Answer the following questions using information from the course moodle resources and from the article on dynamic pricing. 1. Read the attached article about dynamic pricing and explain what it means 2. Explain how demand impacts the price of a hotel room. 3. 4. What are the 2 unique characteristics of the hotel industry we have discussed, that contribute to why hotels use dynamic pricing? Using the PDF information documents from the simulation, answer the following questions: 5. Describe how demand for rooms(occupancy %) changes throughout the year in the simulation? 6. How many months are there in 1 quarter? 7. Which quarter of the year has the highest occupancy? 8. What is the price limit for premium, standard, and discounted rooms? 9. What happens to your occupancy % if you price your rooms at or above the price limit? 10. What is the price limit for each restaurant meal? 11. What is the price limit for beverages? 12. What does resident and non-resident cover mean? 13. Under the revenue forecast - rooms - make decision screen, you need to decide on two different areas that combined will give you your revenue forecast. What are they?

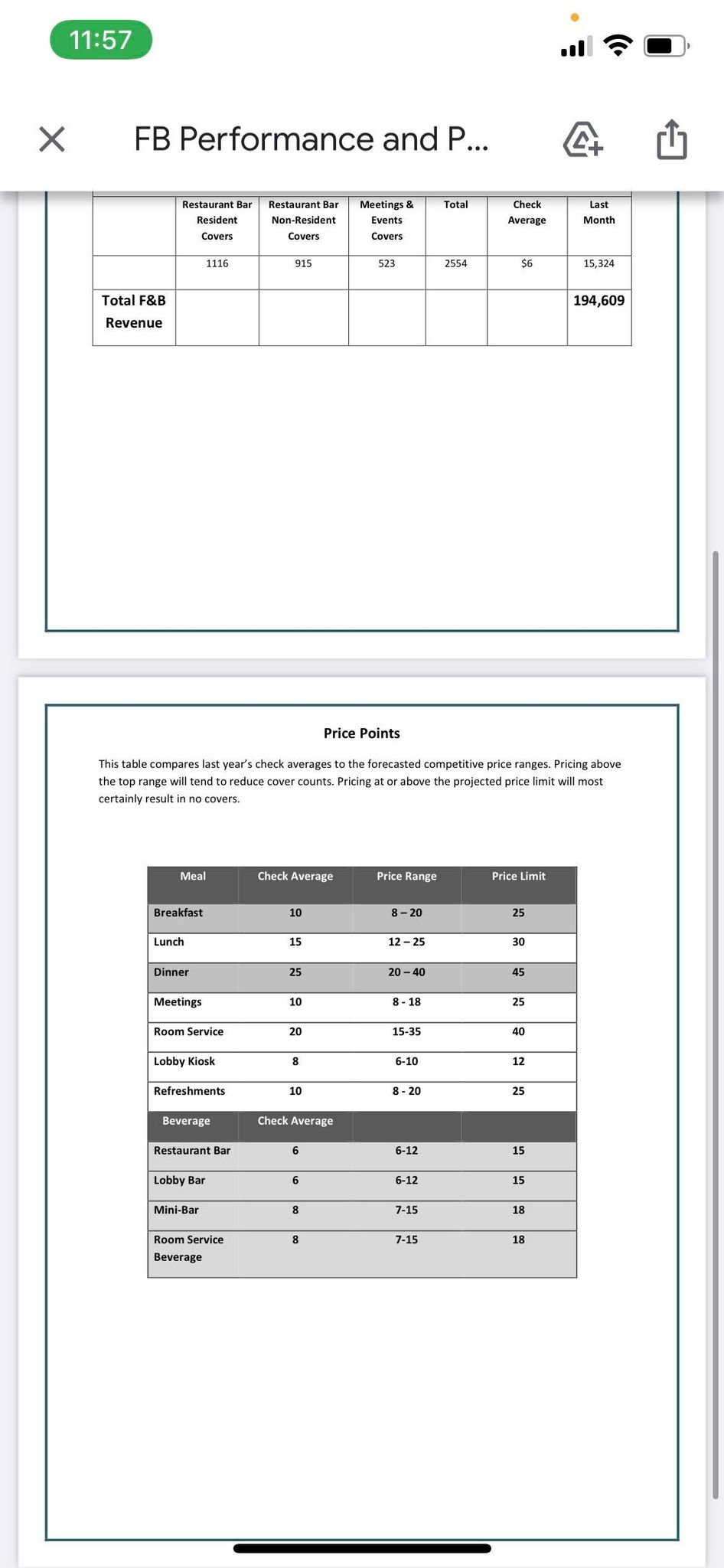

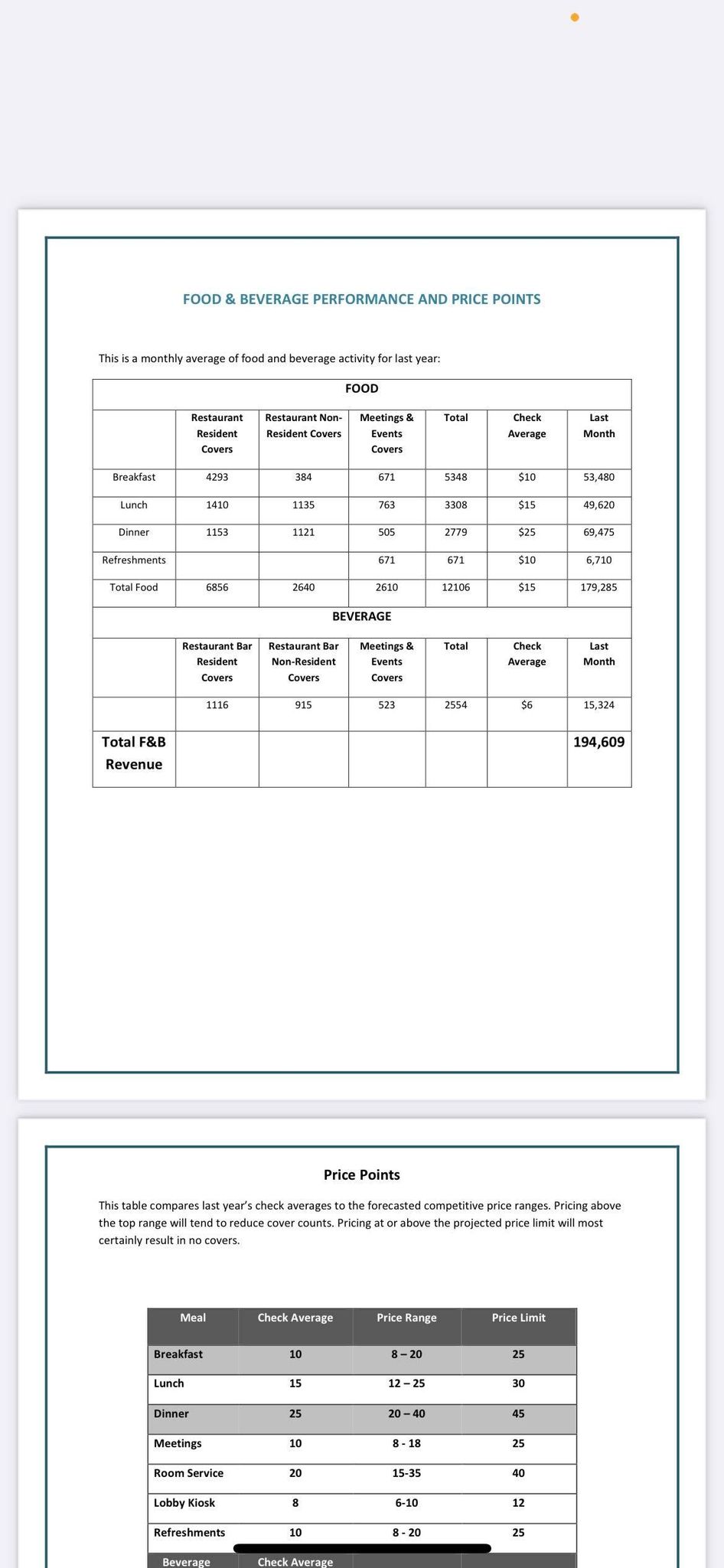

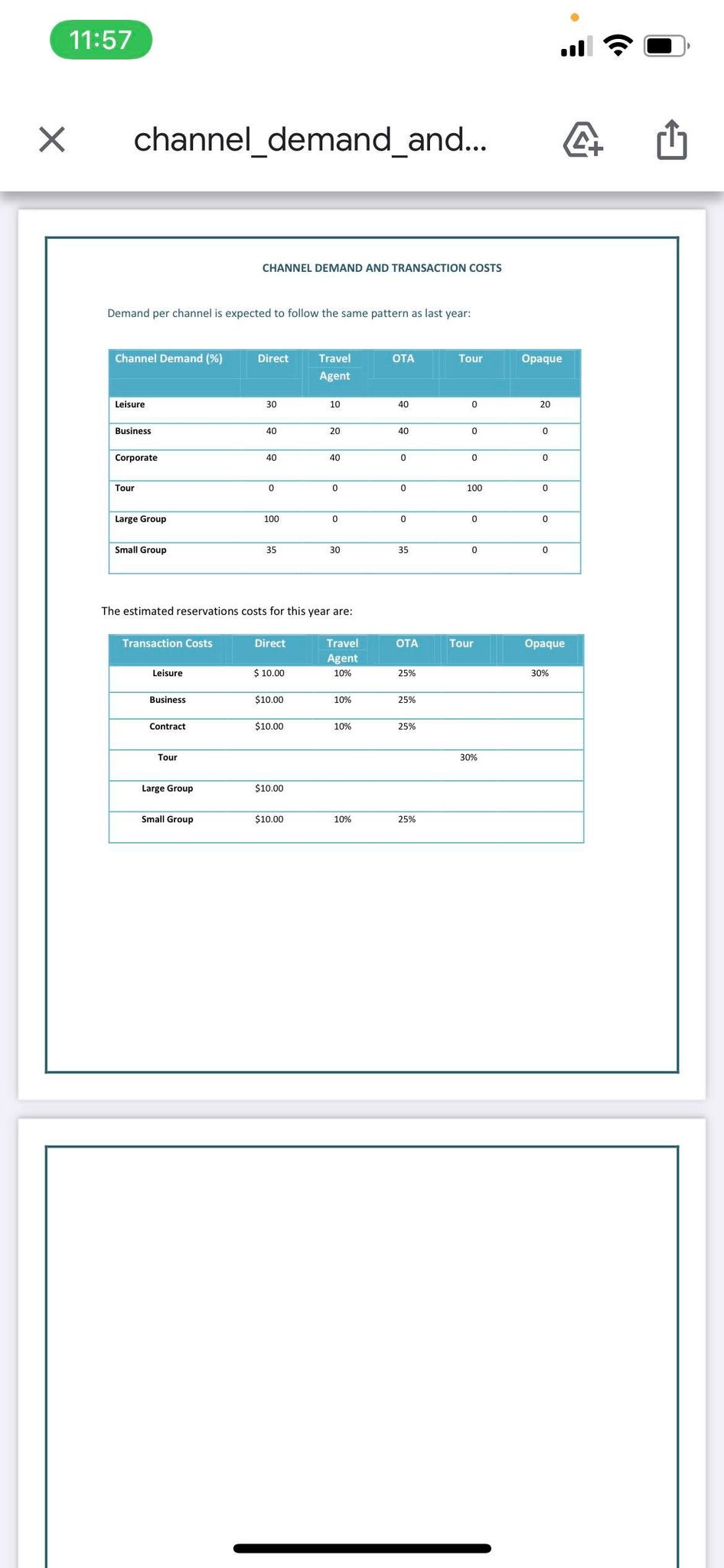

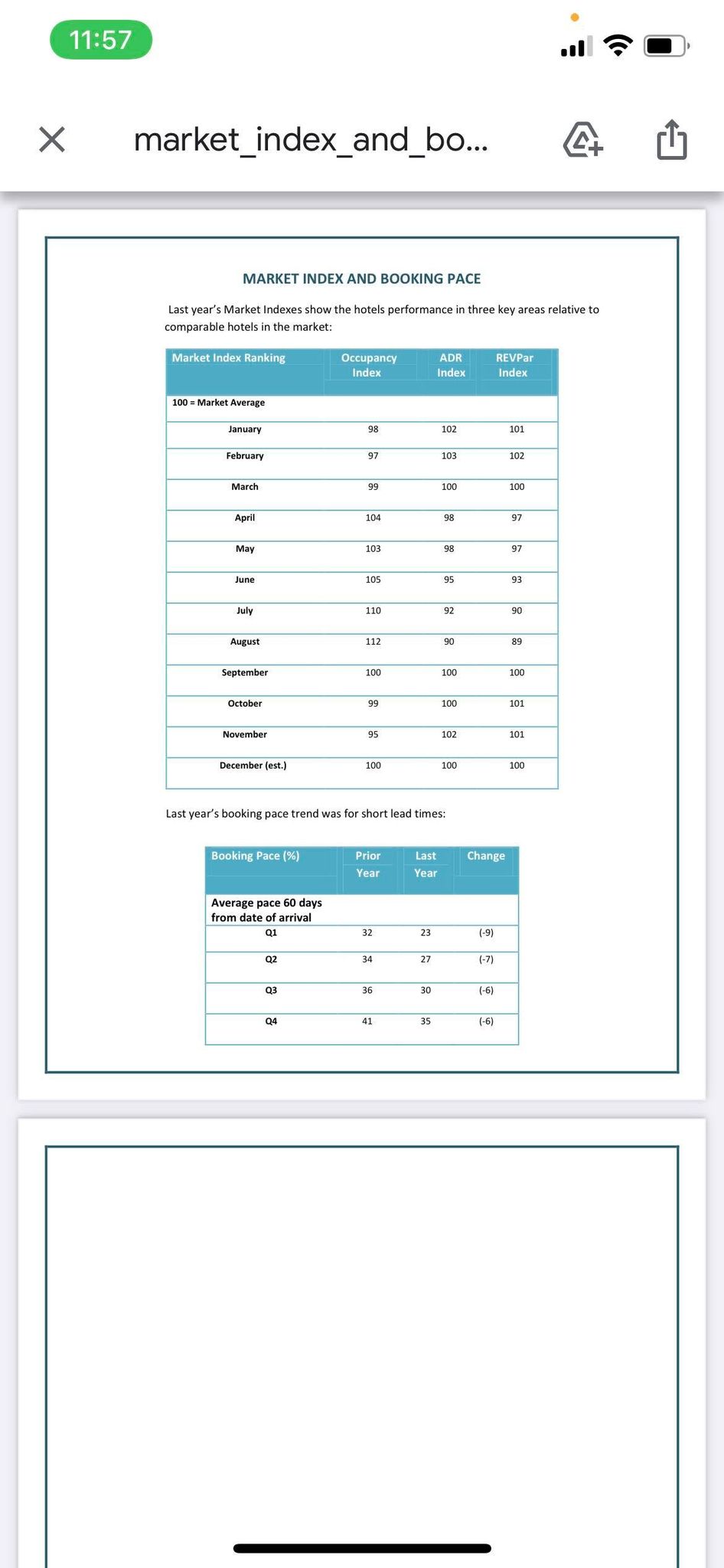

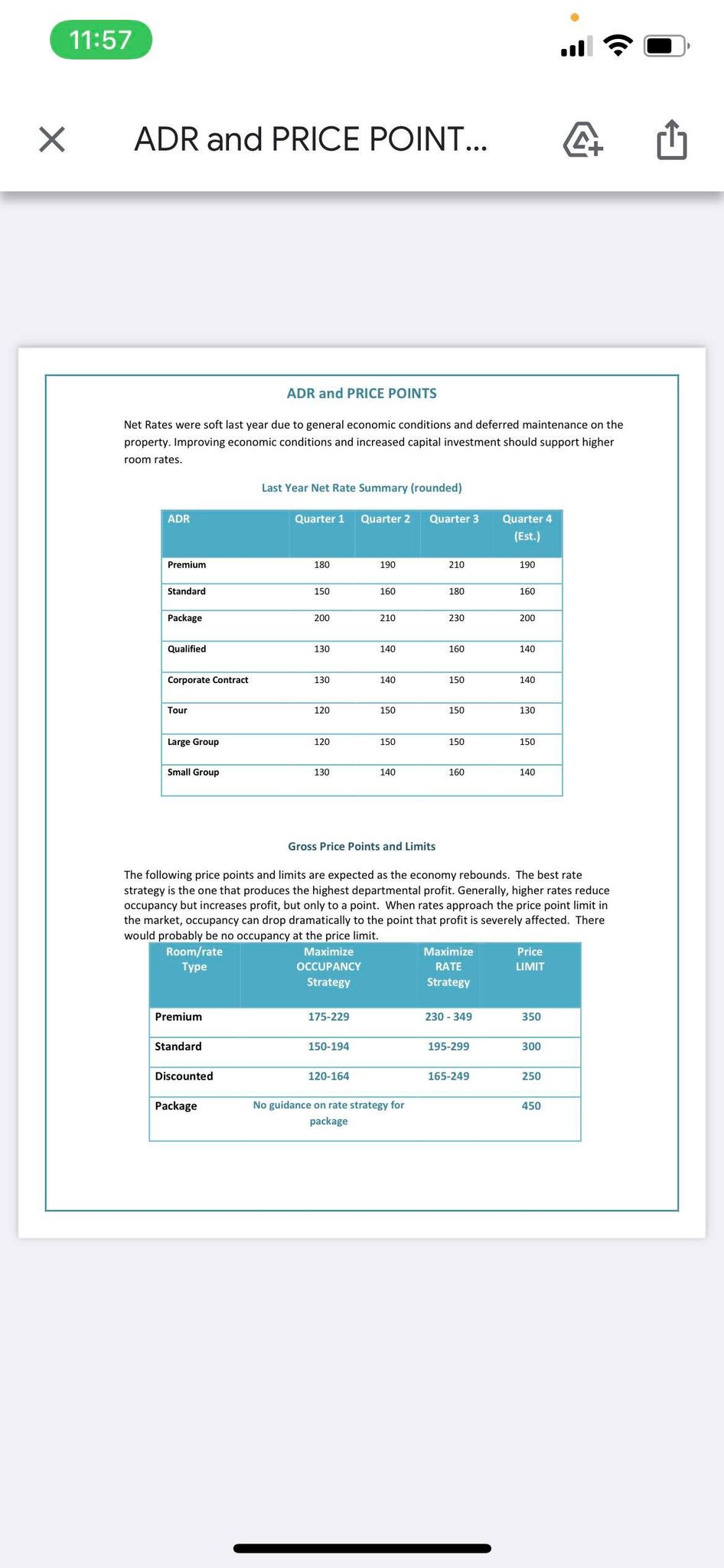

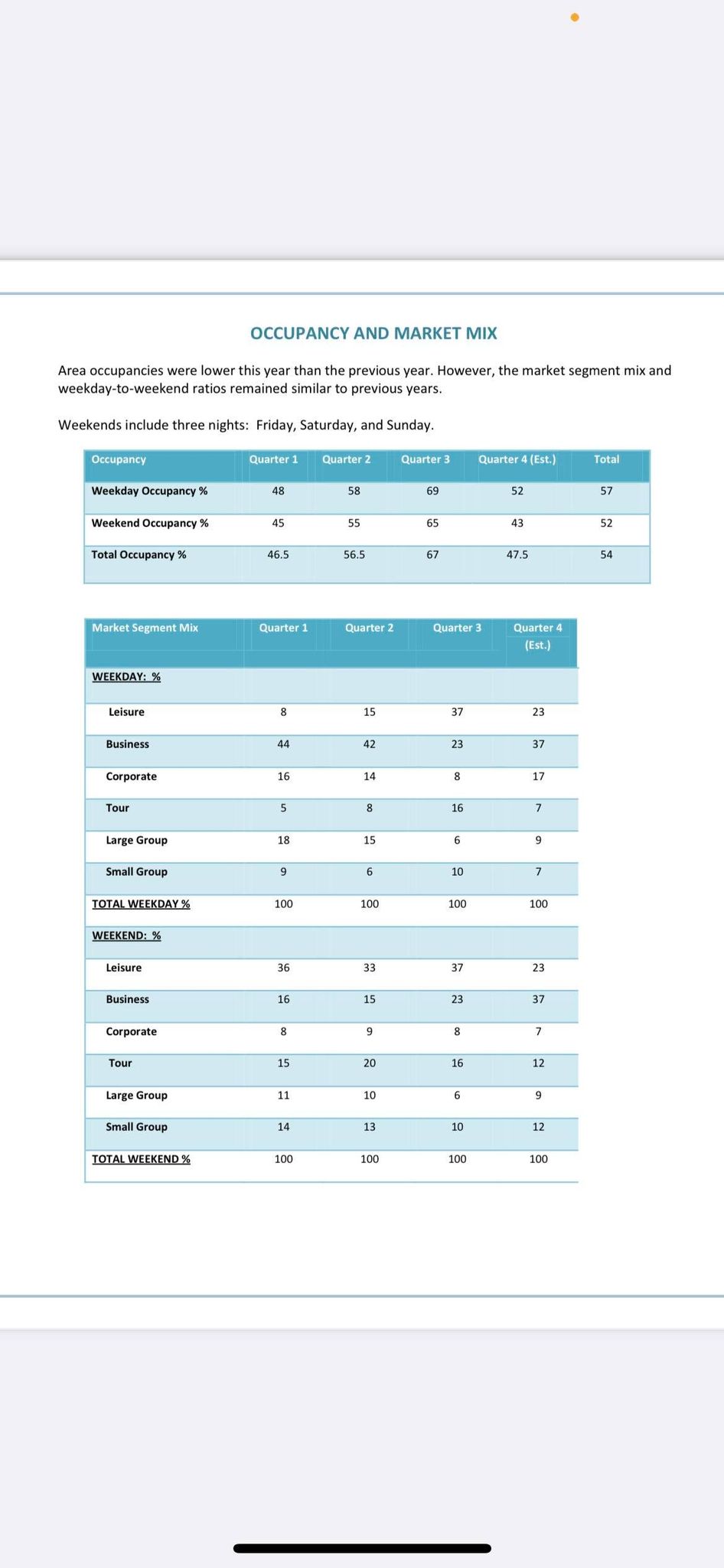

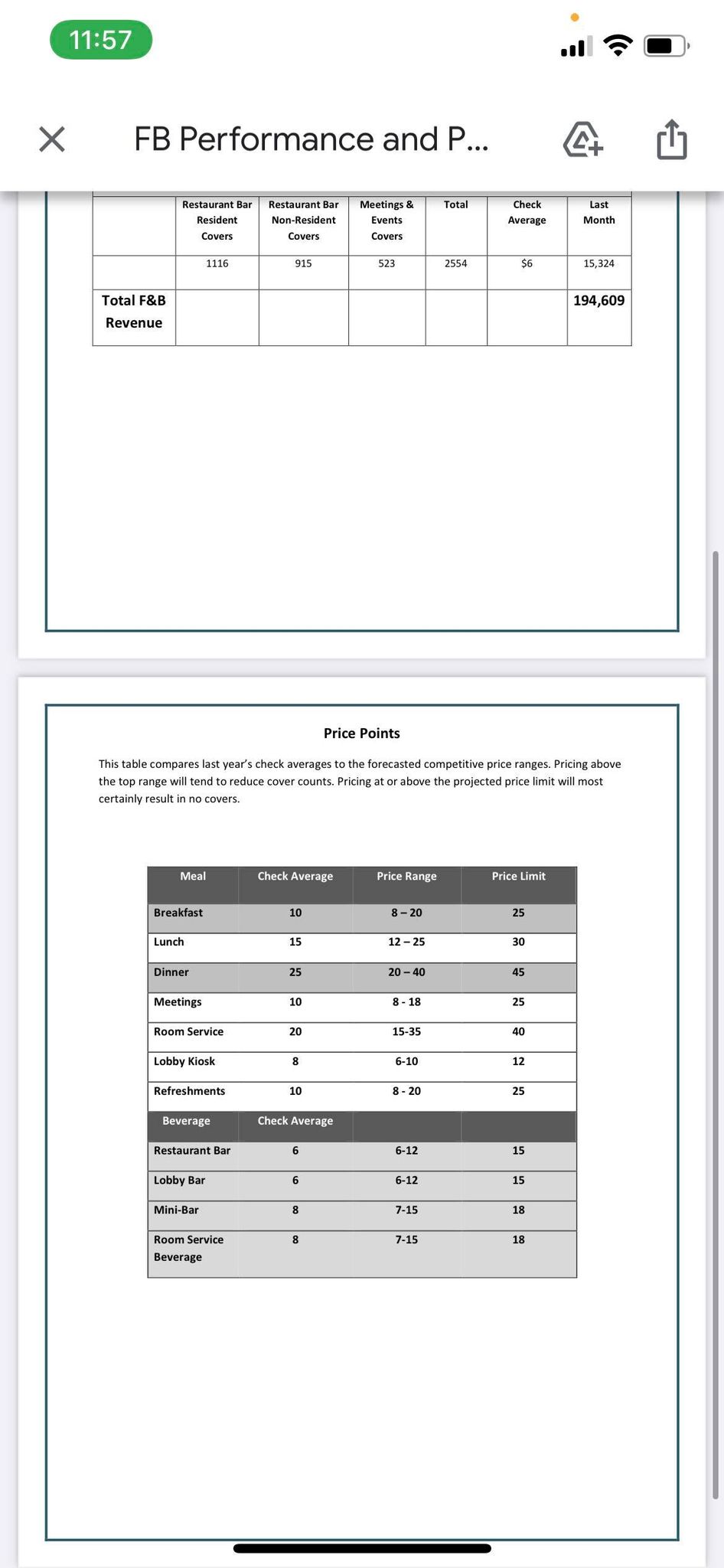

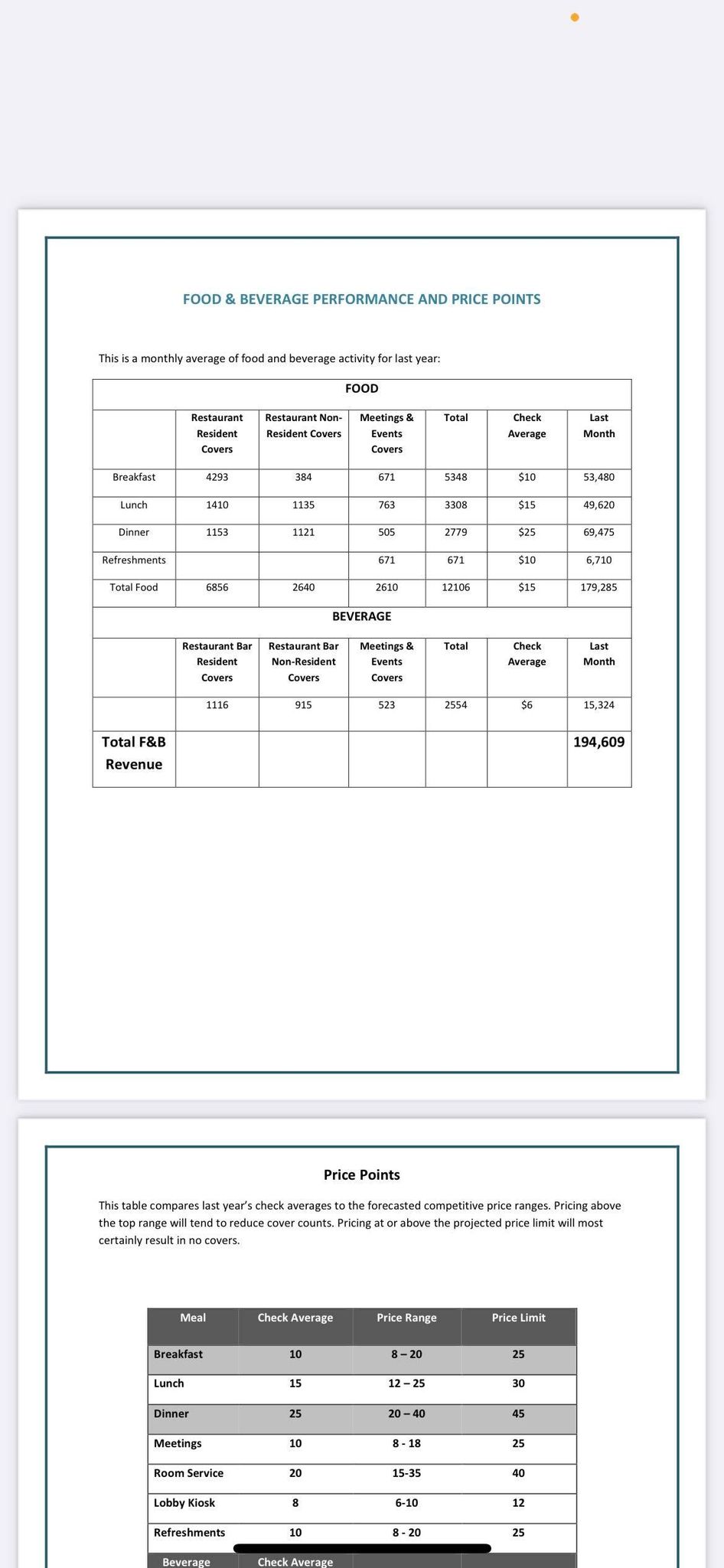

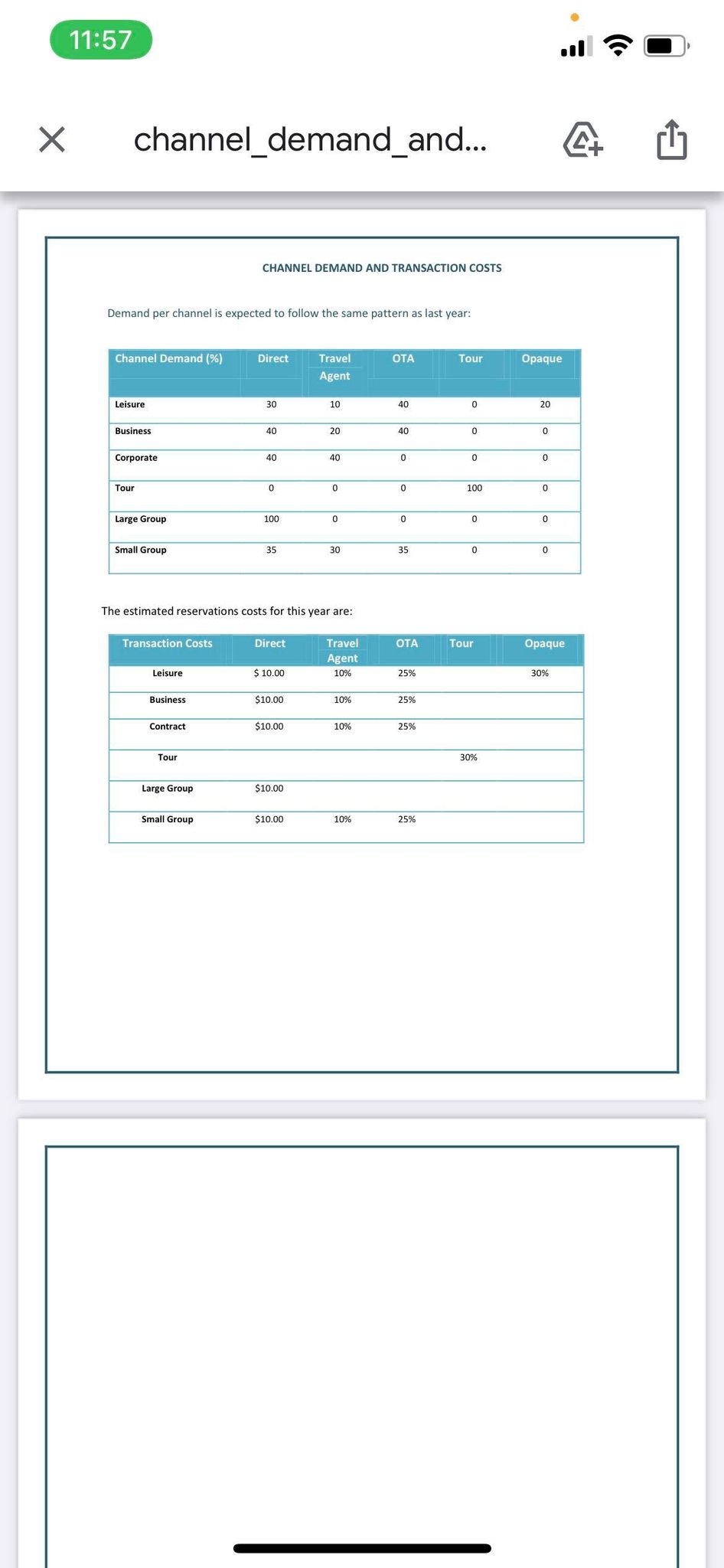

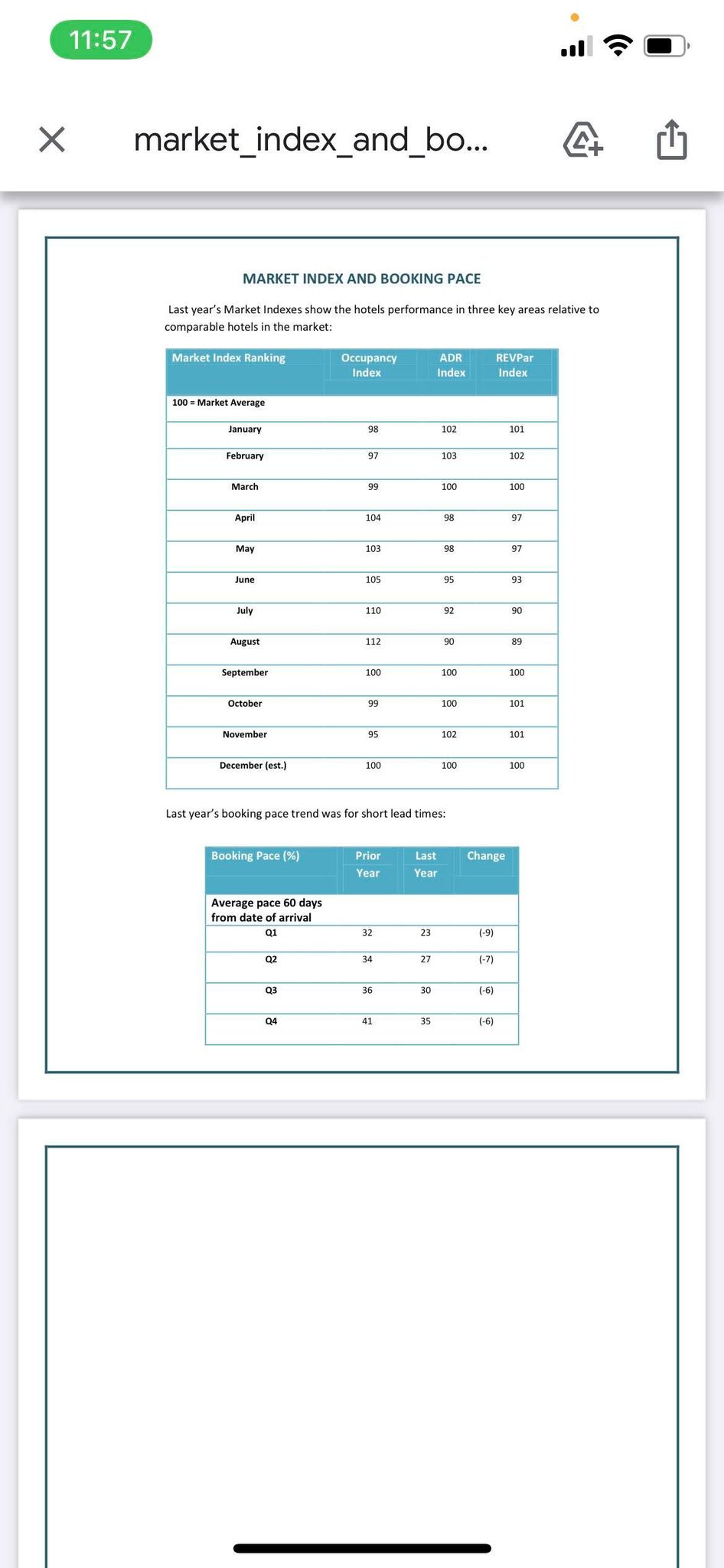

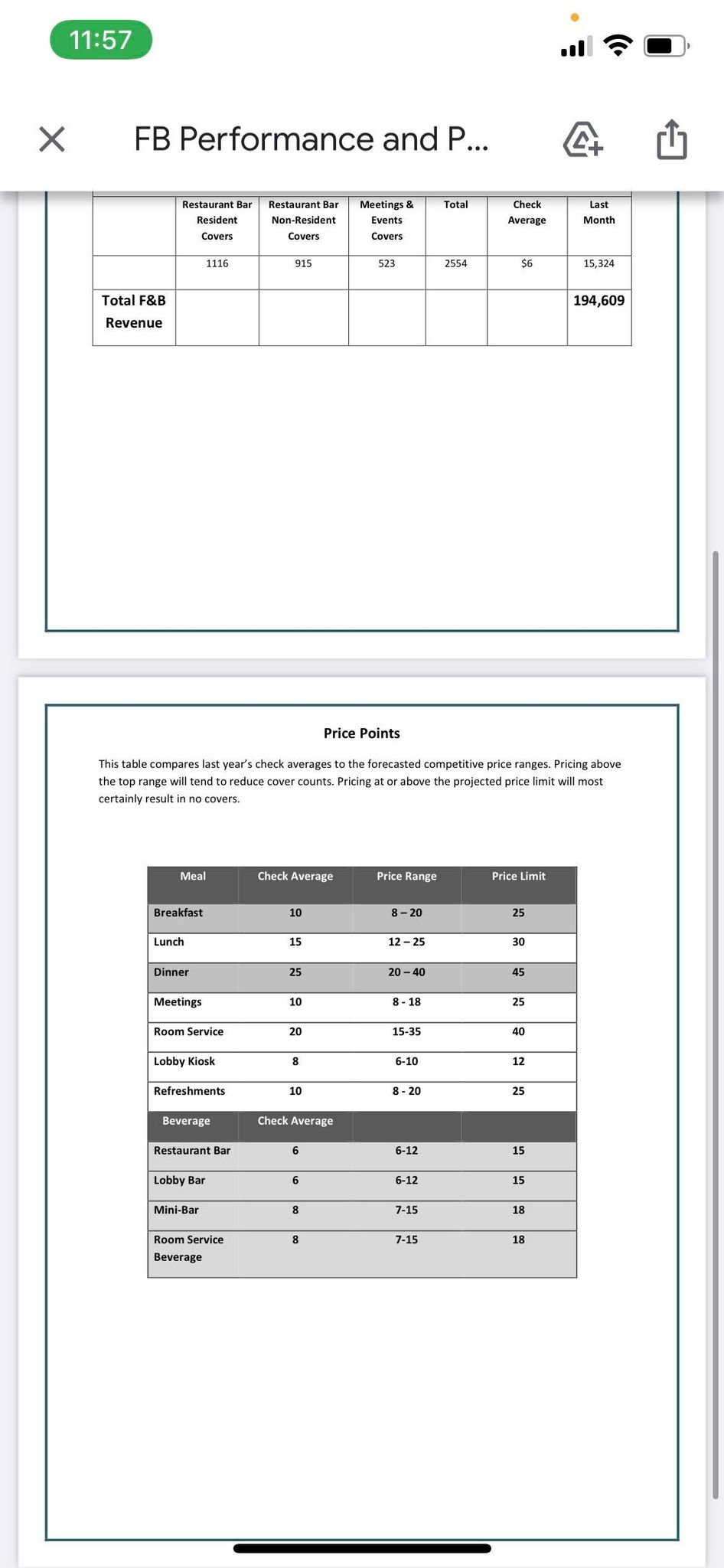

