answer

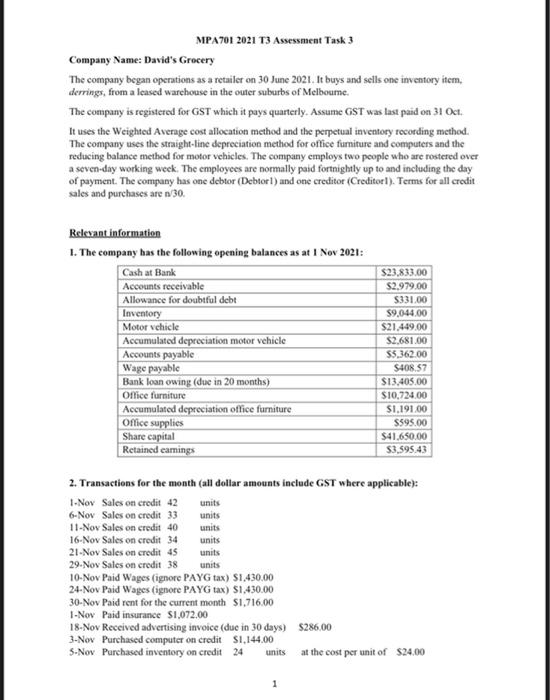

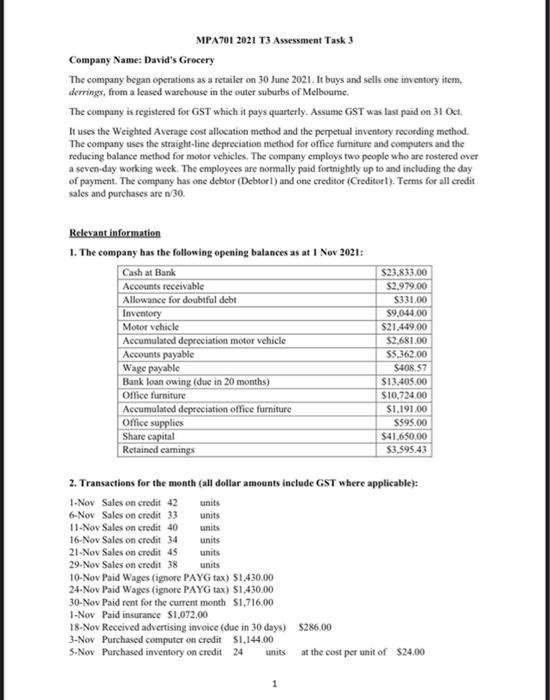

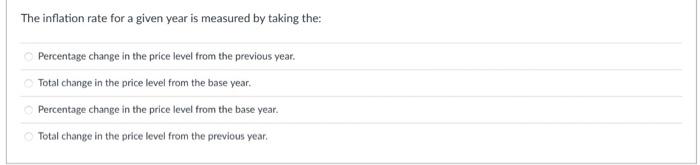

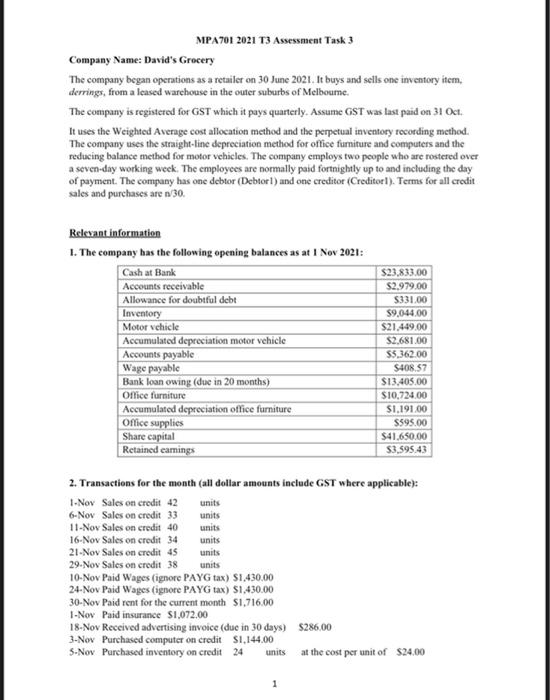

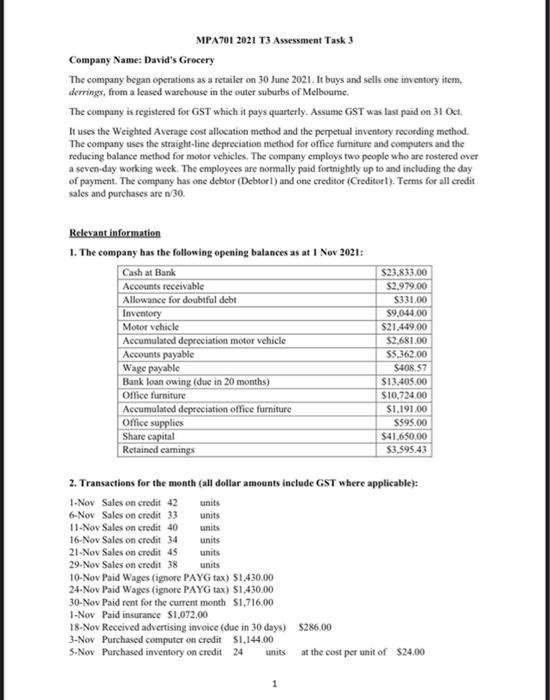

The inflation rate for a given year is measured by taking the Percentage change in the price level from the previous year. Total change in the price level from the base year. Percentage change in the price level from the base year. Total change in the price level from the previous year. Thec MPA701 2021 T3 Assessment Task 3 Company Name: David's Grocery The company began operations as a retailer on 30 June 2021. It buys and sells one inventory item, derrings, from a leased warehouse in the outer suburbs of Melboume. e company is registered for GST which it pays quarterly. Assume GST was last paid on 31 Oct. It uses the Weighted Average cost allocation method and the perpetual inventory recording method. The company uses the straight-line depreciation method for office furniture and computers and the reducing balance method for motor vehicles. The company employs two people who are rostered over a seven-day working week. The employees are normally paid fortnightly up to and including the day of payment. The company has one debtor (Debtorl) and one creditor (Creditorl). Terms for all credit sales and purchases are n/30. Relevant information 1. The company has the following opening balances as at Nov 2021: Cash at Bank Accounts receivable Allowance for doubtful debt Inventory Motor vehicle Accumulated depreciation motor vehicle Accounts payable Wage payable Bank loan owing (due in 20 months) Office furniture Accumulated depreciation office furniture Office supplies Share capital Retained earnings $23.833.00 $2.979.00 S331.00 59,044,00 $21.449.00 S2.681.00 55,362.00 $408.57 $13.405.00 $10,724.00 $1.191.00 S595.00 $41.650.00 $3,595.43 2. Transactions for the month (all dollar amounts include GST where applicable): 1-Nov Sales on credit 42 units 6-Nov Sales on credit 33 units 11-Nox Sales on credit 40 units 16-Nov Sales on credit 34 units 21-Nov Sales on credit 45 units 29. Noy Sales on credit 38 units 10-Nov Paid Wages (ignore PAYG tax) S1,430,00 24-Nov Paid Wages (ignore PAYG tax) $1,430.00 30-Nov