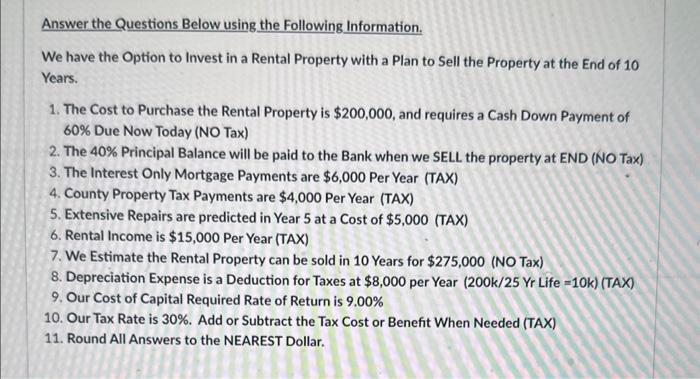

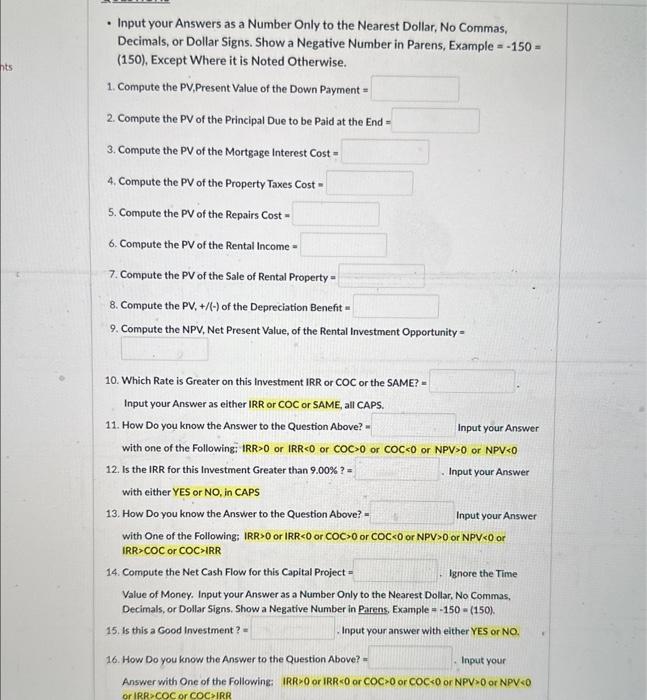

Answer the Questions Below using the Following Information. We have the Option to Invest in a Rental Property with a Plan to Sell the Property at the End of 10 Years. 1. The Cost to Purchase the Rental Property is $200,000, and requires a Cash Down Payment of 60\% Due Now Today (NO Tax) 2. The 40% Principal Balance will be paid to the Bank when we SELL the property at END (NO Tax) 3. The Interest Only Mortgage Payments are $6,000 Per Year (TAX) 4. County Property Tax Payments are $4,000 Per Year (TAX) 5. Extensive Repairs are predicted in Year 5 at a Cost of $5,000 (TAX) 6. Rental Income is $15,000 Per Year (TAX) 7. We Estimate the Rental Property can be sold in 10 Years for $275,000 (NO Tax) 8. Depreciation Expense is a Deduction for Taxes at $8,000 per Year (200k/25 Yr Life =10k ) (TAX) 9. Our Cost of Capital Required Rate of Return is 9.00% 10. Our Tax Rate is 30%. Add or Subtract the Tax Cost or Benefit When Needed (TAX) 11. Round All Answers to the NEAREST Dollar. - Input your Answers as a Number Only to the Nearest Dollar, No Commas, Decimals, or Dollar Signs. Show a Negative Number in Parens, Example =150= (150), Except Where it is Noted Otherwise. 1. Compute the PV, Present Value of the Down Payment = 2. Compute the PV of the Principal Due to be Paid at the End = 3. Compute the PV of the Mortgage Interest Cost = 4. Compute the PV of the Property Taxes Cost = 5. Compute the PV of the Repairs Cost = 6. Compute the PV of the Rental Income = 7. Compute the PV of the Sale of Rental Property= 8. Compute the PV, +/() of the Depreciation Benefit = 9. Compute the NPV, Net Present Value, of the Rental Investment Opportunity = 10. Which Rate is Greater on this investment IRR or COC or the SAME? = Input your Answer as elther IRR or COC or SAME, all CAPS. 11. How Do you know the Answer to the Question Above? = Input your Answer with one of the Following: IRR>0 or IRR0 or COC0 or NPV0 or IRR>0 or COC0 or NPVIRR>COC or COC>IRR 14. Compute the Net Cash Flow for this Capital Project= Ignore the Time Value of Money. Input your Answer as a Number Only to the Nearest Dollar, No Commas, Decimals, or Dollar Signs. Show a Negative Number in Parens, Example =150= (150). 15. Is this a Good investment ? = . Input your answer with elther YES or NO. 16. How Do you know the Answer to the Question Above? = Input your Answer with One of the Following: IRR>0 or IRR 0 or COC0 or NPV COC or COC >IRR Answer the Questions Below using the Following Information. We have the Option to Invest in a Rental Property with a Plan to Sell the Property at the End of 10 Years. 1. The Cost to Purchase the Rental Property is $200,000, and requires a Cash Down Payment of 60\% Due Now Today (NO Tax) 2. The 40% Principal Balance will be paid to the Bank when we SELL the property at END (NO Tax) 3. The Interest Only Mortgage Payments are $6,000 Per Year (TAX) 4. County Property Tax Payments are $4,000 Per Year (TAX) 5. Extensive Repairs are predicted in Year 5 at a Cost of $5,000 (TAX) 6. Rental Income is $15,000 Per Year (TAX) 7. We Estimate the Rental Property can be sold in 10 Years for $275,000 (NO Tax) 8. Depreciation Expense is a Deduction for Taxes at $8,000 per Year (200k/25 Yr Life =10k ) (TAX) 9. Our Cost of Capital Required Rate of Return is 9.00% 10. Our Tax Rate is 30%. Add or Subtract the Tax Cost or Benefit When Needed (TAX) 11. Round All Answers to the NEAREST Dollar. - Input your Answers as a Number Only to the Nearest Dollar, No Commas, Decimals, or Dollar Signs. Show a Negative Number in Parens, Example =150= (150), Except Where it is Noted Otherwise. 1. Compute the PV, Present Value of the Down Payment = 2. Compute the PV of the Principal Due to be Paid at the End = 3. Compute the PV of the Mortgage Interest Cost = 4. Compute the PV of the Property Taxes Cost = 5. Compute the PV of the Repairs Cost = 6. Compute the PV of the Rental Income = 7. Compute the PV of the Sale of Rental Property= 8. Compute the PV, +/() of the Depreciation Benefit = 9. Compute the NPV, Net Present Value, of the Rental Investment Opportunity = 10. Which Rate is Greater on this investment IRR or COC or the SAME? = Input your Answer as elther IRR or COC or SAME, all CAPS. 11. How Do you know the Answer to the Question Above? = Input your Answer with one of the Following: IRR>0 or IRR0 or COC0 or NPV0 or IRR>0 or COC0 or NPVIRR>COC or COC>IRR 14. Compute the Net Cash Flow for this Capital Project= Ignore the Time Value of Money. Input your Answer as a Number Only to the Nearest Dollar, No Commas, Decimals, or Dollar Signs. Show a Negative Number in Parens, Example =150= (150). 15. Is this a Good investment ? = . Input your answer with elther YES or NO. 16. How Do you know the Answer to the Question Above? = Input your Answer with One of the Following: IRR>0 or IRR 0 or COC0 or NPV COC or COC >IRR