Question

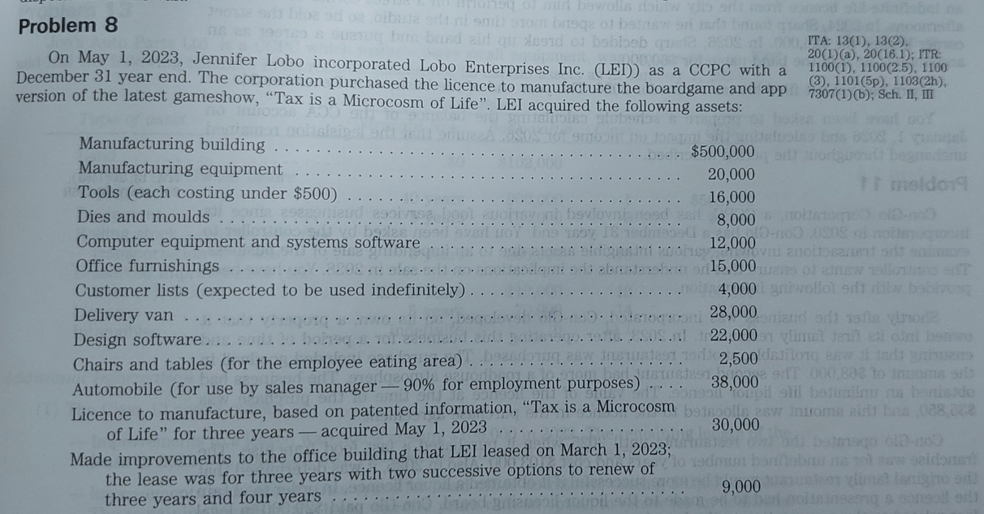

Answer the following question: Eligible property includes all property except for CCA classes 1 to 6 , 14.1, 17, 47, 49, and 51 (those definitely

Answer the following question:

Eligible property includes all property except for CCA classes 1 to 6 , 14.1, 17, 47, 49, and 51 (those definitely cannot be immediately expensed). Not immediately expense Class 12 and Class 53 because they're at a 100% anyway.

Immediate Expensed Items: Everything except manufacturing building and customer lists. Total is 198500.

| Manufacturing building | Class 1 - MB (10%) |

| Manufacturing equipment | Class 53 (50%) |

| Tools (each costing under $500) | Class 12 (100%) |

| Dies and moulds | Class 12 (100%) |

| Computer equipment and systems software | Class 50 (55%) |

| Office furnishing | Class 8 (20%) |

| Customer lists | Class 14.1 (5%) |

| Delivery van | Class 10 (30%) |

| Design Software | Class 12 (100%) |

| Chairs and tables | Class 8 (20%) |

| Automobile | Class 10.1 (30%) |

| Liscense to manufacture | Class 14 |

| Made improvements to the office | Class 13 |

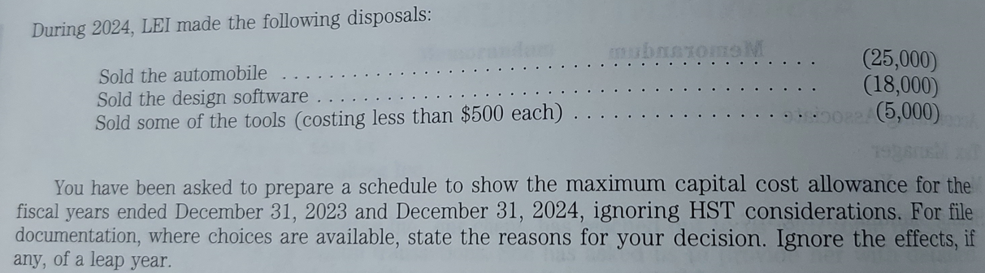

| Additions | Class 1 10% | Class 10.1 30% | Class 12 100% | Class 14.1 5% | Class 53 100% |

| Manufacturing building | |||||

| Manufacturing equipment | |||||

| Tools | |||||

| Dies and Moulds | |||||

| Customer lists | |||||

| Design Software |

Why do we only include Class 1, 10%, Class 10.1 30%, Class 12 100%, Class 14.1 5%, and Class 53 100% in the chart and not the others? Explain very clearly.

The automobile under Class 10.1 30% is -23684. Show how this was calculated clearly.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started