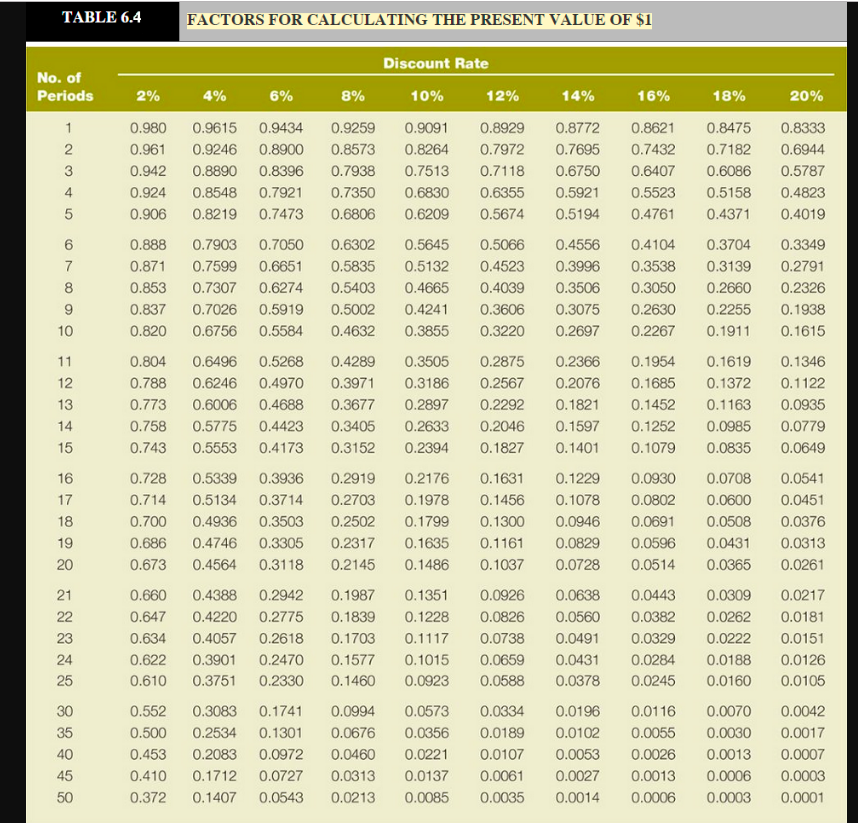

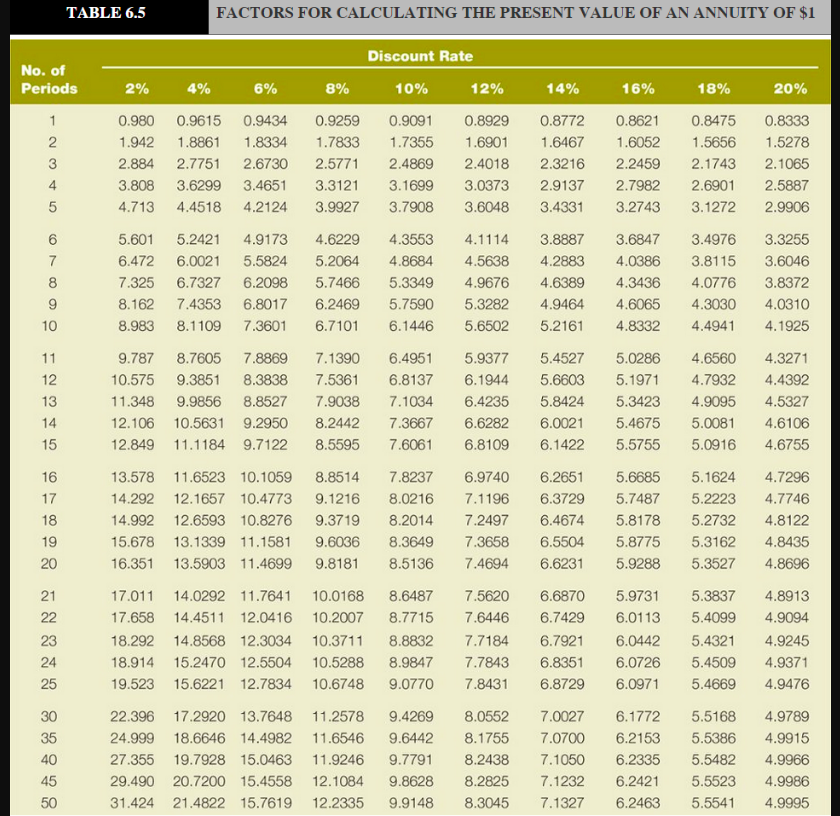

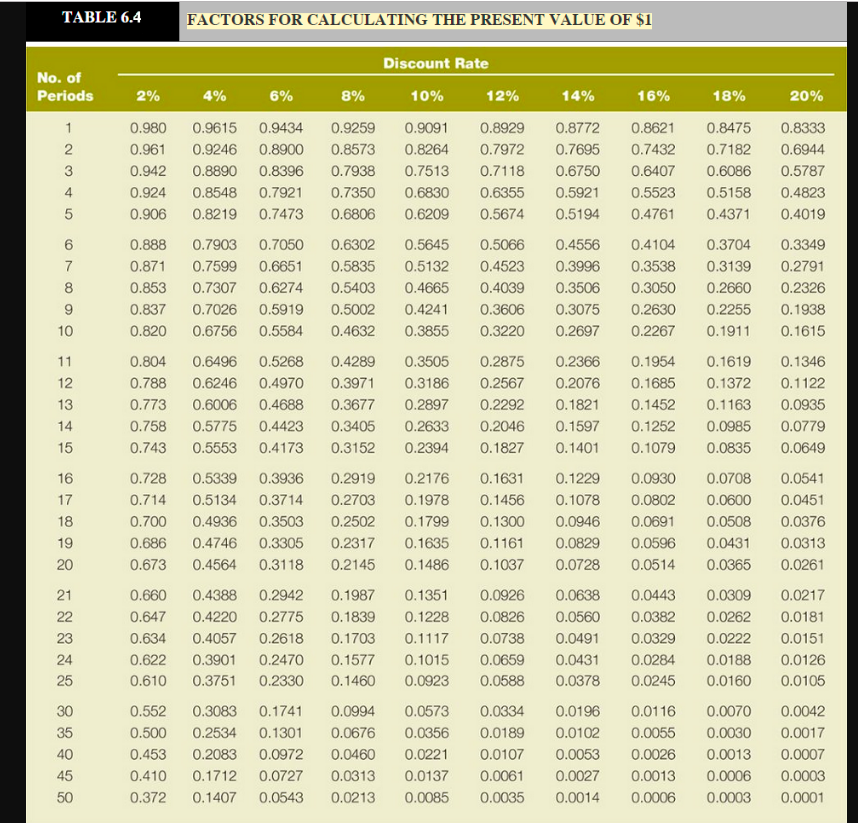

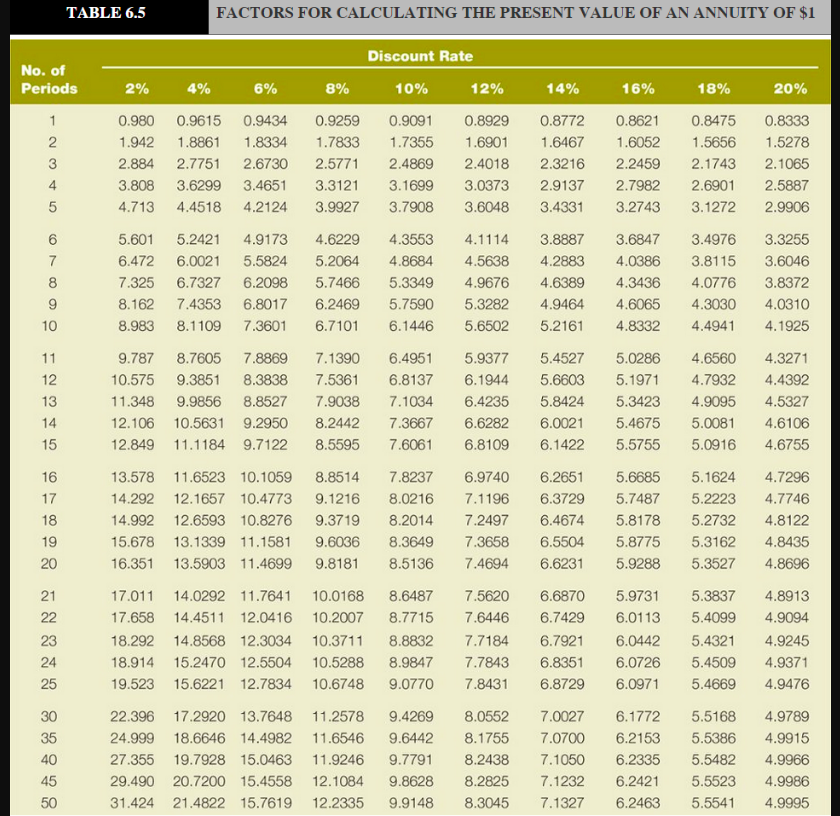

Answer the following questions. Table 6-4 or Table 6-5. (Use appropriate factor[s) from the tables provided. Round the PV factors to 4 decimals.) a Spencer Co.'s common stock s expected to have a didend of $7 per share for each of the next nine ears and it is estimated that the market value per share wil be $111 at the end o nine ears. If an in estor requres a return on investment of 12%, what is he maximum price the investor wouid be willing to pay for a share of Spencer Co. common sock today?(Do not round intermediate calculations. Round your answer to 2 decimal places. places)ot nine years, Ifan b. Mario bought a bond with a face amount of $1,000, a stated interest rate of 8%, and a maturity date nineteen years in the future for $987. The bond pays interest on an annual basis. Three years have gone by and the market interest rate is now 12%. What is the market value of the bond today? (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. Alexis purchased a U.S. Series EE savings bond for $300, and eight years later received $555.25 when the bond was redeemed. What average annual return on investment did Alexis carn over the eight years? TABLE 6.4 FACTORS FOR CALCULATING THE PRESENT VALUE OF $1 Discount Rate No. of Periods 20% 2% 0.980 0.9615 0.9434 0.9259 0.9091 0.8929 0.8772 0.8621 0.8475 0.8333 0.961 0.9246 0.8900 0.8573 0.8264 0.7972 0.7695 0.7432 0.7182 0.6944 0.942 0.8890 0.8396 0.7938 0.7513 0.7118 0.6750 0.6407 0.6086 0.5787 0.924 0.8548 0.7921 0.7350 