Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determine the merchandise lost by fire, assuming: (a) A beginning inventory of $20,000 and a gross profit rate of 40% on net sales. (b)

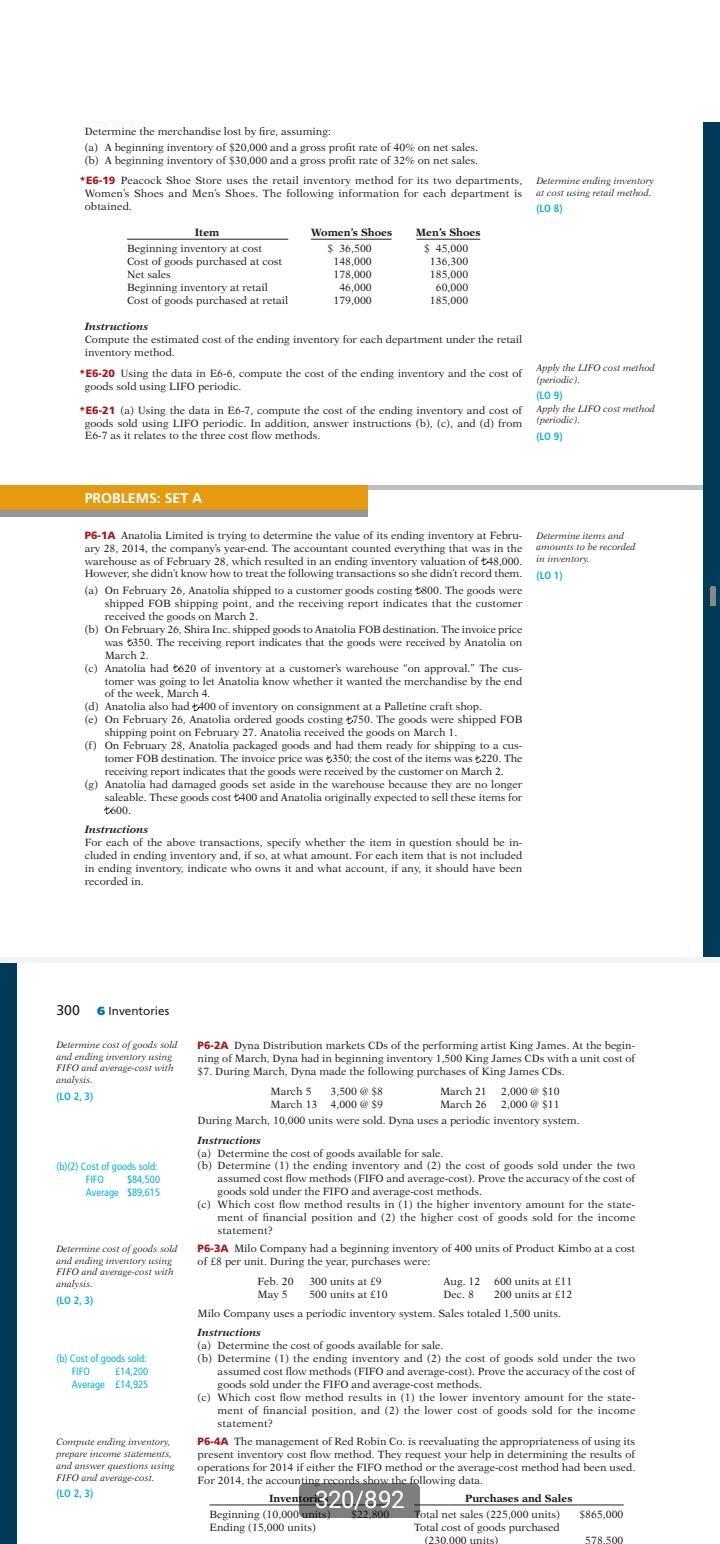

Determine the merchandise lost by fire, assuming: (a) A beginning inventory of $20,000 and a gross profit rate of 40% on net sales. (b) A beginning inventory of $30,000 and a gross profit rate of 32% on net sales. *E6-19 Peacock Shoe Store uses the retail inventory method for its two departments, Women's Shoes and Men's Shoes. The following information for each department is obtained. Determine ending inventory at cost using retail method. (LO 8) Item Women's Shoes Men's Shoes $ 36,500 Beginning inventory at cost Cost of goods purchased at cost Net sales 148,000 $ 45,000 136,300 178,000 185.000 Beginning inventory at retail 46.000 60,000 Cost of goods purchased at retail 179,000 185,000 Instructions Compute the estimated cost of the ending inventory for each department under the retail inventory method. *E6-20 Using the data in E6-6, compute the cost of the ending inventory and the cost of Apply the LIFO cost method (periodic). goods sold using LIFO periodic. (LO 9) *E6-21 (a) Using the data in E6-7, compute the cost of the ending inventory and cost of goods sold using LIFO periodic. In addition, answer instructions (b), (c), and (d) from E6-7 as it relates to the three cost flow methods. Apply the LIFO cost method (periodic). (LO 9) PROBLEMS: SET A Determine items and amounts to be recorded in inventory. P6-1A Anatolia Limited is trying to determine the value of its ending inventory at Febru- ary 28, 2014, the company's year-end. The accountant counted everything that was in the warehouse as of February 28, which resulted in an ending inventory valuation of t48,000. However, she didn't know how to treat the following transactions so she didn't record them. (a) On February 26, Anatolia shipped to a customer goods costing t800. The goods were shipped FOB shipping point, and the receiving report indicates that the customer received the goods on March 2. (LO 1) (b) On February 26, Shira Inc. shipped goods to Anatolia FOB destination. The invoice price was 350. The receiving report indicates that the goods were received by Anatolia on March 2 (c) Anatolia had t620 of inventory at a customer's warehouse "on approval." The cus- tomer was going to let Anatolia know whether it wanted the merchandise by the end of the week, March 4. (d) Anatolia also had +400 of inventory on consignment at a Palletine craft shop. (e) On February 26, Anatolia ordered goods costing +750. The goods were shipped FOB shipping point on February 27. Anatolia received the goods on March 1. (f) On February 28, Anatolia packaged goods and had them ready for shipping to a cus- tomer FOB destination. The invoice price was 350; the cost of the items was 220. The receiving report indicates that the goods were received by the customer on March 2. (g) Anatolia had damaged goods set aside in the warehouse because they are no longer saleable. These goods cost 400 and Anatolia originally expected to sell these items for t600. Instructions