Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer the following questions: (10 points for each sub-question, 20 points total) a. Suppose you are analyzing three firms that are operating in the

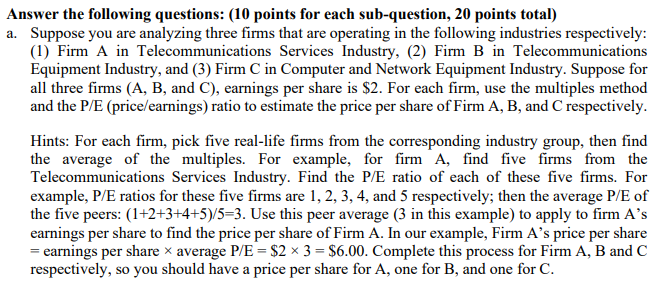

Answer the following questions: (10 points for each sub-question, 20 points total) a. Suppose you are analyzing three firms that are operating in the following industries respectively: (1) Firm A in Telecommunications Services Industry, (2) Firm B in Telecommunications Equipment Industry, and (3) Firm C in Computer and Network Equipment Industry. Suppose for all three firms (A, B, and C), earnings per share is $2. For each firm, use the multiples method and the P/E (price/earnings) ratio to estimate the price per share of Firm A, B, and C respectively. Hints: For each firm, pick five real-life firms from the corresponding industry group, then find the average of the multiples. For example, for firm A, find five firms from the Telecommunications Services Industry. Find the P/E ratio of each of these five firms. For example, P/E ratios for these five firms are 1, 2, 3, 4, and 5 respectively; then the average P/E of the five peers: (1+2+3+4+5)/5=3. Use this peer average (3 in this example) to apply to firm A's earnings per share to find the price per share of Firm A. In our example, Firm A's price per share = earnings per share average P/E = $2 3 = $6.00. Complete this process for Firm A, B and C respectively, so you should have a price per share for A, one for B, and one for C.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started