Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer the following questions. You need to show all the workings. a. Cahaya Corporation just paid a dividend yesterday of RM2 per share. The

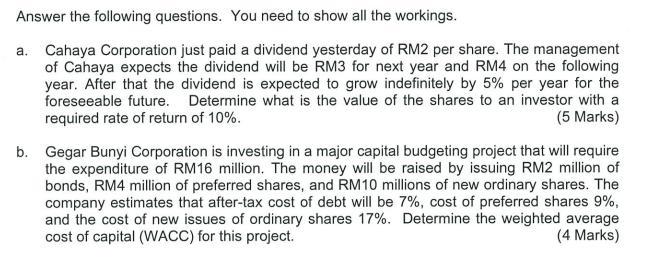

Answer the following questions. You need to show all the workings. a. Cahaya Corporation just paid a dividend yesterday of RM2 per share. The management of Cahaya expects the dividend will be RM3 for next year and RM4 on the following year. After that the dividend is expected to grow indefinitely by 5% per year for the foreseeable future. Determine what is the value of the shares to an investor with a required rate of return of 10%. (5 Marks) b. Gegar Bunyi Corporation is investing in a major capital budgeting project that will require the expenditure of RM16 million. The money will be raised by issuing RM2 million of bonds, RM4 million of preferred shares, and RM10 millions of new ordinary shares. The company estimates that after-tax cost of debt will be 7%, cost of preferred shares 9%, and the cost of new issues of ordinary shares 17%. Determine the weighted average cost of capital (WACC) for this project. (4 Marks)

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Using the dividend discount model we can calculate the value of Cahaya Corporations shares as follows Year 1 D1 RM3 Year 2 D2 RM4 Year 3 and beyond ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started