Answer the following question, please? Convenience Casey Stores:

Answer the following question, please? Convenience Casey Stores:

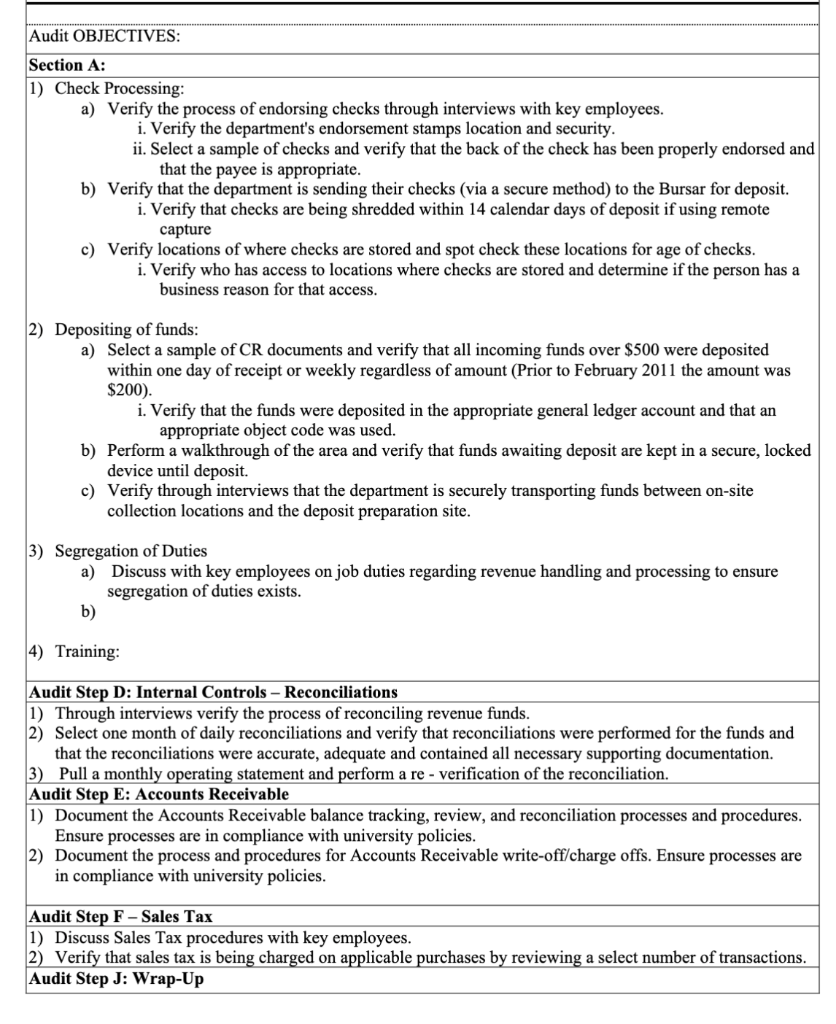

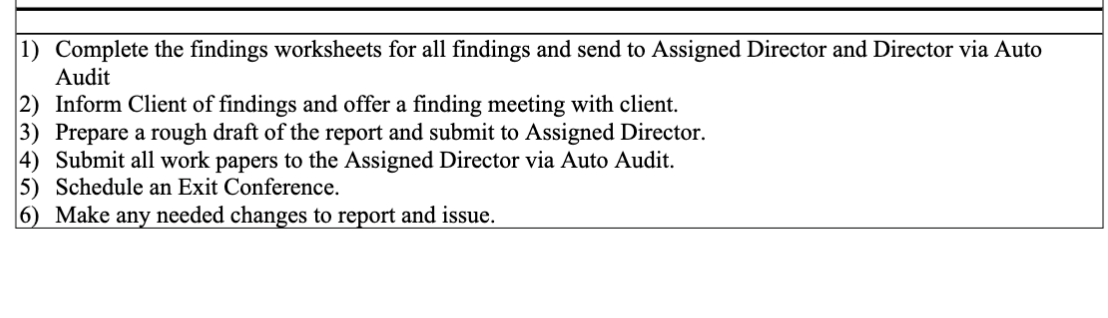

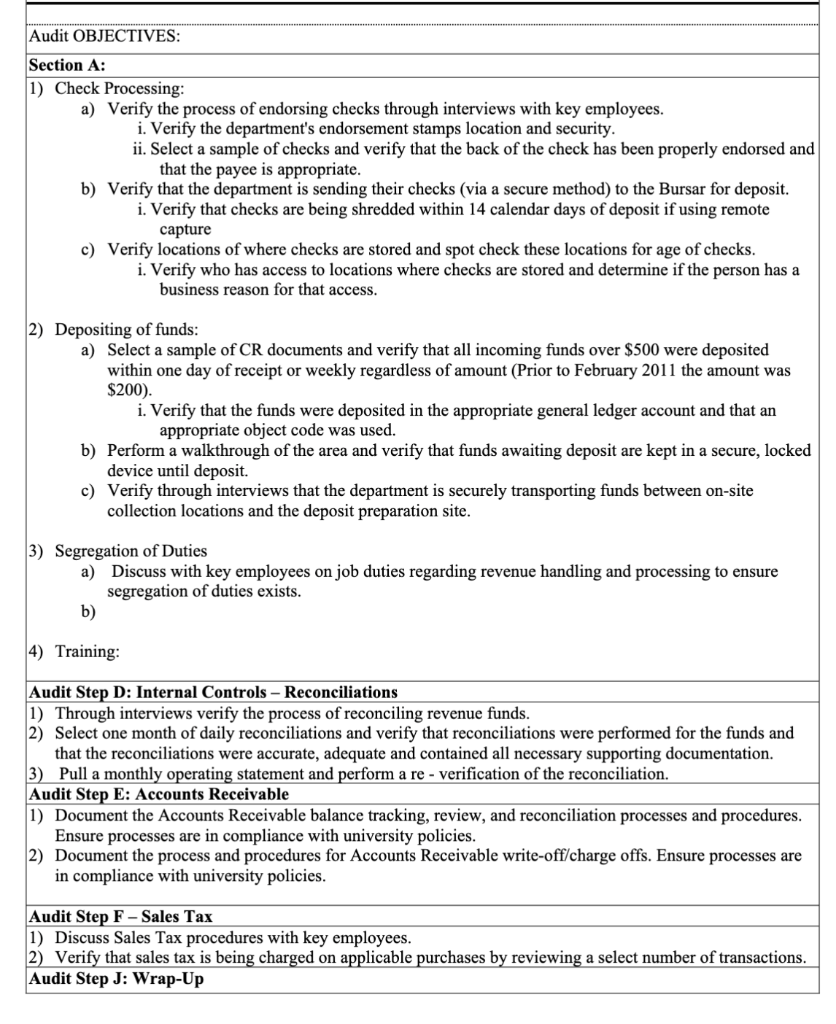

Audit OBJECTIVES: Section A: 1) Check Processing: a) Verify the process of endorsing checks through interviews with key employees. i. Verify the department's endorsement stamps location and security. ii. Select a sample of checks and verify that the back of the check has been properly endorsed and that the payee is appropriate. b) Verify that the department is sending their checks (via a secure method) to the Bursar for deposit. i. Verify that checks are being shredded within 14 calendar days of deposit if using remote capture c) Verify locations of where checks are stored and spot check these locations for age of checks. i. Verify who has access to locations where checks are stored and determine if the person has a business reason for that access. 2) Depositing of funds: a) Select a sample of CR documents and verify that all incoming funds over $500 were deposited within one day of receipt or weekly regardless of amount (Prior to February 2011 the amount was $200). i. Verify that the funds were deposited in the appropriate general ledger account and that an appropriate object code was used. b) Perform a walkthrough of the area and verify that funds awaiting deposit are kept in a secure, locked device until deposit. c) Verify through interviews that the department is securely transporting funds between on-site collection locations and the deposit preparation site. 3) Segregation of Duties a) Discuss with key employees on job duties regarding revenue handling and processing to ensure segregation of duties exists. b) 4) Training: Audit Step D: Internal Controls - Reconciliations 1) Through interviews verify the process of reconciling revenue funds. 2) Select one month of daily reconciliations and verify that reconciliations were performed for the funds and that the reconciliations were accurate, adequate and contained all necessary supporting documentation. 