Question

Answer the following questions with clear explanation and supporting ratios: a. Is the firms liquidity better or worse than the industry? Explain. b. Regarding the

Answer the following questions with clear explanation and supporting ratios:

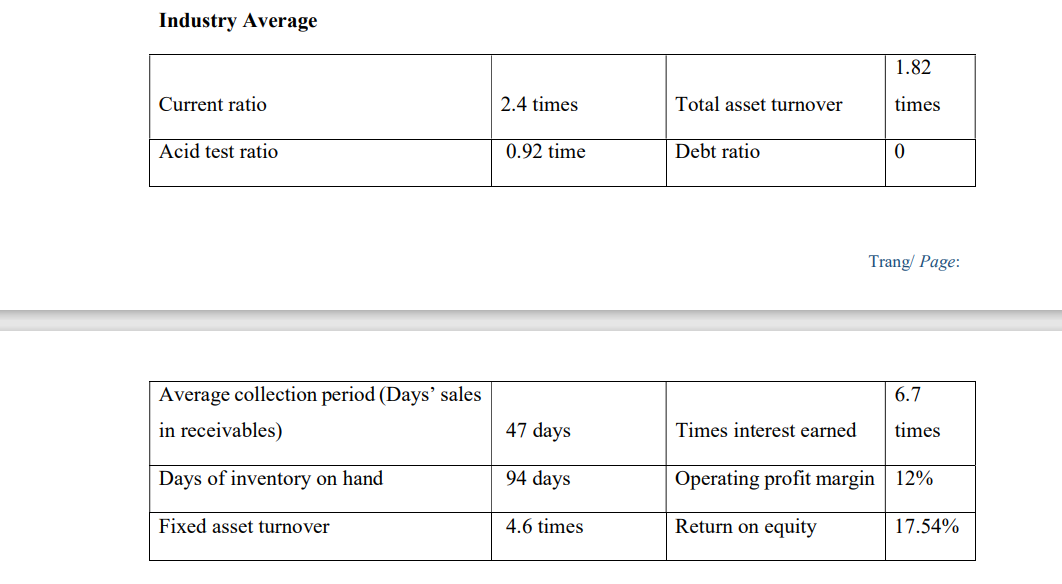

a. Is the firms liquidity better or worse than the industry? Explain.

b. Regarding the firms account receivable and inventory management, is it more efficient than industry? Explain

. c. Is the firms overall asset utilization more efficient than the industry? Explain

. d. Is the firms interest paying ability higher than that of the industry? Explain. e. Analyze the firms return to owners by using the DuPont System ratio. Explain why the firms ratio is higher or lower than that of the industry.

