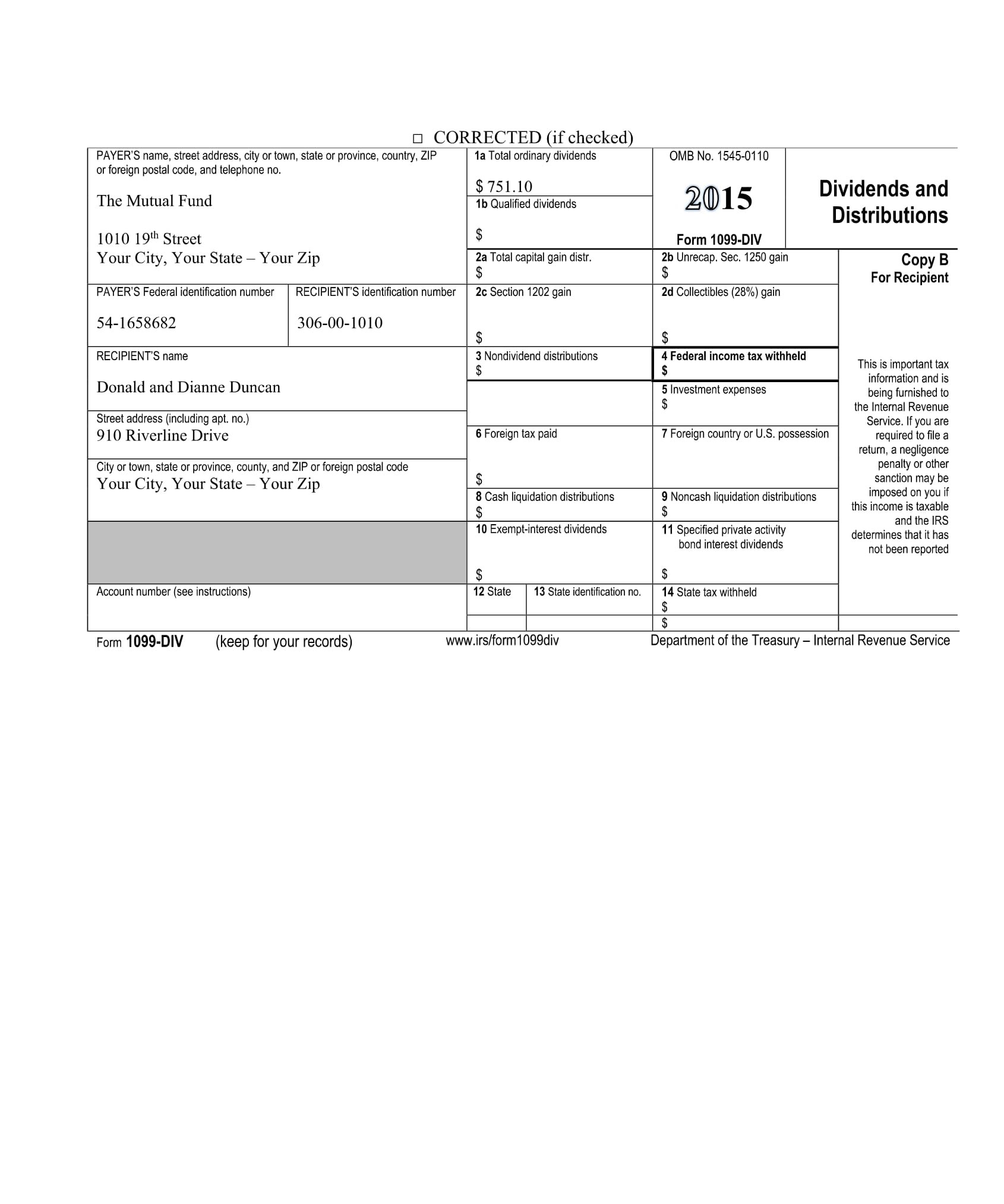

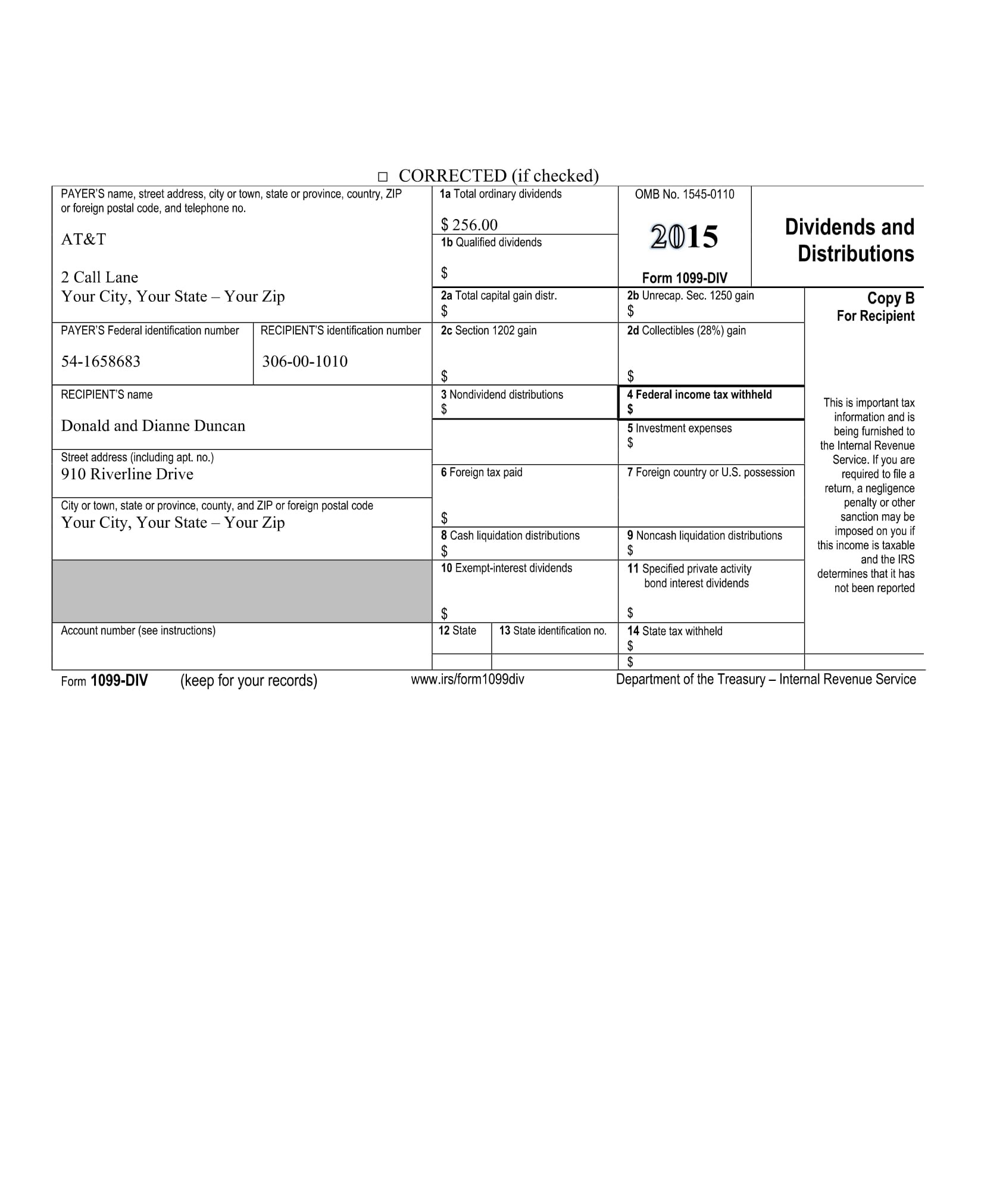

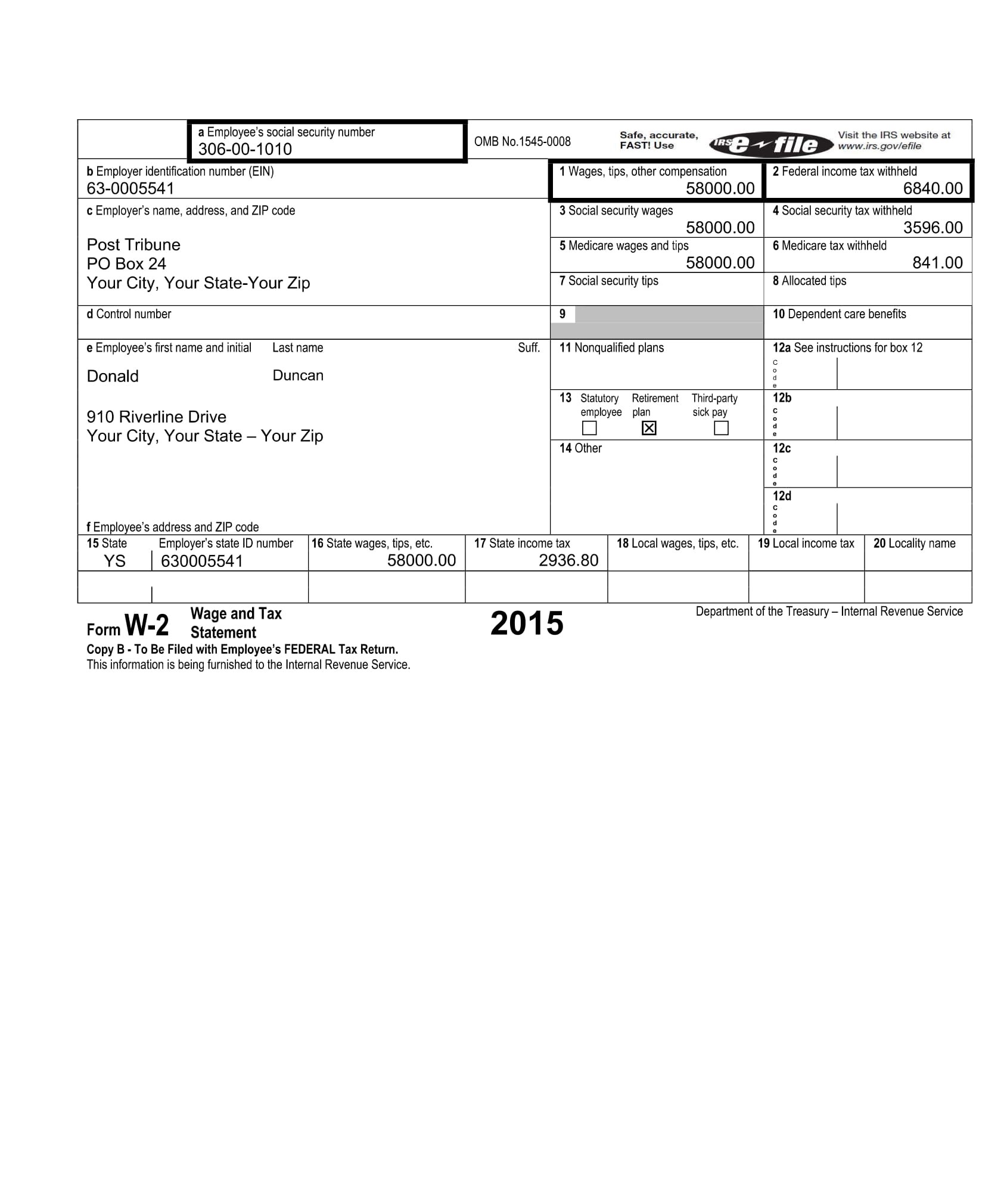

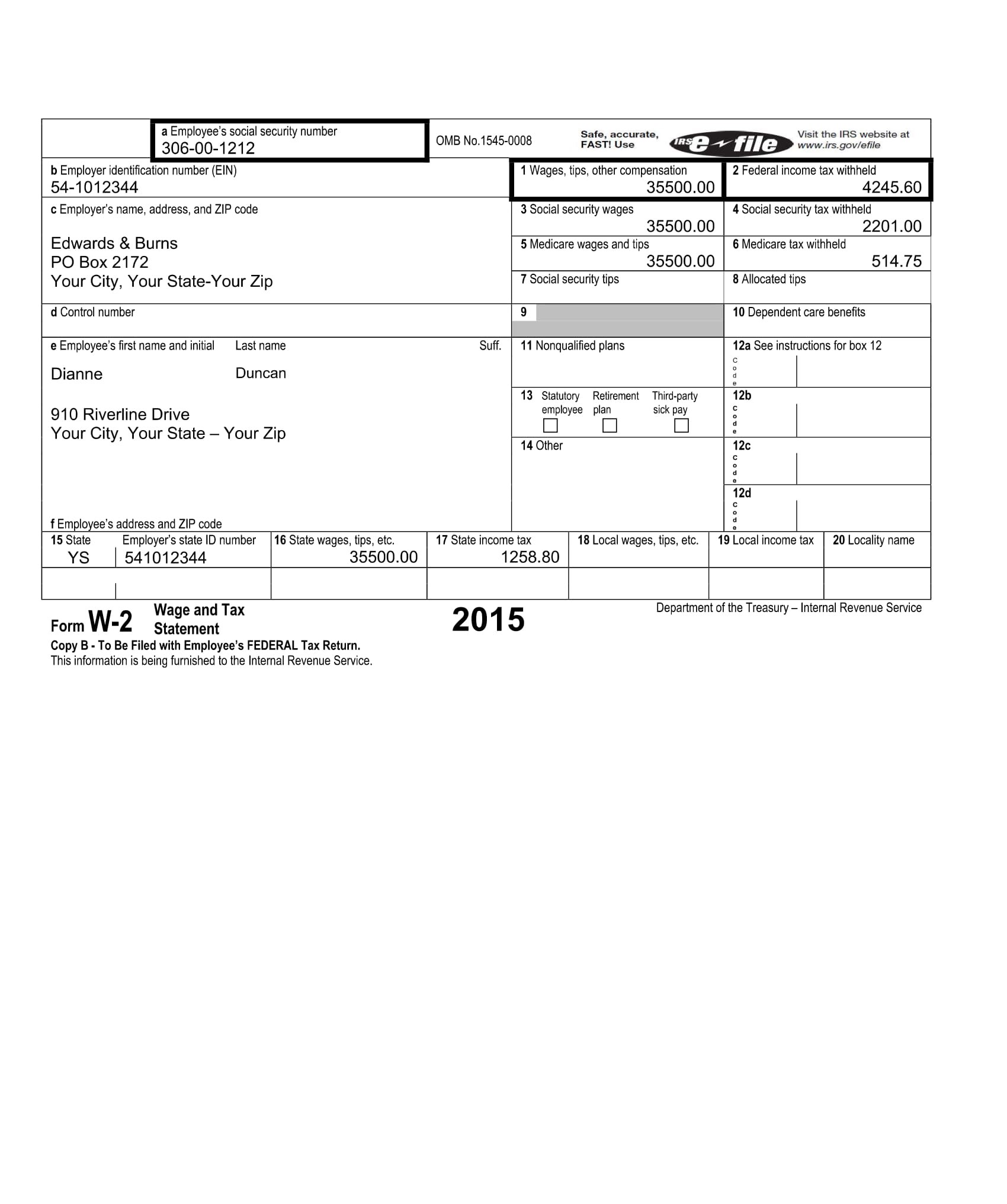

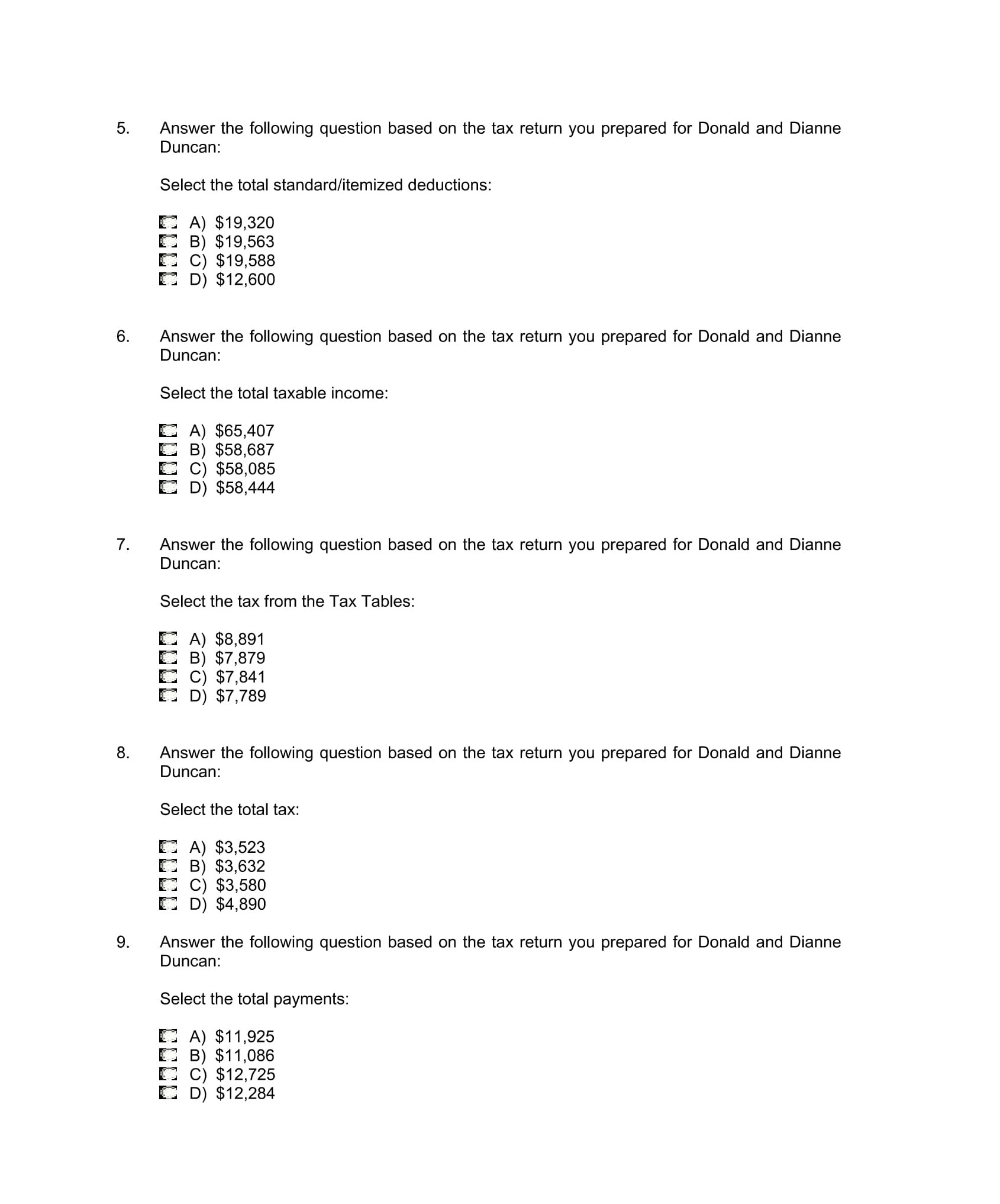

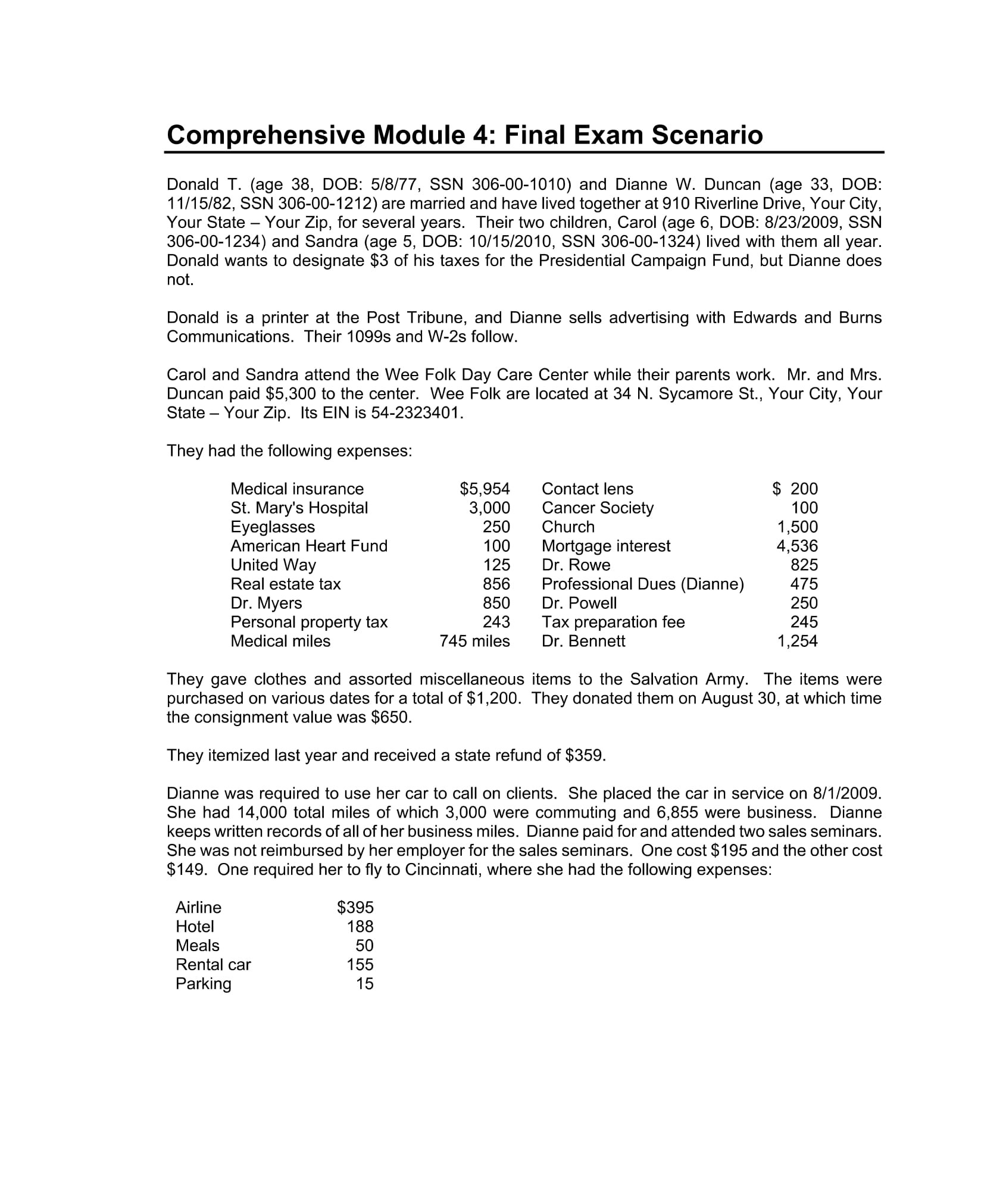

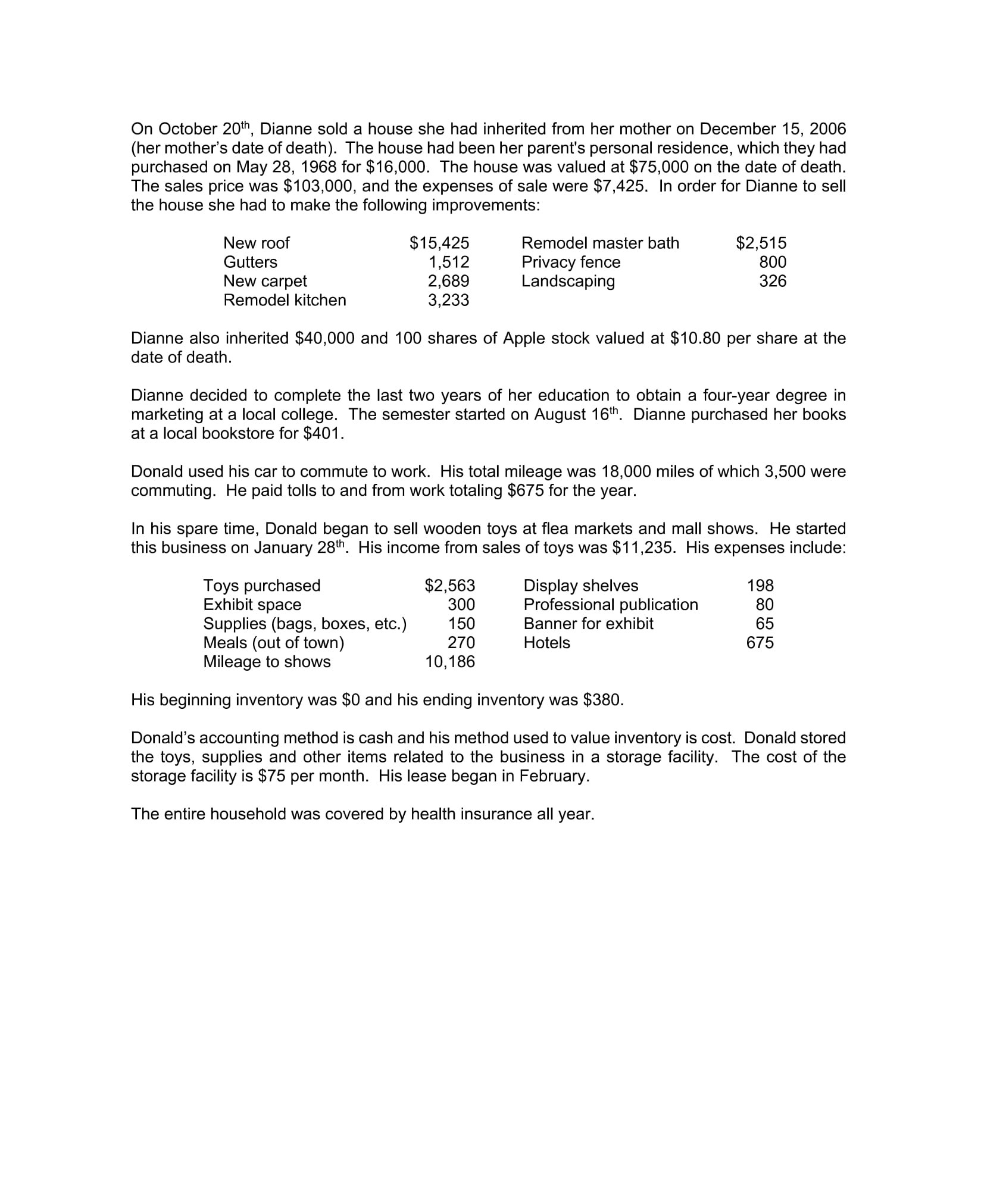

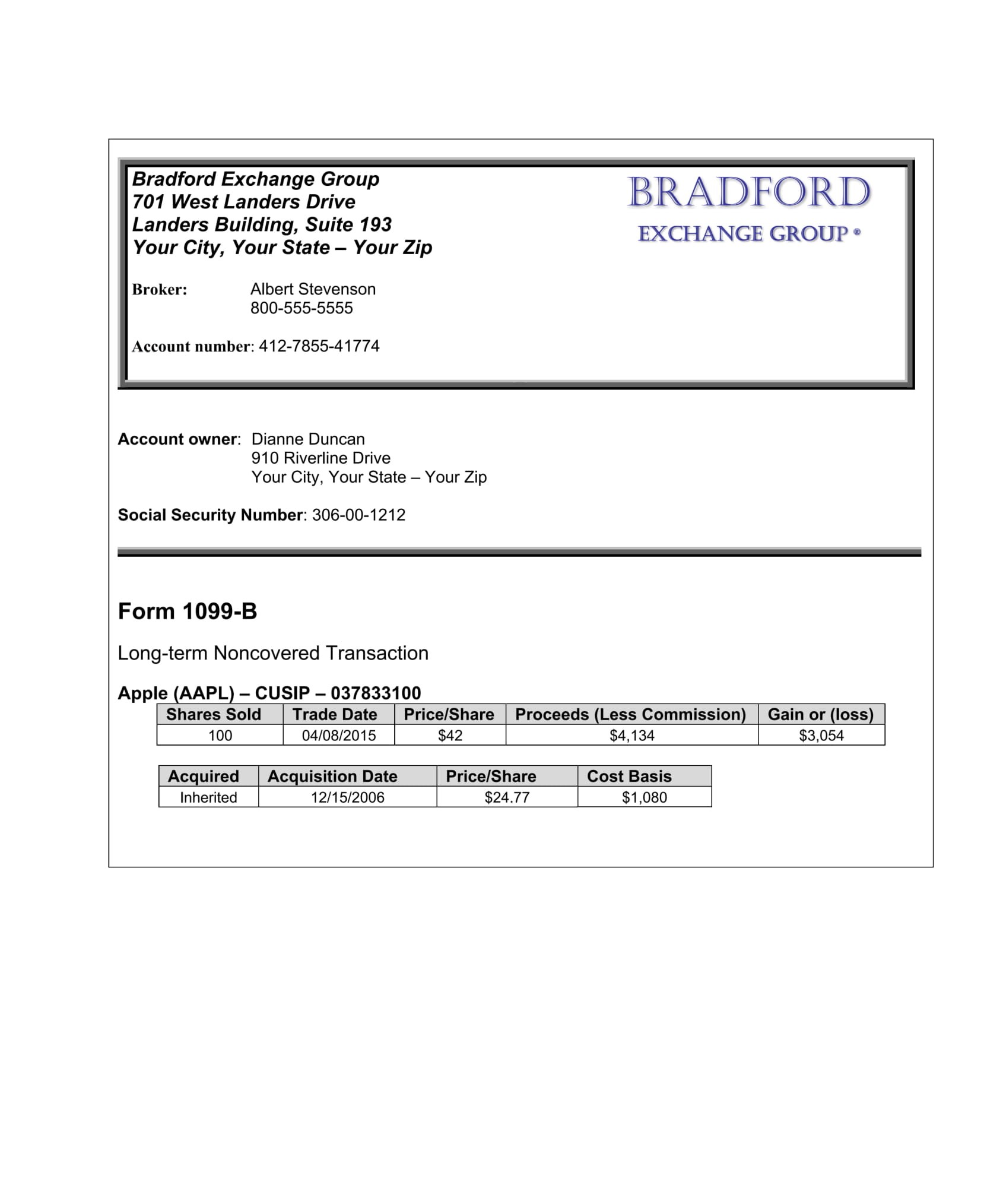

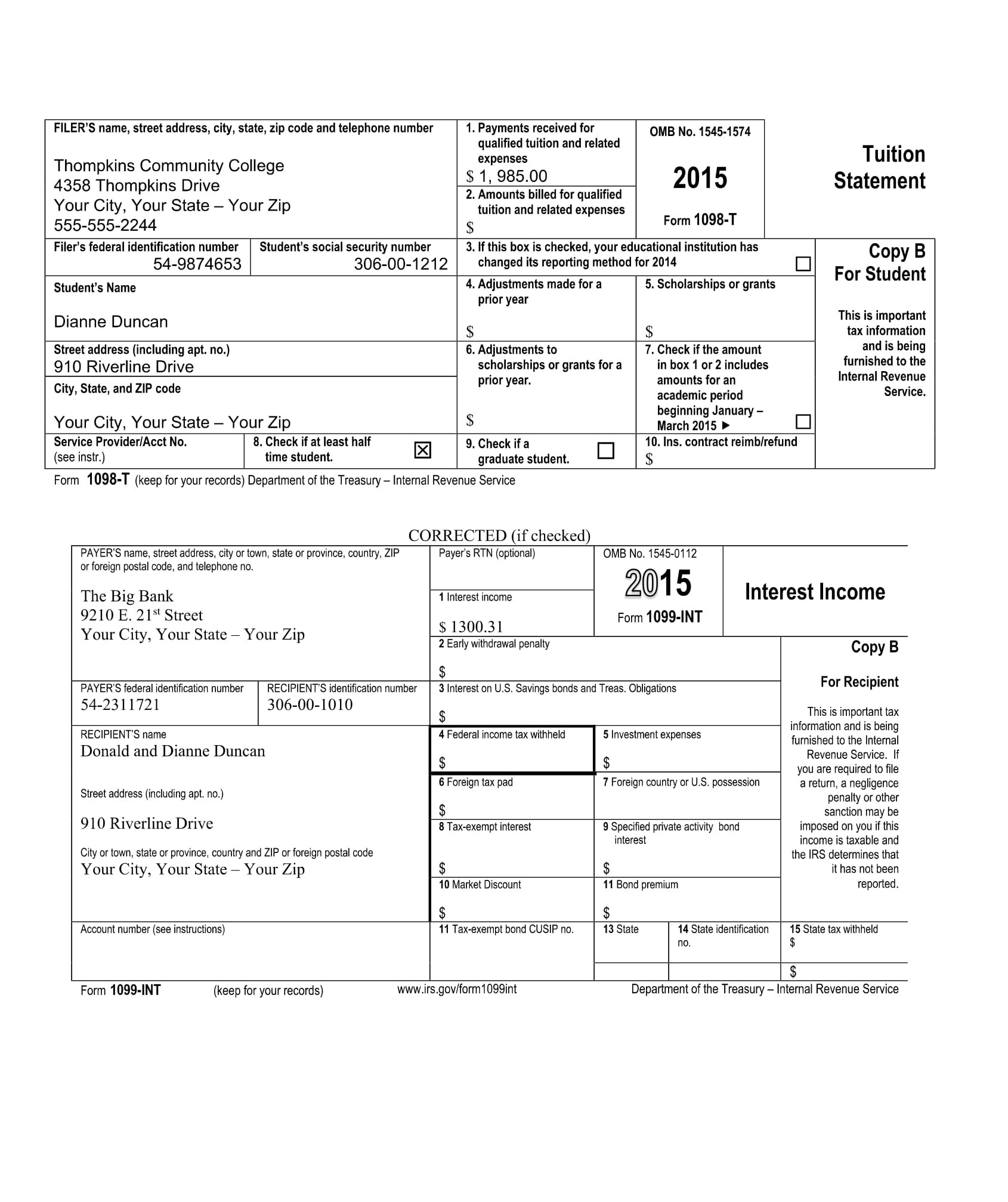

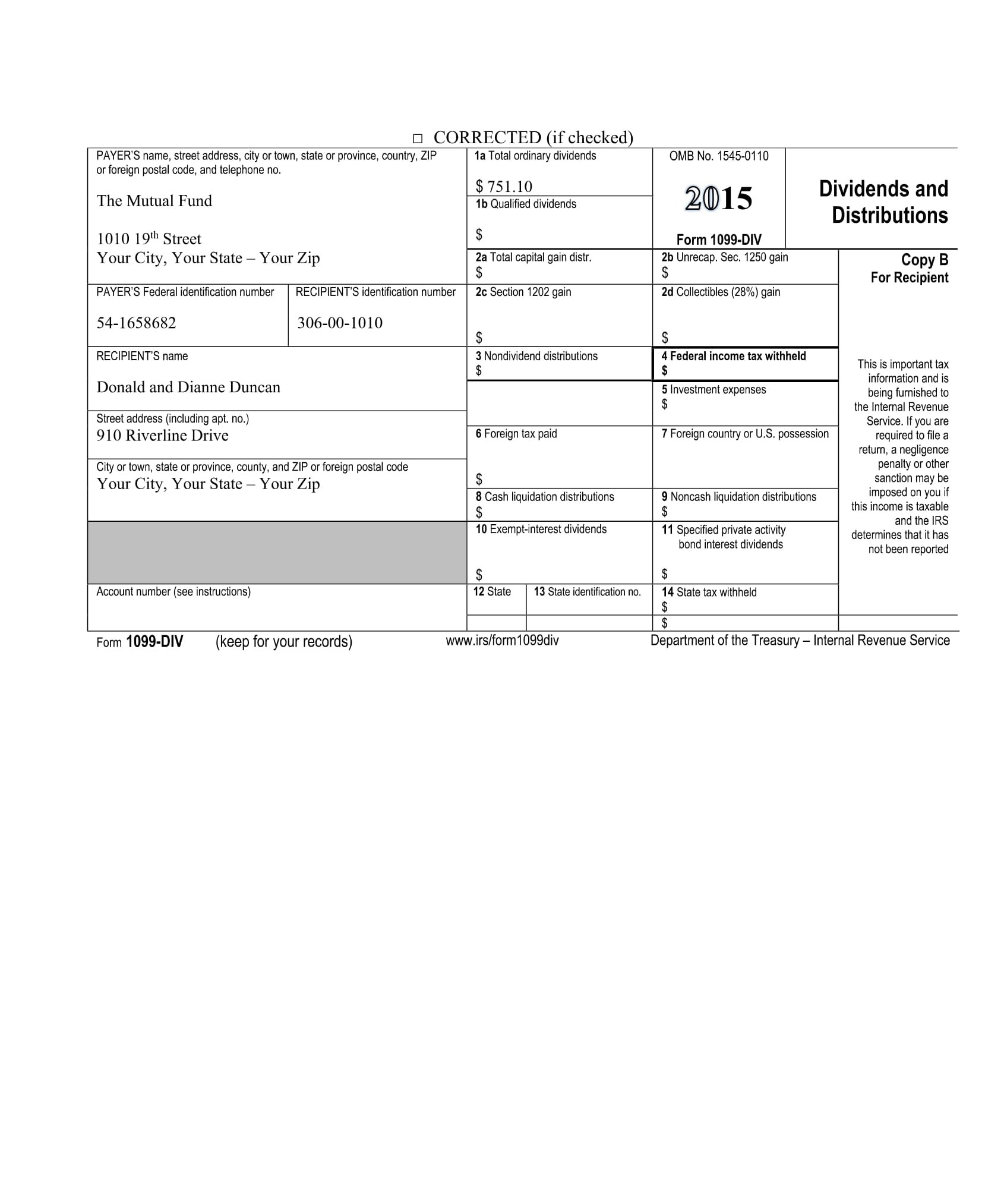

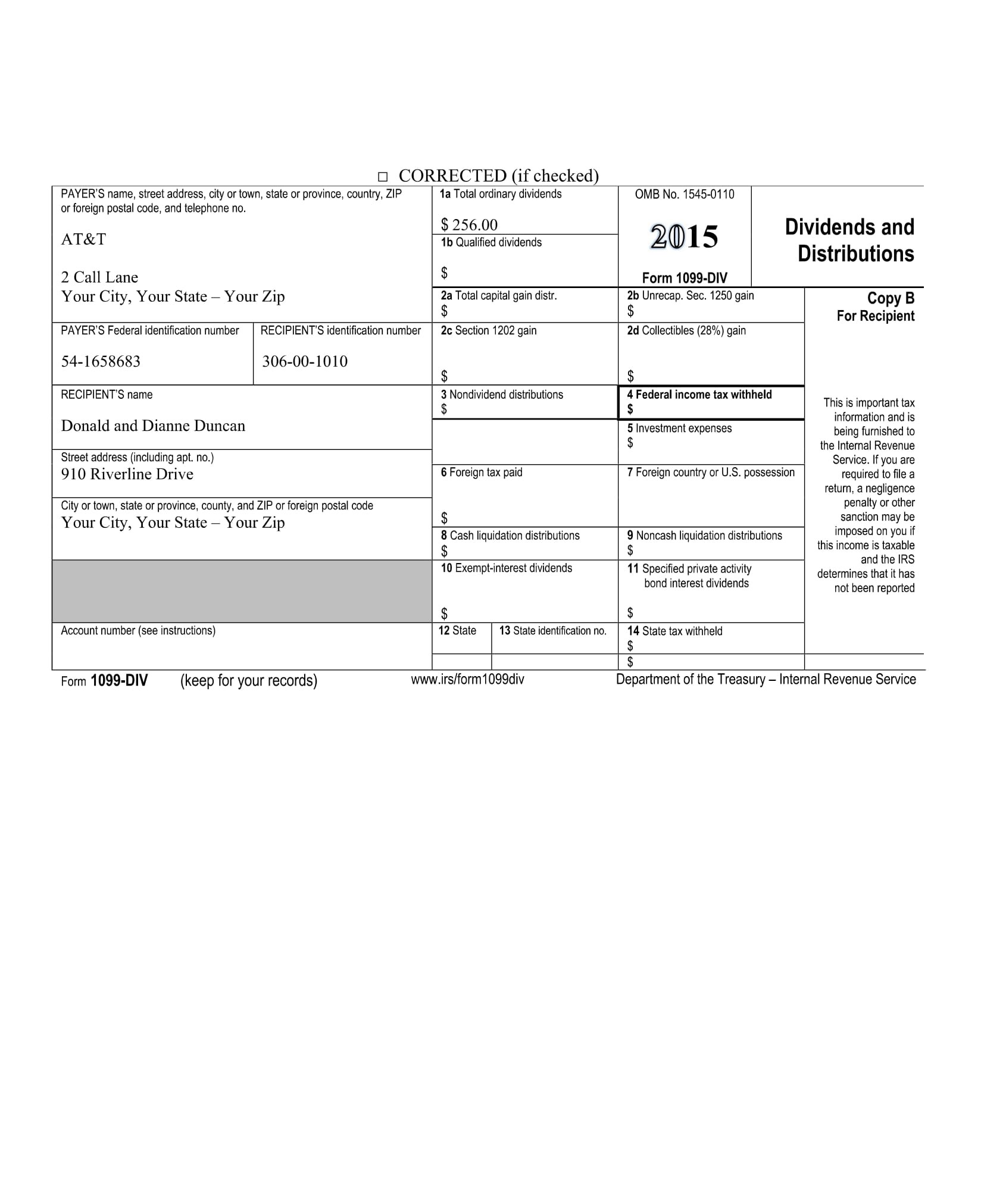

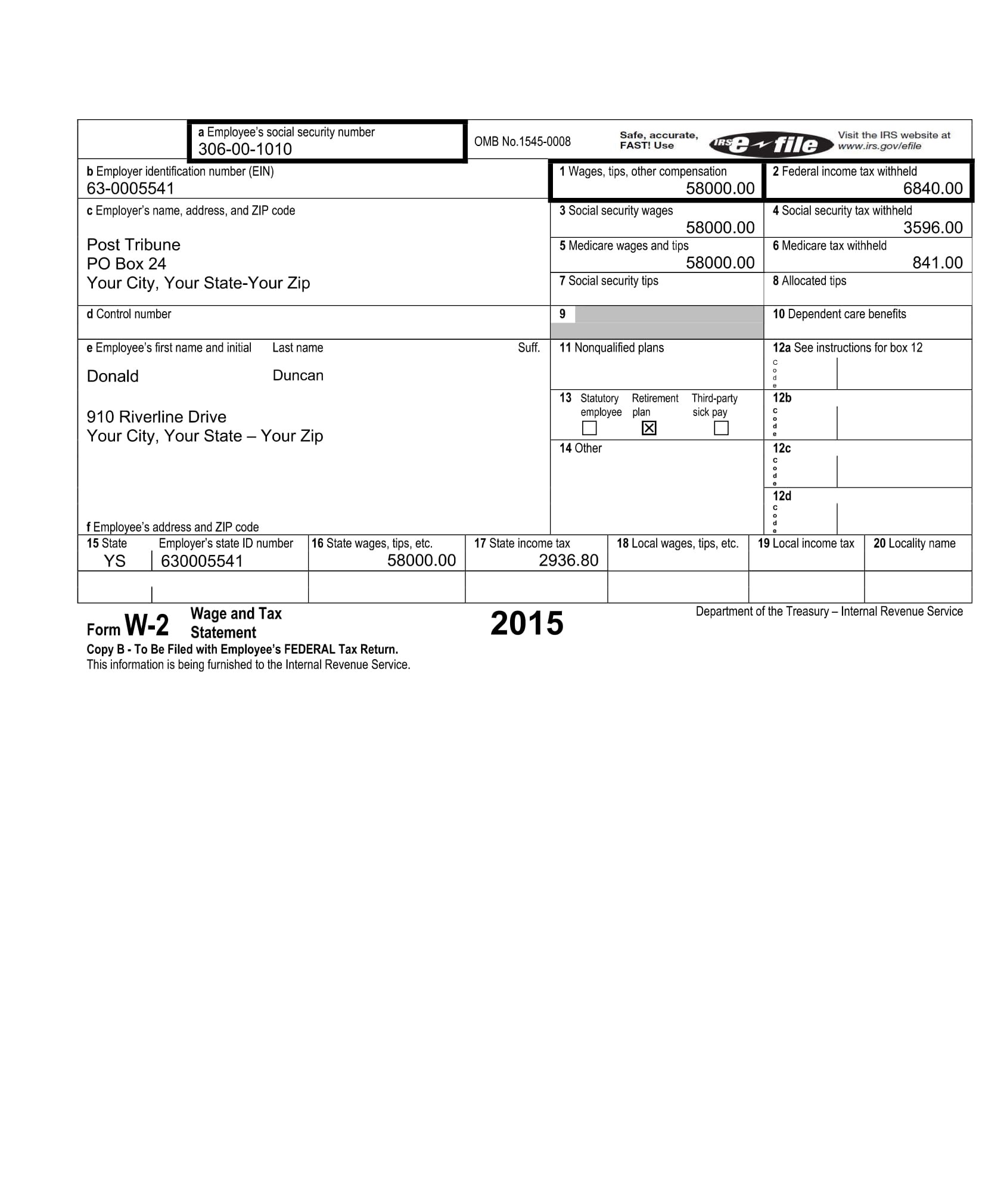

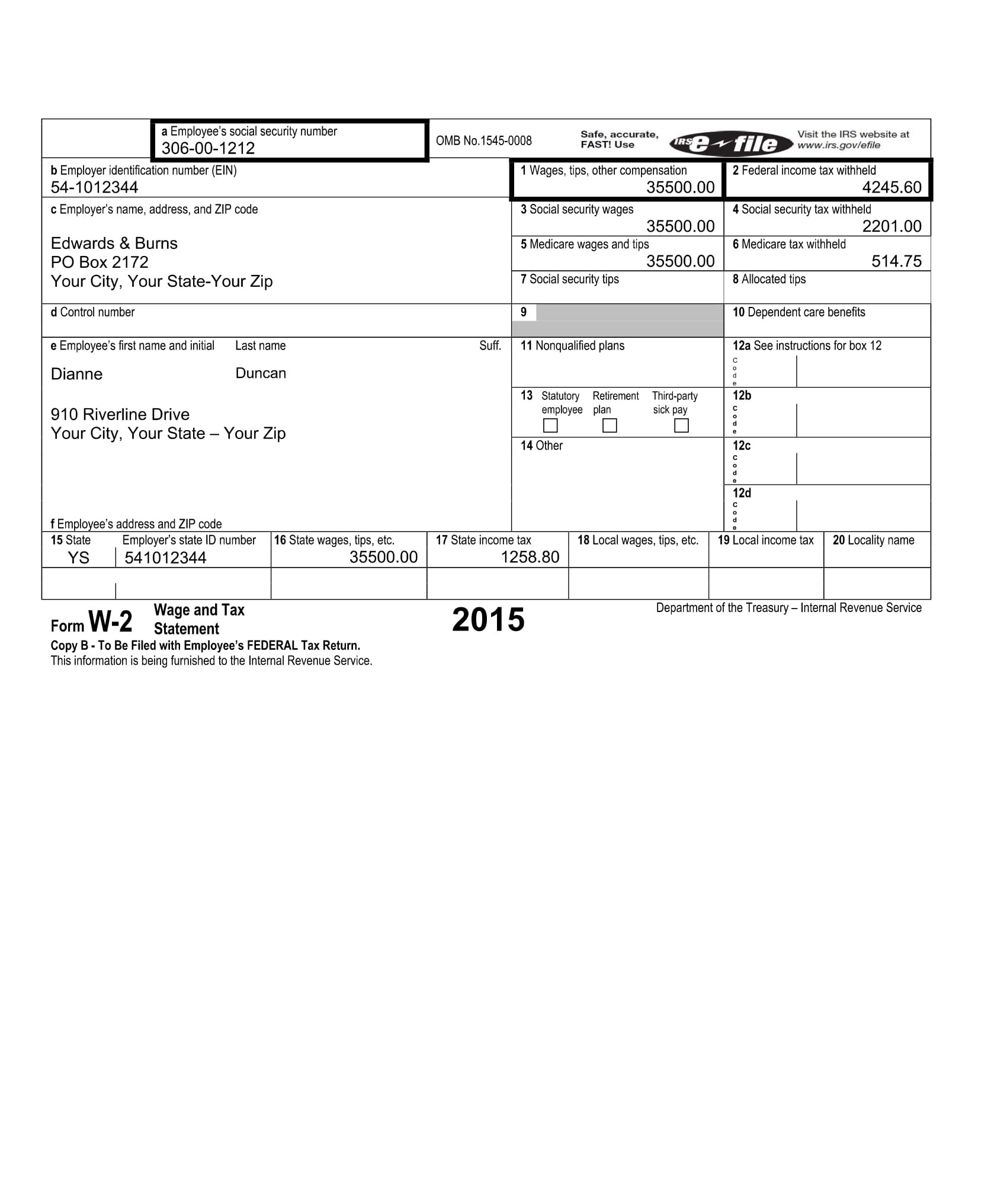

Comprehensive Module 4: Final Exam Scenario Donald T. (age 38, DOB: 5/8/77, SSN 306-00-1010) and Dianne W. Duncan (age 33, DOB: 11/15/82, SSN 306-00-1212) are married and have lived together at 910 Riverline Drive, Your City, Your State Your Zip, for several years. Their two children, Carol (age 6, DOB: 8/23/2009, SSN 306-00-1234) and Sandra (age 5, DOB: 10/15/2010, SSN 306-00-1324) lived with them all year. Donald wants to designate $3 of his taxes for the Presidential Campaign Fund, but Dianne does not. Donald is a printer at the Post Tribune, and Dianne sells advertising with Edwards and Burns Communications. Their 10995 and W-2s follow. Carol and Sandra attend the Wee Folk Day Care Center while their parents work. Mr. and Mrs. Duncan paid $5,300 to the center. Wee Folk are located at 34 N. Sycamore St., Your City, Your State Your Zip. Its EIN is 54-2323401. They had the following expenses: Medical insurance $5,954 Contact lens $ 200 St. Mary's Hospital 3,000 Cancer Society 100 Eyeglasses 250 