Question: Answer the question of this case in minimum 500 counts.. Case 1-3: Wa Imart stores, Inc. In November of 2013, Doug McMillon had just been

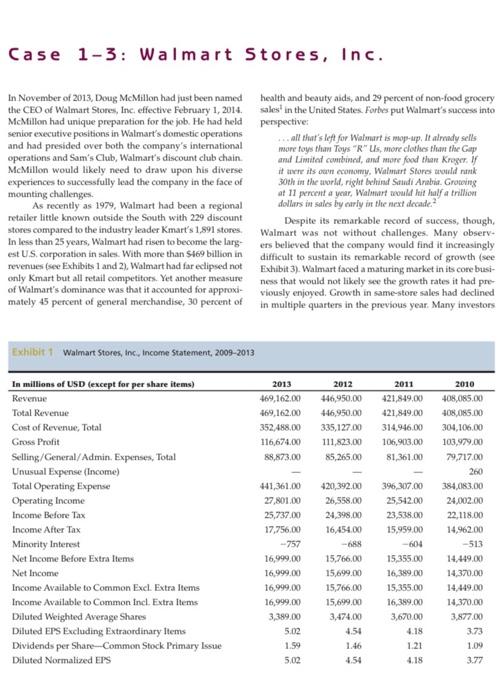

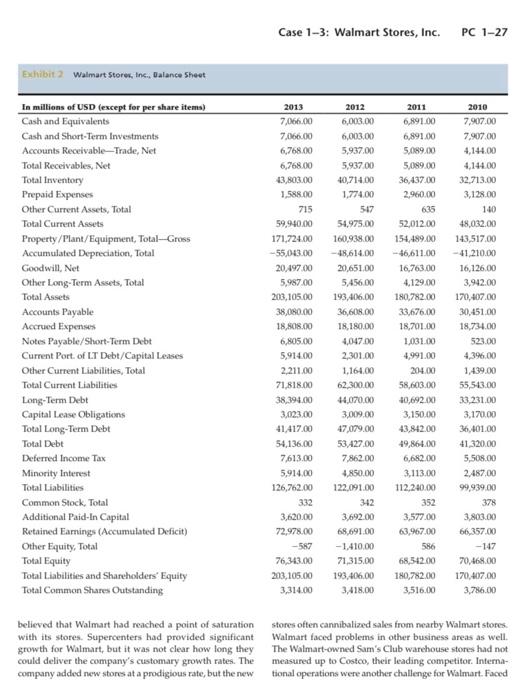

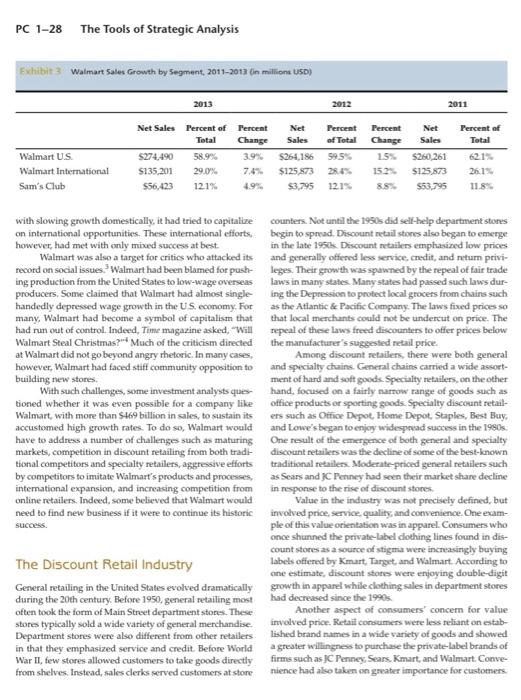

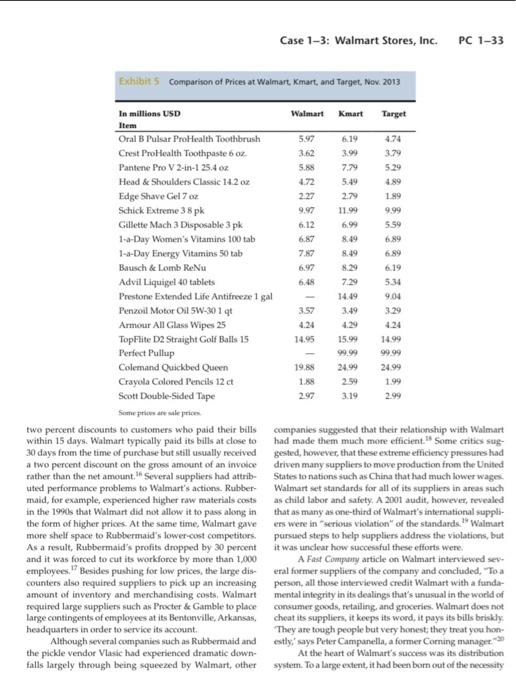

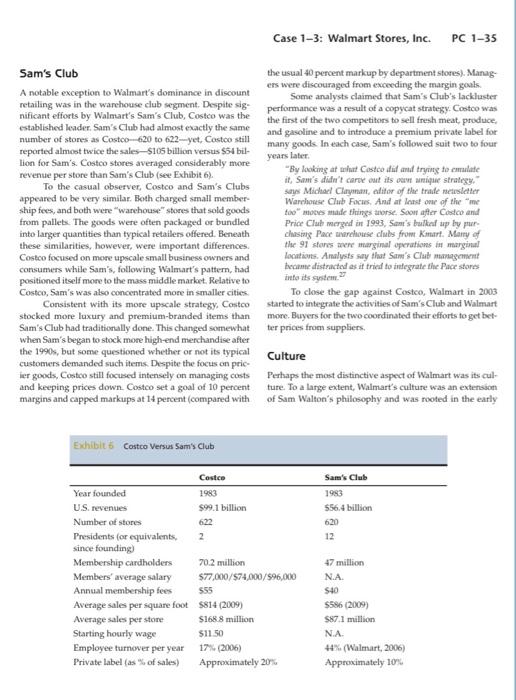

Case 1-3: Wa Imart stores, Inc. In November of 2013, Doug McMillon had just been named health and beatuty aids, and 29 percent of non-food grocery the CEO of Walmart Stores, Inc. effective February 1, 2014. sales" in the United States. Forbes put Walmart's success into 1 McMillon had unique preparation for the job. He had held penpective: senior executive positions in Walmart's domestic operations andhadpresidedoverboththecompanysinternationaloperationsandSamsClub,Walmartsdiscountclubchain.andLimitatcourbined,andmorefaodthanKreger.IfmorefoysthanToys"R"Us,moreclothesthantheGayp ... all that's left for Waimart is mop-up, It almady sells McMillon would likely need to draw upon his diverse it wene its oun economy, Walmart Storos awouli nink experiences to successfully lead the company in the face of 30 th in the avorld, right behind Sitiali Arabria. Growing mounting challenges. at 11 pereent a year, Walmart would hit half a trillion As recently as 1979 , Walmart had been a regional dollars in sales by narly in the next decade. retailer little known outside the South with 229 discount Despite its remarkable record of success, though, stores compared to the industry leader Kmart's 1,891 stores. Walmart was not without challenges. Many observIn less than 25 years, Walmart had risen to become the larg- ers believed that the company would find it increasingly est US. corporation in sales. With more than $169 billion in difficult to sustain its remarkable record of growth (see revenues (see Exhibits 1 and 2). Walmart had far eclipsed not Exhibit 3). Walmart faced a maturing market in its core busionly Kmart but all retail competitors. Yet another measure ness that would not likely see the growth rates it had preof Walmart's dominance was that it accounted for approxi- viously enjoyed. Growth in same-store sales had declined mately 45 percent of general merchandise, 30 percent of in multiple quarters in the previous year. Many investors Case 1-3: Walmart Stores, Inc. PC 1-27 believed that Walmart had reached a point of saturation stores often cannibalized sales from nearby Walmart stores. with its stores. Supercenters had provided significant Walmart laced problems in other business areas as well. growth for Walmart, but it was not clear how long they The Walmart-owned Sam's Club warehouse stores had not could deliver the company's customary growth rates. The measured up to Costco, their leading competitor. Internacompany added new stores at a prodigious rate, but the new tional operations were another challenge for Walmart. Faced PC 1-28 The Tools of Strategic Analysis Fxhituit 3 Walmart 5ales Growth by Segment, 2011-2013 (in millions USD) with slowing growth domestically, it had tried to capitalize counters. Not until the 1950s did sell-help department stones on international opportunities. These international efforts. begin to spred. Disoount retail stores also began to emerge however, had met with only mixed success at best. in the late 195 Lh. Discount retailers emphasized low prices Walmart was also a target for critics who attacked its and generally offered less service, credit, and return privirecord on social issues. 3 Walmart had been blamed for push- leges. Their growth was spawned by the repeal of fair trade ing production from the United States to low-wage overseas laws in many states. Many states had passed such laws durproducers. Some claimed that Walmart had almost single ing the Depression to protect local grocers from chains such handedly depressed wage growth in the US. economy. For as the Atlantic \& Pacific Company. The laws fixed prices so many, Walmart had become a symbol of capitalism that that local merchants coculd not be undercut on price. The had run out of control. Indeed, Time magazine asked, "Will repeal of these laws freed discounters to offer prices below Walmart Steal Christmas?" Much of the criticism directed the manufacturer's suggested retail price. at Walmart did not go beyond angry thetoric. In many cases, Among discount setailens, there were both general however, Walmart had faced stiff community opposition to and specialty chains. General chains carried a wide assortbuilding new stores. ment of hard and soft goods. Specialty retailers, on the other With such challenges, some investment analysts ques- hand, focused on a fairly narrow range of goods such as tioned whether it was even possible for a company like office products or sporting goods. Specialty discount retailWalmart, with more than \$469 billion in sales, to sustain its ers such as Otrioe Depot, Home Depot, Staples, Best Buy. accustomed high growth rates. To do so, Walmart would and Lowe's began to enjoy widespowad success in the 1980s. have to address a number of challenges such as maturing. One result of the emergence of both general and specialty markets, competition in discount retaaling from both tradi- discount retailers was the decline of some of the best-known thonal competitors and specialty retailers, aggressive efforts traditional retailers. Moderate-priced general retailers such by competitors to imitate Walmart's products and processes, as Sears and JC Penney had scen their market shane decline intemational expansion, and increasing competition from in response to the rise of discount stores. online retailers. Indeed, some believed that Walmart would Value in the industry was not precisely defined, but need to find new business if it were to continue its historic involved price, service, quality, and convenience. One examsuccess. ple of this value orientation was in apparel. Consumers who once shunned the private-label dothing lines found in descount stoces as a source of stigma were increasingly buying TheDiscountRetailIndustryaneestimate,discountstoceswereenjoyingdouble-digitlabelsofferedbyKmart,Target,andWalmart.Accondingto Gerveral retailing in the United States evolved dramatically . growth in apparel while clothing sales in