Answer the questions a-e please type it in word or pdf so that i can copy and paste and explain your answers please NO HANDWRITINGS

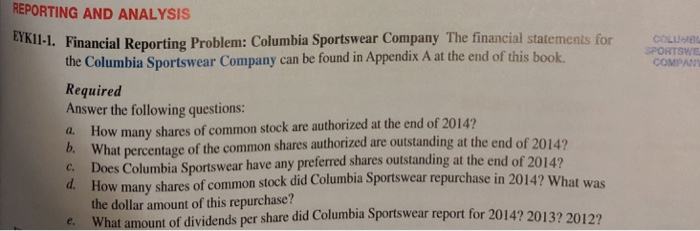

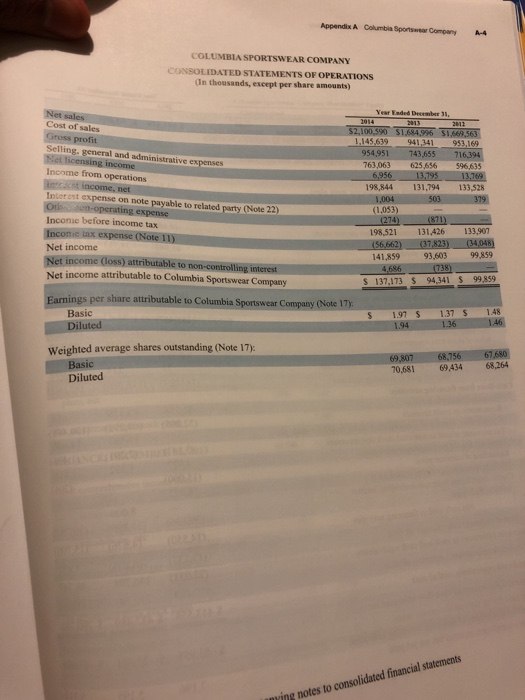

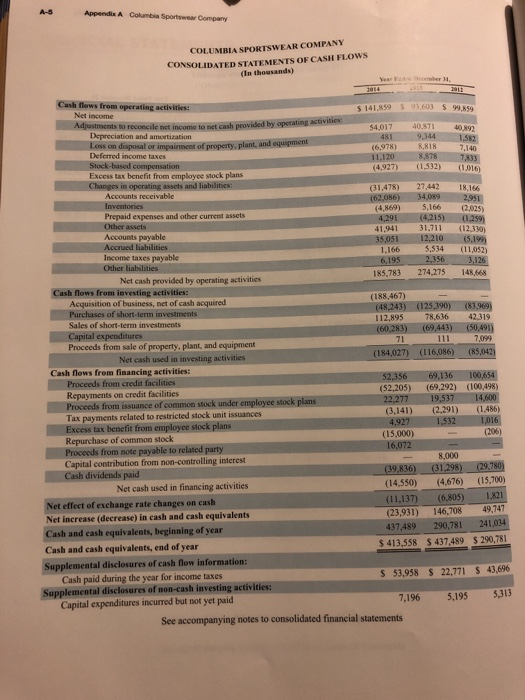

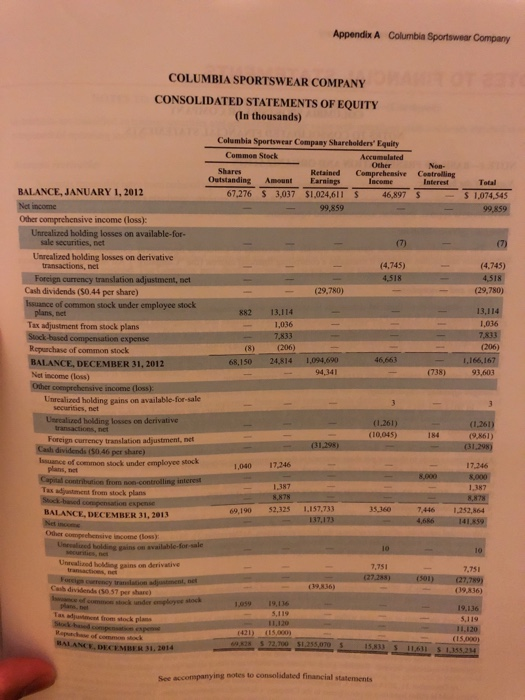

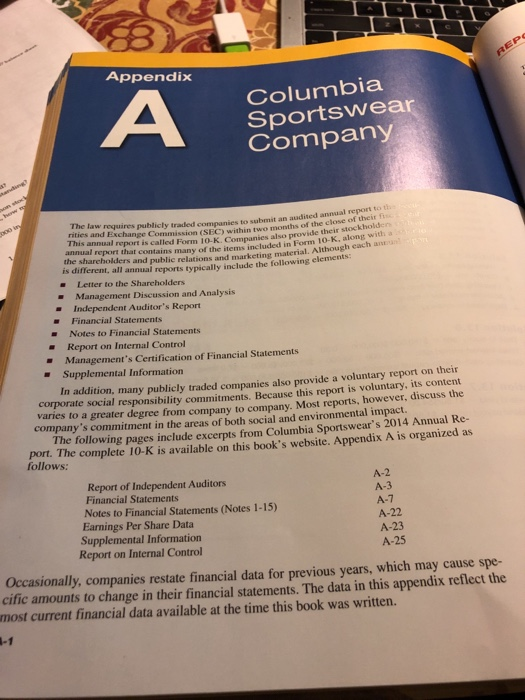

t Appendix Columbia Sportswea Company nual report to th The law requires publicly traded companies to submit an audited a rities and Exchange Commission (SEC) within t This annual report is called Form 1o-k annual report that contains many of the items included in Form 10- wo months of the close of their f ide their stockholden mpanies alse the shareholders and public relations and marketing material. Althougn is different, all annual reports typically include the following elements: Letter to the Shareholders -Management Discussion and Analysis -Independent Auditor's Report Financial Statements - Notes to Financial Statements Report on Internal Control Management's Certification of Financial Statements Supplemental Information In addition, many publicly traded companies also provide a voluntary report on their corporate social responsibility commitments. Because this report is voluntary, its con varies to a greater degree from company to company. Most reports, however, di company's commitment in the areas of both social and environmental impact. The following pages include excerpts from Columbia Sportswear's 2014 Annual Re port. The complete 10-K is available on this book's website. Appendix A is organized as follows: A-2 Report of Independent Auditors Financial Statements Notes to Financial Statements (Notes 1-15) Earnings Per Share Data Supplemental Information A-3 A-7 A-22 A-23 A-25 Report on Internal Control Occasionally, companies restate financial data for previous years, which may cause spe- cific amounts to change in their financial statements. The data in this appendix reflect the most current financial data available at the time this book was written. -1 REPORTING AND ANALYSIS BVkil-1. Financial Reporting Problem: Columbia Sportswear Company The financial statements for oLLise the Columbia Sportswear Company can be found in Appendix A at the end of this book COMPAN Required Answer the following questions: a. b. ow many shares of common stock are authorized at the end of 2014 outstanding at the end of 2014? What percentage of the common shares authorized are c. Does Columbia Sportswear have any preferred shares outstanding at the end of 2014? d. How many shares of common stock did Columbia Sportswear repurchase in 201 4? What was the dollar amount of this repurchase? What amount of dividends per share did Columbia Sportswear report for 2014? 20132 20122 e. Appendix A Columbia Sportswear Company INANCIAL STATEMENTS COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED BALANCE SHEETS (In thousands) December 31 2014 Current Assets: 437,489 91,755 344,390 306,878 384,650 329,228 valents 27,267 Short-term investments Inventories Prepaid unts receivable, net (Note 6) income taxes (Note1 expenses and other current assets 57,001 52.041 39,175 33,081 1,266,041 1,250,472 Total current assets 291,563 279,373 Property, plant, and equipment, net (Note 7) 143,731 36,288 14,438 68,594 Goodwill (Notes 3, 8) Other non-current assets s 1,792,209 s 1,605,588 Total assets LIABILITIES AND EQUITY Current Liabilities: 