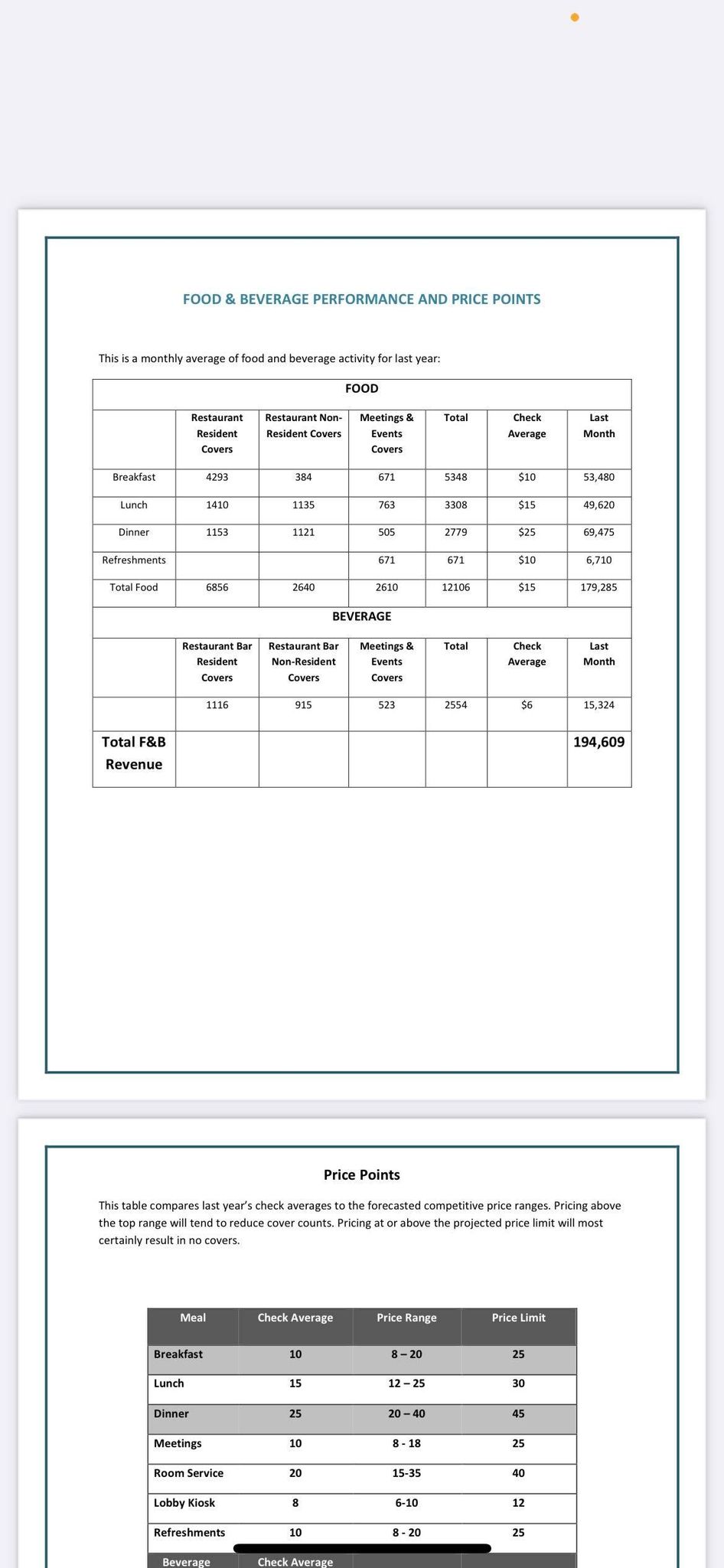

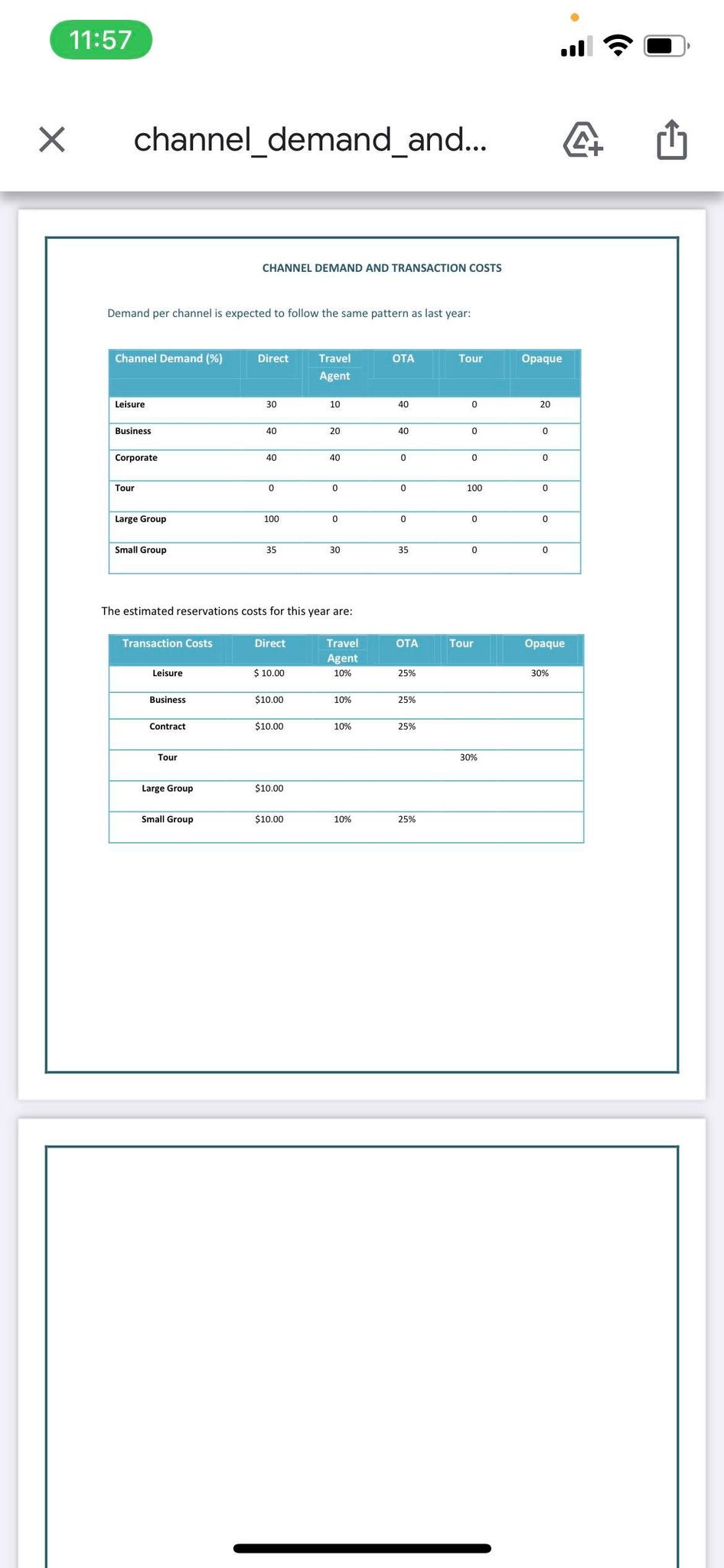

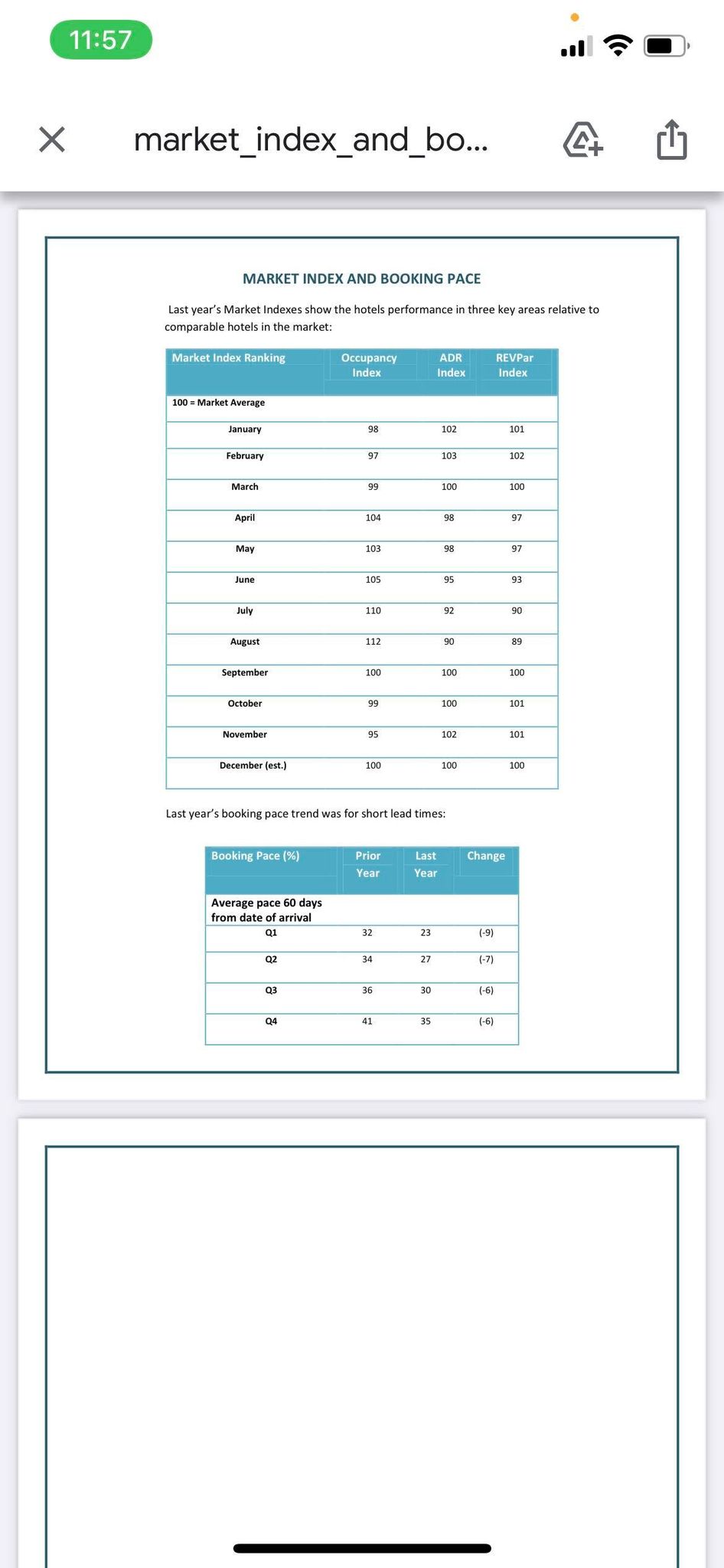

11:57 X ADR and PRICE POINT... 4+ ADR and PRICE POINTS Net Rates were soft last year due to general economic conditions and deferred maintenance on the property. Improving economic conditions and increased capital investment should support higher room rates. Last Year Net Rate Summary (rounded) ADR Quarter 1 Quarter 2 Quarter 3 Quarter 4 (Est.) Premium 180 190 210 190 Standard 150 160 180 160 Package 200 210 230 200 Qualified 130 140 160 140 Corporate Contract 130 140 150 140 Tour 120 150 150 130 Large Group 120 150 150 150 Small Group 130 140 160 140 Gross Price Points and Limits The following price points and limits are expected as the economy rebounds. The best rate strategy is the one that produces the highest departmental profit. Generally, higher rates reduce occupancy but increases profit, but only to a point. When rates approach the price point limit in the market, occupancy can drop dramatically to the point that profit is severely affected. There would probably be no occupancy at the price limit. Room/rate Maximize Maximize Price Type OCCUPANCY RATE LIMIT Strategy Strategy Premium 175-229 230 - 349 350 Standard 150-194 195-299 300 Discounted 120-164 165-249 250 Package No guidance on rate strategy for 450 packageOCCUPANCY AND MARKET MIX Area occupancies were lower this year than the previous year. However, the market segment mix and weekday-to-weekend ratios remained similar to previous years. Weekends include three nights: Friday, Saturday, and Sunday. Occupancy Quarter 1 Quarter 2 Quarter 3 Quarter 4 (Est.) Total Weekday Occupancy % 48 58 69 52 57 Weekend Occupancy % 45 55 65 43 52 Total Occupancy % 46.5 56.5 67 47.5 54 Market Segment Mix Quarter 1 Quarter 2 Quarter 3 Quarter 4 (Est.) WEEKDAY: % Leisure 8 15 37 23 Business 44 42 23 37 Corporate 16 14 8 17 Tour 5 8 16 7 Large Group 18 15 6 Small Group 9 6 10 7 TOTAL WEEKDAY % 100 100 100 100 WEEKEND: % Leisure 36 33 37 23 Business 16 15 23 37 Corporate 8 9 8 Tour 15 20 16 12 Large Group 11 10 6 Small Group 14 13 10 12 TOTAL WEEKEND % 100 100 100 100X Revenue This table compares last year's check averages to the forecasted competitive price ranges. Pricing above the top range will tend to reduce cover counts. Pricing at or above the projected price limit will most certainly result in no covers. Meetings