department stores during the 20th century. Before 1950, general retailing most had decreased since the 19905. often took the form of Main Street department stores. These Another aspect of consumers' concern for value stores typically sold a wide variety of general merchandise. involved price. Retail consumers were less reliant on estabDepartment stores were also different from other retailers liahed brand names in a wide variety of goods and showed in that they emphasized service and credit. Before World a greater willingness to purchase the private-label brands of War II, few stores allowed customers to take goods directly firms such as JC Penney, Sears, Kmart, and Walnart. Convefrom shelves. Instead, sales clerks served customers at store nience had also taken on greater importance for customers. Case 1-3: Walmart Stores, Inc. PC 1-29 As demographics shifted to include more working mothers and longer workweeks, many Amencan workers placed a greater emphasis on fast, efficient shopping trips. More consumers desined "one-stop shopping." where a broad range of goods were available in one store to minimize the time they spent shopping. This trend accelerated in the previous decade with the spread of superoenters. Supercenters, which combined traditional discount retail stores with supermarkets under one roof, grew to more than $100 billion in sales by 2001 and blurred some of the traditional lines in retailing. Larger firms had an advantage in discount retailing. Large size enabled firms to spread their overhead costs over more stores. Larger firms were also able to distribute their advertising costs over a broader base. Perhaps the greatest advantage of size, however, was in relationships with suppliers. Increased size led to savings in negotiating price reductions, but it also helped in other important ways. Suppliers were more likely to engage in arrangements with large store chains such as cooperative advertising and electronic data interchange (EDI) links. The Internet posed an increasing threat to discount labels required a high level of coordination between designretailers as more people became comfortable with shop- ers and manufacturers (who were often foreign). Investment ping online. Internet shopping was appealing because of the in systems that could track production and inventory was convenience and selection available, but perhaps the most also necossary. attractive aspect was the competitive pricing. Some Inter- Technology investments in sophisticated inventory net retailens were able to offer steep discounts because of management systems, state-of-the-art distribution centers. lower overhead costs. Additionally, customers were able to and other aspects of logistics were seen as critically important quickly compare prices between different Internet retailers. for all discount retailers. Discount retailers were spending Most, if not all, major retailers sold goods via the Internet. Iarge sums of money on computer and telecommunicaLarge discount retailers such as Walmart derived tions technology in order to lower their costs in these areas. considerable purchasing clout with suppliers because of The widespread use of Universal Product Codes (UPCs.) their immense size. Even many of the company's larg- allowed retailers to more accurately track inventories est suppliers gained a high proportion of their sales from for shopkeeping units (SKUs) and better match inventory to Walmart (see Exhibit 4). Suppliers with more than $1 billion demand. Discount retailers also used EDI to shorten the disin sales such as Newell, Fruit of the Loom, Sunbeam, and tribution cycle. EDI involved the electronic transmission of Fieldcrest Cannon received more than 15 percent of their sales and inventory data from the registers and computers sales from Walmart. Many of these large manufacturers of discounters directly to suppliers' computers. Often, also sold a substantial proportion of their output to Kmart, replenishment of inventories was triggered without human Target, and other discount retailers. Walmart's purchasing intervention. Thus, EDI removed the need for several clout was considerable, though, even compared to other intermediate steps in procurement such as data entry by large retailers. For example, Walmart accounted for more the discounter, ordering by purchasers, data entry by the than 24 percent of Dial's sales, and it was estimated that it supplier, and even some production scheduling by supplier would have to double sales to its next seven largest cus- managers. Walmart was also pushing the adoption of radio tomens to replace the sales made to Walmart. 5 Frequently, frequency identification (RFID), a new technology for tracksmaller manufacturers were even more reliant on the large ing and identifying products. RFID promised to eliminate discount retailers such as Walmart. For example. Walmart the need for employees to scan UPC codes and would also accounted for as much as 50 percent of revenues for many dramatically reduce shrinkage, another term for shoplifting smaller suppliers. and employee pilferage. The implementation of RFID had Private-label goods offered by discount sfores had not materialized in the way Walmart had envisioned and, become much more important in recent years and presented by 2013, was still evolving in ways not forecasted by the new challenges in supplier relationships. Managing private company. Another important aspect of managing inventory was advertising circulars distributed in newspapers each Sunaccurate torecasting. Having the right quantity of prod- day. These items were priced sharply lower than competiucts in the correct stores was essential to success. Stories tors' prices. The effective implementation of this strategy of retailers having an abundance of snow sleds in Florida . had been impeded by Kmart's difficulty in keeping shelves stores while stores in other areas with heavy snowfall had stocked with sale items and by Walmart's willingness to none were common examples of the challenges in manag- match Kmart's sale prices. An attempt to imitate Walmart's ing inventory. Discounters used variables such as past store everyday low pricing strategy failed to deliver sales growthy sales, the presence of competition, variation in seasonal at the same time, it squeczed margins, so Kmart returned to demand, and year-to-year calendar changes to arrive at its traditional pricing strategy in 2000. their forecasts. Kmart sought to follow Walmart's pattern in many Point-of-sale (POS) scanning enabled retailers to of its activities. The company expressed a coenmitment to gain information for any purchase on the dollar amount of building a strong culture that emphasized performance, the purchase, category of merchandise, color, vendor, and teamwork, and respect for individuals who, borrowing SKU number. POS scanning. while valuable in managing from Walmart, were referred to as associates. Fstablishing inventory, was also seen as a potentially significant mar- such a culture was particularly challenging in the midst of keting tool. Databases of such information offered retailers workforce reductions that had taken Kmart from 373,000 the potential to "micromarket" to their customers. Upscale employees in 1990 to 307,000 at the end of 1995 , and then an department stores had used the PCS database marketing even more precipitous drop to 158,000 in 2004. more extensively than discounters. Walmart, however, had Target, Walmart's other large national competitor, used such information extensively. For example, POS data was owned by Target Corporation, formerly Dayton Hudshowed that customers who purchased children's videos son Corporation, based in Minneapolis, Minnesota. In 2013 , typically bought more than one. Based on this finding. Target operated 1,763 stores, which was an increase of only Walmart emphasized placing other children's videos near 11 stores from three years earlier. This accounted for s65.4 displays of hot-selling videos. billion in sales and $2.5 billion in profits. Target was considered an "upscale discounter." The median income of Tar- Competitors get shoppers, at $64,000, was considerably higher than its Competition in discount retailing came from both general completed college. . Target attracted a more affluent clienand specialty discount stores. Among the general discount tele through a more trendy and upscale product mix and retailers, Walmart was the largest, followed by Target and through a store ambience that differed from most discountKmart. Kmart had approximately 10 times more sales than ers in aspects such as wider aisles and brighter lighting. The the next largest retailers, Dollar General and ShopKo. The company also emphasized design much more in its products most formidable specialty discount retailers included office and had partnered with a number of designers to develop supply chains such as Office Depot with more than $10 bil- products across a broad range of apparel and housewares. lion in sales, Staples with approximately $24 billion, Toys Target had also introduced a proprietary credit card, the "R" Us with more than $11 billion, and Best Buy in elec- Target Guest Card, to differentiate it froen other discounttronics with approximately $45 billion. In warchouse clubs, ers. The conventional wisdom in the industry suggested Costco and Sam's Club dominated. Costco was the leader that pricing at Target was generally not as low as Walmart with more than $99 billion in sales, followed by Sam's Club but was lower than middle-market department stores such with $56 billion in revenue. Bj's Wholesale Club followed as JC Penney and Mervyn's. As with Walmart and Kmart, far behind with around $11 billion in sales before being supercenters were also high on Target's list of strategic priacquired by a private equity firm in 2011. orities. The supercenters, named Super Targets, had opened Once, Walmart's largest competitor, Kmart, had expe- in many cities, and the company planned to aggressively rienced a long slide in performance. Kmart operated approx- grow in this area. Promotions were an important part of imately 1,300 stores, about the same number it had had three. Target's marketing approach. Each week, more than 100 milyears previously. Traditionally, Kmart's discount philosophy Iion Target advertising circulars were distributed in Sunday had differed from Walmart's, Kmart discount centers sought newspapers. Holiday promotions were also emphasized at to price close to, but not necessarily lower than, Walmart's Target. Like Kmart, Target had traditionally focused much everyday low prices (EDLP). More emphasis was placed on of its effort on metropolitan areas. Enticed by the growth sale items at Kmart. Pricing strategy revolved around sev- of large cities felative to suburbs, Target introduced a new eral key items that were advertised in Kmart's 73 million downsized format in Chicago in 2012 and planned several other such stores dubbed City for San Francisco, Seattle, and to be shipped. Amazon Prime negated the cost problem other large cities. larget's phtanthropic activities were well and lamited the wat time as well. Online sales ot consumer known. Each year, the company gave five percent of its pre- products were growing by as much as 20 percent a year. tax earnings to not-for-profit organizations-St. Jude Chil- Brick and mortar stores such as Walmart, Best Buy, Macy's, dren's Research Hospital and local schools were perhaps and others were trying to close the online gap with Amazon Target's highest philanthropic priorities. by embracing what some described as omni-channel fulfillWhile Target had been an increasingly formidable ment or ship-from-store. In the omni-channel model, retailcompetitor, many believed that the greatest competitive ers would route the fulfillment of online orders through threat to Walmart came from a firm with no bricks and retail stores near the customer. Though promising, the omndmortar stores: Amazon.com. Amazon began in 1994 as an channel model required sophisticated technology to locate online bookseller. Before long. Amazon offered other media products and reliable execution from local stores in fulfillproducts such as music CDs, movies (VHS and DVD), soft- ing orders, a capability generally found more in warehouses ware, and video games. By 2013, with sales of $61 billion (in than retail outlets. contrast, Walmart's online sales were $7.7 billion), Amazon Amazon's performance offened sonse indication of the emphasized price, selection, and convenience and sold a rapid growth in the online sale of consurner products. The wide diversity of products including perhaps anything that company went from $24.5 billion in sales in 2009 to $34.2 could be purchased at a traditional discount retailer along billion in 2010, to 548 billion in 2011 , to 561 billion in 2012. with a scemingly inexhaustible array of products that could Amazon was renowned for its long-term perspective. It be purchased at the most specialized retailers. In the typical had clearly traded short-term profits in favor of investing Amazon model, customers selected and purchased items in technology and infrastructure intended to help it achieve online. Through technology, the company then located the dominance in online retailing. Walmart had not been blind product in large warehouses known as fulfillment centers. to the rise and importance of online retailing generally and, The product was then processed and sent to the customer via more specifically, the threat from Amazon. From the early a third party such as UPS or FedFx. Amazon had invested days of online commerce, it had sought to build a strong heavily in its fulfillment capability. By 2013, it had about position in online commerce yet lagged dramatically behind 35 large fulfillment centers spread throughout the United Amazon in 2013. States with another 25 in Europe and 13 in Asia. For a flat annual fee of $79, customers could receive free two-day shpping and discounted one-day shipping rates on eligible Walmart's History products. Additionally, the company had made very visible moves into technology with its own line of Kindle readers Walmart was started in 1962 by Sam Walton. The discount and tablets. Its Prime Instant Video, with over 38,000 mov- retail industry was then in its infancy. Of the four new venles and TV episodes, competed against online firms such as tures in discount retailingstarted that year, Walmart seemed Netflix and Hulu in the online distribution of media content. the least likely to succeed. Most Walmart stores were in Amazon also hosted a large number of third-party northwestern Arkansas and adjacent areas of Oklahoma, sellers. Customers could view products sold by these sell- Missouri, and Kansas. Walton had started his retailing career ers, purchase the product through Amazon, and then the with Ben Franklin in small towns because his wife Helen did seller would ship to the customer. Amazon had begun giv- not want to live in any city with a population of more than ing these third-party sellers the option of warchousing their 10,000 people. He had chosen northwestern Arkansas as a inventory in Amazon's fulfillment network. base because it allowed him to take advantage of the quailAmazon could claim multiple advantages over bricks. hanting season in four states. Walmart was, in Sam Walton's and mortar retailers. The firm did not have to deal with words, "underfinanced and undercapitalized" in the beginthe extensive overhead involved with traditional stones, Its ning. Nevertheless, Walton sought to grow Walmart as fast selection of products was vastly wider than that available as he could, because he feared new competitors would prein any traditional store. Yet another advantage for Amazon empt growth opportunities if Walmart did not open stones was that customers did not have to pay a state sales tax in new towns. After five years, Walmart had 19 stores and on many products purchased. For many shoppers, the con- sales of $9 million. In contrast, Kmart had 250 stores and venience of shopping online was appealing. t.ike Walmart, 5800 million in sales. Amazon employed an everyday low pricing strategy. There_ Walton retained many of the practices regarding were some disadvantages to online shopping. Customers customer service and satisfaction that he had learned in typically had to pay shipping costs and wait for products the variety stores business. The central focus of Walmart, however, was on price. Walton sought to make Walmart the supermarkets and discount centers into one store. Walmart low-priced provider of any product it sold. As Walton said, also operated 6 dEsam's Clubs, whudh were warchouse mem- What ine aeere obsessed aveh anas knying our prices heberahip clubs. In 1999, Walmart opened its first Neighborloap everybudy dse's. Our defication to fhat ifon ants hood Markets, which wene supermarkets, and it expanded fotal. Eicerybody morknd like crary fo kerp the expenses to 286 in operation by 2013. doew. We didn't have systems. We difn't haree ondering proghims. We didn't hare a hasic menchandise assortment. We certainty difir't hane any sort of computOperations crs. In fact, when I look at at today, I roalize that so From its beginning, Walmart had focused on EDLR. EDL. much of avhat are afid in the begimning was nally poorly saved on advertising costs and on labor costs because done. But ax mandegot to self our merchandise ass lown as employees did not have to rearrange stock before and after me possilty could and that knpt as right-side up for the sales. The coenpany changed its traditional slogan, "Always finst ten yoars. .... The idou anas simule unhen customthe Lowest Price," in the 1990 s to "Always Low Prices. crs thoinght of Walmart, they showld think of lowe pricos Alawys." In late 2000, Walmart changed its tagline to "Save and satisfactidin guanation. Thry oould he preffy sure Money, Live Better." Despite the changes in slogan, how" they fidn't liter it, they aald bring it back." ever, Walmart continurd to price goods lower than its com- The other problem that plagued Walmart in its early . petitors (see Exhibit 5). When faced with a decline in profits years was finding a way to keep its costs down. Large ven- in the late 1990s, Walmart considered raising margins. 12 dors were reluctant to call on Walmart and, when they did Instrad of pricing 7 bo 8 percent below competitors, some do business with the company, they would dictate the price managers believed that pricing only about 6 percent below and quantity of what they sold. Walton described the satuawould raise gross mangins without jeopurdiaing sales. Some tion, "I don't mind saying that we were the victims of a good . managers and boand members, however, were skeptical that bit of arrogance from a lot of vendors in those days. They price hikes would work at Walmart. They reasoned that didn't need us, and they acted that way. 10 Another problem. Walmart's culture and identity were so closely attached to that contributed to high costs was distribution. Distributors low prices that broad price incroases would clash with the did not service Walmart with the same care that they did its company's bedrock beliefs. Another concern was that comlarger competitors. Walton saw that "the only alternative. petitors might seise any opportunity to narrow the gap with was to build our own warchouse so we could bury in volume. Walmart. While the reason was anclear, it appeared that at attractive prices and store the merchandise, = if some narrowing on price was occurring by 2008 . One study Walmart increased from 32 stores in 1970 to 899 stores showed that the price gap between Walmart and Kroger had 15 years latee. For much of that time, Walmart retained its. shrunk to 7.5 percent in 2007 from 15 percent a few years small-town focus. More than half its stores were in towns carlier. 13 Some analysts worried that many shoppers would with populations of less than 25,000 . Because of its small- switch to other retailers as the gap narrowed. town operations, Walmart was not highly visible to many others in the retail industry. By 1985, though, that had changed. Forbes named Sam Walton the richest man in America. Furthermore, Walmart had begun to expand from its small-town base in the South and had established a strung presence in several large cities. Hy the 19901s, it had spread throughout the United States in both Large cities and small towns. aggressive use of technology. Walmart had pioneered the use of technology in metail operations foe many years and still possessed significant advantages over its competitorx. It was the leader in forging EDt links with suppliers. Its Retail Link technology gave ower 3,200 vendors POS data and authorization to replace inventory foe more than 3,000 stores. 14 Competitors had responded to Walmart's advantage in logivtics and EDI by forming cooperative exchanges, but despite their efforts, a lange gap remained between Walmart in 2013 Walmart and its competitors. 15 As a result. Walmart possessed a substantial advantage in information about supply By the beginning of 2013, Walmart's activities had spread and demand, which reduced both the number of items that beyond its historical roots in domestic discount centers. were either overstacked or out of stock. The number of domestic discount centers had declined to Technology was only one area where Walmart 561 from a high of 1,995 in 1996. Many discount centers exploited advantages through its relationships with suphad been converted to supercenters, which had increased. pliers. Walmart's clout was clearly evident in the payment to 3,15s stores. Walmart Supercenters combined full-line terms it had with its suppliens. Suppliers frequently offered Case 1-3: Walmart Stores, Inc. PC 1-33 two percent discounts to customers who paid their bills companies suggeted that their relationship with Walmart within 15 days. Walmart typically paid its bills at close to had made them much more efficient. 15 Some critics sug30 days from the time of purchase but still usually received gested, however, that these extreme efficiency prestures had a two percent discount on the gross amount of an involoe driven many suppliers to move production from the United rather than the net amount. 16 Several suppliers had attrib- States to nations such as China that had much lower wages. uted performance problems to Walmart's actions. Rubber- Walmart set standards for all of its suppliers in areas such maid, for example, experienced higher raw materials costs as child labor and safety. A 2001 audit, however, revealed in the 1990 s that Walmart did not allow it to pass along in that as many as one-third of Walmart's international supplithe form of higher prioss. At the same time, Walmart gave ens were in "serionas violation" of the standards. 19 Walmart more shelf space to Rubbermaid's lower-cost coenpetitors. pursued steps to help suppliers address the violations, but As a result, Rubbermaid's profits dropped by 30 percent it was unclear how successful these efforts were. and it was forced to cut its workforce by more than 1,000 A Fast Compary article on Walmart interviewed sevemployees." Besides pushing for low prices, the large dis- eral former suppliers of the company and concluded, "To a counters also requifed suppliers to pick up an increasing person, all those interviewed credit Walmart with a fundaamount of inventory and merchandising costs, Walmart mental integrity in its dealings that's anusual in the world of required large suppliers such as Procter \& Gamble to place consumer goods, retailing, and groceries. Walenart does not large contingents of employees at its Bentonville, Arkansas, cheat its suppliers, it keeps its word, it pays ats bills briskly. headquarters in order to service its account. They are tough people but very honest they treat you honAlthough several companies such as Rubbermaid and Estly, says Peter Campanella, a former Corning manager." 20 the pickle vendor Vlasic had experienced dramatic down- At the heart of Walmart's success was its distribution falls largely through being squeezed by Walmart, other system. To a large eatent, it had been born out of the necessity of servicing so many stores in small towns while trying to company used historical selling data and cumples models maintain low prices. Walmart used distribution centers to that included many variables such as local demographics to achieve efficiencies in logistios. Initially, distribution centers decide what items should be placed in each store. were large facilities- the first were 72,000 square feet - that Unlike many of its competitors. Walmart had no served 80 to 100 Walmart stores within a 250 -mile radius. regional offices antil 2006. Instead, regional vice presiNewer distribution centens were considerably larger than the dents maintained their offices at company beadquarters in early ones and in some cases served a wider gengraphical Bentonville, Arkansas. The absence of regional offices was fadius. Walmart had far more distribution centers than any estimated to save Walmart as much as one percent of sales. of its competitors. Cross-docking was a particularly impor- Regional managers visited stores from Monday to Tharsday tant practice of these centers. 