0.6830 0.6355 0.5921 0.5523 0.5158 0.4823 0.906 0.8219 0.7473 0.6806 0.6209 0.5674 0.5194 0.4761 0.4371 0.4019 0.888 0.7903 0.7050 0.6302 0.5645 0.5066 0.4556 0.4104 0.3704 0.3349 0.871 0.7599 0.6651 0.5835 0.5132 0.4523 0.3996 0.3538 0.3139 0.2791 0.853 0.7307 0.6274 0.5403 0.4665 0.4039 0.3506 0.3050 0.2660 0.2326 0.8370.7026 0.5919 0.5002 0.4241 0.3606 0.3075 0.2630 0.2255 0.1938 0.820 0.6756 0.5584 0.4632 0.3855 0.3220 0.2697 0.2267 0.1911 0.1615 0.804 0.6496 0.5268 0.4289 0.3505 0.2875 0.2366 0.1954 0.1619 0.1346 0.788 0.6246 0.4970 0.3971 0.3186 0.2567 0.2076 0.1685 0.1372 0.1122 0.773 0.6006 0.4688 0.3677 0.2897 0.2292 0.1821 0.1452 0.1163 0.0935 0.758 0.5775 0.4423 0.3405 0.2633 0.2046 0.1597 0.1252 0.0985 0.0779 0.743 0.5553 0.4173 0.3152 0.2394 0.1827 0.1401 0.1079 0.0835 0.0649 0.728 0.5339 0.3936 0.2919 0.2176 0.1631 0.1229 0.0930 0.0708 0.0541 0.714 0.5134 0.3714 0.2703 0.1978 0.1456 0.1078 0.0802 0.0600 0.0451 0.700 0.4936 0.3503 0.2502 0.1799 0.1300 0.0946 0.0691 0.0508 0.0376 0.686 0.4746 0.3305 0.2317 0.1635 0.1161 0.0829 0.0596 0.0431 0.0313 0.673 0.4564 0.3118 0.2145 0.1486 0.1037 0.0728 0.0514 0.0365 0.0261 0.660 0.4388 0.2942 0.1987 0.1351 0.0926 0.0638 0.0443 0.0309 0.0217 0.6470.4220 0.2775 0.1839 0.1228 0.0826 0.0560 0.0382 0.0262 0.018 0.634 0.4057 0.2618 0.1703 0.1117 0.0738 0.0491 0.0329 0.0222 0.0151 0.622 0.3901 0.2470 0.1577 0.1015 0.0659 0.0431 0.0284 0.0188 0.0126 0.610 0.3751 0.2330 0.1460 0.0923 0.0588 0.0378 0.0245 0.0160 0.0105 0.552 0.3083 0.1741 0.0994 0.0573 0.0334 0.0196 0.0116 0.0070 0.0042 0.500 0.2534 0.1301 0.0676 0.0356 0.0189 0.0102 0.0055 0.0030 0.0017 0.453 0.2083 0.0972 0.0460 