3) Pull a monthly operating statement and perform a re - verification of the reconciliation. Audit Step E: Accounts Receivable 1) Document the Accounts Receivable balance tracking, review, and reconciliation processes and procedures. Ensure processes are in compliance with university policies. 2) Document the process and procedures for Accounts Receivable write-off/charge offs. Ensure processes are in compliance with university policies. Audit Step F-Sales Tax 1) Discuss Sales Tax procedures with key employees. 2) Verify that sales tax is being charged on applicable purchases by reviewing a select number of transactions. Audit Step J: Wrap-Up 1) Complete the findings worksheets for all findings and send to Assigned Director and Director via Auto Audit 2) Inform Client of findings and offer a finding meeting with client. 3) Prepare a rough draft of the report and submit to Assigned Director. 4) Submit all work papers to the Assigned Director via Auto Audit. 5) Schedule an Exit Conference. 6) Make any needed changes to report and issue. Audit OBJECTIVES: Section A: 1) Check Processing: a) Verify the process of endorsing checks through interviews with key employees. i. Verify the department's endorsement stamps location and security. ii. Select a sample of checks and verify that the back of the check has been properly endorsed and that the payee is appropriate. b) Verify that the department is sending their checks (via a secure method) to the Bursar for deposit. i. Verify that checks are being shredded within 14 calendar days of deposit if using remote capture c) Verify locations of where checks are stored and spot check these locations for age of checks. i. Verify who has access to locations where checks are stored and determine if the person has a business reason for that access. 