Answer the Following Questions: 1. Why did Jeff Hasting hire you? What advice does he need? What advice does he not need right now? 2.

Answer the Following Questions:

Answer the Following Questions:

1. Why did Jeff Hasting hire you? What advice does he need? What advice does he not need right now?

2. Describe how Jeff Hasting will use the report you provide him. Is he likely to share the information in your report with the current owners of Custom App Company (CAC)? How does anticipating this affect the way you should prepare the report?

3. What level of accounting knowledge do Mr. Hasting and Ms. Becker have? How will this affect the way you prepare your report?

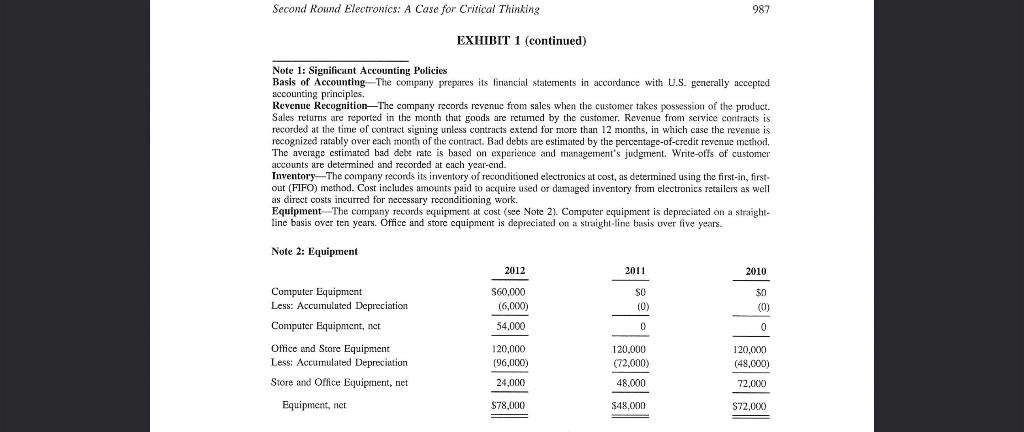

4. Which source(s) of financial accounting rules has CAC used? Who has evaluated the accounting policies followed by CAC?

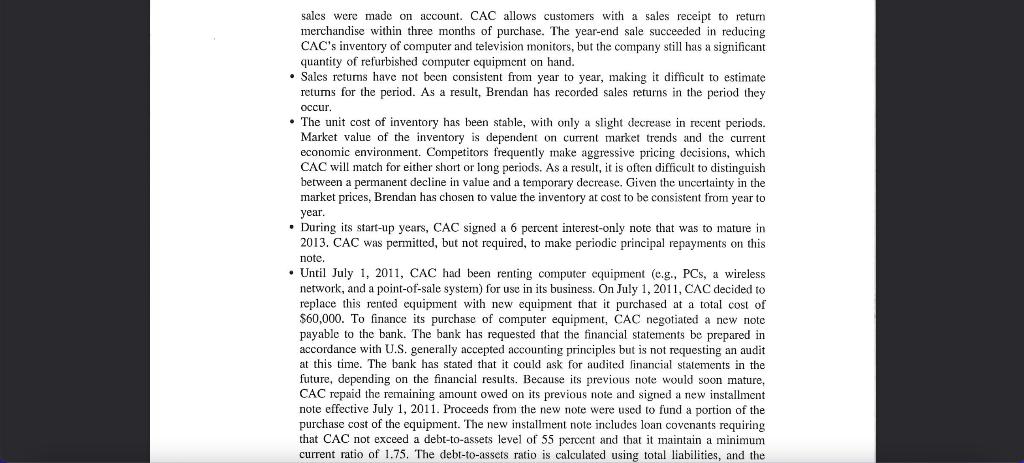

5. Are any other external parties, other than Mr. Hasting as a potential purchaser, relying on the financial statements of CAC? Has this user placed any restrictions on CAC that may be of concern to Mr. Hasting?

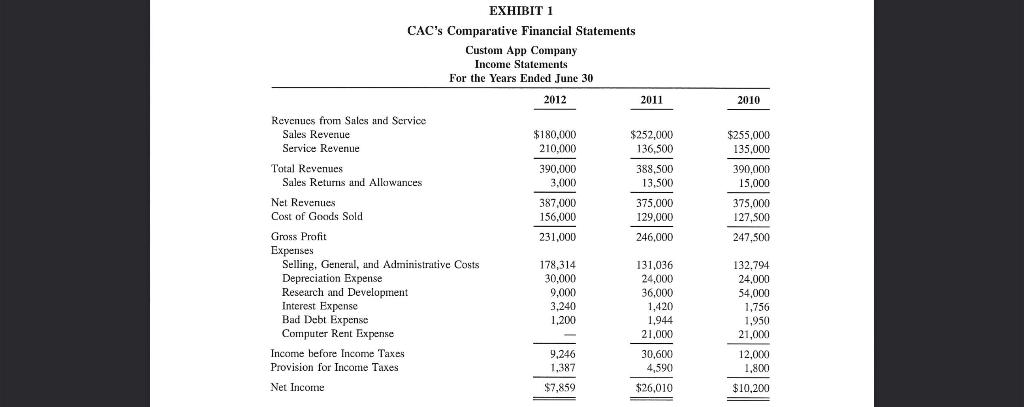

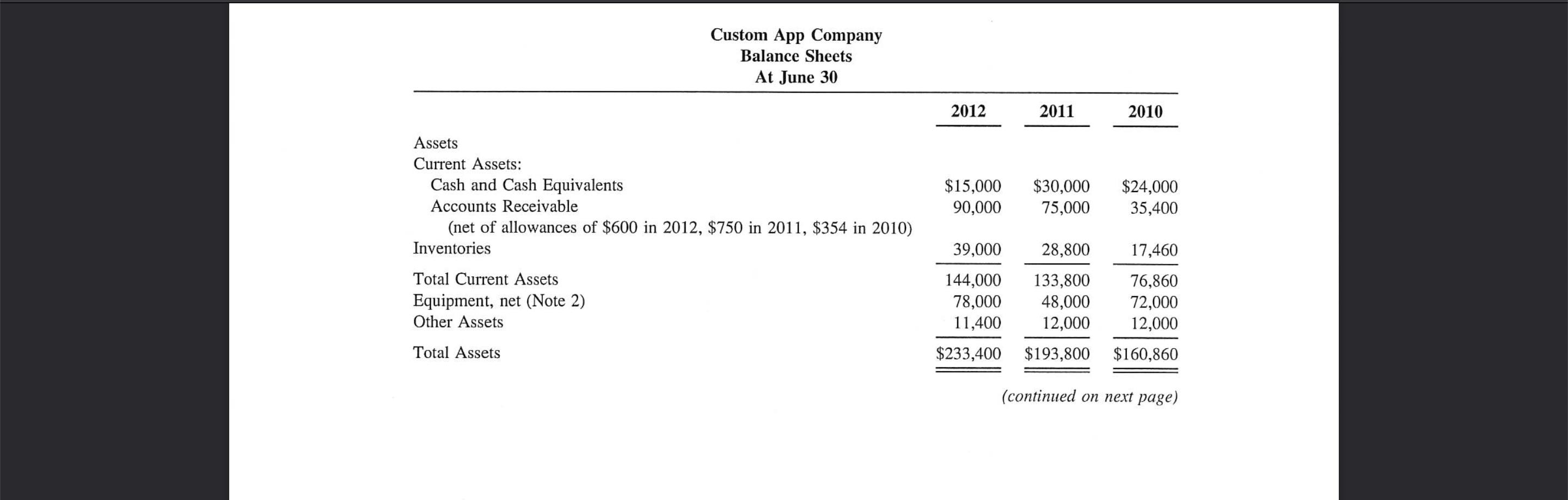

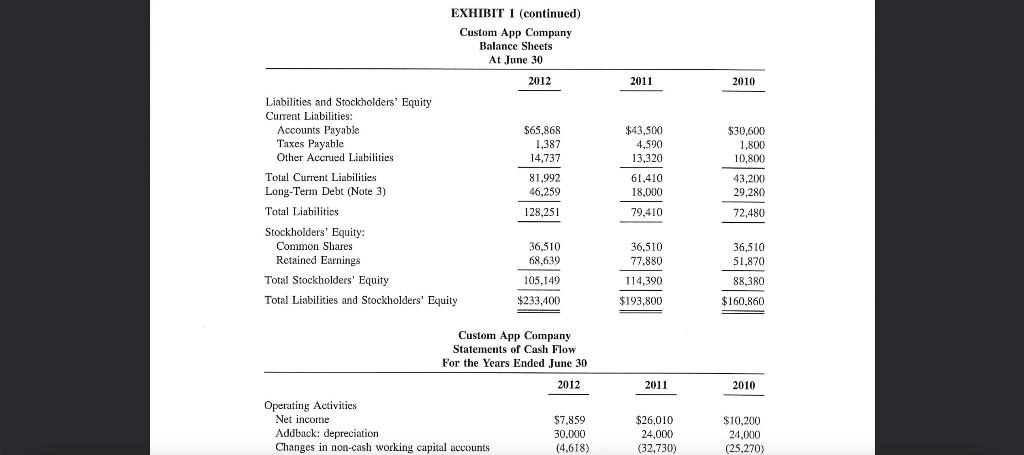

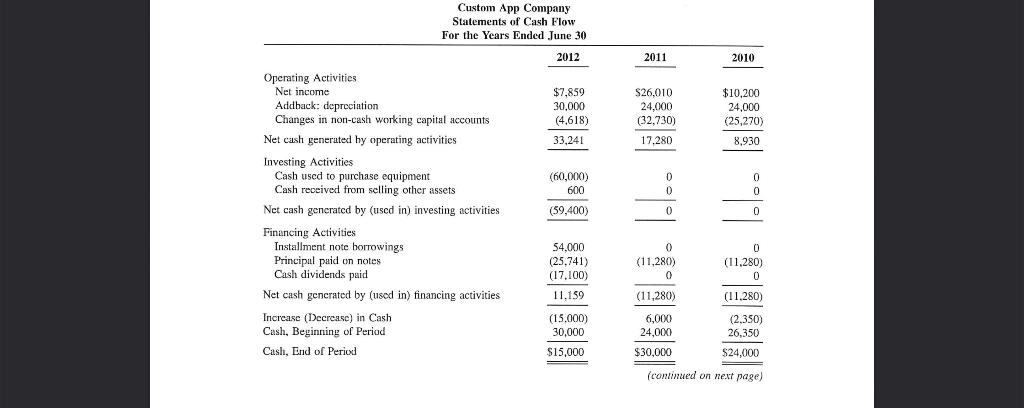

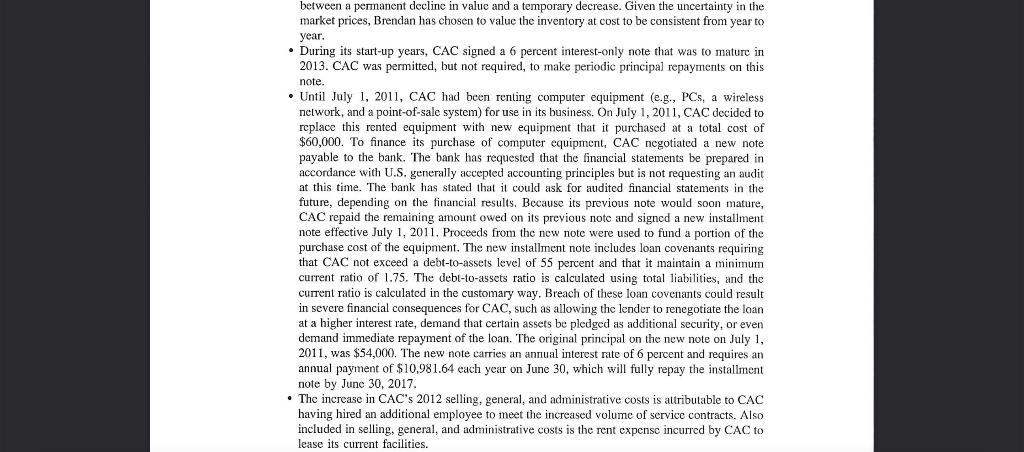

6. Has CAC been profitable from 2010 through 2012? Has CAC generated positive operating cash flows from 2010 through 2012? Compare these observations to the changes in CAC's financial position (e.g., ratio of liabilities to assets) over the past three years. Are your observations of net income, cash flow, and changes in a financial position consistent? Should these observations be brought to the attention of Mr. Hasting?

7. If SRE acquires CAC, what amount of cash would Mr. Hasting expect to recover from CAC's accounts receivable? Is there qualitative or quantitative evidence suggesting that CAC may have difficulty collecting the accounts receivable currently reported on the balance sheet? How has CAC's accounts receivable changed over the past three years? Given these changes in accounts receivable, what changes would you have expected to see in the Allowance for Doubtful Accounts? Is the change in the Allowance for Doubtful Accounts between 2011 and 2012 consistent with the change in accounts receivable? Is the policy used by CAC to estimate uncollectible credit sales acceptable under GAAP? What is the problem with how CAC has accounted for its uncollectible sales made on an account?

8. At what value does GAAP require inventory to be reported? How does this requirement protect an acquirer like Mr. Hasting from overpaying for CAC's inventory? If SRE acquires CAC, what minimum dollar amount would Mr. Hasting expect to recover from CAC's inventory? Is there qualitative or quantitative evidence suggesting that CAC may have difficulty recovering this amount? How would an overstatement of inventory value on the balance sheet affect the financial statements and other restrictions? Explain why a potential overstatement of inventory should be of concern to Mr. Hasting.