Church 1,500 American Heart Fund 100 Mortgage interest 4,536 United Way 125 Dr. Rowe 825 Real estate tax 856 Professional Dues (Dianne) 475 Dr. Myers 850 Dr. Powell 250 Personal property tax 243 Tax preparation fee 245 Medical miles 745 miles Dr. Bennett 1,254 They gave clothes and assorted miscellaneous items to the Salvation Army. The items were purchased on various dates for a total of $1,200. They donated them on August 30, at which time the consignment value was $650. They itemized last year and received a state refund of $359. Dianne was required to use her car to call on clients. She placed the car in service on 8/1/2009. She had 14,000 total miles of which 3,000 were commuting and 6,855 were business. Dianne keeps written records of all of her business miles. Dianne paid for and attended two sales seminars. She was not reimbursed by her employer for the sales seminars. One cost $195 and the other cost $149. One required her to y to Cincinnati, where she had the following expenses: Airline $395 Hotel 188 Meals 50 Rental car 155 Parking 15 On October 20'\Bradford Exchange Group 701 West Landers Drive BRADFORD Landers Building, Suite 193 Your City, Your State - Your Zip EXCHANGE GROUP Broker: Albert Stevenson 800-555-5555 Account number: 412-7855-41774 Account owner: Dianne Duncan 910 Riverline Drive Your City, Your State - Your Zip Social Security Number: 306-00-1212 Form 1099-B Long-term Noncovered Transaction Apple (AAPL) - CUSIP - 037833100 Shares Sold Trade Date Price/Share |Proceeds (Less Commission) |Gain or (loss) 100 