Answer the Q1 and Q2

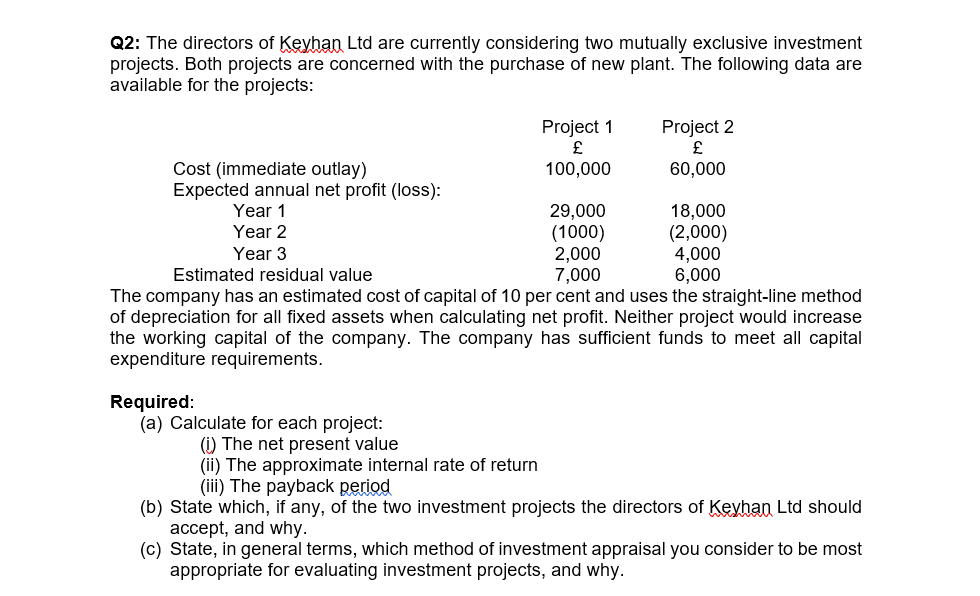

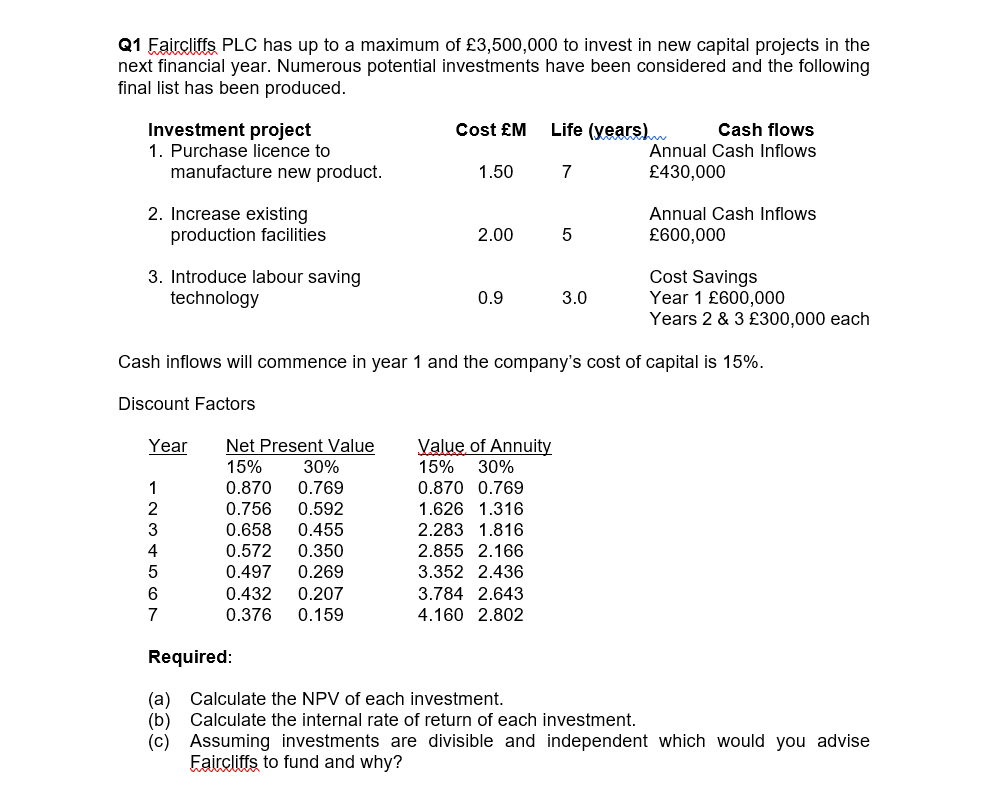

Q1 Faircliffs PLC has up to a maximum of $3,500,000 to invest in new capital projects in the next financial year. Numerous potential investments have been considered and the following final list has been produced. Investment project Cost EM Life (years) Cash flows 1. Purchase licence to Annual Cash Inflows manufacture new product. 1.50 7 $430,000 2. Increase existing Annual Cash Inflows production facilities 2.00 5 $600,000 3. Introduce labour saving Cost Savings technology 0.9 3.0 Year 1 2600,000 Years 2 & 3 2300,000 each Cash inflows will commence in year 1 and the company's cost of capital is 15%. Discount Factors Year Net Present Value Value of Annuity 15% 30% 15% 30% NO UPON- 0.870 0.769 0.870 0.769 0.756 0.592 1.626 1.316 0.658 0.455 2.283 1.816 0.572 0.350 2.855 2.166 0.497 0.269 3.352 2.436 0.432 0.207 3.784 2.643 0.376 0.159 4.160 2.802 Required: (a) Calculate the NPV of each investment. (b) Calculate the internal rate of return of each investment. (c) Assuming investments are divisible and independent which would you advise Faircliffs to fund and why?Q2: The directors of WLtd are currently considering two mutually exclusive investment projects. Both projects are concemed with the purchase of new plant. The following data are available for the projects: Project 1 Project 2 Cost {immediate outlay) 100,000 60,000 Expected annual net prot (loss): Year 1 29,000 18,000 Year 2 (1000) (2,000} Year 3 2,000 4,000 Estimated residual value 7,000 6,000 The company has an estimated cost of capital of 10 per cent and uses the straight-line method of depreciation for all xed assets when calculating net prot. Neither project would increase the working capital of the company. The company has sufcient funds to meet all capital expenditure requirements. Required: (a) Calculate for each project: (1} The net present value (ii) The approximate internal rate of return (iii) The payback ESE-99 (in) State which, if any, of the two investment projects the directors of m Ltd should accept, and why. (c) State, in general terms, which method ct investment appraisal you consider to be most appropriate for evaluating investment projects, and why