Answered step by step

Verified Expert Solution

Question

1 Approved Answer

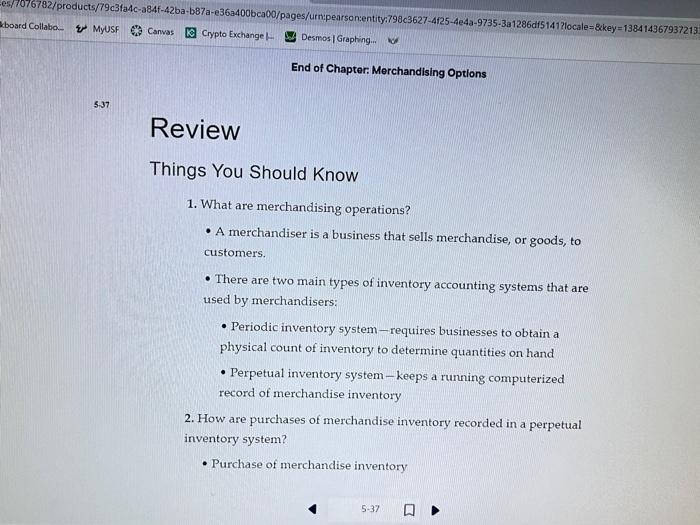

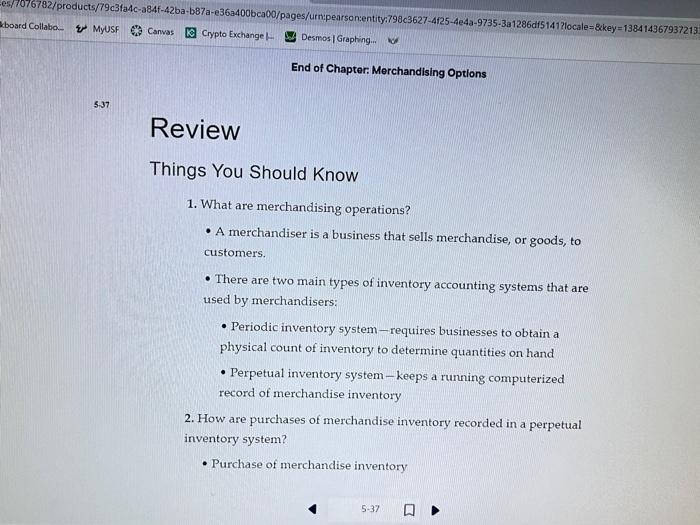

answer the question ings You Should Know 1. What are merchandising operations? - A merchandiser is a business that sells merchandise, or goods, to customers.