0.0221 0.0107 0.0053 0.0026 0.0013 0.0007 0.410 0.1712 0.0727 0.0313 0.0137 0.0061 0.0027 0.0013 0.0006 0.0003 0.372 0.1407 0.0543 0.0213 0.0085 0.0035 0.0014 0.0006 0.0003 0.0001 a% 6% 8% 10% 12% 14% 16% 18% 4 6 10 12 13 14 15 16 18 19 20 21 24 25 35 40 45 TABLE 6.5 FACTORS FOR CALCULATING THE PRESENT VALUE OF AN ANNUITY OF $1 Discount Rate No. of Periods 2% a% 6% 8% 10% 1 2% 14% 1 6% 18% 20% 0.980 0.9615 0.9434 0.9259 0.909 0.8929 0.8772 0.8621 0.8475 0.8333 1.942 1.8861 1.8334 1.7833 1.7355 1.6901 1.64671.6052 5656 1.5278 2.884 2.7751 2.6730 2.5771 2.4869 2.4018 2.3216 2.2459 2.1743 2.1065 3.808 3.6299 3.4651 3.3121 3.1699 3.0373 2.9137 2.7982 2.6901 2.5887 4.713 4.4518 4.2124 3.9927 3.7908 3.6048 3.4331 3.2743 3.1272 2.9906 3 5.601 5.2421 4.9173 4.6229 4.3553 4.1114 3.8887 3.6847 3.4976 3.3255 6.472 6.0021 5.5824 5.2064 4.86844.5638 4.2883 4.0386 3.8115 3.6046 7.325 6.7327 6.2098 5.7466 5.3349 4.9676 4.6389 4.3436 4.0776 3.8372 8.162 7.4353 6.8017 6.2469 5.7590 5.3282 4.9464 4.6065 4.3030 4.0310 8.983 8.1109 7.3601 6.7101 6.14465.6502 5.2161 4.8332 4.4941 4.1925 10 12 13 14 15 9.787 8.7605 7.8869 7.1390 6.4951 5.9377 5.4527 5.0286 4.6560 4.3271 10.575 9.3851 8.3838 7.5361 6.8137 6.1944 5.6603 5.1971 4.7932 4.4392 11.348 9.9856 8.8527 7.9038 7.1034 6.4235 5.8424 5.3423 4.9095 4.5327 12.106 10.5631 9.2950 8.2442 7.3667 6.6282 6.0021 5.4675 5.0081 4.6106 12.849 11.1184 9.7122 8.5595 7.60616.8109 6.1422 5.57555.0916 4.6755 16 17 18 19 20 21 13.578 11.6523 10.1059 8.8514 7.8237 6.9740 6.2651 5.6685 5.1624 4.7296 14.292 12.1657 10.4773 9.1216 8.0216 7.1196 6.3729 5.7487 5.2223 4.7746 4.992 12.6593 10.8276 9.3719 8.2014 7.2497 