Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer the following questions for Fred corporation. Assume that the firm revenues grow at a rate of 10% per year during years 1 through

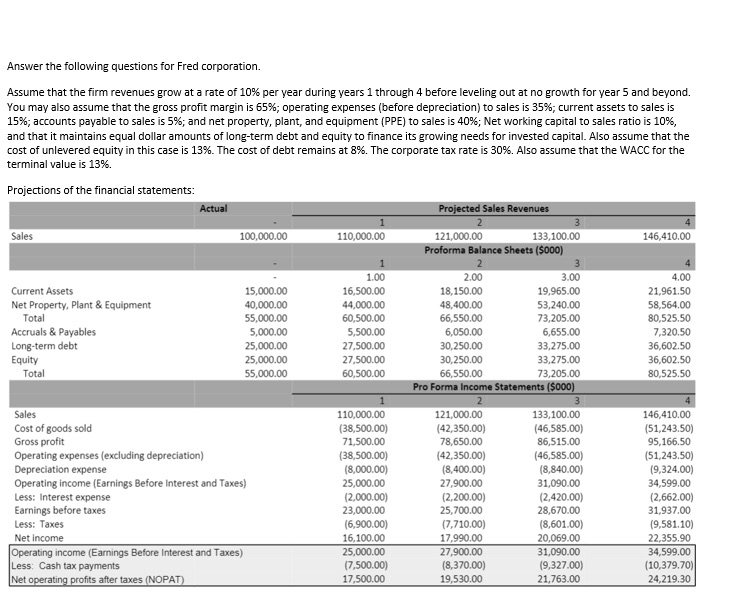

Answer the following questions for Fred corporation. Assume that the firm revenues grow at a rate of 10% per year during years 1 through 4 before leveling out at no growth for year 5 and beyond. You may also assume that the gross profit margin is 65%; operating expenses (before depreciation) to sales is 35%; current assets to sales is 15%; accounts payable to sales is 5%; and net property, plant, and equipment (PPE) to sales is 40%; Net working capital to sales ratio is 10%, and that it maintains equal dollar amounts of long-term debt and equity to finance its growing needs for invested capital. Also assume that the cost of unlevered equity in this case is 13%. The cost of debt remains at 8%. The corporate tax rate is 30%. Also assume that the WACC for the terminal value is 13%. Projections of the financial statements: Sales Actual 100,000.00 110,000.00 Projected Sales Revenues 2 121,000.00 133,100.00 146,410.00 Proforma Balance Sheets ($000) Current Assets 15,000.00 1 1.00 16,500.00 2.00 3.00 4.00 18,150.00 19,965.00 21,961.50 Net Property, Plant & Equipment 40,000.00 44,000.00 48,400.00 53,240.00 58,564.00 Total 55,000.00 60,500.00 66,550.00 73,205.00 80,525.50 Accruals & Payables 5,000.00 5,500.00 6,050.00 6,655.00 7,320.50 Long-term debt 25,000.00 27,500.00 30,250.00 33,275.00 36,602.50 Equity 25,000.00 27,500.00 30,250.00 33,275.00 36,602.50 Total 55,000.00 60,500.00 66,550.00 73,205.00 80,525.50 Pro Forma Income Statements ($000) 1 3 Sales Cost of goods sold Gross profit 110,000.00 (38,500.00) 71,500.00 121,000.00 133,100.00 146,410.00 (42,350.00) (46,585.00) (51,243.50) 78,650.00 86,515.00 Operating expenses (excluding depreciation) (38,500.00) (42,350.00) (46,585.00) 95,166.50 (51,243.50) Depreciation expense (8,000.00) (8,400.00) (8,840.00) (9,324.00) Operating income (Earnings Before Interest and Taxes) 25,000.00 27,900.00 31,090.00 34,599.00 Less: Interest expense (2,000.00) (2,200.00) (2,420.00) (2,662.00) Earnings before taxes 23,000.00 25,700.00 28,670.00 31,937.00 Less: Taxes (6,900.00) (7,710.00) (8,601.00) (9,581.10) Net income 16,100.00 17,990.00 20,069.00 22,355.90 Operating income (Earnings Before Interest and Taxes) Less: Cash tax payments 25,000.00 27,900.00 31,090.00 34,599.00 (7,500.00) (8,370.00) (9,327.00) (10,379.70) Net operating profits after taxes (NOPAT) 17,500.00 19,530.00 21,763.00 24,219.30

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the weighted average cost of capital WACC for Fred Corporation we need to consider the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started