Question: answer the following questions 5. Calculating Leverage Ratios LO2) Mobius, Inc., has a total debt ratio of 57. What is its debt-equity ratio? What is

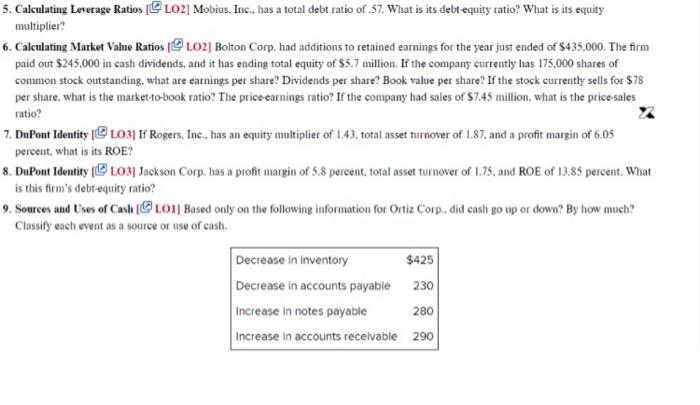

5. Calculating Leverage Ratios LO2) Mobius, Inc., has a total debt ratio of 57. What is its debt-equity ratio? What is its equity multiplier? 6. Calculating Market Value Ratios (L02) Bolton Corp. had additions to retained earnings for the year just ended of S435,000. The firm paid out $245,000 in cash dividends, and it has ending total equity of $5.7 million. If the company currently has 175.000 shares of common stock outstanding, what are earnings per share? Dividends per share? Book value per share? If the stock currently sells for $78 per share, what is the market-to-book ratio? The price earnings ratio? If the company had sales of $7.45 million, what is the price-sales ratio? x 7. DuPont Identity (L03) If Rogers, Inc. has an equity multiplier of 1.43, total asset turnover of 1.87. and a profit margin of 6.05 percent, what is its ROE? 8. DuPont Identity (L03) Jackson Corp. has a profit margin of 5.8 percent, total asset turnover of 1.75, and ROE of 13.85 percent. What is this firm's debt-equity ratio? 9. Sources and Uses of Cash L01Based only on the following information for Ortiz Corp., did cash go up or down? By how much? Classify each event as a source or use of cash. Decrease in inventory $425 Decrease in accounts payable 230 Increase in notes payable 280 Increase in accounts receivable 290

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts