Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer the question ASAP t Question 8 uro at the end of the next 3 years, 50 million Euro at the end of its life

answer the question ASAP

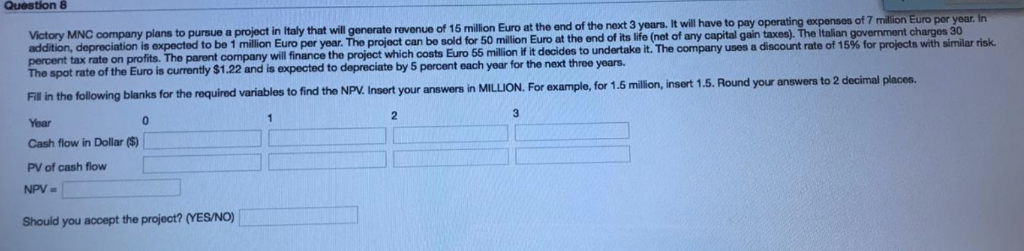

t Question 8 uro at the end of the next 3 years, 50 million Euro at the end of its life (net of any capital gain taxes). The italian government t will have to pay operating expenses of 7 million Euro por yoar n Victory MNC company plans to pursue a project in Italy that will generate revenue of 15 million E addition, depreciation is expected to be 1 million Euro per year. The project carn percent tax rate on profits. The parent company will finance the project which costs Euro charges 30 be sold for discount rate of 15% for proiects with similar risk. 55 million if it decides to undertake it. The company uses a spot rate of the Euro is currently $1.22 and FIl in the following blanks for the required variables to find the NPV. I Year Cash flow in Dollar ($) PV of cash flow is expected to depreciate by 5 percent each year for the next throe insert your answers in MILLION. For example, for 1.5 million, insert 1.5. Round your answers to 2 decimal places. 0 NPV Should you accept the project? (YES/NO)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started