Room service Lobby Kiosk Refreshmmis Beverage Price Points Check Average 10 2|] 10 Check Average Price Range Price Limit FOOD & BEVERAGE PERFORMANCE AND PRICE POINTS This is a monthly average of food and beverage activity for last year: FOOD Restaurant Restaurant Non- Meetings & Total Check Last Resident Resident Covers Events Average Month Covers Covers Breakfast 4293 384 671 5348 $10 53,480 Lunch 1410 1135 763 3308 $15 49,620 Dinner 1153 1121 505 2779 $25 69,475 Refreshments 671 671 $10 6,710 Total Food 6856 2640 2610 12106 $15 179,285 BEVERAGE Restaurant Bar Restaurant Bar Meetings & Total Check Last Resident Non-Resident Events Average Month Covers Covers Covers 1116 915 523 2554 $6 15,324 Total F&B 194,609 Revenue Price Points This table compares last year's check averages to the forecasted competitive price ranges. Pricing above the top range will tend to reduce cover counts. Pricing at or above the projected price limit will most certainly result in no covers. Meal Check Average Price Range Price Limit Breakfast 10 8 - 20 25 Lunch 15 12 - 25 30 Dinner 25 20 -40 45 Meetings 10 8 - 18 25 Room Service 20 15-35 40 Lobby Kiosk 8 6-10 12 Refreshments 10 8 - 20 25 Check Ave11:57 X channel_demand and.. CHANNEL DEMAND AND TRANSACTION COSTS Demand per channel is expected to follow the same pattern as last year: Channel Demand (%) Direct Travel OTA Tour Opaque Agent Leisure 30 10 0 20 Business 10 20 10 0 Corporate 40 40 0 0 0 Tour 0 0 0 100 0 Large Group 100 0 0 0 0 Small Group 35 30 35 The estimated reservations costs for this year are: Transaction Costs Direct Travel OTA Tour Opaque Agent Leisure $ 10.00 10% 25% 30% Business $10.00 10% 25% Contract $10.00 10% 25% Tour 30% Large Group $10.00 Small Group $10.00 10% 25%11:57 X market_index_and_bo... MARKET INDEX AND BOOKING PACE Last year's Market Indexes show the hotels performance in three key areas relative to comparable hotels in the market: Market Index Ranking Occupancy ADR REVPar Index Index Index 100 = Market Average January 86 102 101 February 97 103 102 March 39 100 100 April 104 98 97 May 103 86 97 June 105 95 93 July 110 92 90 August 112 90 89 September 100 100 100 October 100 101 November 95 102 101 December (est.) 100 100 100 Last year's booking pace trend was for short lead times: Booking Pace (%) Prior Last Change Year Year Average pace 60 days from date of arrival Q1 32 23 (-9 Q2 34 27 (-7) 36 30 (-6) Q4 41 35 (-6)