6.4674 5.8178 5.2732 4.8122 15.678 13.1339 11.1581 9.6036 8.3649 7.3658 6.5504 5.8775 5.3162 4.8435 16.351 13.5903 11.4699 9.8181 8.5136 7.4694 6.6231 5.9288 5.3527 4.8696 17.011 14.0292 11.7641 10.0168 8.6487 7.5620 6.6870 5.9731 5.3837 4.8913 17.658 14.4511 12.0416 10.2007 8.7715 7.6446 6.7429 6.0113 5.4099 4.9094 18.292 14.8568 12.3034 10.3711 8.8832 7.7184 6.7921 6.04425.4321 4.9245 18.914 15.2470 12.5504 10.5288 8.9847 7.7843 6.8351 6.0726 5.4509 4.9371 19.523 15.6221 12.7834 10.6748 9.0770 7.8431 6.8729 6.0971 5.4669 4.9476 23 24 25 22.396 17.2920 13.7648 11.2578 9.4269 8.0552 7.0027 6.1772 5.5168 4.9789 24.999 18.6646 14.4982 11.6546 9.6442 8.1755 7.0700 6.2153 5.5386 4.9915 27.355 19.7928 15.0463 11.9246 9.779 8.2438 7.1050 6.2335 5.5482 4.9966 29.490 20.7200 15.4558 12.1084 9.8628 8.2825 7.1232 6.2421 5.5523 4.9986 31.424 21.4822 15.7619 12.2335 9.9148 8.3045 7.1327 6.2463 5.5541 4.9995 40 45 Answer the following questions. Table 6-4 or Table 6-5. (Use appropriate factor[s) from the tables provided. Round the PV factors to 4 decimals.) a Spencer Co.'s common stock s expected to have a didend of $7 per share for each of the next nine ears and it is estimated that the market value per share wil be $111 at the end o nine ears. If an in estor requres a return on investment of 12%, what is he maximum price the investor wouid be willing to pay for a share of Spencer Co. common sock today?(Do not round intermediate calculations. Round your answer to 2 decimal places. places)ot nine years, Ifan b. Mario bought a bond with a face amount of $1,000, a stated interest rate of 8%, and a maturity date nineteen years in the future for $987. The bond pays interest on an annual basis. Three years have gone by and the market interest rate is now 12%. What is the market value of the bond today? (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. Alexis purchased a U.S. Series EE savings bond for $300, and eight years later received $555.25 when the bond was redeemed. What average annual return on investment did Alexis carn over the eight years? TABLE 6.4 FACTORS FOR CALCULATING THE PRESENT VALUE OF $1 Discount Rate No. of Periods 20% 2% 0.980 0.9615 0.9434 0.9259 0.9091 0.8929 0.8772 0.8621 0.8475 0.8333 0.961 0.9246 0.8900 0.8573 0.8264 0.7972 0.7695 0.7432 0.7182 0.6944 0.942 0.8890 0.8396 0.7938 0.7513 0.7118 0.6750 0.6407 0.6086 0.5787 0.924 0.8548 0.7921 0.7350 0.6830 0.6355 0.5921 0.5523 0.5158 0.4823 0.906 0.8219 0.7473 0.6806 0.6209 0.5674 0.5194 0.4761 0.4371 0.4019 0.888 0.7903 0.7050 0.6302 0.5645 0.5066 0.4556 0.4104 0.3704 0.3349 0.871 0.7599 0.6651 0.5835 0.5132 0.4523 0.3996 0.3538 0.3139 0.2791 0.853 0.7307 0.6274 0.5403 0.4665 0.4039 0.3506 0.3050 0.2660 0.2326 0.8370.7026 0.5919 0.5002 0.4241 0.3606 0.3075 0.2630 0.2255 0.1938 0.820 0.6756 0.5584 0.4632 0.3855 0.3220 0.2697 0.2267 0.1911 0.1615 0.804 0.6496 0.5268 0.4289 0.3505 0.2875 0.2366 0.1954 0.1619 0.1346 0.788 0.6246 0.4970 0.3971 0.3186 0.2567 0.2076 0.1685 0.1372 0.1122 0.773 0.6006 0.4688 0.3677 0.2897 0.2292 0.1821 0.1452 0.1163 0.0935 0.758 0.5775 0.4423 0.3405 0.2633 0.2046 0.1597 0.1252 0.0985 0.0779 0.743 0.5553 0.4173 0.3152 0.2394 0.1827 0.1401 0.1079 0.0835 0.0649 0.728 0.5339 0.3936 0.2919 0.2176 0.1631 0.1229 0.0930 0.0708 0.0541 0.714 0.5134 0.3714 0.2703 0.1978 0.1456 