Answered step by step

Verified Expert Solution

Question

1 Approved Answer

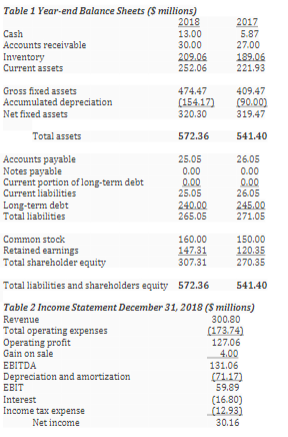

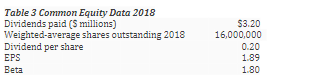

Answer the following questions based on the below financial information for Knead Corp. a) Assuming a perpetual growth rate of 3%, calculate the value per

Answer the following questions based on the below financial information for Knead Corp.

a) Assuming a perpetual growth rate of 3%, calculate the value per share of Knead stock on 12/31/18 using the constant-growth model and the capital asset pricing model:

b) Calculate the sustainable growth rate of Knead on 12/31/18. Use year-end 12/31/17 balance sheet values:

Table 1 Year-end Balance Sheets (S millions) 2018 Cash 13.00 Accounts receivable 30.00 Inventory 209.06 Current assets 252.06 Gross fixed assets 474.47 Accumulated depreciation (154.12) Net fixed assets 320.30 2017 5.87 27.00 189.05 221.93 409,47 (90,00) 319.47 572.36 541.40 Total assets Accounts payable Notes payable Current portion of long-term debt Current liabilities Long-term debt Total liabilities 25.05 0.00 0.00 25.05 240,00 265.05 26.05 0.00 0.00 26.05 245.00 271.05 Common stock 160.00 150.00 Retained earnings 147.31 120.35 Total shareholder equity 307.31 270.35 Total liabilities and shareholders equity 572.36 541.40 Table 2 Income Statement December 31, 2018 (8 millions) Revenue 300.80 Total operating expenses (173.74) Operating profit 127.06 Gain on sale 4.00 EBITDA 131.06 Depreciation and amortization (71.17) EBIT 59.89 Interest (16.80) Income tax expense (12.93) Net income 30.16 Table 3 Common Equity Data 2018 Dividends paid (5 millions) Weighted average shares outstanding 2018 Dividend per share EPS Beta $3.20 16,000,000 0.20 1.89 1.80 Table 1 Year-end Balance Sheets (S millions) 2018 Cash 13.00 Accounts receivable 30.00 Inventory 209.06 Current assets 252.06 Gross fixed assets 474.47 Accumulated depreciation (154.12) Net fixed assets 320.30 2017 5.87 27.00 189.05 221.93 409,47 (90,00) 319.47 572.36 541.40 Total assets Accounts payable Notes payable Current portion of long-term debt Current liabilities Long-term debt Total liabilities 25.05 0.00 0.00 25.05 240,00 265.05 26.05 0.00 0.00 26.05 245.00 271.05 Common stock 160.00 150.00 Retained earnings 147.31 120.35 Total shareholder equity 307.31 270.35 Total liabilities and shareholders equity 572.36 541.40 Table 2 Income Statement December 31, 2018 (8 millions) Revenue 300.80 Total operating expenses (173.74) Operating profit 127.06 Gain on sale 4.00 EBITDA 131.06 Depreciation and amortization (71.17) EBIT 59.89 Interest (16.80) Income tax expense (12.93) Net income 30.16 Table 3 Common Equity Data 2018 Dividends paid (5 millions) Weighted average shares outstanding 2018 Dividend per share EPS Beta $3.20 16,000,000 0.20 1.89 1.80Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started