answer the question

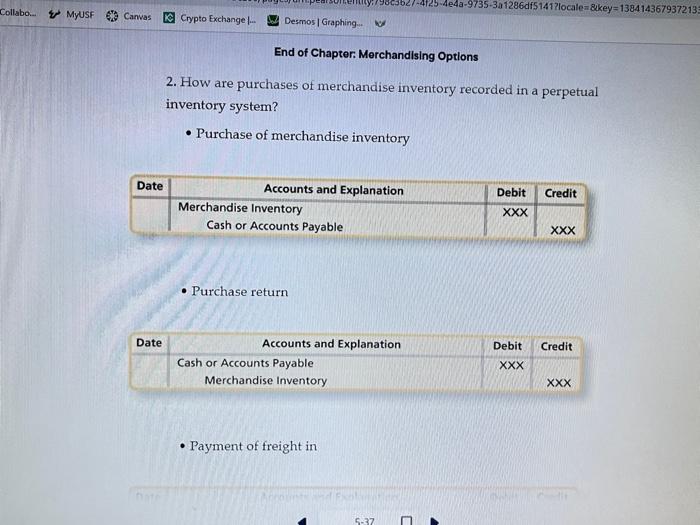

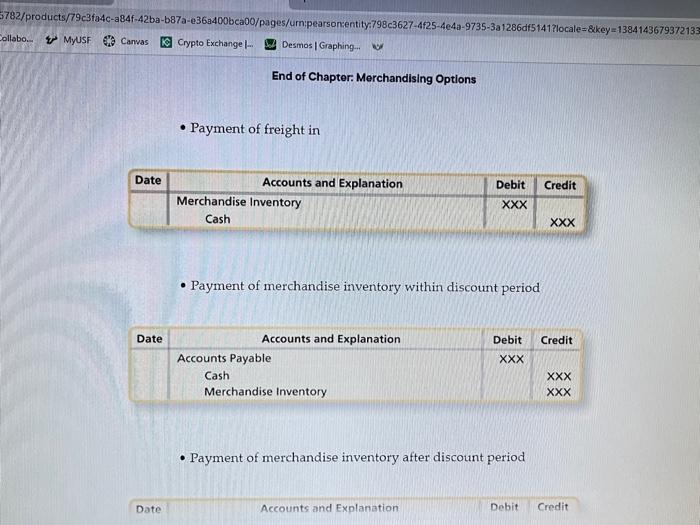

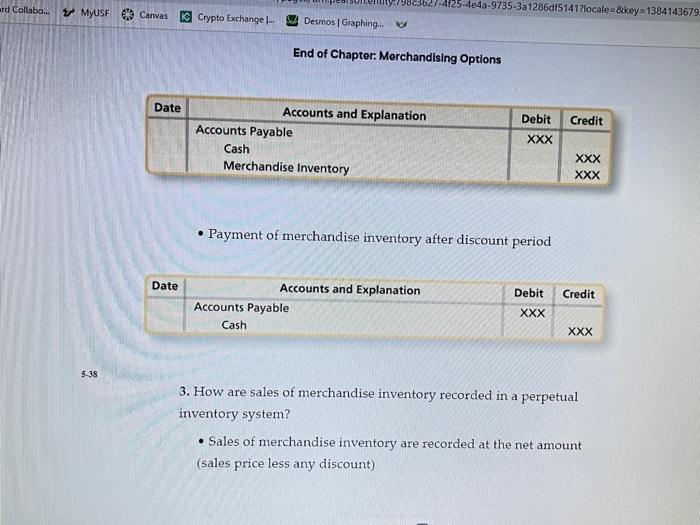

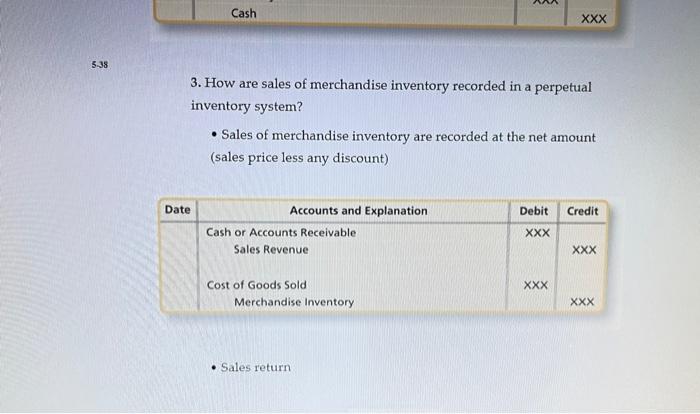

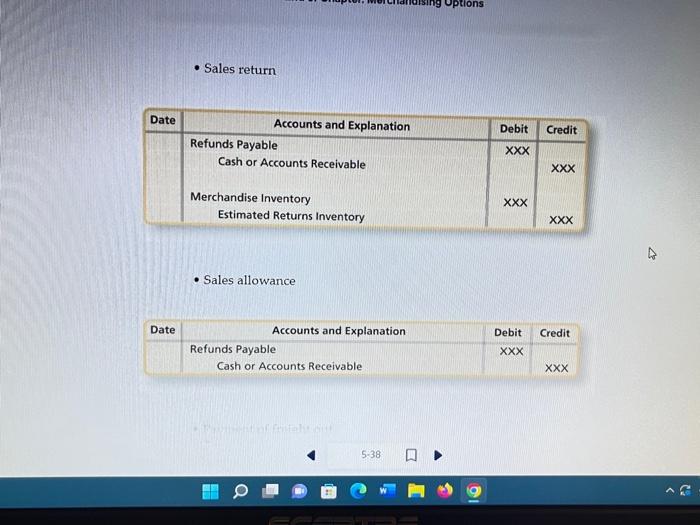

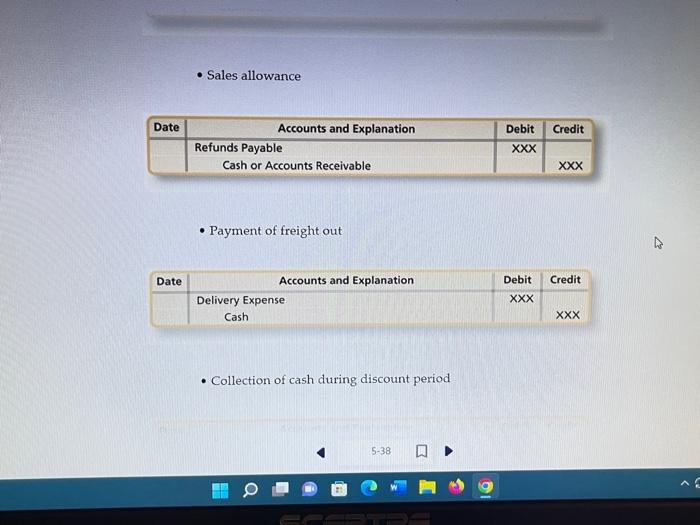

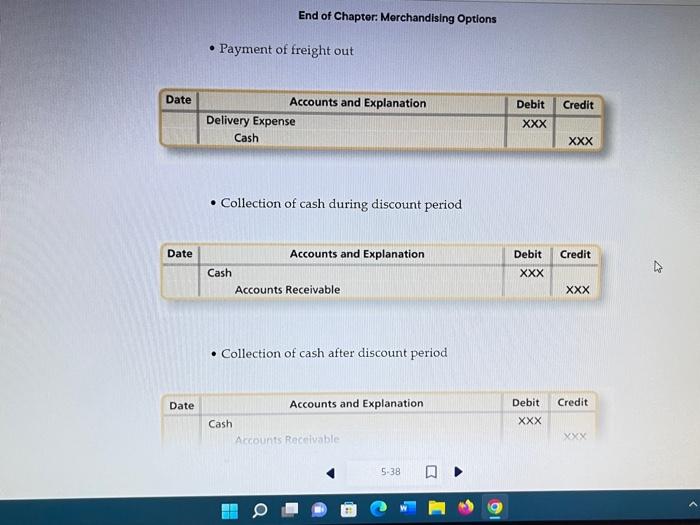

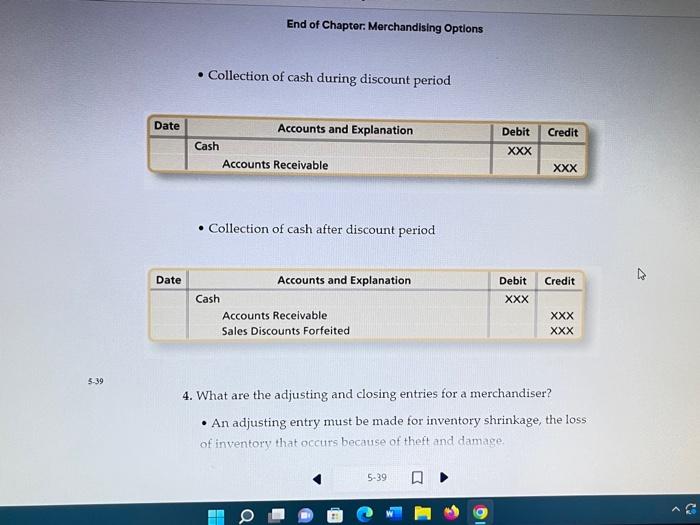

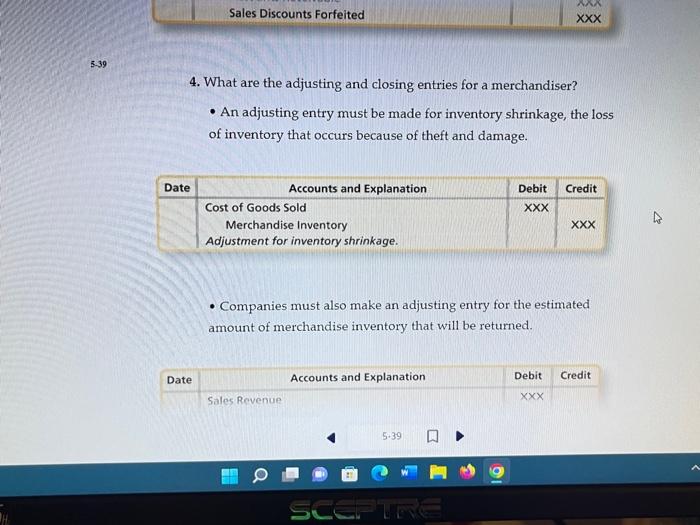

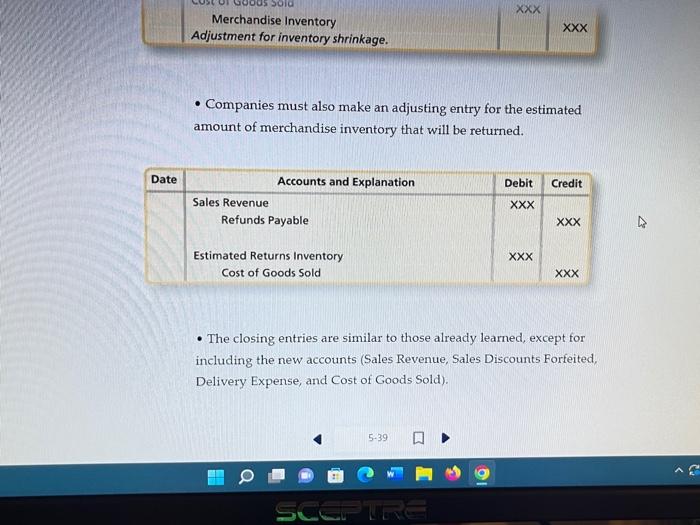

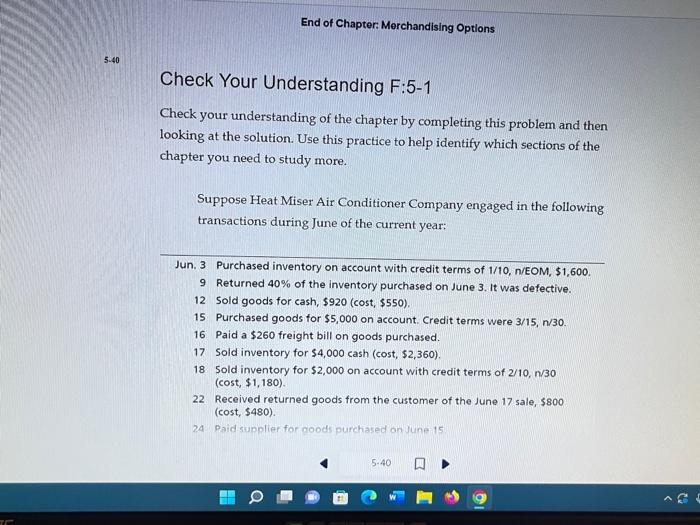

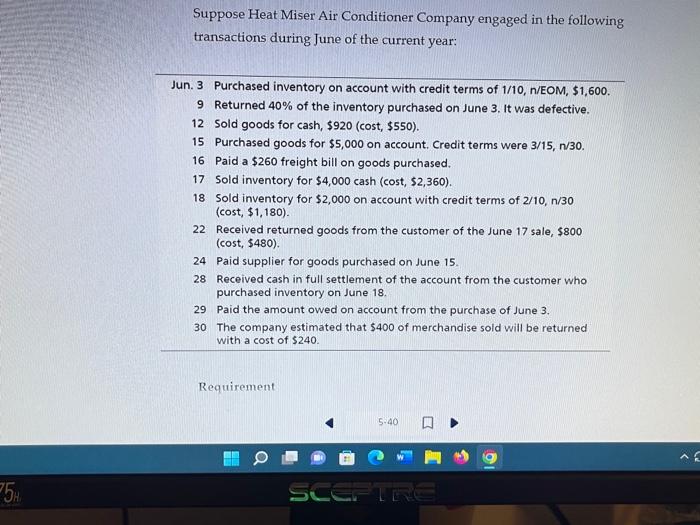

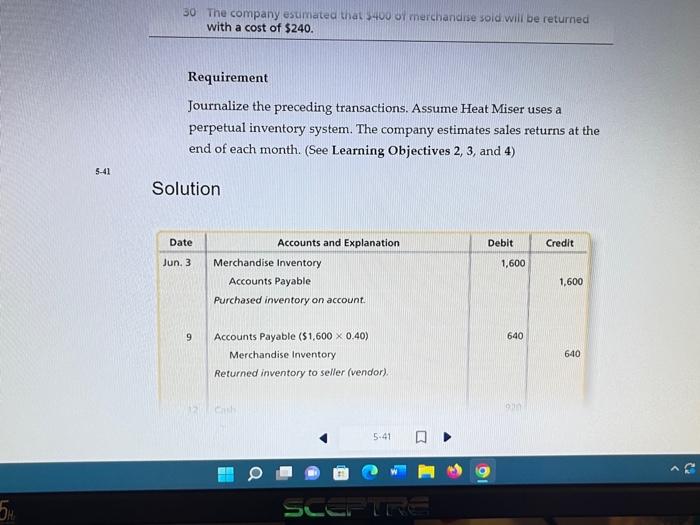

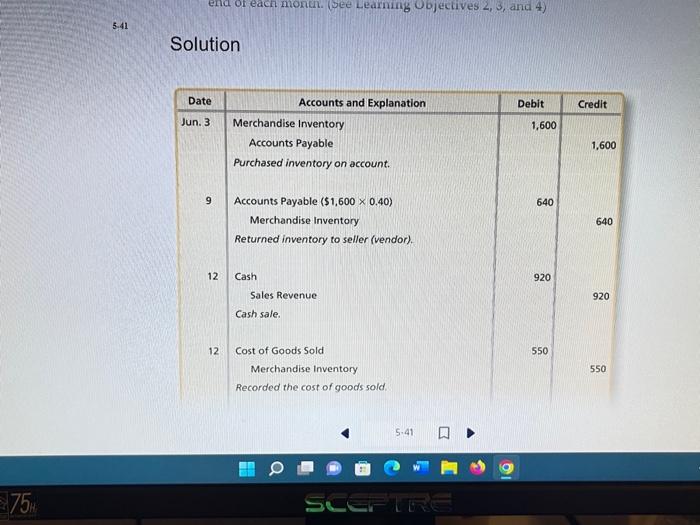

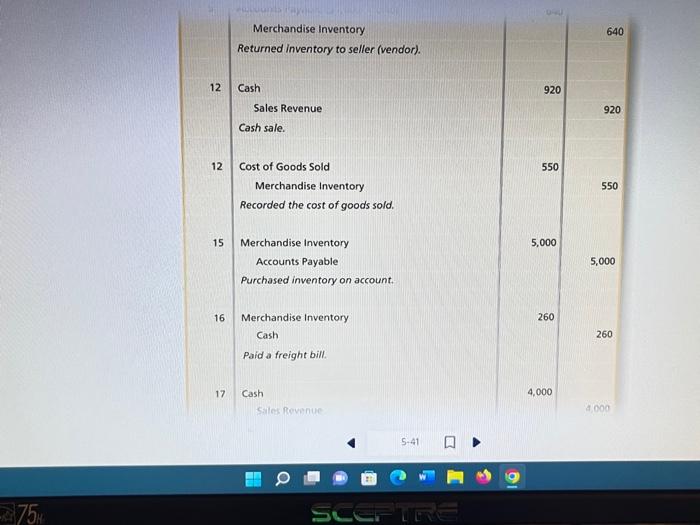

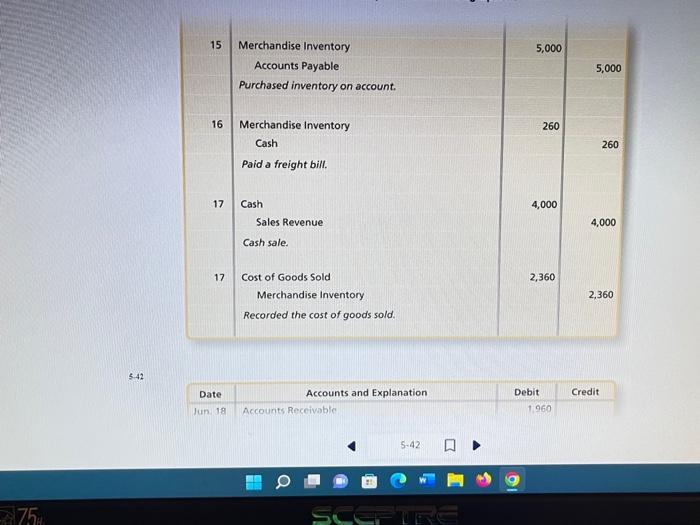

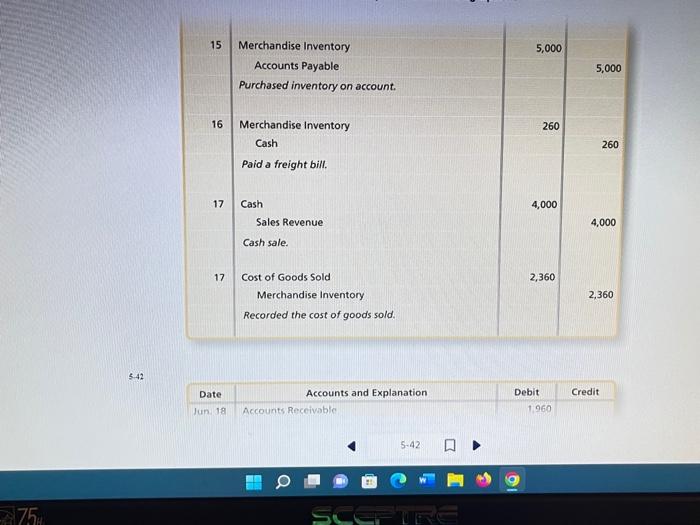

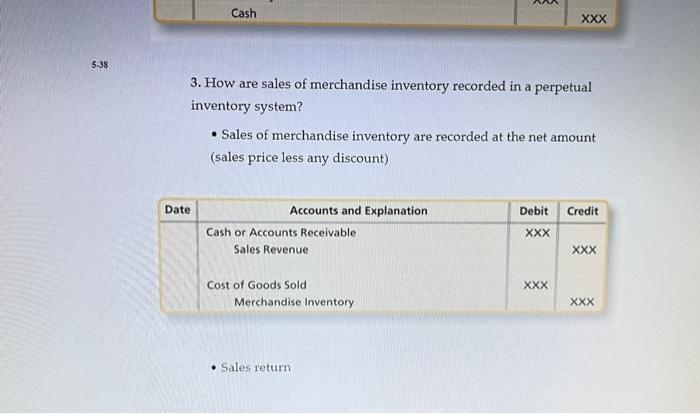

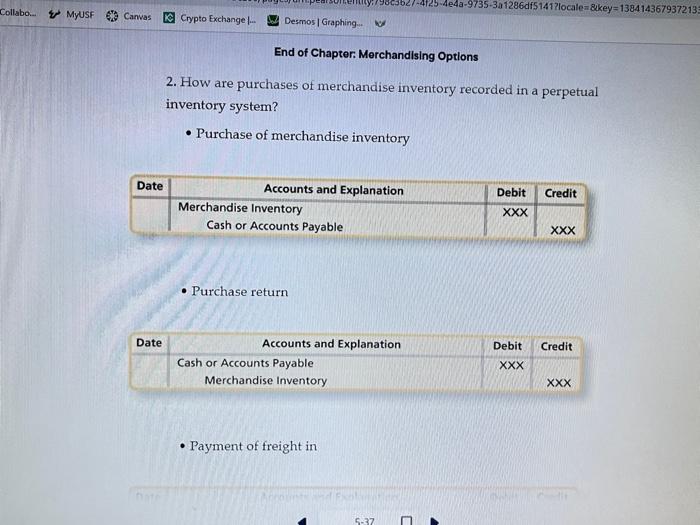

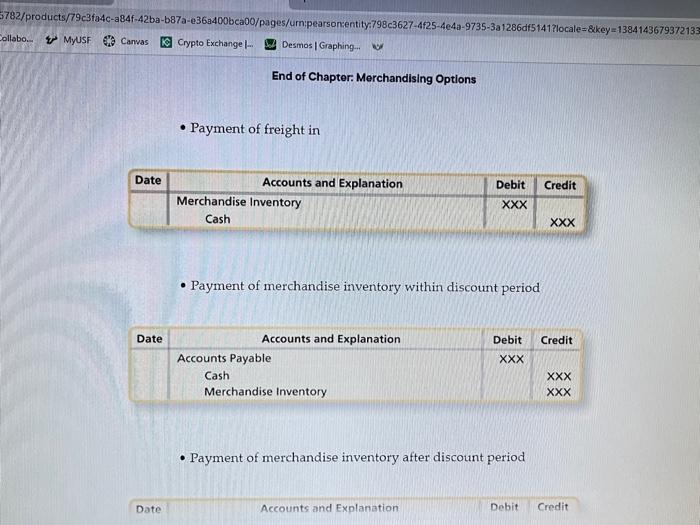

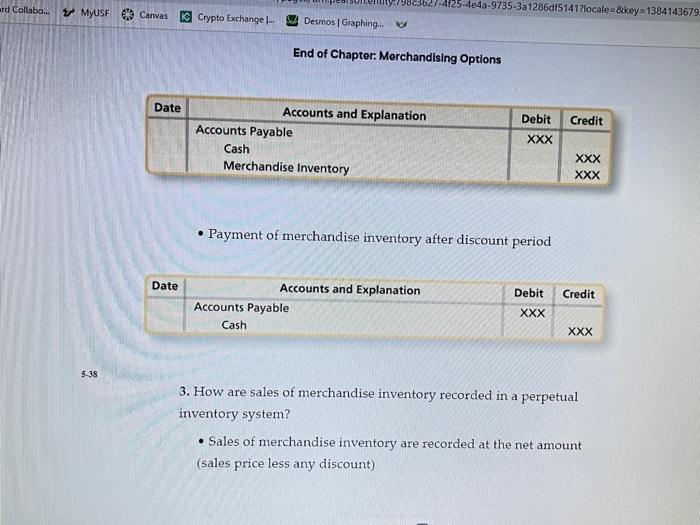

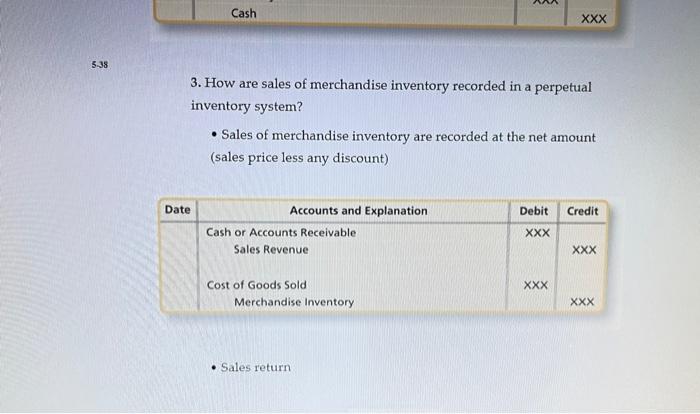

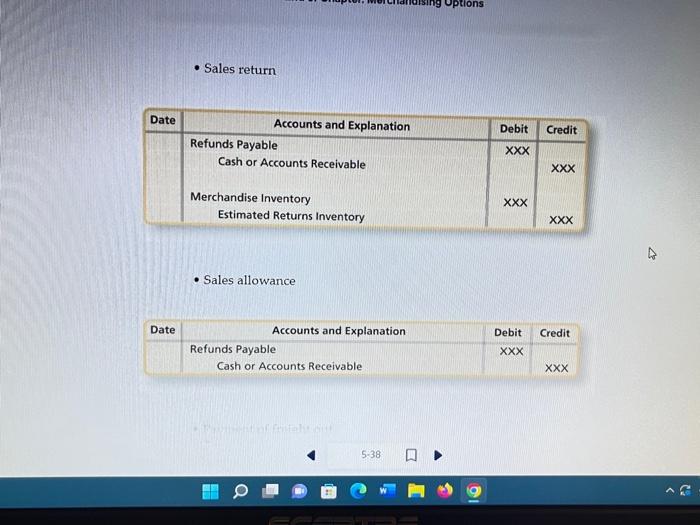

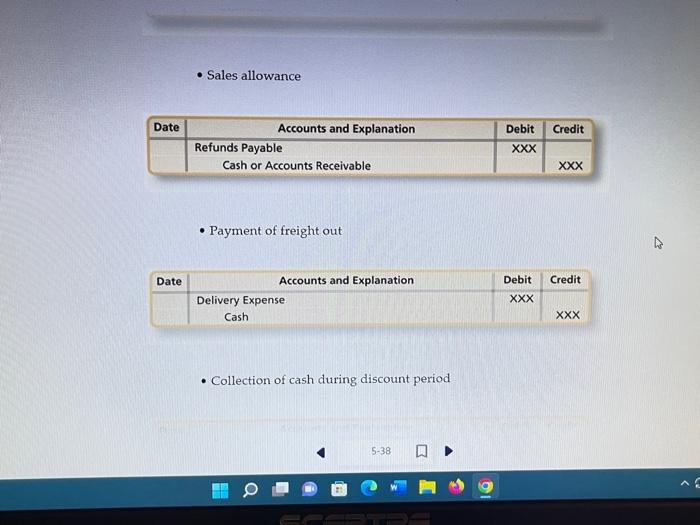

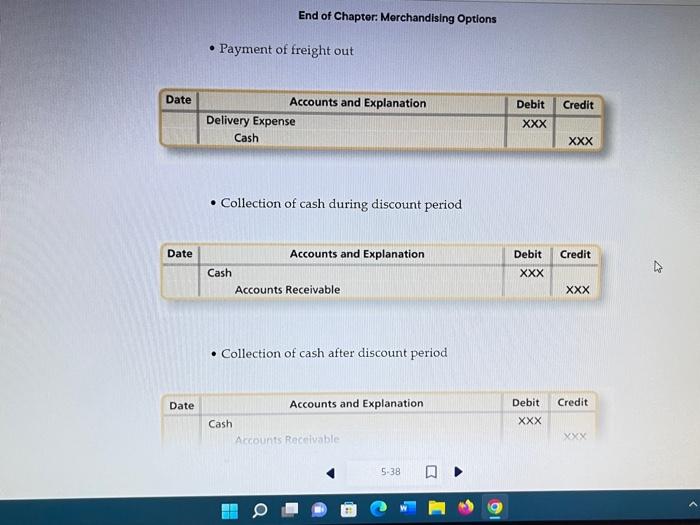

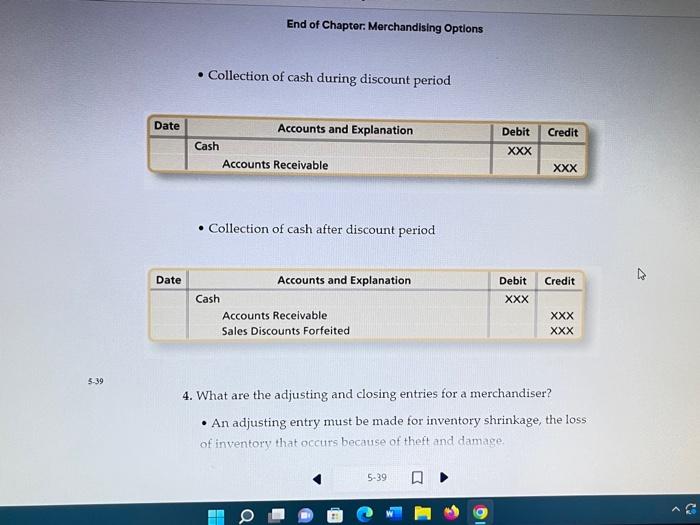

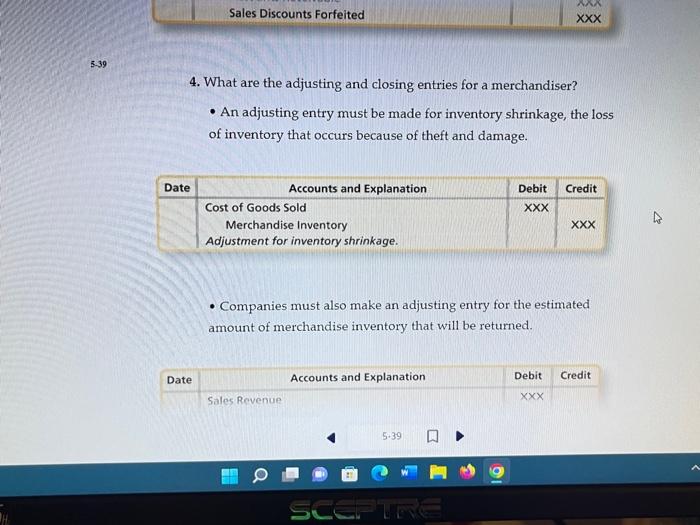

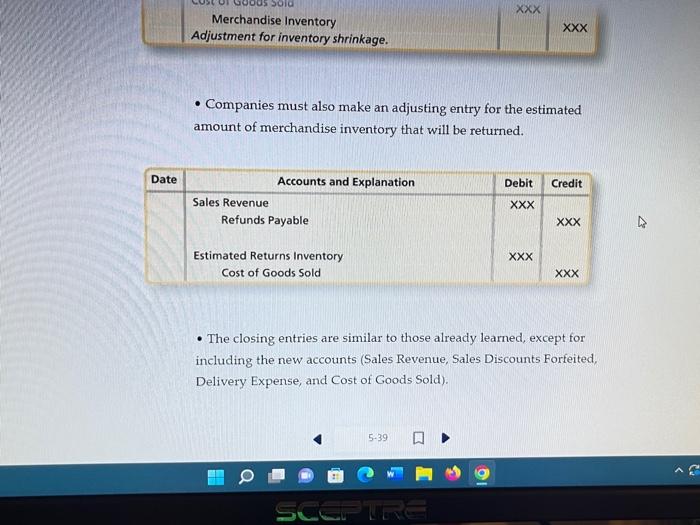

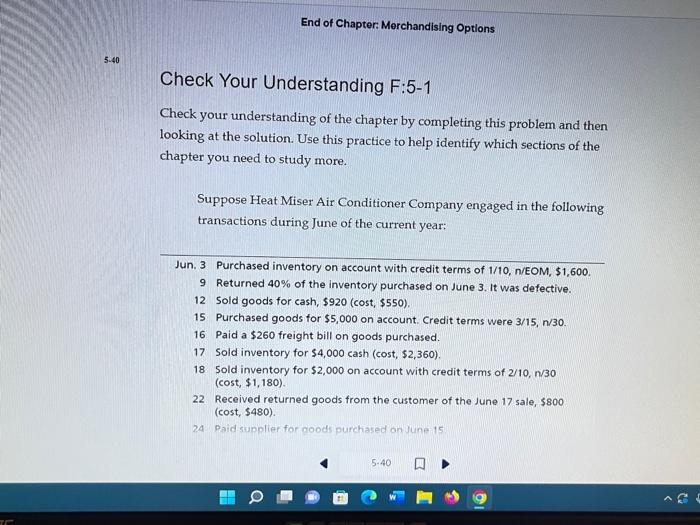

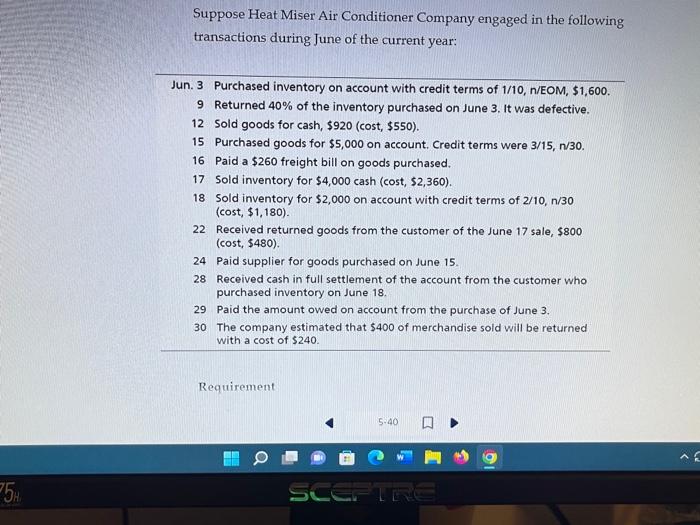

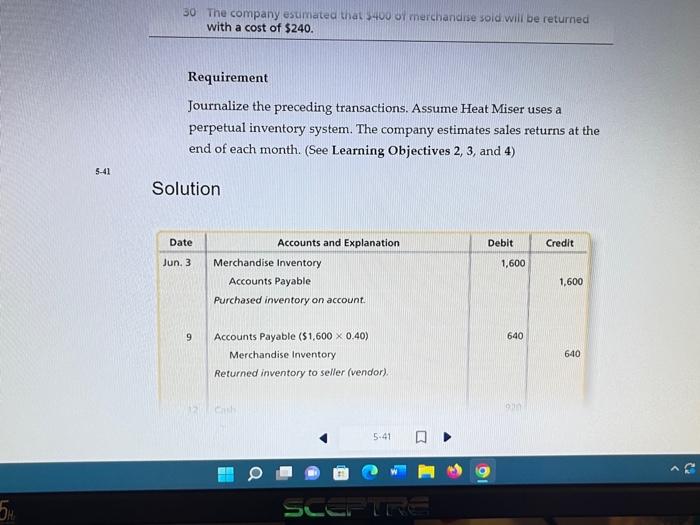

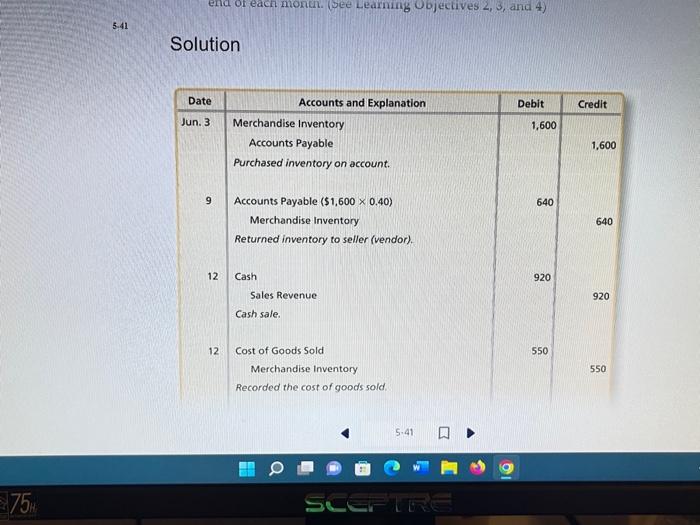

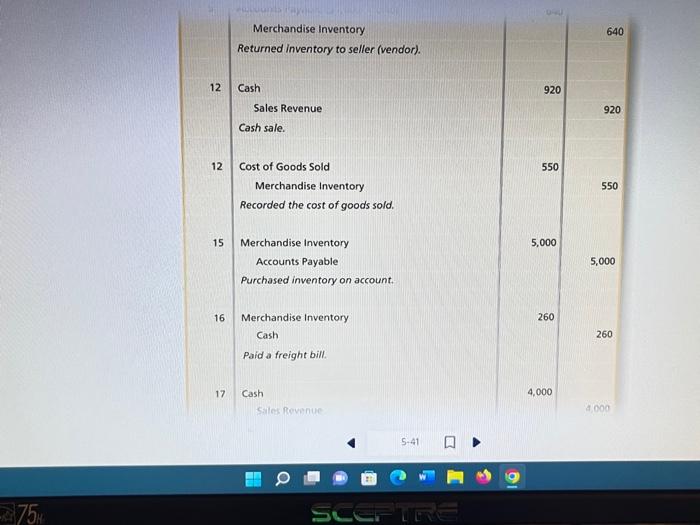

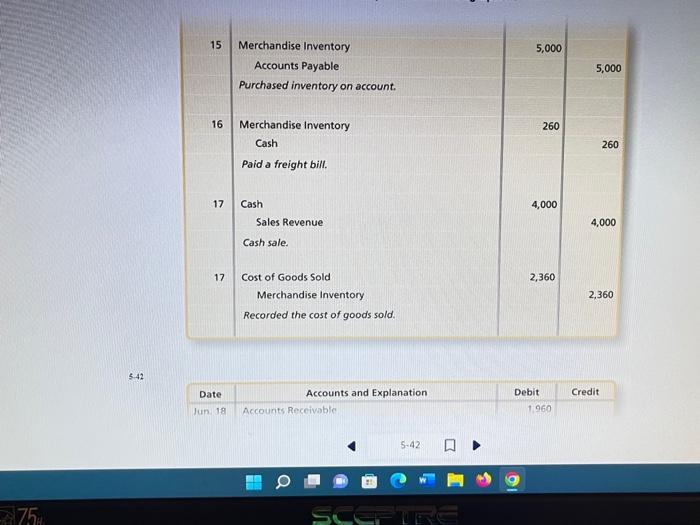

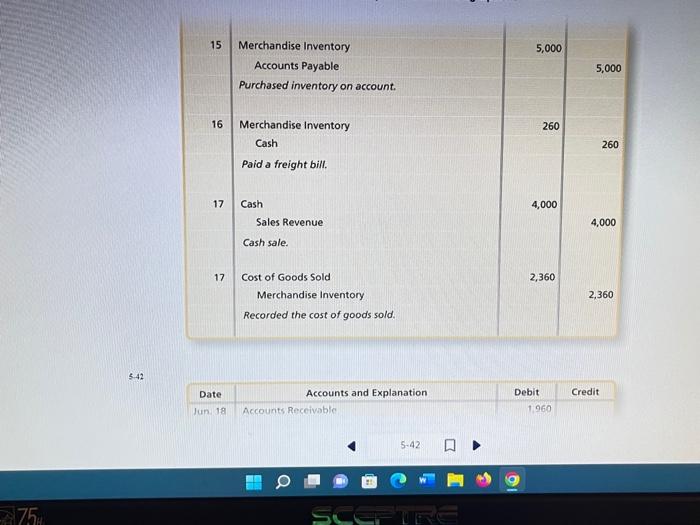

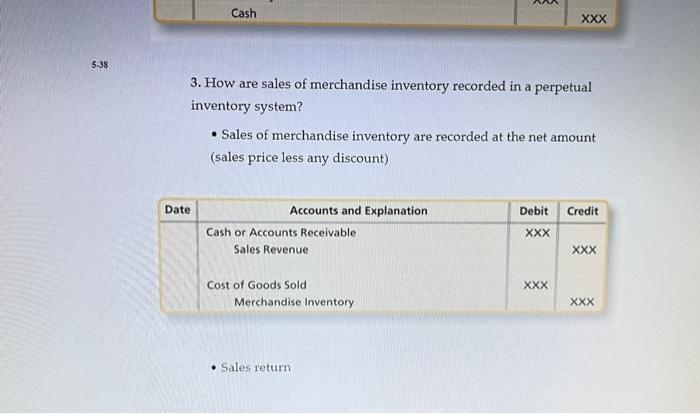

ings You Should Know 1. What are merchandising operations? - A merchandiser is a business that sells merchandise, or goods, to customers. - There are two main types of inventory accounting systems that are used by merchandisers: - Periodic inventory system - requires businesses to obtain a physical count of inventory to determine quantities on hand - Perpetual inventory system-keeps a running computerized record of merchandise inventory 2. How are purchases of merchandise inventory recorded in a perpetual inventory system? - Purchase of merchandise inventory End of Chapter: Merchandising Options 2. How are purchases of merchandise inventory recorded in a perpetual inventory system? - Purchase of merchandise inventory - Purchase return - Payment of freight in End of Chapter: Merchandising Options - Payment of freight in - Payment of merchandise inventory within discount period - Payment of merchandise inventory after discount period End of Chapter: Merchandising Options - Payment of merchandise inventory after discount period 3. How are sales of merchandise inventory recorded in a perpetual inventory system? - Sales of merchandise inventory are recorded at the net amount (sales price less any discount) 3. How are sales of merchandise inventory recorded in a perpetual inventory system? - Sales of merchandise inventory are recorded at the net amount (sales price less any discount) - Sales return - Sales return - Sales allowance - Sales allowance - Payment of freight out - Collection of cash during discount period End of Chapter: Merchandising Options - Payment of freight out - Collection of cash during discount period - Collection of cash after discount period End of Chapter: Merchandising Options - Collection of cash during discount period - Collection of cash after discount period 4. What are the adjusting and closing entries for a merchandiser? - An adjusting entry must be made for inventory shrinkage, the loss of inventory that occurs because of theft and damage. 4. What are the adjusting and closing entries for a merchandiser? - An adjusting entry must be made for inventory shrinkage, the loss of inventory that occurs because of theft and damage. - Companies must also make an adjusting entry for the estimated amount of merchandise inventory that will be returned. - Companies must also make an adjusting entry for the estimated amount of merchandise inventory that will be returned. - The closing entries are similar to those already learned, except for including the new accounts (Sales Revenue, Sales Discounts Forfeited, Delivery Expense, and Cost of Goods Sold). - The closing entries are similar to those already learned, except for including the new accounts (Sales Revenue, Sales Discounts Forfeited, Delivery Expense, and Cost of Goods Sold). 5. How are a merchandiser's financial statements prepared? - There are two formats for the income statement: - Single-step income statement-groups all revenues together and all expenses together without calculating other subtotals - Multi-step income statement-lists several important subtotals including gross profit, operating income, and income before income tax expense - A merchandiser's statement of retained earnings looks exactly like that of a service business. - The balance sheet will also look the same, except merchandisers have additional current asset accounts, such as Merchandise - Single-step income statement - groups all revenues together and all expenses together without calculating other subtotals - Multi-step income statement-lists several important subtotals including gross profit, operating income, and income before income tax expense - A merchandiser's statement of retained earnings looks exactly like that of a service business. - The balance sheet will also look the same, except merchandisers have additional current asset accounts, such as Merchandise Inventory and Estimated Returns Inventory. In addition, a merchandiser's balance sheet also includes the current liability Refunds Payable. 