0.1078 0.0802 0.0600 0.0451 0.700 0.4936 0.3503 0.2502 0.1799 0.1300 0.0946 0.0691 0.0508 0.0376 0.686 0.4746 0.3305 0.2317 0.1635 0.1161 0.0829 0.0596 0.0431 0.0313 0.673 0.4564 0.3118 0.2145 0.1486 0.1037 0.0728 0.0514 0.0365 0.0261 0.660 0.4388 0.2942 0.1987 0.1351 0.0926 0.0638 0.0443 0.0309 0.0217 0.6470.4220 0.2775 0.1839 0.1228 0.0826 0.0560 0.0382 0.0262 0.018 0.634 0.4057 0.2618 0.1703 0.1117 0.0738 0.0491 0.0329 0.0222 0.0151 0.622 0.3901 0.2470 0.1577 0.1015 0.0659 0.0431 0.0284 0.0188 0.0126 0.610 0.3751 0.2330 0.1460 0.0923 0.0588 0.0378 0.0245 0.0160 0.0105 0.552 0.3083 0.1741 0.0994 0.0573 0.0334 0.0196 0.0116 0.0070 0.0042 0.500 0.2534 0.1301 0.0676 0.0356 0.0189 0.0102 0.0055 0.0030 0.0017 0.453 0.2083 0.0972 0.0460 0.0221 0.0107 0.0053 0.0026 0.0013 0.0007 0.410 0.1712 0.0727 0.0313 0.0137 0.0061 0.0027 0.0013 0.0006 0.0003 0.372 0.1407 0.0543 0.0213 0.0085 0.0035 0.0014 0.0006 0.0003 0.0001 a% 6% 8% 10% 12% 14% 16% 18% 4 6 10 12 13 14 15 16 18 19 20 21 24 25 35 40 45 TABLE 6.5 FACTORS FOR CALCULATING THE PRESENT VALUE OF AN ANNUITY OF $1 Discount Rate No. of Periods 2% a% 6% 8% 10% 1 2% 14% 1 6% 18% 20% 0.980 0.9615 0.9434 0.9259 0.909 0.8929 0.8772 0.8621 0.8475 0.8333 1.942 1.8861 1.8334 1.7833 1.7355 1.6901 1.64671.6052 5656 1.5278 2.884 2.7751 2.6730 2.5771 2.4869 2.4018 2.3216 2.2459 2.1743 2.1065 3.808 3.6299 3.4651 3.3121 3.1699 3.0373 2.9137 2.7982 2.6901 2.5887 4.713 4.4518 4.2124 3.9927 3.7908 3.6048 3.4331 3.2743 3.1272 2.9906 3 5.601 5.2421 4.9173 4.6229 4.3553 4.1114 3.8887 3.6847 3.4976 3.3255 6.472 6.0021 5.5824 5.2064 4.86844.5638 4.2883 4.0386 3.8115 3.6046 7.325 6.7327 6.2098 5.7466 5.3349 