173,557 120,397 14,3887,251 ts payable 144,288 Accrued liabilities (Note 10) Income taxes payable (Note 11) Deferred income taxes (Note 11) 169 49 Total current liabilities 373,120 301,254 Note payable to related party (Note 22) 15,728 35,435 9,388 -term liabilities Income taxes payable (Note 11) 13,984 ed income taxes (Note 11) Total liabilities 436,975352,724 Commitments and contingencies (Note 14) Shareholders Equity: Common stock (no par value); 250,000 shares authorized; 69,828 and 69,190 issued and outstanding (Note 15) 52,325 72,700 15,833 11,631 Accumulated other comprehensive income (Note 18) Total Columbia Sportswear Company shareholders' equity 35,360 1,343,603 1,245,418 Non-controlling interest (Note 5) Total equity Total liabilities and equity 1,355,234 1,252,864 S 1,792,209 $ 1,605,588 Appendix A Columbia Spontswear Company A-4 COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share amounts) Year Eaded December 31 Net Cost of sales profit .145.639 941341 953,169 Selling, general and administrative expenses 954,951 743,655 7 763,063 625,656596,635 Income from operations net 198,844 131,794 133,528 sst expense on note payable to related party (Note 22) Inconae before income tax Inconic tax expense (Note 11) Net income Net income (loss) attributable to Net income attributable to Columbia Sportswear Company (1,053) 198,521 131,426 141,859 93,60399,859 S 137,173 $ 94,341 S 99,859 s per share attributable to Columbia Sportswear Company (Note 17 Basic S 1.97 $ 1.37 S 148 Weighted average shares outstanding (Note 17): Basic Diluted 70,681 69,434 68,264 ving notes to consolidated financial statements Appendis A Cokumbin Sportswear Company COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) Cash flews from operating activities: S141,859 93,603 $ 99,859 tincats to reconcile net income to net cash provided by operating 54.01 7 40.ST 40.892 9,344 1582 Depreciation and amoetization Loss on disposal or impairment of property, plant, and equipment Deferred income taxes (6,978) (4,927) (1.532)(1016 Excess tax benefit from employee stock plans (31,478) 27,442 18,166 (62,086) 34089 2951 Accounts receivable (4,869)5,166 (2,025) 4,291 (4,215)-(1259) 41,941 31.711(12,330) 35,051 Prepaid expenses and other current assets Accrued liabilities 5,534 (11,052) Income taxes payable Other liabilities 1,166 6.195 2,356 3,126 185,783 274275 148,668 Net cash provided by operating activities Cash flows from investing activities: (188,467) Acquisition of business, net of cash acquired Sales of short-term investments Proceeds from sale of property, plant, and equipment (48,243) (125,390) (83969) 112,895 78,636 42,319 (60,283) (69,443) (50,491) expenditures 71 (184.027) (116,086) (85,042) Net cash used in investing activities Cash flows from financing activities: Proceeds from credit facilities Repayments on credit facilities Proceeds from issuance of common stock under employee stock plans Tax payments related to restricted stock unit issuances Excess Repurchase of common stock Proceeds from note payable to related party Capital contribution from non-controlling interest Cash dividends paid (52.205) (69,292) (100,498) (3,141) (2.291) (1.486) (206) tax benefit from employee stock plans (15,000) 8,000 (14,380) (4,676) (15,700) (11,137)(6,805)1,82 (23,931) 146,70849,747 437,489290,781 241 413,558 $ 437.489 $ 290,781 Net cash used in financing activities Net effect of exchange rate changes on cash Net increase (decrease) in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year Supplemental disclosures of cash flow information: S 53,958 22,771 S 43,696 Cash paid during the year for income taxes Supplemental disclosures of non-cash investing activities: 5,195 5,313 7,196 Capital expenditures incurred but not yet paid See accompanying notes to consolidated financial statements Appendix A Columbia Sportswear Company COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF EQUITY (In thousands) Columbia Sportswear Company Shareholders' Equity Common Stock Accumulated Other Non- Shares Retained Comprehensive Cestrolling lacome Outstanding Amount Earnings Interest Total BALANCE, JANUARY 1, 2012 S 1,074,545 99,85999,859 67,276 3,037 $1,024,611 46,897 $ Other comprehensive income (loss): holding losses on available-for- sale securities, net Unrealized holding losses on derivative (4,745) 4,518 (4.745) 4,518 (29,780) transactions, net Cash dividends (S0.44 per share) (29,780) of common stock under employee stock plans, net 882 13,114 13,114 Tax adjustment from stock plans 7,833 (206) 68,150 24,814 1,094,690 (206) Repurchase of common stock BALANCE, DECEMBER 31, 2012 Net income (loss) Other 46,663 1,166,167 93,603 94,341 (738) ive income (loss) relized holding gains on available- for sale Uarcalized holding losses on derivative 1.261) (10,045) (1,261) (9,861) Cash dividends (50.46 per Issuance of coemmon stock under employee 17.246 8,0008000 plans, net 1,040 17,246 1,387 8,878 69,190 52,325 1,157,733 Tax adjustment from stock plans .878 7446 1,252,864 4,686 141 859 35.360 BALANCE, DECEMBER 31, 2013 Unrcalined holding gains on derivalive 7,751 7.751 39,836) 09,836) 1,059 19,136 19.1 from stock plans 11.120 15,000) BALANCE, DECEMBER 31,2014 72.700 51.25 notes to consolidated financial statements t Appendix Columbia Sportswea Company nual report to th The law requires publicly traded companies to submit an audited a rities and Exchange Commission (SEC) within t This annual report is called Form 1o-k annual report that contains many of the items included in Form 10- wo months of the close of their f ide their stockholden mpanies alse the shareholders and public relations and marketing material. Althougn is different, all annual reports typically include the following elements: Letter to the Shareholders -Management Discussion and Analysis -Independent Auditor's Report Financial Statements - Notes to Financial Statements Report on Internal Control Management's Certification of Financial Statements Supplemental Information In addition, many publicly traded companies also provide a voluntary report on their corporate social responsibility commitments. Because this report is voluntary, its con varies to a greater degree from company to company. Most reports, however, di company's commitment in the areas of both social and environmental impact. The following pages include excerpts from Columbia Sportswear's 2014 Annual Re port. The complete 10-K is available on this book's website. Appendix A is organized as follows: A-2 Report of Independent Auditors Financial Statements Notes to Financial Statements (Notes 1-15) Earnings Per Share Data Supplemental Information A-3 A-7 A-22 A-23 A-25 Report on Internal Control Occasionally, companies restate financial data for previous years, which may cause spe- cific