Paid rent for the current month $1,716,00 1-Now Paid insurance $1,072.00 18-Nov Received advertising invoice (duc in 30 days) $286.00 3-Nov Purchased computer on credit S1,144.00 5-Nov Purchased inventory on credit 24 units at the cost per unit of $24.00 Thec MPA701 2021 T3 Assessment Task 3 Company Name: David's Grocery The company began operations as a retailer on 30 June 2021. It buys and sells one inventory item, derrings, from a leased warehouse in the outer suburbs of Melboume. e company is registered for GST which it pays quarterly. Assume GST was last paid on 31 Oct. It uses the Weighted Average cost allocation method and the perpetual inventory recording method. The company uses the straight-line depreciation method for office furniture and computers and the reducing balance method for motor vehicles. The company employs two people who are rostered over a seven-day working week. The employees are normally paid fortnightly up to and including the day of payment. The company has one debtor (Debtorl) and one creditor (Creditorl). Terms for all credit sales and purchases are n/30. Relevant information 1. The company has the following opening balances as at Nov 2021: Cash at Bank Accounts receivable Allowance for doubtful debt Inventory Motor vehicle Accumulated depreciation motor vehicle Accounts payable Wage payable Bank loan owing (due in 20 months) Office furniture Accumulated depreciation office furniture Office supplies Share capital Retained earnings $23.833.00 $2.979.00 S331.00 59,044,00 $21.449.00 S2.681.00 55,362.00 $408.57 $13.405.00 $10,724.00 $1.191.00 S595.00 $41.650.00 $3,595.43 2. Transactions for the month (all dollar amounts include GST where applicable): 1-Nov Sales on credit 42 units 6-Nov Sales on credit 33 units 11-Nox Sales on credit 40 units 16-Nov Sales on credit 34 units 21-Nov Sales on credit 45 units 29. Noy Sales on credit 38 units 10-Nov Paid Wages (ignore PAYG tax) S1,430,00 24-Nov Paid Wages (ignore PAYG tax) $1,430.00 30-Nov Paid rent for the current month $1,716,00 1-Now Paid insurance $1,072.00 18-Nov Received advertising invoice (duc in 30 days) $286.00 3-Nov Purchased computer on credit S1,144.00 5-Nov Purchased inventory on credit 24 units at the cost per unit of $24.00