Answer the following questions using the appropriate theories and models.

Korean company has been exporting cosmetics to the European Union for the last 25 years. The EU market represents 55% of the company's revenue. What would be the possible business strategies for the company if the EU implements a 45% tariff on Korean goods?

Suppose that this Korean company possesses two important ownership advantages: Efficient bio-cosmetics manufacturing techniques and a reputation for producing high quality cosmetics. What would be the possible business strategies for the company to enter the EU market?

Suppose that this cosmetics-producing company is Korean Beauty, a brand which is already well-known in many countries. If a company would like to maintain the brand familiarity, would be the possible business strategies for the company to enter the market of Brazil?

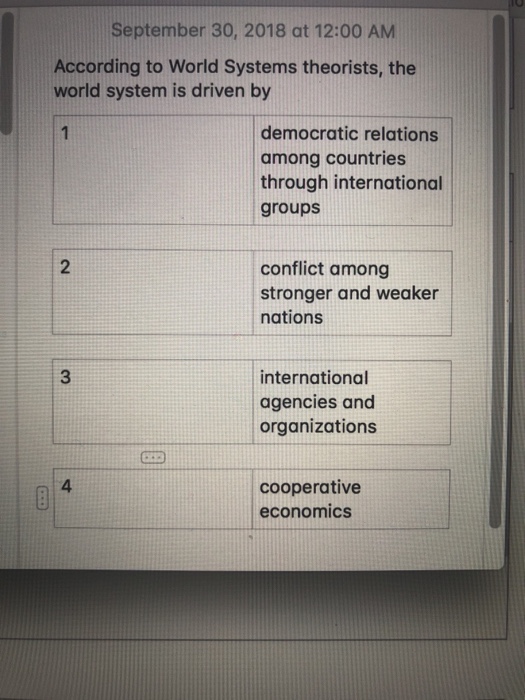

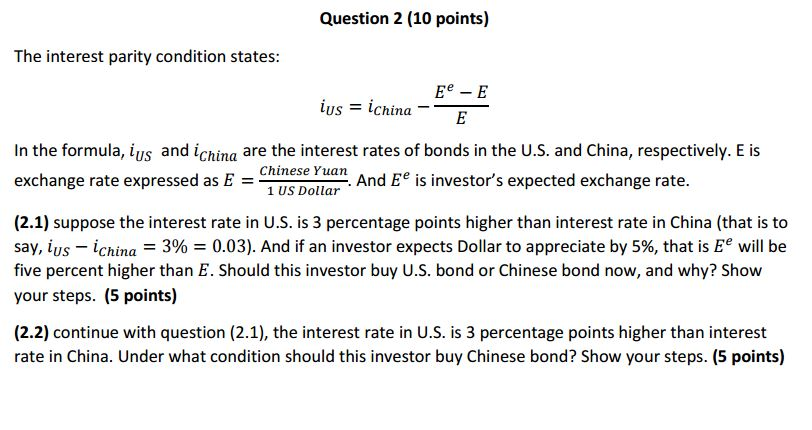

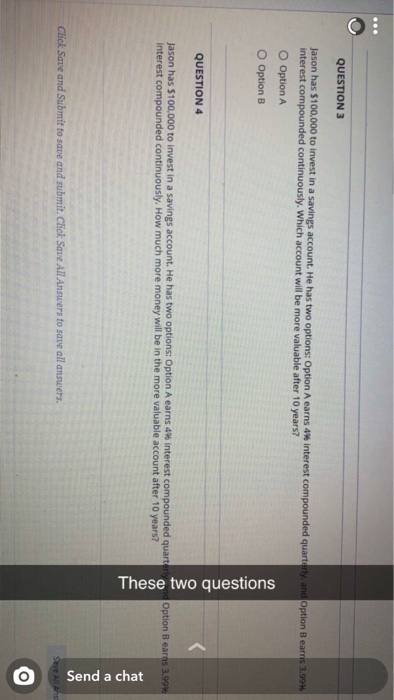

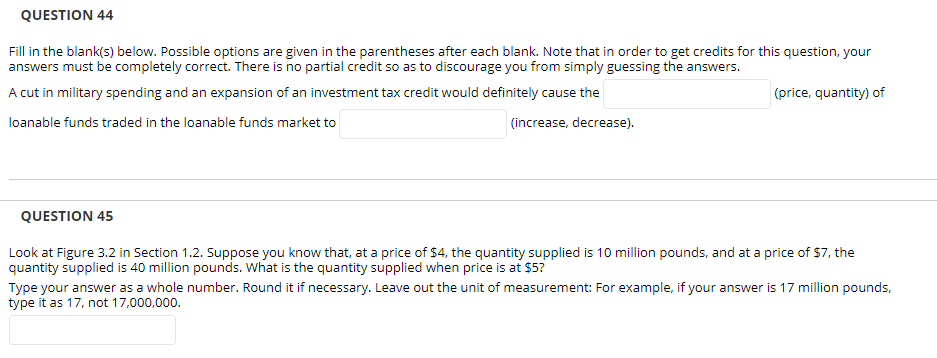

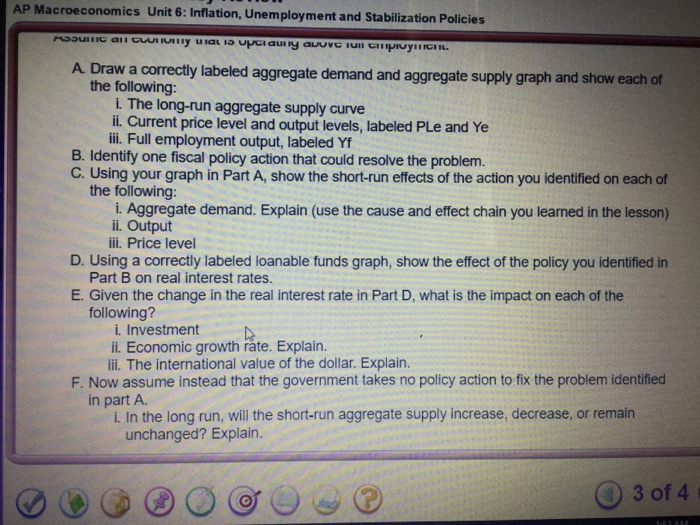

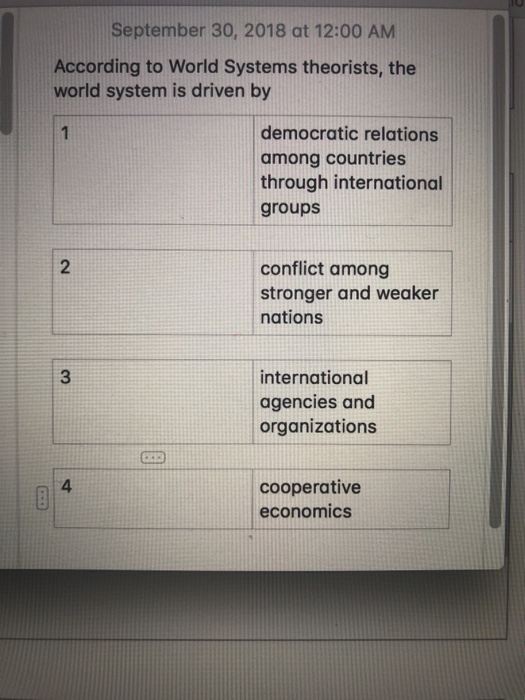

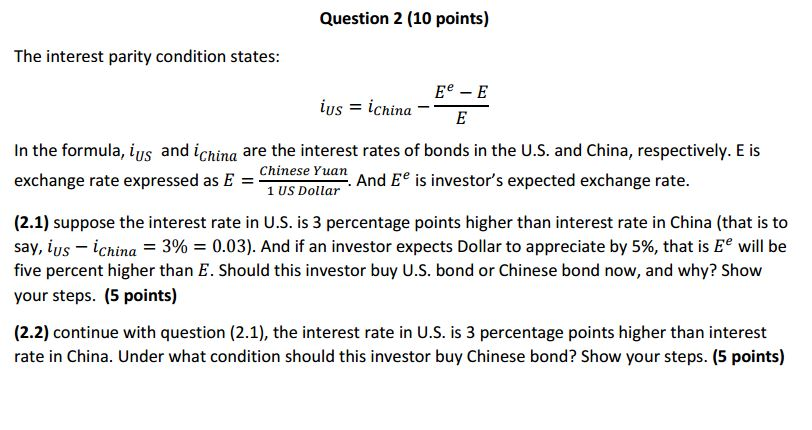

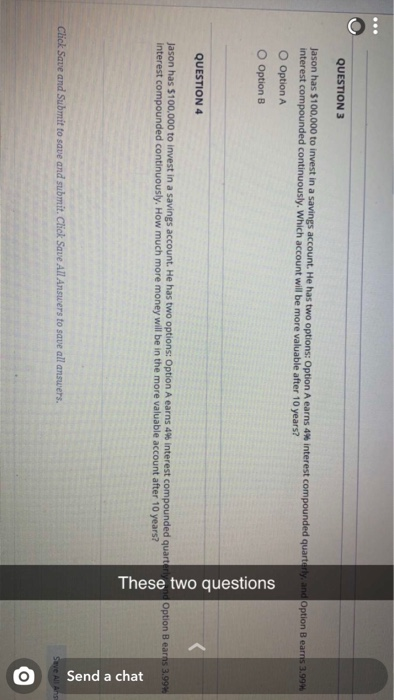

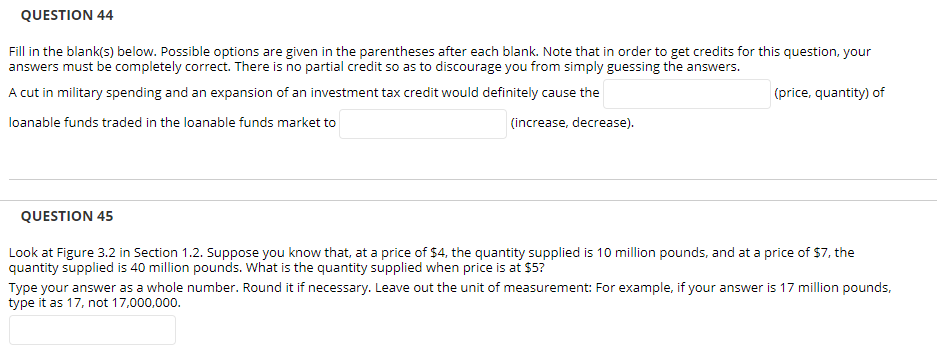

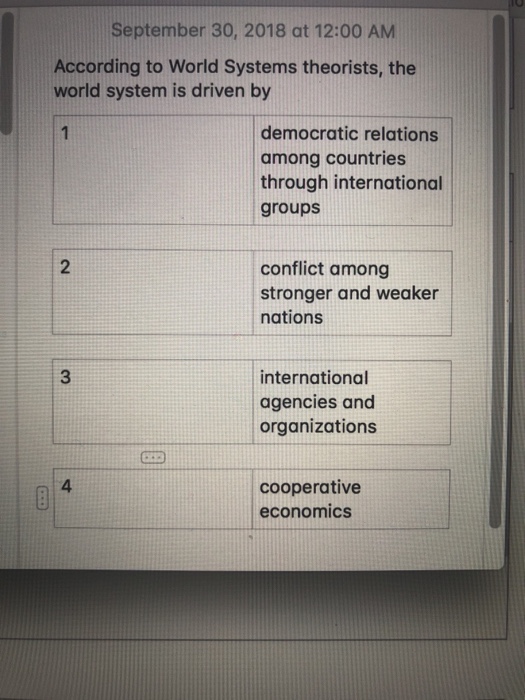

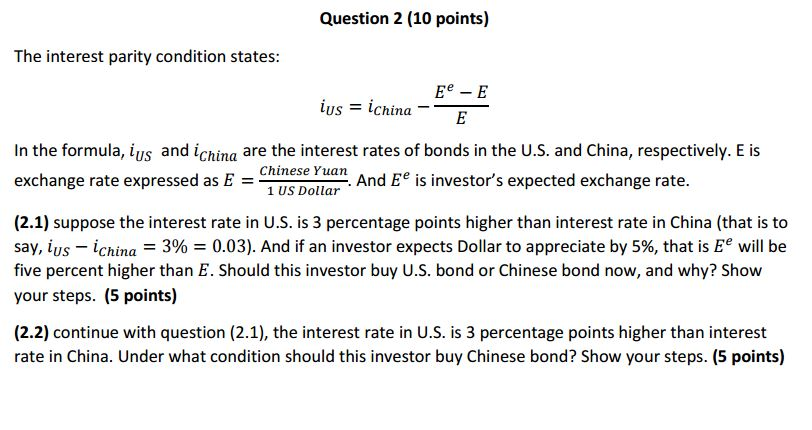