For each of the above transactions, specify whether the item in question should be in- cluded in ending inventory and, if so, at what amount. For each item that is not included in ending inventory, indicate who owns it and what account, if any, it should have been recorded in. 300 6 Inventories Determine cost of goods sold and ending inventory using FIFO and average-cost with analysis. (LO 2, 3) P6-2A Dyna Distribution markets CDs of the performing artist King James. At the begin- ning of March, Dyna had in beginning inventory 1,500 King James CDs with a unit cost of $7. During March, Dyna made the following purchases of King James CDs. March 5 3,500 @ $8 March 13 4,000 @ $9 March 26 March 21 2,000 $10 2,000 @ $11 During March, 10,000 units were sold. Dyna uses a periodic inventory system. Instructions (a) Determine the cost of goods available for sale. (b)(2) Cost of goods sold: (b) Determine (1) the ending inventory and (2) the cost of goods sold under the two FIFO $84,500 assumed cost flow methods (FIFO and average-cost). Prove the accuracy of the cost of Average $89,615 goods sold under the FIFO and average-cost methods. (c) Which cost flow method results in (1) the higher inventory amount for the state- ment of financial position and (2) the higher cost of goods sold for the income statement? P6-3A Milo Company had a beginning inventory of 400 units of Product Kimbo at a cost of 8 per unit. During the year, purchases were: Determine cost of goods sold and ending inventory using FIFO and average-cost with analysis. (LO 2, 3) Feb. 20 300 units at 9 May 5 500 units at 10 Aug. 12 Dec. 8 600 units at 11 200 units at 12 Milo Company uses a periodic inventory system. Sales totaled 1,500 units. Instructions (a) Determine the cost of goods available for sale. (b) Cost of goods sold. (b) Determine (1) the ending inventory and (2) the cost of goods sold under the two FIFO 14,200 assumed cost flow methods (FIFO and average-cost). Prove the accuracy of the cost of Average 14,925 goods sold under the FIFO and average-cost methods. (c) Which cost flow method results in (1) the lower inventory amount for the state- ment of financial position, and (2) the lower cost of goods sold for the income statement? Compute ending inventory, prepare income statements, and answer questions using FIFO and average-cost. P6-4A The management of Red Robin Co. is reevaluating the appropriateness of using its present inventory cost flow method. They request your help in determining the results of operations for 2014 if either the FIFO method or the average-cost method had been used. For 2014, the accounting records show the following data. (LO 2, 3) Inventori320/892 Purchases and Sales $22,800 Total net sales (225,000 units) $865,000 Beginning (10,000 units) Ending (15,000 units) Total cost of goods purchased (230.000 units) 578.500

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Problem 1A a On February 26 Anatolia shipped to a customer goods costing 1800 The goods were shipped FOB shipping point and the receiving report indicates that the customer received the goods on March ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started