Answered step by step

Verified Expert Solution

Question

1 Approved Answer

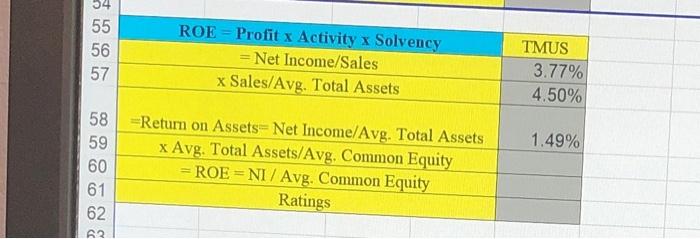

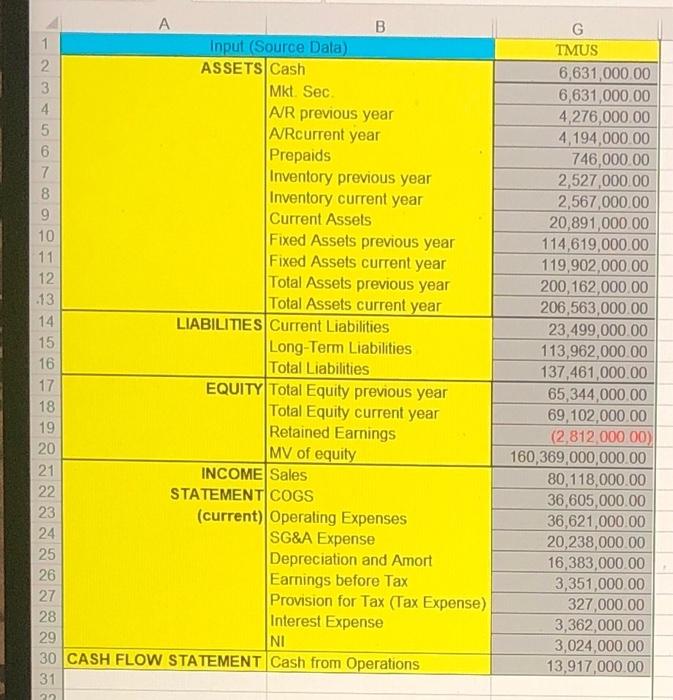

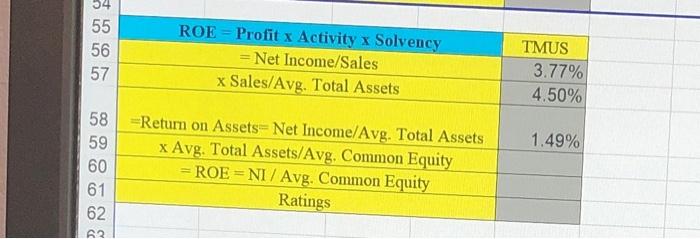

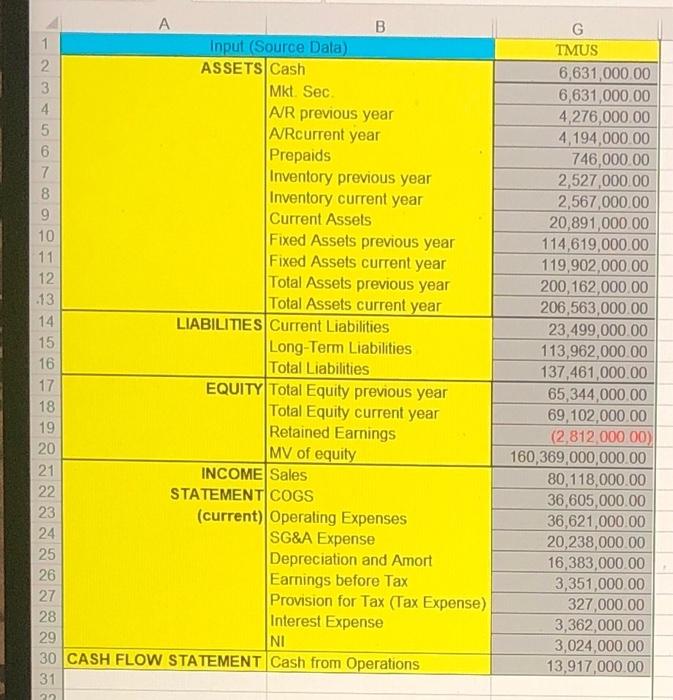

Answer the questions concerning ROE based on information given below 34 55 56 57 ROE = Profit x Activity x Solvency =Net Income/Sales x Sales/Avg.

Answer the questions concerning ROE based on information given below

34 55 56 57 ROE = Profit x Activity x Solvency =Net Income/Sales x Sales/Avg. Total Assets - TMUS 3.77% 4.50% 1.49% 58 Return on Assets=Net Income/Avg. Total Assets 59 x Avg. Total Assets/Avg. Common Equity 60 =ROE=NI / Avg. Common Equity 61 Ratings 62 62 A B 1 Input (Source Dala) 2 ASSETS Cash 3 Mkt Sec 4 A/R previous year 5 A/Rcurrent year 6 Prepaids 7 Inventory previous year 8 Inventory current year 9 Current Assets 10 Fixed Assets previous year 11 Fixed Assets current year 12 Total Assets previous year 13 Total Assets current year 14 LIABILITIES Current Liabilities 15 Long-Term Liabilities 16 Total Liabilities 17 EQUITY Total Equity previous year 18 Total Equity current year 19 Retained Earnings 20 MV of equity 21 INCOME Sales 22 STATEMENT COGS (current) Operating Expenses 24 SG&A Expense 25 Depreciation and Amort 26 Earnings before Tax 27 Provision for Tax (Tax Expense) Interest Expense 29 NI 30 CASH FLOW STATEMENT Cash from Operations 31 G TMUS 6,631,000.00 6,631,000.00 4,276,000.00 4,194,000.00 746,000.00 2,527,000.00 2,567,000.00 20,891,000.00 114,619,000.00 119,902,000.00 200,162,000.00 206,563,000.00 23,499,000.00 113,962,000.00 137,461,000.00 65,344,000.00 69,102,000.00 (2,812,000.00) 160,369,000,000.00 80,118,000.00 36,605,000.00 36,621,000.00 20,238,000.00 16,383,000.00 3,351,000.00 327,000.00 3,362,000.00 3,024,000.00 13,917,000.00 23 28 22

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started