Question

Answer the following questions based on the attached table below. a. Calculate the market values of equity, debt and firm for both Cheetah Limited and

Answer the following questions based on the attached table below.

a. Calculate the market values of equity, debt and firm for both Cheetah Limited and Lion Limited.

b. What is the Weighted Average Cost of Capital (WACC) for each of the two firms?

c. What happens to the average cost of Cheetah Limited if it employs $30million of debt to finance a project that yields an operating income of $4million?

d. What are the likely implications for the cost of equity, and thus the WACC, if the debt increases significantly such that the long-term gearing changes?

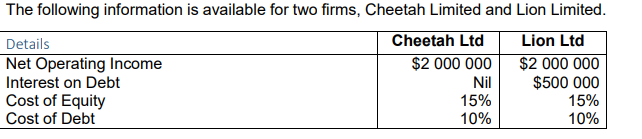

The following information is available for two firms, Cheetah Limited and Lion Limited. Details Net Operating Income Interest on Debt Cost of Equity Cost of Debt Cheetah Ltd $2 000 000 Lion Ltd $2 000 000 Nil $500 000 15% 15% 10% 10%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started