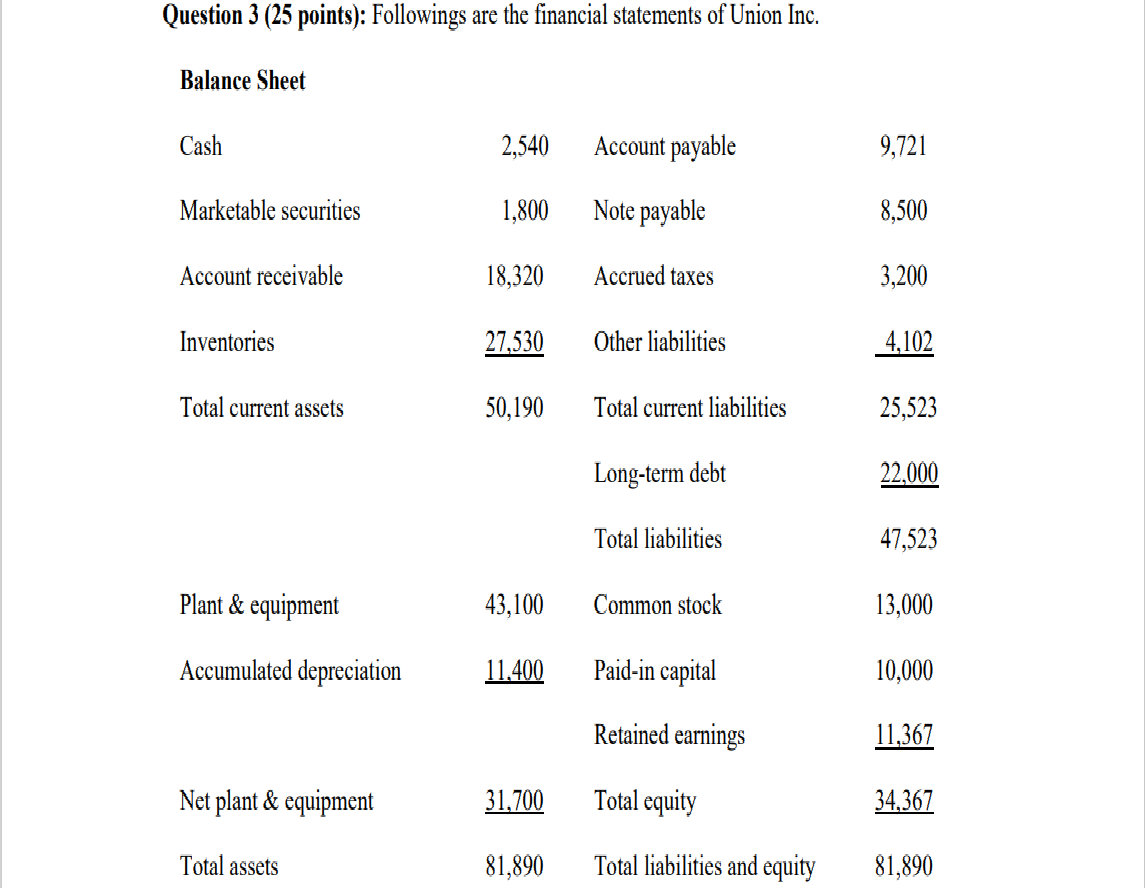

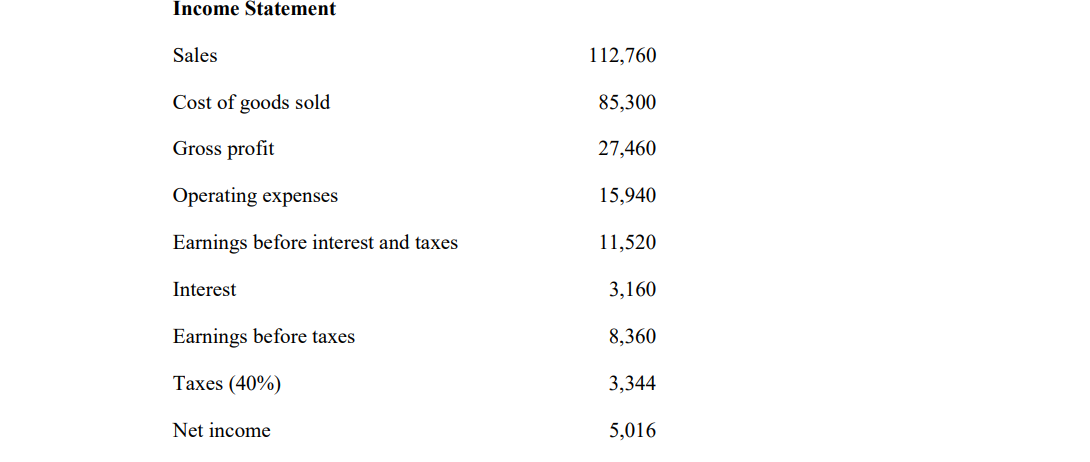

Question 3 (25 points): Followings are the financial statements of Union Inc. Balance Sheet Cash 2,540 Account payable 9,721 Marketable securities 1,800 Note payable 8,500 Account receivable 18,320 Accrued taxes 3,200 Inventories 27,530 Other liabilities 4,102 Total current assets 50,190 Total current liabilities 25,523 Long-term debt 22,000 Total liabilities 47,523 Plant & equipment 43,100 Common stock 13,000 Accumulated depreciation 11.400 Paid-in capital 10,000 Retained earnings 11,367 Net plant & equipment 31,700 Total equity 34,367 Total assets 81,890 Total liabilities and equity 81,890 Income Statement Sales 112,760 Cost of goods sold 85,300 Gross profit 27,460 Operating expenses 15,940 Earnings before interest and taxes 11,520 Interest 3,160 Earnings before taxes 8,360 Taxes (40%) 3,344 Net income 5,016 Industry Average 1.82 Current ratio 2.4 times Total asset turnover times Acid test ratio 0.92 time Debt ratio 0 Trang Page: 6.7 Average collection period (Days' sales in receivables) 47 days Times interest earned times Days of inventory on hand 94 days Operating profit margin 12% Fixed asset turnover 4.6 times Return on equity 17.54%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started