Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer the question ir i will have to report for not completing the question. all the information you need is there. Vatalie is considering hiring

answer the question ir i will have to report for not completing the question. all the information you need is there.

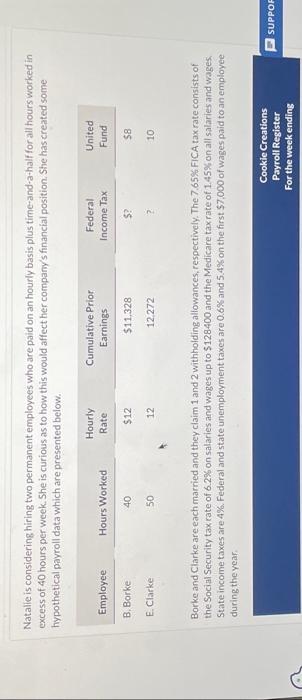

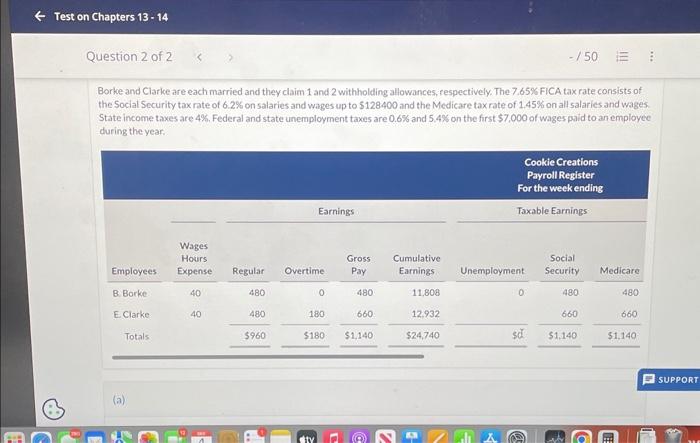

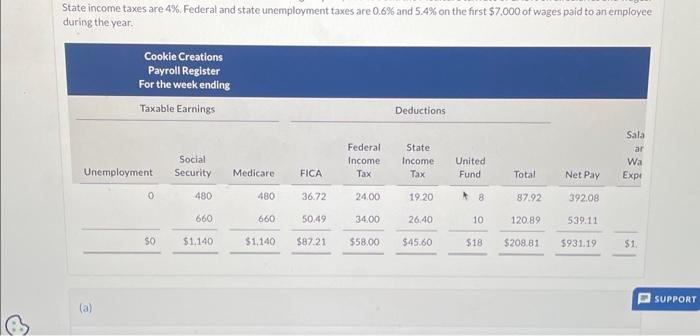

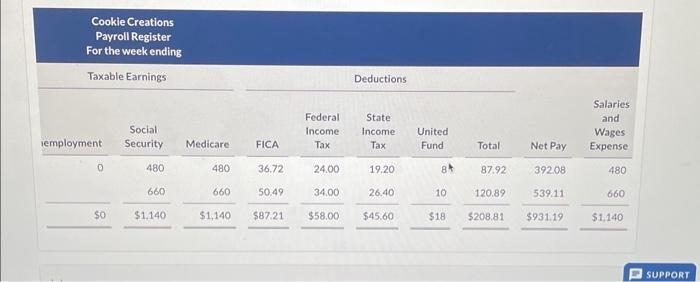

Vatalie is considering hiring two permanent employees who are paid on an hourly basis plus time-and-a-half for all hours worked in excess of 40 hours per week. She is curious as to how this would affect her company's financial position. She has created some hypothetical payroll data which are presented below. Borke and Clarke are each married and they claim 1 and 2 withholding allowances, respectively. The 7.65% FICA tax rate consists of the Social Security tax rate of 6.2% on salaries and wages up to $128400 and the Medicare tax rate of 1.45% on all salaries and wages State income taxes are 4%. Federal and state unemployment taxes are 0.6% and 5.4% on the first 57,000 of wages paid to an employee during the year. Borke and Clarke are each married and they claim 1 and 2 withholding allowances, respectively. The 7.65% FiCA tax rate consists of the Social Security tax rate of 6.2% on salaries and wages up to 5128400 and the Medicare tax rate of 1.45% on all salaries and wages. State income taxes are 4%. Federal and state unemployment taxes are 0.6% and 5.4% on the first $7,000 of wages paid to an employee during the year. State income taxes are 4%. Federal and state unemployment taxes are 0.6% and 5.4% on the first $7.000 of wages paid to an employee during the year: \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{10}{|c|}{\begin{tabular}{l} Cookie Creations \\ Payroll Register \\ For the weekending \end{tabular}} \\ \hline \multicolumn{3}{|c|}{ Taxable Earnings } & \multicolumn{5}{|c|}{ Deductions } & \multirow[b]{2}{*}{ Net Pay } & \multirow[b]{2}{*}{\begin{tabular}{l} Salaries \\ and \\ Wages \\ Expense \end{tabular}} \\ \hline iemployment & \begin{tabular}{c} Social \\ Security \end{tabular} & Medicare & FICA & \begin{tabular}{c} Federal \\ Income \\ Tax \end{tabular} & \begin{tabular}{c} State \\ Income \\ Tax \end{tabular} & \begin{tabular}{l} United \\ Fund \end{tabular} & Total & & \\ \hline 0 & 480 & 480 & 36.72 & 24.00 & 19.20 & 84 & 87.92 & 39208 & 480 \\ \hline & 660 & 660 & 50.49 & 34.00 & 26.40 & 10 & 120.89 & 539.11 & 660 \\ \hline so & $1,140 & $1,140 & $87.21 & $58.00 & $45.60 & $18 & $208.81 & $931.19 & $1,140 \\ \hline \end{tabular} SUPPORT What journal entry would be made to record the employer's payroll taxes on this hypothetical payroll? (Round answers to 2 decimal places, e.g. 15.25. Credit account titles are automatically indented when amount is eentered. Do not indent manually.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started