4.9676 4.6389 4.3436 4.0776 3.8372 8.162 7.4353 6.8017 6.2469 5.7590 5.3282 4.9464 4.6065 4.3030 4.0310 8.983 8.1109 7.3601 6.7101 6.14465.6502 5.2161 4.8332 4.4941 4.1925 10 12 13 14 15 9.787 8.7605 7.8869 7.1390 6.4951 5.9377 5.4527 5.0286 4.6560 4.3271 10.575 9.3851 8.3838 7.5361 6.8137 6.1944 5.6603 5.1971 4.7932 4.4392 11.348 9.9856 8.8527 7.9038 7.1034 6.4235 5.8424 5.3423 4.9095 4.5327 12.106 10.5631 9.2950 8.2442 7.3667 6.6282 6.0021 5.4675 5.0081 4.6106 12.849 11.1184 9.7122 8.5595 7.60616.8109 6.1422 5.57555.0916 4.6755 16 17 18 19 20 21 13.578 11.6523 10.1059 8.8514 7.8237 6.9740 6.2651 5.6685 5.1624 4.7296 14.292 12.1657 10.4773 9.1216 8.0216 7.1196 6.3729 5.7487 5.2223 4.7746 4.992 12.6593 10.8276 9.3719 8.2014 7.2497 6.4674 5.8178 5.2732 4.8122 15.678 13.1339 11.1581 9.6036 8.3649 7.3658 6.5504 5.8775 5.3162 4.8435 16.351 13.5903 11.4699 9.8181 8.5136 7.4694 6.6231 5.9288 5.3527 4.8696 17.011 14.0292 11.7641 10.0168 8.6487 7.5620 6.6870 5.9731 5.3837 4.8913 17.658 14.4511 12.0416 10.2007 8.7715 7.6446 6.7429 6.0113 5.4099 4.9094 18.292 14.8568 12.3034 10.3711 8.8832 7.7184 6.7921 6.04425.4321 4.9245 18.914 15.2470 12.5504 10.5288 8.9847 7.7843 6.8351 6.0726 5.4509 4.9371 19.523 15.6221 12.7834 10.6748 9.0770 7.8431 6.8729 6.0971 5.4669 4.9476 23 24 25 22.396 17.2920 13.7648 11.2578 9.4269 8.0552 7.0027 6.1772 5.5168 4.9789 24.999 18.6646 14.4982 11.6546 9.6442 8.1755 7.0700 6.2153 5.5386 4.9915 27.355 19.7928 15.0463 11.9246 9.779 8.2438 7.1050 6.2335 5.5482 4.9966 29.490 20.7200 15.4558 12.1084 9.8628 8.2825 7.1232 6.2421 5.5523 4.9986 31.424 21.4822 15.7619 12.2335 9.9148 8.3045 7.1327 6.2463 5.5541 4.9995 40 45