6. How do we use the gross profit percentage to evaluate business performance? - The gross profit percentage measures the profitability of each sales dollar above the cost of goods sold. - Gross profit percentage = Gross profit/Net sales revenue. 6. How do we use the gross profit percentage to evaluate business performance? - The gross profit percentage measures the profitability of each sales dollar above the cost of goods sold. - Gross profit percentage = Gross profit/Net sales revenue. 7. How are multiple performance obligations recorded in a perpetual inventory system? (Appendix 5A) - The sales price of contracts involving multiple performance obligations must be allocated among each distinct performance obligation. - Revenue is recognized when, or as, the company satisfies each performance obligation. 8. How are merchandise inventory transactions recorded in a periodic inventory system? (Appendix 5B) - The Merchandise Inventory account is not used when recording purchase transactions. Instead Purchases, Purchase Discounts, - Revenue is recogruzed wher, or as, the company satisties each performance obligation. 8. How are merchandise inventory transactions recorded in a periodic inventory system? (Appendix 5B) - The Merchandise Inventory account is not used when recording purchase transactions. Instead Purchases, Purchase Discounts, Purchase Returns and Allowances, and Freight In are used. - Sales transactions only involve recording the Sales Revenue. The Merchandise Inventory account is not used. - An adjustment for inventory shrinkage is not needed. - Closing entries are similar to the perpetual inventory system with the addition of closing the new accounts discussed. Ending Merchandise Inventory must be recorded, and beginning Merchandise Inventory must be removed. Check Your Understanding F:5-1 Check your understanding of the chapter by completing this problem and then looking at the solution. Use this practice to help identify which sections of the chapter you need to study more. Suppose Heat Miser Air Conditioner Company engaged in the following transactions during June of the current year: Jun. 3 Purchased inventory on account with credit terms of 1/10,n/EOM,$1,600. 9 Returned 40% of the inventory purchased on June 3 . It was defective. 12 Sold goods for cash, $920 (cost, $550 ). 15 Purchased goods for $5,000 on account. Credit terms were 3/15,n/30. 16 Paid a $260 freight bill on goods purchased. 17 Sold inventory for $4,000 cash (cost, $2,360 ). 18 Sold inventory for $2,000 on account with credit terms of 2/10,n/30 (cost, \$1,180). 22 Received returned goods from the customer of the June 17 sale, $800 ( cost, 5480) 24 Paid supplier for goods purchased on June 15 Suppose Heat Miser Air Conditioner Company engaged in the following transactions during June of the current year: 30 The company escimated that s400 of merchandise sold wili be returned with a cost of $240. Requirement Journalize the preceding transactions. Assume Heat Miser uses a perpetual inventory system. The company estimates sales returns at the end of each month. (See Learning Objectives 2, 3, and 4) Solution Solution 15 Merchandise Inventory Accounts Payable Purchased inventory on account. 16 Merchandise Inventory 5,000 15 Merchandise Inventory Accounts Payable Purchased inventory on account. 16 Merchandise Inventory 5,000 3. How are sales of merchandise inventory recorded in a perpetual inventory system? - Sales of merchandise inventory are recorded at the net amount (sales price less any discount) - Sales return - Single-step income statement - groups all revenues together and all expenses together without calculating other subtotals - Multi-step income statement-lists several important subtotals including gross profit, operating income, and income before income tax expense - A merchandiser's statement of retained earnings looks exactly like that of a service business. - The balance sheet will also look the same, except merchandisers have additional current asset accounts, such as Merchandise Inventory and Estimated Returns Inventory, In addition, a merchandiser's balance sheet also includes the current liability Refunds Payable. 6. How do we use the gross profit percentage to evaluate business performance? - The gross profit percentage measures the profitability of each sales dollar above the cost of goods sold. - Gross profit percentage = Gross profit / Net sales revenue. ings You Should Know 1. What are merchandising operations? - A merchandiser is a business that sells merchandise, or goods, to customers. - There are two main types of inventory accounting systems that are used by merchandisers: - Periodic inventory system - requires businesses to obtain a physical count of inventory to determine quantities on hand - Perpetual inventory system-keeps a running computerized record of merchandise inventory 2. How are purchases of merchandise inventory recorded in a perpetual inventory system? - Purchase of merchandise inventory End of Chapter: Merchandising Options 2. How are purchases of merchandise inventory recorded in a perpetual inventory system? - Purchase of merchandise inventory - Purchase return - Payment of freight in End of Chapter: Merchandising Options - Payment of freight in - Payment of merchandise inventory within discount period - Payment of merchandise inventory after discount period End of Chapter: Merchandising Options - Payment of merchandise inventory after discount period 3. How are sales of merchandise inventory recorded in a perpetual inventory system? - Sales of merchandise inventory are recorded at the net amount (sales price less any discount) 3. How are sales of merchandise inventory recorded in a perpetual inventory system? - Sales of merchandise inventory are recorded at the net amount (sales price less any discount) - Sales return - Sales return - Sales allowance - Sales allowance - Payment of freight out - Collection of cash during discount period End of Chapter: Merchandising Options - Payment of freight out - Collection of cash during discount period - Collection of cash after discount period End of Chapter: Merchandising Options - Collection of cash during discount period - Collection of cash after discount period 4. What are the adjusting and closing entries for a merchandiser? - An adjusting entry must be made for inventory shrinkage, the loss of inventory that occurs because of theft and damage. 4. What are the adjusting and closing entries for a merchandiser? - An adjusting entry must be made for inventory shrinkage, the loss of inventory that occurs because of theft and damage. - Companies must also make an adjusting entry for the estimated amount of merchandise inventory that will be returned. - Companies must also make an adjusting entry for the estimated amount of merchandise inventory that will be returned. - The closing entries are similar to those already learned, except for including the new accounts (Sales Revenue, Sales Discounts Forfeited, Delivery Expense, and Cost of Goods Sold). - The closing entries are similar to those already learned, except for including the new accounts (Sales Revenue, Sales Discounts Forfeited, Delivery Expense, and Cost of Goods Sold). 5. How are a merchandiser's financial statements prepared? - There are two formats for the income statement: - Single-step income statement-groups all revenues together and all expenses together without calculating other subtotals - Multi-step income statement-lists several important subtotals including gross profit, operating income, and income before income tax expense - A merchandiser's statement of retained earnings looks exactly like that of a service business. - The balance sheet will also look the same, except merchandisers have additional current asset accounts, such as Merchandise - Single-step income statement - groups all revenues together and all expenses together without calculating other subtotals - Multi-step income statement-lists several important subtotals including gross profit, operating income, and income before income tax expense - A merchandiser's statement of retained earnings looks exactly like that of a service business. - The balance sheet will also look the same, except merchandisers have additional current asset accounts, such as Merchandise Inventory and Estimated Returns Inventory. In addition, a merchandiser's balance sheet also includes the current liability Refunds Payable. 6. How do we use the gross profit percentage to evaluate business performance? - The gross profit percentage measures the profitability of each sales dollar above the cost of goods sold. - Gross profit percentage = Gross profit/Net sales revenue. 6. How do we use the gross profit percentage to evaluate business performance? - The gross profit percentage measures the profitability of each sales dollar above the cost of goods sold. - Gross profit percentage = Gross profit/Net sales revenue. 7. How are multiple performance obligations recorded in a perpetual inventory system? (Appendix 5A) - The sales price of contracts involving multiple performance obligations must be allocated among each distinct performance obligation. - Revenue is recognized when, or as, the company satisfies each performance obligation. 8. How are merchandise inventory transactions recorded in a periodic inventory system? (Appendix 5B) - The Merchandise Inventory account is not used when recording purchase transactions. Instead Purchases, Purchase Discounts, - Revenue is recogruzed wher, or as, the company satisties each performance obligation. 8. How are merchandise inventory transactions recorded in a periodic inventory system? (Appendix 5B) - The Merchandise Inventory account is not used when recording purchase transactions. Instead Purchases, Purchase Discounts, Purchase Returns and Allowances, and Freight In are used. - Sales transactions only involve recording the Sales Revenue. The Merchandise Inventory account is not used. - An adjustment for inventory shrinkage is not needed. - Closing entries are similar to the perpetual inventory system with the addition of closing the new accounts discussed. Ending Merchandise Inventory must be recorded, and beginning Merchandise Inventory must be removed. Check Your Understanding F:5-1 Check your understanding of the chapter by completing this problem and then looking at the solution. Use this practice to help identify which sections of the chapter you need to study more. Suppose Heat Miser Air Conditioner Company engaged in the following transactions during June of the current year: Jun. 3 Purchased inventory on account with credit terms of 1/10,n/EOM,$1,600. 9 Returned 40% of the inventory purchased on June 3 . It was defective. 12 Sold goods for cash, $920 (cost, $550 ). 15 Purchased goods for $5,000 on account. Credit terms were 3/15,n/30. 16 Paid a $260 freight bill on goods purchased. 17 Sold inventory for $4,000 cash (cost, $2,360 ). 18 Sold inventory for $2,000 on account with credit terms of 2/10,n/30 (cost, \$1,180). 22 Received returned goods from the customer of the June 17 sale, $800 ( cost, 5480) 24 Paid supplier for goods purchased on June 15 Suppose Heat Miser Air Conditioner Company engaged in the following transactions during June of the current year: 30 The company escimated that s400 of merchandise sold wili be returned with a cost of $240. Requirement Journalize the preceding transactions. Assume Heat Miser uses a perpetual inventory system. The company estimates sales returns at the end of each month. (See Learning Objectives 2, 3, and 4) Solution Solution 15 Merchandise Inventory Accounts Payable Purchased inventory on account. 16 Merchandise Inventory 5,000 15 Merchandise Inventory Accounts Payable Purchased inventory on account. 16 Merchandise Inventory 5,000 3. How are sales of merchandise inventory recorded in a perpetual inventory system? - Sales of merchandise inventory are recorded at the net amount (sales price less any discount) - Sales return - Single-step income statement - groups all revenues together and all expenses together without calculating other subtotals - Multi-step income statement-lists several important subtotals including gross profit, operating income, and income before income tax expense - A merchandiser's statement of retained earnings looks exactly like that of a service business. - The balance sheet will also look the same, except merchandisers have additional current asset accounts, such as Merchandise Inventory and Estimated Returns Inventory, In addition, a merchandiser's balance sheet also includes the current liability Refunds Payable. 6. How do we use the gross profit percentage to evaluate business performance? - The gross profit percentage measures the profitability of each sales dollar above the cost of goods sold. - Gross profit percentage = Gross profit / Net sales revenue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started