2) Depositing of funds: a) Select a sample of CR documents and verify that all incoming funds over $500 were deposited within one day of receipt or weekly regardless of amount (Prior to February 2011 the amount was $200). i. Verify that the funds were deposited in the appropriate general ledger account and that an appropriate object code was used. b) Perform a walkthrough of the area and verify that funds awaiting deposit are kept in a secure, locked device until deposit. c) Verify through interviews that the department is securely transporting funds between on-site collection locations and the deposit preparation site. 3) Segregation of Duties a) Discuss with key employees on job duties regarding revenue handling and processing to ensure segregation of duties exists. b) 4) Training: Audit Step D: Internal Controls - Reconciliations 1) Through interviews verify the process of reconciling revenue funds. 2) Select one month of daily reconciliations and verify that reconciliations were performed for the funds and that the reconciliations were accurate, adequate and contained all necessary supporting documentation. 3) Pull a monthly operating statement and perform a re - verification of the reconciliation. Audit Step E: Accounts Receivable 1) Document the Accounts Receivable balance tracking, review, and reconciliation processes and procedures. Ensure processes are in compliance with university policies. 2) Document the process and procedures for Accounts Receivable write-off/charge offs. Ensure processes are in compliance with university policies. Audit Step F-Sales Tax 1) Discuss Sales Tax procedures with key employees. 2) Verify that sales tax is being charged on applicable purchases by reviewing a select number of transactions. Audit Step J: Wrap-Up 1) Complete the findings worksheets for all findings and send to Assigned Director and Director via Auto Audit 2) Inform Client of findings and offer a finding meeting with client. 3) Prepare a rough draft of the report and submit to Assigned Director. 4) Submit all work papers to the Assigned Director via Auto Audit. 5) Schedule an Exit Conference. 6) Make any needed changes to report and issue

Answer the following question, please? Convenience Casey Stores:

Answer the following question, please? Convenience Casey Stores: