Answer the questions below. If possible, include solutions.

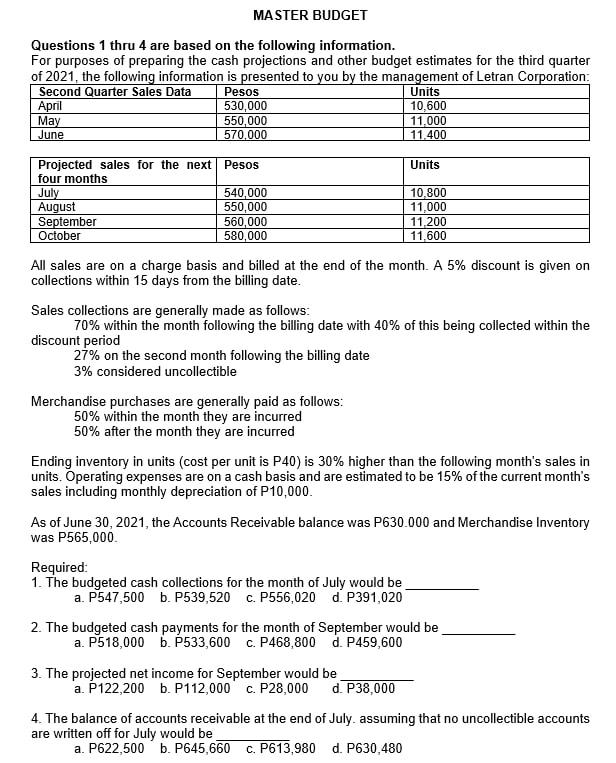

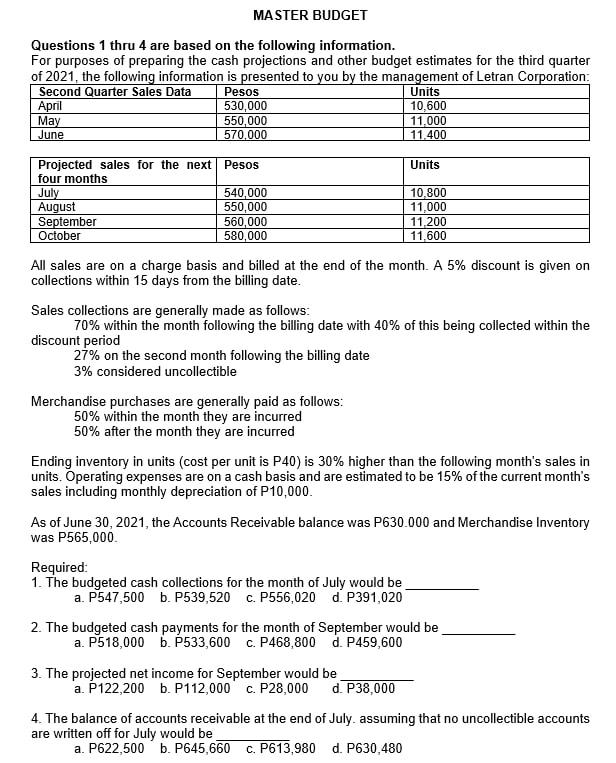

MASTER BUDGET Questions 1 thru 4 are based on the following information. For purposes of preparing the cash projections and other budget estimates for the third quarter of 2021 , the following information is presented to you by the management of Letran Corporation: All sales are on a charge basis and billed at the end of the month. A 5% discount is given on collections within 15 days from the billing date. Sales collections are generally made as follows: 70% within the month following the billing date with 40% of this being collected within the discount period 27% on the second month following the billing date 3% considered uncollectible Merchandise purchases are generally paid as follows: 50% within the month they are incurred 50% after the month they are incurred Ending inventory in units (cost per unit is P40) is 30% higher than the following month's sales in units. Operating expenses are on a cash basis and are estimated to be 15% of the current month's sales including monthly depreciation of P10,000. As of June 30, 2021, the Accounts Receivable balance was P630.000 and Merchandise Inventory was P565,000. Required: 1. The budgeted cash collections for the month of July would be a. P547,500 b. P539,520 c. P556,020 d. P391,020 2. The budgeted cash payments for the month of September would be a. P518,000 b. P533,600 c. P468,800 d. P459,600 3. The projected net income for September would be a. P122,200 b. P112,000 c. P28,000 d. P38,000 4. The balance of accounts receivable at the end of July. assuming that no uncollectible accounts are written off for July would be a. P622,500 b. P645,660 c. P613,980 d. P630,480 MASTER BUDGET Questions 1 thru 4 are based on the following information. For purposes of preparing the cash projections and other budget estimates for the third quarter of 2021 , the following information is presented to you by the management of Letran Corporation: All sales are on a charge basis and billed at the end of the month. A 5% discount is given on collections within 15 days from the billing date. Sales collections are generally made as follows: 70% within the month following the billing date with 40% of this being collected within the discount period 27% on the second month following the billing date 3% considered uncollectible Merchandise purchases are generally paid as follows: 50% within the month they are incurred 50% after the month they are incurred Ending inventory in units (cost per unit is P40) is 30% higher than the following month's sales in units. Operating expenses are on a cash basis and are estimated to be 15% of the current month's sales including monthly depreciation of P10,000. As of June 30, 2021, the Accounts Receivable balance was P630.000 and Merchandise Inventory was P565,000. Required: 1. The budgeted cash collections for the month of July would be a. P547,500 b. P539,520 c. P556,020 d. P391,020 2. The budgeted cash payments for the month of September would be a. P518,000 b. P533,600 c. P468,800 d. P459,600 3. The projected net income for September would be a. P122,200 b. P112,000 c. P28,000 d. P38,000 4. The balance of accounts receivable at the end of July. assuming that no uncollectible accounts are written off for July would be a. P622,500 b. P645,660 c. P613,980 d. P630,480