amounts to change in their financial statements. The data in this appendix reflect the most current financial data available at the time this book was written. -1 REPORTING AND ANALYSIS BVkil-1. Financial Reporting Problem: Columbia Sportswear Company The financial statements for oLLise the Columbia Sportswear Company can be found in Appendix A at the end of this book COMPAN Required Answer the following questions: a. b. ow many shares of common stock are authorized at the end of 2014 outstanding at the end of 2014? What percentage of the common shares authorized are c. Does Columbia Sportswear have any preferred shares outstanding at the end of 2014? d. How many shares of common stock did Columbia Sportswear repurchase in 201 4? What was the dollar amount of this repurchase? What amount of dividends per share did Columbia Sportswear report for 2014? 20132 20122 e. Appendix A Columbia Sportswear Company INANCIAL STATEMENTS COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED BALANCE SHEETS (In thousands) December 31 2014 Current Assets: 437,489 91,755 344,390 306,878 384,650 329,228 valents 27,267 Short-term investments Inventories Prepaid unts receivable, net (Note 6) income taxes (Note1 expenses and other current assets 57,001 52.041 39,175 33,081 1,266,041 1,250,472 Total current assets 291,563 279,373 Property, plant, and equipment, net (Note 7) 143,731 36,288 14,438 68,594 Goodwill (Notes 3, 8) Other non-current assets s 1,792,209 s 1,605,588 Total assets LIABILITIES AND EQUITY Current Liabilities: 173,557 120,397 14,3887,251 ts payable 144,288 Accrued liabilities (Note 10) Income taxes payable (Note 11) Deferred income taxes (Note 11) 169 49 Total current liabilities 373,120 301,254 Note payable to related party (Note 22) 15,728 35,435 9,388 -term liabilities Income taxes payable (Note 11) 13,984 ed income taxes (Note 11) Total liabilities 436,975352,724 Commitments and contingencies (Note 14) Shareholders Equity: Common stock (no par value); 250,000 shares authorized; 69,828 and 69,190 issued and outstanding (Note 15) 52,325 72,700 15,833 11,631 Accumulated other comprehensive income (Note 18) Total Columbia Sportswear Company shareholders' equity 35,360 1,343,603 1,245,418 Non-controlling interest (Note 5) Total equity Total liabilities and equity 1,355,234 1,252,864 S 1,792,209 $ 1,605,588 Appendix A Columbia Spontswear Company A-4 COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share amounts) Year Eaded December 31 Net Cost of sales profit .145.639 941341 953,169 Selling, general and administrative expenses 954,951 743,655 7 763,063 625,656596,635 Income from operations net 198,844 131,794 133,528 sst expense on note payable to related party (Note 22) Inconae before income tax Inconic tax expense (Note 11) Net income Net income (loss) attributable to Net income attributable to Columbia Sportswear Company (1,053) 198,521 131,426 141,859 93,60399,859 S 137,173 $ 94,341 S 99,859 s per share attributable to Columbia Sportswear Company (Note 17 Basic S 1.97 $ 1.37 S 148 Weighted average shares outstanding (Note 17): Basic Diluted 70,681 69,434 68,264 ving notes to consolidated financial statements Appendis A Cokumbin Sportswear Company COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) Cash flews from operating activities: S141,859 93,603 $ 99,859 tincats to reconcile net income to net cash provided by operating 