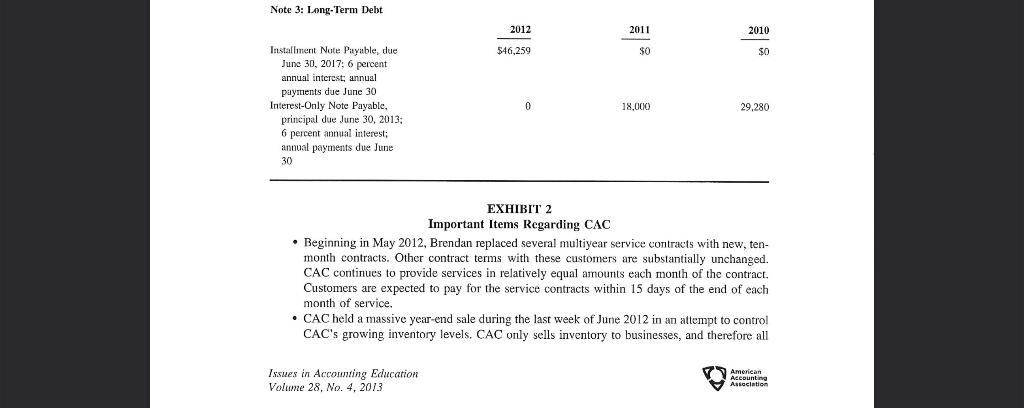

9. What amount is CAC required to pay each year on its bank loan? Use a loan amortization calculator, such as the one online at http://bretwhissel.net/amortization/, to determine how much of the annual payment relates to principal versus interest. Specifically, in the 2012 and 2013 fiscal years, how much principal is CAC required to repay? In what balance sheet category should the required 2013 principal repayment be reported? Has CAC reported the 2013 principal repayment correctly? What effect would changing CAC's reporting have on the external restrictions placed on the company?

10. How does CAC record revenue from its service contracts? How would signing a significant number of short-term service contracts (less than 12 months) near June 30 (CAC's year-end) affect the service revenue and accounts receivable reported at year-end? What effect would the timing of reporting revenue from these contracts have on the company's current assets and total assets, and on its current and debt-to-asset ratios? What would be a more appropriate policy for recognizing short-term contract revenue?

11. What is CAC's business policy for accepting sales returns? What is CAC's accounting policy for sales returns? Under CAC's current accounting policy, are the returns from CAC's year-end inventory reduction sale likely to occur in the same period as the sales revenue? How could CAC revise its accounting policy to account for sales revenue and returns in the same period? How would this revised policy change CAC's financial statements?

12. What method does GAAP require companies to use when determining depreciation? What method does CAC use? Is CAC's choice of method acceptable? Has CAC followed its stated method when calculating 2012 depreciation? Is there any aspect of CAC's depreciation practice that you should bring to the attention of Mr. Hasting? Why?

13. Which financial ratios would be relevant to creditors such as the bank? Why are these ratios of concern to the bank? What other ratios would be of concern to Mr. Hasting?

S econd Round Electronics (SRE) is a privately owned company that reconditions and sells used consumer electronics. Its product offerings include home and car audio systems, televisions, and other devices with touch-sensitive monitors, such as smartphones and computer tablets. SRE'S sole owner, Jeff Hasting, started the company 15 years ago after obtaining a degree in electronics repair at a local college. Jeff has been very happy with SRE's results to date. SRE has developed into a successful company with relatively stable profits and a solid financial condition. Jeff is a very competitive person, however, and he feels that SRE could be even more successful, so he would like to see his company expand into selling and servicing emerging technologies for corporate customers. Jeff has been working closely with Rachel Becker, SRE's controller, to explore opportunities for SRE to become a bigger player in the local electronics market and increase its profitability. An idea that they have been tossing around is to acquire a company that produces complementary technologies for SRE's products. Such an acquisition could lead to synergies that increase SRE's market presence and drive greater profitability. Jeff has asked you to analyze a company that he and Nathalie Johnstone and Brandy Mackintosh are Assistant Professors and Fred Phillips is a Professor, all at the University of Saskatchewan. The authors thank their students, Doug Kalesnikoff, an anonymous associate editor, and three anonymous reviewers for comments on a prior version of the case. Published Online: April 2013

Step by Step Solution

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Jeff Hasting hired me in order to gain advice on how to proceed with a potential purchase of the Custom App Company CAC He specifically wants to know if the company is a good financial investment an...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started