04/08/2015 $42 $4, 134 $3,054 Acquired Acquisition Date Price/Share Cost Basis Inherited 12/15/2006 $24.77 $1,080FILER'S name , street address , city , state , zip code and telephone number 1 . Payments received for* qualified tuition and related OMB NO . 1545 - 1574 Thompkins Community College expenses 4358 Thompkins Drive* $ 1, 985. 00 2015 Tuition Your City , Your State - Your Zip 2 . Amounts billed for qualified Statement 555- 555- 2244 tuition and related expenses S Form 1098 - 7 Filer's federal identification number* Student's social security number 3 . If this box is checked , your educational institution has 54 - 987 4653 306- 00 - 1212 changed its reporting method for 2014\\ Copy B Student's Name 4 . Adjustments made for a 5 . Scholarships or grants* For Student prior year Dianne Duncan This is important tax information Street address ( including apt . 170 . ) `. Adjustments to 7 . Check if the amount and is being 910 Riverline Drive scholarships or grants for a in box 1 or 2 includes furnished to the City , State , and ZIP code prior year .\\ amounts for an Internal Revenue academic period Service . Your City , Your State - Your Zip S beginning January - March 2015 0 Service Provider / Acct No ." 8 . Check if at least half 10 . Ins . contract reimblrefund ( see instr . )\\ time student .\\ 9 . Check if a graduate student . Form 1098 - 7 ( keep for your records ) Department of the Treasury - Internal Revenue Service CORRECTED ( if checked ) PAYER'S name , street address , city or town , state or province , country , ZIP Payer's RTN ( optional ) OMB NO . 1545 - 01 12 or foreign postal code , and telephone no ." The Big Bank 1 Interest income* 2015 Interest Income 9210 E . 21 st Street Form 109 9 - INT Your City , Your State - Your Zip $ 1300. 31 2 Early withdrawal penalty Copy B PAYER'S federal identification number RECIPIENT'S identification number 54 - 23 1 1721 306 - 00 - 1010 3 Interest on U .S . Savings bonds and Treas . Obligations For Recipient $ This is important tax RECIPIENT'S name 4 Federal income tax withheld 5 Investment expenses nformation and is being Donald and Dianne Duncan furnished to the Internal S Revenue Service . If you are required to file Street address ( including apt . no . ) 6 Foreign tax pad 7 Foreign country or U.S. possession a return , a negligence penalty or other 910 Riverline Drive Sanction may be 8 Tax - exempt interest Specified private activity bond imposed on you if this City or town , state or province , country and ZIP or foreign postal code* interest income is taxable and he IRS determines that Your City , Your State - Your Zip it has not been 10 Market Discount* 11 Bond premium* reported . Account number ( see instructions ) 11 Tax - exempt bond CUSIP no . 13 State 14 State identification\\ 15 State tax withheld no . S Form 1099 - INT ( keep for your records ) www . irs . gov / form 109 9int Department of the Treasury - Internal Revenue Service*PAYER'S name, street address, city or town, state or province, country, ZIP . CORRECTED (if checked) 1a Total ordinary dividends or foreign postal code, and telephone no. OMB No. 1545-0110 The Mutual Fund $ 751.10 1b Qualified dividends 2015 Dividends and Distributions 1010 19th Street $ Form 1099-DIV Your City, Your State - Your Zip 2a Total capital gain distr 2b Unrecap. Sec. 1250 gain Copy B PAYER'S Federal identification number For Recipient RECIPIENT'S identification number 2c Section 1202 gain 2d Collectibles (28%) gain 54-1658682 306-00-1010 RECIPIENT'S name 3 Nondividend distributions Federal income tax withheld This is important tax Donald and Dianne Duncan nformation and is Investment expenses being furnished to Street address (including apt. no.) the Internal Revenue 910 Riverline Drive 6 Foreign tax paid 7 Foreign country or U.S. possession Service. If you are required to file a return, a negligence City or town, state or province, county, and ZIP or foreign postal code penalty or other Your City, Your State - Your Zip $ sanction may be 8 Cash liquidation distributions Noncash liquidation distributions imposed on you if $ his income is taxable 10 Exempt-interest dividends 11 Specified private activity and the IRS bond interest dividends determines that it has not been reported $ Account number (see instructions) 12 State 13 State identification no. 14 State tax withheld Form 1099-DIV (keep for your records) www.irs/form1099div Department of the Treasury - Internal Revenue ServiceA CORRECTED ( if checked ) PAYER'S name , street address , city or town , state or province , country , ZIP* 1 a Total ordinary dividends* OMB NO . 1545 - 01 10 or foreign postal code , and telephone no ." AT& T $ 256. 00 16 Qualified dividends 2015 Dividends and Distributions 2 Call Lane Form 1099 - DIV Your City , Your State - Your Zip 2 2 Total capital gain distr 26 Unrecap . Sec . 1250 gain Copy B PAYER'S Federal identification number* RECIPIENT'S identification number \\\\ or Recipient 2 c Section 120 2 gain 2 d Collectibles ( 28 % ) gain 54 - 1658683 306 - 00 - 1010 RECIPIENT'S name 3 Nondividend distributions 4 Federal income tax withheld This is important tay Donald and Dianne Duncan 5 Investment expenses information and is being furnished to Street address ( including apt . no . ) the Internal Revenue 910 Riverline Drive 6 Foreign tax paid\\ 7 Foreign country or U.S. possession* Service . If you are required to file a return , a negligence City or town , state or province , county , and ZIP or foreign postal code* penalty or other Your City , Your State - Your Zip sanction may be 8 Cash liquidation distributions 9 Noncash liquidation distributions imposed on you it this income is taxable* 10 Exempt- interest dividends 1 1 Specified private activity and the IRS bond interest dividends determines that it ha not been reported $ Account number ( see instructions ) 12 State\\ | 13 State identification no ." 14 State tax withheld Form 1099 - DIV ( keep for your records ) www . irs / form logodiv Department of the Treasury - Internal Revenue Servicea Employee's social security number OMB No. 1545-0008 Safe, accurate, 306-00-1010 FAST! Use IRS 41 Visit the IRS website at www.irs.gov/efile b Employer identification number (EIN) Wages, tips, other compensation Federal income tax withheld 63-0005541 58000.00 6840.00 c Employer's name, address, and ZIP code 3 Social security wages Social security tax withheld 58000.00 3596.00 Post Tribune 5 Medicare wages and tips 6 Medicare tax withheld PO Box 24 58000.00 341.00 Your City, Your State-Your Zip 7 Social security tips 8 Allocated tips d Control number 9 10 Dependent care benefits e Employee's first name and initial Last name Suff. 11 Nonqualified plans 2a See instructions for box 12 Donald Duncan 13 Statutory Retirement Third-party 12b 910 Riverline Drive employee plan sick pay Your City, Your State - Your Zip X 14 Other 12c 12 f Employee's address and ZIP code 15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax | 2 20 Locality name YS 630005541 58000.00 2936.80 Form W-2 Wage and Tax Statement 2015 Department of the Treasury - Internal Revenue Service Copy B - To Be Filed with Employee's FEDERAL Tax Return. This information is being furnished to the Internal Revenue Servicea Employee's social security number Safe, accurate, isit the IRS website at 306-00-1212 OMB No. 1545-0008 FAST! Use iRe file www.irs.gov/efile b Employer identification number (EIN) Wages, tips, other compensation 2 Federal income tax withheld 54-1012344 35500.00 4245.6 c Employer's name, address, and ZIP code 3 Social security wages Social security tax withheld 35500.00 2201.00 Edwards & Burns 5 Medicare wages and tips Medicare tax withheld PO Box 2172 35500.00 514.75 Your City, Your State-Your Zip 7 Social security tips Allocated tips d Control number 9 10 Dependent care benefits e Employee's first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12 Dianne Duncan 13 Statutory Retirement Third-party 12b 910 Riverline Drive employee plan sick pay Your City, Your State - Your Zip 14 Other 12c 12d f Employee's address and ZIP code 15 State Employer's state ID number 16 State wages, tips, etc 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name YS 541012344 35500.00 1258.80 Form W-2 Wage and Tax Department of the Treasury - Internal Revenue Service Statement 2015 Copy B - To Be Filed with Employee's FEDERAL Tax Return. This information is being furnished to the Internal Revenue Service.5. Answer the following question based on the tax return you prepared for Donald and Dianne Duncan: Select the total standard/itemized deductions: A) $19,320 B) $19,563 C) $19,588 D) $12,600 6. Answer the following question based on the tax return you prepared for Donald and Dianne Duncan: Select the total taxable income: A) $65,407 B) $58,687 C) $58,085 D) $58,444 7. Answer the following question based on the tax return you prepared for Donald and Dianne Duncan: Select the tax from the Tax Tables: DL A) $8,891 B) $7,879 C) $7,841 [: D) $7,789 8. Answer the following question based on the tax return you prepared for Donald and Dianne Duncan: Select the total tax: A) $3,523 CCL B) $3,632 C) $3,580 D) $4,890 9. Answer the following question based on the tax return you prepared for Donald and Dianne Duncan: Select the total payments: A) $11,925 B) $11,086 C) $12,725 [D) $12,284