54.01 7 40.ST 40.892 9,344 1582 Depreciation and amoetization Loss on disposal or impairment of property, plant, and equipment Deferred income taxes (6,978) (4,927) (1.532)(1016 Excess tax benefit from employee stock plans (31,478) 27,442 18,166 (62,086) 34089 2951 Accounts receivable (4,869)5,166 (2,025) 4,291 (4,215)-(1259) 41,941 31.711(12,330) 35,051 Prepaid expenses and other current assets Accrued liabilities 5,534 (11,052) Income taxes payable Other liabilities 1,166 6.195 2,356 3,126 185,783 274275 148,668 Net cash provided by operating activities Cash flows from investing activities: (188,467) Acquisition of business, net of cash acquired Sales of short-term investments Proceeds from sale of property, plant, and equipment (48,243) (125,390) (83969) 112,895 78,636 42,319 (60,283) (69,443) (50,491) expenditures 71 (184.027) (116,086) (85,042) Net cash used in investing activities Cash flows from financing activities: Proceeds from credit facilities Repayments on credit facilities Proceeds from issuance of common stock under employee stock plans Tax payments related to restricted stock unit issuances Excess Repurchase of common stock Proceeds from note payable to related party Capital contribution from non-controlling interest Cash dividends paid (52.205) (69,292) (100,498) (3,141) (2.291) (1.486) (206) tax benefit from employee stock plans (15,000) 8,000 (14,380) (4,676) (15,700) (11,137)(6,805)1,82 (23,931) 146,70849,747 437,489290,781 241 413,558 $ 437.489 $ 290,781 Net cash used in financing activities Net effect of exchange rate changes on cash Net increase (decrease) in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year Supplemental disclosures of cash flow information: S 53,958 22,771 S 43,696 Cash paid during the year for income taxes Supplemental disclosures of non-cash investing activities: 5,195 5,313 7,196 Capital expenditures incurred but not yet paid See accompanying notes to consolidated financial statements Appendix A Columbia Sportswear Company COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF EQUITY (In thousands) Columbia Sportswear Company Shareholders' Equity Common Stock Accumulated Other Non- Shares Retained Comprehensive Cestrolling lacome Outstanding Amount Earnings Interest Total BALANCE, JANUARY 1, 2012 S 1,074,545 99,85999,859 67,276 3,037 $1,024,611 46,897 $ Other comprehensive income (loss): holding losses on available-for- sale securities, net Unrealized holding losses on derivative (4,745) 4,518 (4.745) 4,518 (29,780) transactions, net Cash dividends (S0.44 per share) (29,780) of common stock under employee stock plans, net 882 13,114 13,114 Tax adjustment from stock plans 7,833 (206) 68,150 24,814 1,094,690 (206) Repurchase of common stock BALANCE, DECEMBER 31, 2012 Net income (loss) Other 46,663 1,166,167 93,603 94,341 (738) ive income (loss) relized holding gains on available- for sale Uarcalized holding losses on derivative 1.261) (10,045) (1,261) (9,861) Cash dividends (50.46 per Issuance of coemmon stock under employee 17.246 8,0008000 plans, net 1,040 17,246 1,387 8,878 69,190 52,325 1,157,733 Tax adjustment from stock plans .878 7446 1,252,864 4,686 141 859 35.360 BALANCE, DECEMBER 31, 2013 Unrcalined holding gains on derivalive 7,751 7.751 39,836) 09,836) 1,059 19,136 19.1 from stock plans 11.120 15,000) BALANCE, DECEMBER 31,2014 72.700 51.25 notes to consolidated financial statements