21 In cross-docking, goods were of each week. Each Saturday at 730 A.M. regional vice prestdelivered to distribution centers and often simply loaded dents and a few hundred other managers and employer from one dock to another or even from one truck to another met with the firm's top managers to discuss the previous without ever sitting in inventory. Cross-docking reduced weck's results and discuss dafferent directions for the nent Walmart's cost of sales by 2 to 3 peroent compared to compet- week. Regional managers then conveyed information from itors. Croos-docking was receiving a great deal of attention the meeting to managers in the field via the videoconferencamong retailers with most attempting to implement it for a ing links that were present in each store. In 2006 , Walmart greater proportion of goods. It was extremely difficult to man- shifted this policy by requiring many of its 27 neglonal manage, however, because of the close coordination and timing agers to live in the areas they supervised. required between the store, manufacturer, and wanchouse. Aside from Walmart's impact on supplien, it was freAs one supplier noted, "Everyone from the forkhif driver on quently criticized for its employment practices, which critup to me, the CEO, knew we had to deliver on time. Not 10 ies characteriaed as being low in both wages and benefits. minutes late. And not 45 minutes early, either.... The mes _ Charles Fishenan acknowledged that Walmart saved cas sage came through clearly: you have this 30-second delivery tomers 530 billion on groceries alone and posolbly as much window. Either you're there or you're out." =22 gecause of the as $150 billion overall when its effect on competitor pricclose coordination needed, cross-docking required an infor- ing was considered, but he estimated that while Walmart mationsystem that effectively linked stores, wanchouses, and created 125,000 jobs in 2005 , it destroyed 127,900.24 Oehers manufacturers. Most major retailers were finding it difficult agreed that Walmart's employment and supplier practices to duplicate Walmart's success at cross-docking. resulted in negative externalities on employess, communiWalmart's focus on logistics manifestedl itself in other ties, and taxpayers. Harvand professor Pankaj Ghemawat ways. Before 2006, the company essentially employed two responded to Fishman by calculating that-based on Fishdistribution networks, one for general merchandise and man's number- Walmart created customer savings rang" one for groceries. The company created High Velocity Dis- ing from $12 million to $60 million for each job lost. $5 He. tribution Centers in 2006 that distributed both grocery and also argued that, because Walmart operated moee heavily general merchandise goods that needed more frequent in lower-income areas of the poorest one-third of the United replenishment. Walmart's logistios system also included States, low-income customers were much more likely to a fleet of more than 2,000 company-owned trucks. It was benefit from Walmart's lower prices. Another criticism of able to routinely ship goods from distribution centers to Walmart was that it consistently drove small local retailstores within 48 hours of receiving an order. Store shelves ers out of business when it introduced new stores in small were replenished twice a week on average in contrast to the towns and that employees in such rural areas were increasindustry average of once every two weeks. 21 ingly at the mercy of Walmart, essentially redistributing Walmart stores typically included many departments wealth from these areas to Flentonville jack and Sury Welch in areas such as soft goods, domestics, hard goods, statio- defended Walmart by pointing out that employees in these nery and candy. pharmaceuticals, necords and electronics, areas were better off after a Walmart opened: sporting goods, toys, shoes, and jewelry. The selection of products varied from one region to another. Department In most small foains the stomotimer drose the best arr, managers and in some caces associates (or employees) . lized in the fanciest house, and helarged so the ovunhad the authority to change prices in response to competi-__ try club. Mnaraduile, cmployess avrri't castly alurtors. This was in stark contrast to the traditional practice of _ ing the arealrh. Thry narely had life insarnatoe or hawlth many chains where prices were centrally set at a company's _._ brisfits and certarinly dit not mocioc mich an the aryy headquarters. Walmart's use of technology was particularly of thaining or big halarios. And fere of these storosunwing. useful in determining the mix of goods in each store. The corpleyoss senking lige-danging carcers 2 Sam's Club the usual 40 percent markup by department stores). Manag- A notable exception to Walmart's dominance in discount ers were discouraged from exceeding the margin goalk retailing was in the warchouse club segment. Despite sig-_ Some analysts claimed that Sam's Club's lackluster nificant efforts by Walnuart's Sam's Club, Costco was the performance was a result of a copycat strategy. Contco was established leader. Sam's Club had almost exactly the same. the first of the two competitors to sell fresh meat, produce, number of stores as Costco-620 to 622y yet, Costco still and gasoline and to introduce a premium private label for reported almost twice the sales- 5105 billion versus $54 bil- many goods. In each case, Sam's followed suit two to four lion for Sam's. Costco stores averaged considerably more years later. revenue per store than Sam's Club (see Exhabit 6). "By looking at arhat Costco dial and trying fo cmalate To the casual observer, Costco and Sam's Clubs it, Sam's didn't caric out its own anipue strategy." ship fees, and both were "warehouse" stores that sold goods foo" move made finings anorse. Soon after Coodco and from pallets. The goods were often packaged or bundiled Price Club merged ar 1993, 5amt's butkat up by purinto larger quantities than typical retailers offered. Beneath chasing Pace warchouse clubs from Kmart. Mary of these similarities, however, were important differences. The 91 stars were marginal operations in marginal Costco focused on more upscale small business owners and locatians. Analysts say that Sam's Clabl manggoment consumers while Sam's, following Walmart's pattern, had ivalme distracted as it tried to infegrate the Pace stores positioned itself mone to the mass middle market. Relative to _ inte its syntem. 