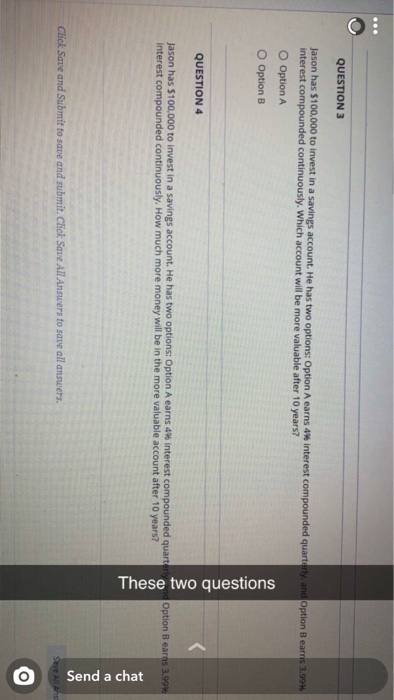

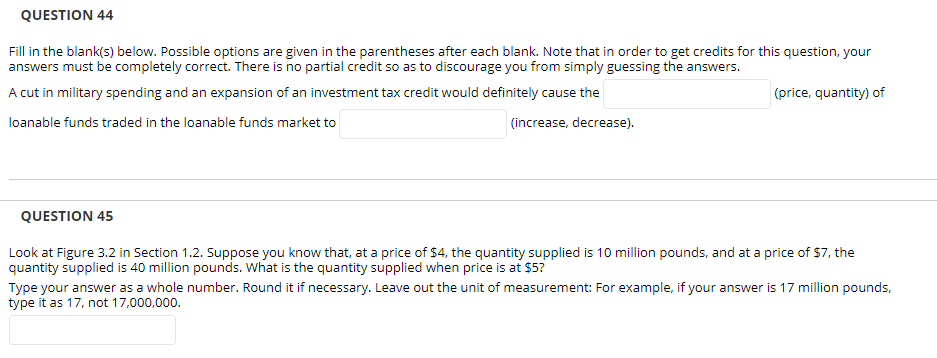

AP Macroeconomics Unit 6: Inflation, Unemployment and Stabilization Policies ASSUITIt all COUTUIlly UIat IS UpCIquily auUVE lull CITYIVYIIIGIRL. A. Draw a correctly labeled aggregate demand and aggregate supply graph and show each of the following: 1. The long-run aggregate supply curve ii. Current price level and output levels, labeled PLe and Ye ili. Full employment output, labeled Yf B. Identify one fiscal policy action that could resolve the problem. C. Using your graph in Part A, show the short-run effects of the action you identified on each of the following: i. Aggregate demand. Explain (use the cause and effect chain you learned in the lesson) ii. Output iii. Price level D. Using a correctly labeled loanable funds graph, show the effect of the policy you identified in Part B on real interest rates. E. Given the change in the real interest rate in Part D, what is the impact on each of the following? i. Investment ii. Economic growth rate. Explain. iii. The international value of the dollar. Explain. F. Now assume instead that the government takes no policy action to fix the problem identified in part A. i. In the long run, will the short-run aggregate supply increase, decrease, or remain unchanged? Explain. 3 of 4September 30, 2018 at 12:00 AM According to World Systems theorists, the world system is driven by democratic relations among countries through international groups 2 conflict among stronger and weaker nations international agencies and organizations 4 cooperative economicsQuestion 2 (10 points) The interest parity condition states: E - E ius = ichina - E In the formula, ius and iching are the interest rates of bonds in the U.S. and China, respectively. E is exchange rate expressed as E = Chinese Yuan And E is investor's expected exchange rate. 1 US Dollar (2.1) suppose the interest rate in U.S. is 3 percentage points higher than interest rate in China (that is to say, ius - ichina = 3% = 0.03). And if an investor expects Dollar to appreciate by 5%, that is E will be five percent higher than E. Should this investor buy U.S. bond or Chinese bond now, and why? Show your steps. (5 points) (2.2) continue with question (2.1), the interest rate in U.S. is 3 percentage points higher than interest rate in China. Under what condition should this investor buy Chinese bond? Show your steps. (5 points)O QUESTION 3 Jason has $100,000 to invest in a savings account. He has two options: Option A earns 4% interest compounded quarterly, and Option B earns 3.994 interest compounded continuously. Which account will be more valuable after 10 years? O Option A O Option B QUESTION 4 These two questions Jason has $100,000 to invest in a savings account. He has two options: Option A earns 49% interest compounded quarterly Option B earns 3.99% Interest compounded continuously. How much more money will be in the more valuable account after 10 years? Send a chat Click Save and Submit to save and submit. Click Save All Answers to save all answers. Saye All OQUESTION 44 Fill in the blank(s) below. Possible options are given in the parentheses after each blank. Note that in order to get credits for this question, your answers must be completely correct. There is no partial credit so as to discourage you from simply guessing the answers. A cut in military spending and an expansion of an investment tax credit would definitely cause the (price, quantity) of loanable funds traded in the loanable funds market to (increase, decrease). QUESTION 45 Look at Figure 3.2 in Section 1.2. Suppose you know that, at a price of $4, the quantity supplied is 10 million pounds, and at a price of $7, the quantity supplied is 40 million pounds. What is the quantity supplied when price is at $5? Type your answer as a whole number. Round it if necessary. Leave out the unit of measurement: For example, if your answer is 17 million pounds, type it as 17, not 17,000,000