Answered step by step

Verified Expert Solution

Question

1 Approved Answer

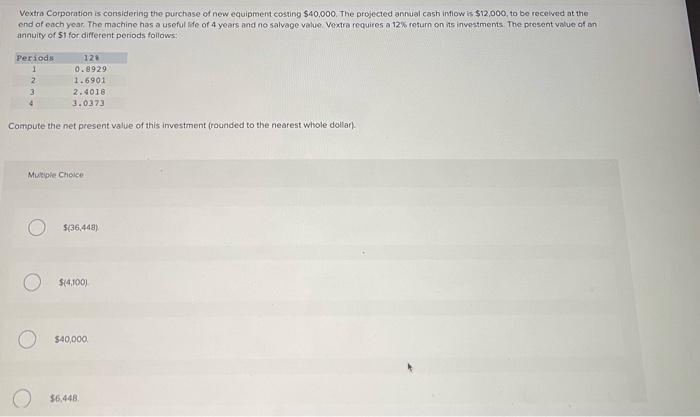

answer the question? Vextro Corporation is considering the purchase of new equipment costing $40,000. The projected annual cash inflow is $12,000, to be recelved at

answer the question?

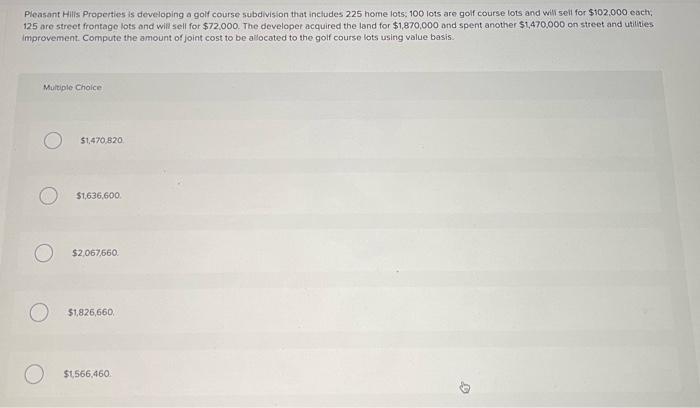

Vextro Corporation is considering the purchase of new equipment costing $40,000. The projected annual cash inflow is $12,000, to be recelved at the end of each year. The machine has a useful ife of 4 years and no salvage value. Vextra requires a 12% return on its invostments. The piesent value af an annuity of 51 for different periods follows: Compute the net present value of this invostment (rounded to the nearest whole dollar). Mutipie Criciee 5(36.448) $(4,100) $40,000. $6.448 Pleasant Hilis Properties is developing a golf course subdivision that includes 225 home lots. 100 lots are golf course lots and will sell for $102,000 each; 125 are street frontage lots ond will sell for $72,000. The developer acquired the land for $1,870,000 and spent another $1,470,000 on street and utilies improvement. Compute the amount of joint cost to be allocated to the golf course lots using value basis: Mutiple Choice 51,470.820 $1,636,600. $2,067,660 $1,826,660. $1,566,460

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started