27. Costco, Sam's was also concentrated more in smaller cities. To close the gap against Costco, Walmart in 2003 Consistent with its more upscale strategy, Costco started to integrate the activities of Sam's Club and Walmart stocked more luxury and premium-branded items than more. Buyers for the two coordinated their efforts to get betSam's Club had traditionally done. This changed somewhat ter prices from suppliers. when Sam's began to stock more high-end merchandise after the 1990s, but some questioned whether or not its typical customers demanded such items. Despite the focus on pric- Culture ier goods, Costco still focused intensely on managing costs Perhaps the most distinctive aspect of Walmart was its culand keeping prices down. Costco set a goal of 10 percent ture. To a large extent, Walmart's culture was an extension margins and capped markups at 14 percent (compared with. of Sam Walton's philosophy and was rooted in the early experiences and practices of Walmart. The Walmart culture International Operations emphasized values such as thriftiness, hard work, innovation, and continuous improvement. As Walton wrote, Walmart's entry into the international retail arena had been somewhat focent. As late as 1492 , Walmart's entite internainstill in our follss the ilot that aee at Walmart have tional operations consisted of only 162,535 square feet of owr owv avy of doing things. It mary be different and it retail space in Mexico. By 2013, however, intemational sales may take some folls a while to adjust to it at first. But contributed nearly 30 percent of the company's sales. With it's straight and honest and basically prity simple to growth rates of 7.4 percent in sales and 8.3 percent in operatfigure it out if you trant to. And nhether or not other ing incorne, Walmart's international growth ecceeded that folls want to accommodate as, we pretfy much stick to of its domestic operations. Although it was the company's iohat ave believe in becanse at's proven to be very, ocry fastest-growing division-going from about 559 billion in successful. 2 sales in 2006 to more than 5135 billion in 2013-Walmart's Walmart's thriftiness was consistent with its obses- performance in international markets had beent mixed, or sion with controlling costs. One observer joked that, "the as Forkes put it, "Overseas, Walmart has won some-and Walmart folks stay at Mo 3, where they don't even leave Sost a lot. "11 Only a few years earlier, more than 80 percent the light on for you." This was not, however, far from the of Walmart's intemational revenue came from only three truth. Walton told of early buying trips to New York where countries: Canada, Mexico, and the United Kingdom. several Walmart managers shared the same hotel room and walked everywhere they went rather than use taxis, One of diverse set of challenges in the diffenent countries it entered. the early managers described how these early trips taught Entry into international markets had ranged from gremfield managers to work hard and keep costs low: developenent to franchiking joint ventures, and acquisitions. Frow the ocry beginning. Sam tavs almarys trying fo Each country that Walmart had entered had presented new tinstill in us that you just diln't go to New York and and unique challenges. In China, Walmart had to deal with roll with the flow. We aluays awilknd everyuher. We a backward supply chain. In Japan, it had to negotiate an newver took cabs. And Sam had an equation for the trips: emironment that was hostile to large chains and protective expenses should never exend ove percent of aur purof its small retailers. Strong foreign competitors were the chases, so we would all crosid in these liffle hotel nowns. problem in Brazil and Argentina. Labor unions had plagued somewhere down around Madison Spuare Gandent. . Walmart's entry into Germany along with unforeseen dif.. We newer forished up until about twive-thirty at ficulties in integrating acquisitions. Mistakes in choosing night, and we' af all go out for a berr except Mr. Waltont. Store locations had hampened the company in South Korea He'd say, "IIl mod you at brotifitst at sir e'clock." And and Hong Kong. ar'd say. "Mr. Walton, there's mo moan to mort that Walmart approached international operations with ourly. We can't conr get jate the buildings that marly.," much the same philosophy it had used in the United States. And he'd just say, "We'll find something to do, "30 " We' re still very young at this, we're still learning. "13 stated The roots of Walmart'semphasis on innovation and con- John Meruer, former chief euecutive of Walmart Internatinuous improvement can also be seen in Walton's example. Sional. Menzer's approach was to have country presidents Walton emphasized always looking for ways to make decisions. His thinking was that it would facilitate improve. Walmart managers were encouraged to critique the faster implementation of decisions. Each country presitheir own operations, Managers met regularly to discuss dent made decisions regarding his or her own sourcing. their store operations. Lessons learned in one store were merchandising, and real estate. Menzer concluded, "Over quickly spread to other stores. Walmart managers also care- time all you really have is sperd. I think that's our most fully analyzed the activities of their competitors and tried important asset. =3 to borrow practices that worked well. Walton stressed the In most countries, entrenched competitors sesponded importance of observing what other firms did well rather vigorously to Walmart's entry. For example, Tesco, the than what they did wrong. Another way in which Walmart United Kingdom's biggest grocee, responded by opening had focused on improvement from its earliest days was in supercenters. In China, Lanhua, and Huilan, the hwo largest information and measurement. Long before Walmart had retailers, merged in 2003 into one state-owned entity named any computers, Walton would personally enter measures on the Bailan Group. Walmart was also not alone among major several variables for each store into a ledger he carried with international retailers in secking new growth in South him. Information technology enabled Walmart to extend America and Asia, One intermational competitoc, the French this emphasis on information and measurement. retailer Carrefour, was already the leading retailer in Brazil and Argentina. Carrefouar expanded into China in the late. a solution to their problems at home, they will learn by spill1990 s with a hypermarket in Shanghai. In Asia, Makro, a ing their blood. Global retailing demands a huge investment Dutch wholesale club retailer, was the regional leader. and gives no guarantee of a return." 34 Both of the European firms were viewed as able, experi-_ Walmart sotaght aggressive growth in its international enced competitors. The Japanese netailer, Yaohan, moved operations. The company added 497 units during 2013. its headquarters from Tokyo to Hong Kong with the aim of Walmart's early activities in a country typically involved becoming the world's largest retailer. Helped by the close acquisitions, but it had emphasized organic growth more relationship between Chairman Kazuo Wada and Mao's in recent years. successor Deng Xiaoping. Yaohan was the first foreign retail firm to receive a license to operate in China and planned to open more than 1,000 stores there. Like Walmart, these inter- LOOKing Ahead national firms were motivated to expand internationally by slowing down growth in their own domestic markets. Some Walmart CEO Doug McMillon faced the daunting chalanalysts feared that the pace of expansion by these major lenge of achieving the company's accustomed growth rates retailers was faster than the rate of growth in the market and despite its enormous size. A five percent organic growth could result in a price war. Like Walmart, these competitors rate would require the firm to add the equivalent of a firm had also found difficulty in moving into international mar- ranking 129 th in the Forfune 500 each year. To put that into kets and adapting to local differences. Bhoth Carrefour and perspective, the company's growth in revenues would need Makro had experienced visible failures in their international to nearly equal the total sales of Nike and exceed the sales efforts. Folkert Schukken, chairman of Makro, noted this of companies as large as Xerox and Kimberly Clark. What challenge, "We have trouble selling the same toilet paper in strategic priorities would allow Walmart to achieve that Belgium and Holland." The chairman of Carrefour, Daniel amount of growth? Or would the company need to adjust Bernard, agreed, "If people think that going international is its aspirations? End Notes 1 Standard and Poor's Industry Surveys. Retailing, February 1998. 2 Upbin, B. "Wall-to-wall Wal-Mart." Farbes, Apriil 12, 2004. 3. Nordlinger, J. (2004). "The new colossus: Wal-Mart is America's store, and the world's and its enemies are sadly behind. "Nationat Reoice, April 19, 2004. 4 lbid. 5 Fishman, C. (2003): "The Wal-Mart you don't know," Fast Confany, December 2003. 6 Berner, R. (2004). "The next Warren Buffett?" Business Weck, November 22, 2004. 7 Standard and Poor's Industry Surveyk. (1998). Retailing: Generit, February 5, 1998. 8 Walton, S. (with J. Hury). (1993). Saw Waltor: Mafe in America. New Yorke Doubleday, p. 63. 9 Ibid, PP. 64-65. 10. Jbid. p. 66 . 10 loid. p. 66 . 11 (1982). Farbs, August 16, p. 43. 12. Pulliam, S. (1996). TWab-Mart considers raising prices, drawing praise from analysts, but concem from board." Walt 5 tmet journal, March 8,1996,p. C2. 13 Bianco, A. (2007). "Wal-Mart's midlife crisis." BasinessWo , April 30,2007. 14 Standard and Poor's Industry Surveys. (1998). Retailing: General, February 5, 1995. 15 Useem, J. (2003), "America's most admired companies." Forfame, February 18, 2003. 16 Schifrin, M. (1996). "The big squeeze." Forlves, March 11, 1996. 17 Ibid. 18 Fishman, C. (2003). "The Wal-Mart you don't know." Fast Conypany. December 2003. 19. Walmart website. 20 Fshman, C. (2003). "The Wal-Mart you don't know." Fast Compuny, December 2003, p. 73. 21 Stalk, G. R. Evans, and L. E. Schulman. (1992). "Competing on capabilities The new rules of corporate strategy." Harnand Business Review, March/April 1992, pp. 57-58. 22 Fishman, C. (2003). "The Wal-Mart you don't know," Fast Comyany, December 2003, p. 73. 1-38 The Tools of Strategic Analysis 23 Stalk G., R. Evans, and L. E. Schulman. (1992), "Competing on capabilities: The new rules of corporate strategy," Harnant Business Rrotew, March/April 1992, pp. 57-58. 24 Fishman, C. (2006). "Wal-Mart and the decent society: Who knew that shopping was so important. "Analrary of Managatent Perspoctines, August 2006. 25 Chemawat, P. (2006). "Business, society, and the "Wal-Mart effect." Acodomy of Mandgemant Perspectiors, August 2006. 26 Welch, J. and S. Welch. (2006). "What's right about Wal-Mart." Bacines Work, May 1, 2006, p. 112 27 Helyar, ]. (2003). "The enly company Wal-Mart fears." Fortane, November 24, 2003, p. 158. 28 Walton, S. (with J. Huey). (1993). Sam Walfan: Male in America. New York: Doubleday. p. 85. 29 Loeb, M. (1994), "Editor's desk: The secret of two successes." Farfune, May 2, 1994. 30 Walton, S. (with J. Huey). (1993). Sam Wathan: Made in Amerian. New York: Doubleday, p. 84. 31 Upbin, B. (2004). "Wall-to-wall Wal-Mart." Forbs, April 12, 2004. 32 fbid. 33 lbid. 34 Rapoport, C. (1995). "Retailers go global." Fortani, February 20, 1995. Walmart Case Study Walmart CEO Doug McMillon faced the daunting challenge of achieving the company's accustomed growth rates despite its enormous size. A five percent organic growth rate would require the firm to add the equivalent of a firm ranking 129 th in the Fortune 500 each year. To put that into perspective, the company's growth in revenues would need to nearly equal the total sales of Nike and exceed the sales of companies as large as Xerox and Kimberly Clark. Read Walmart case on pages PC 1-26: PC 1-37 then answer the following question: What strategic priorities would allow Walmart to achieve that amount of growth? Or would the company need to adjust its aspirations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts