Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer the following questions using data from the Campbell Soup Company 2 0 2 0 annual report ( See pages 4 2 , 4 3

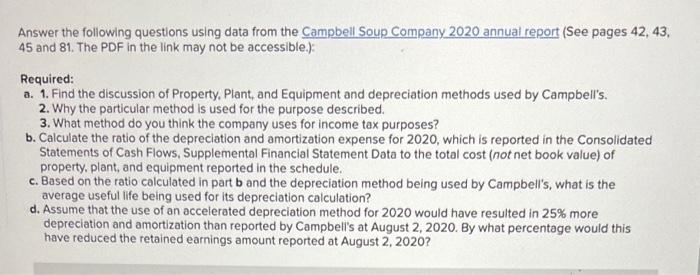

Answer the following questions using data from the Campbell Soup Company annual report See pages and The PDF in the link may not be accessible.:

Required:

Find the discussion of Property, Plant, and Equipment and depreciation methods used by Campbells

Why the particular method is used for the purpose described.

What method do you think the company uses for income tax purposes?

Calculate the ratio of the depreciation and amortization expense for which is reported in the Consolidated Statements of Cash Flows, Supplemental Financial Statement Data to the total cost not net book value of property, plant, and equipment reported in the schedule.

Based on the ratio calculated in part b and the depreciation method being used by Campbells what is the average useful life being used for its depreciation calculation?

Assume that the use of an accelerated depreciation method for would have resulted in more depreciation and amortization than reported by Campbell's at August By what percentage would this have reduced the retained earnings amount reported at August

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started