Answer the questions on Excel and show the calculation.

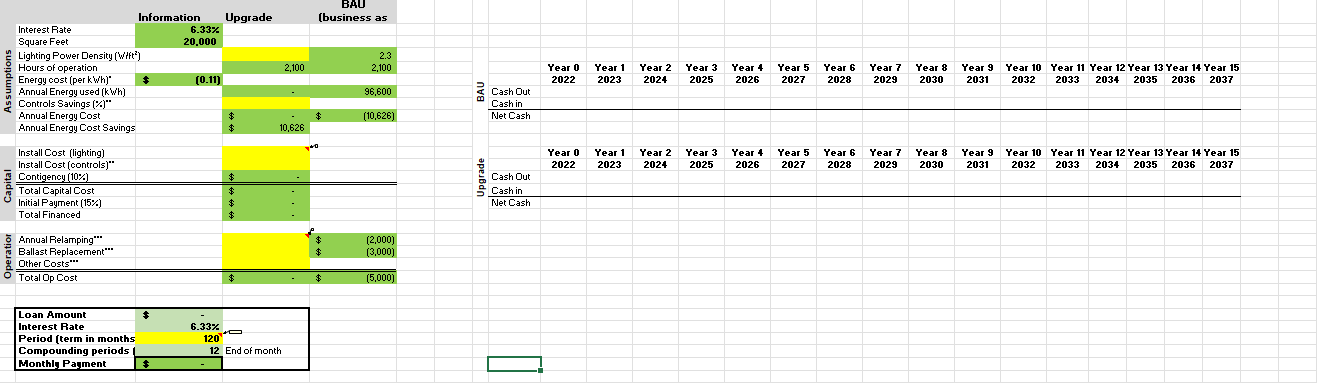

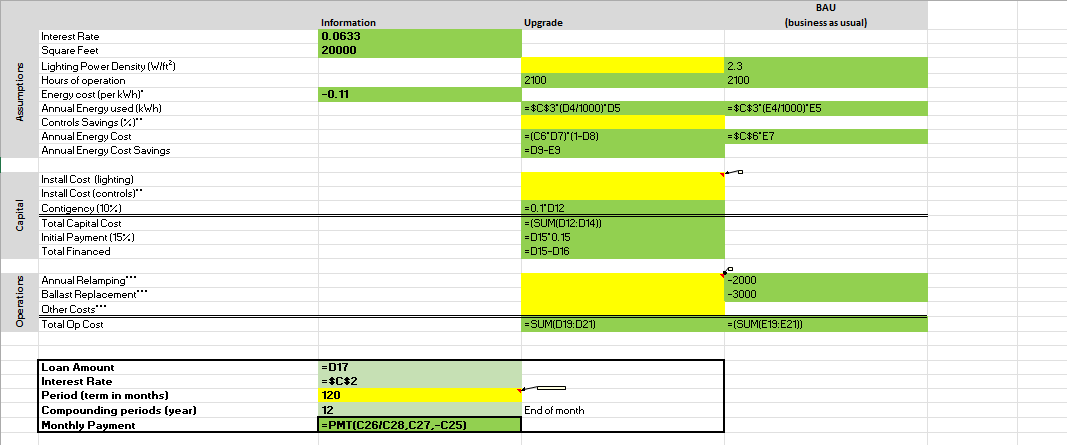

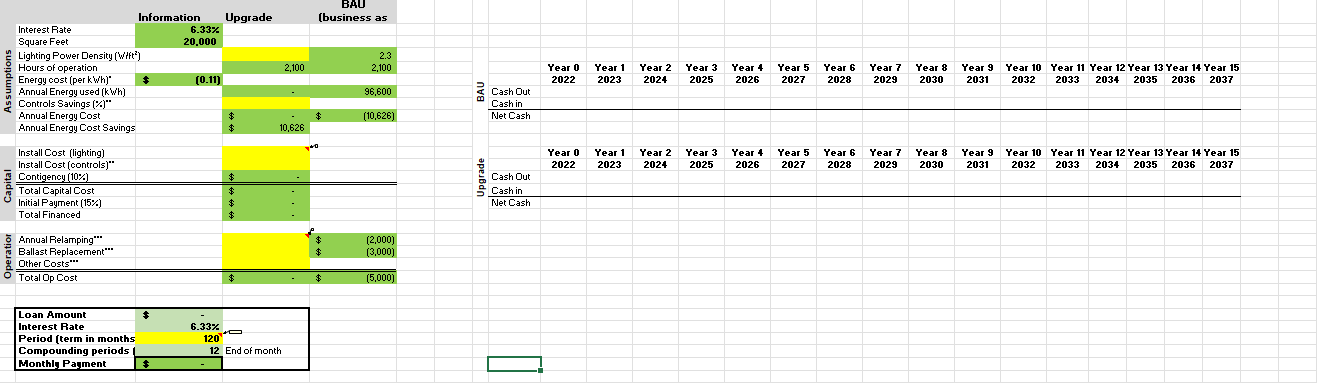

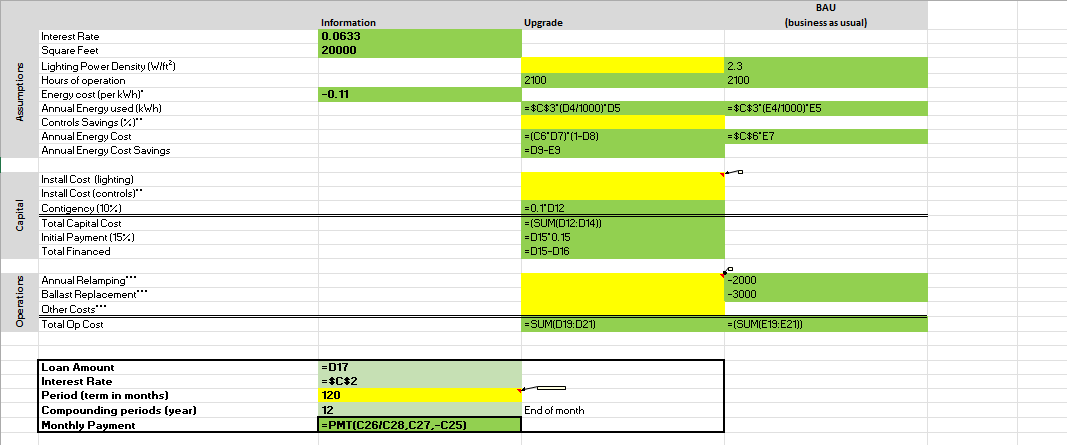

BAU (business as 2,100 2.3 2,100 Information Upgrade Interest Rate 6.33% Square Feet 20.000 Lighting Power Density (Witt) Hours of operation Energy cost (per kWh)" $ (0.11) Annual Energy used (kWh) Controls Savings (%)" Annual Energy Cost $ Annual Energy Cost Savings $ Year 0 2022 Year 1 2023 Year 2 2024 Year 3 2025 Year 4 2026 Year 5 2027 Year 6 2028 Year 7 2029 Year 8 2030 Year 9 2031 Year 10 Year 11 Year 12 Year 13 Year 14 Year 15 2032 2033 2034 2035 2036 2037 96,600 Cash Out Cash in Net Cash (10,626) 10,626 0 Year 0 2022 Year 1 2023 Year 2 2024 Year 3 2025 Year 4 2026 Year 5 2027 Year 6 2028 Year 7 2029 Year 8 2030 Year 9 2031 Year 10 Year 11 Year 12 Year 13 Year 14 Year 15 2032 2033 2034 2035 2036 2037 $ Install Cost (lighting) Install Cost (controls)" Contigency (104) Total Capital Cost Initial Payment (15%) Total Financed $ $ $ Cash Out S Cash in Net Cash - $ (2.000) (3,000) Annual Relamping" Ballast Replacement" Other Costs"" Total Op Cost $ - $ (5,000) Loan Amount $ Interest Rate Period (term in months Compounding periods Monthly Payment $ 6.33% 120 12 End of month BAU (business as usual) Upgrade Information 0.0633 20000 2.3 2100 2100 Assumptions Interest Rate Square Feet Lighting Power Density (Wift) Hours of operation Energy cost (per kWh) Annual Energy used (kWh) Controls Savings (%)" Annual Energy Cost Annual Energy Cost Savings -0.11 = $C$3"[04/1000)*D5 = $C$3 (E4/1000)'E5 = (C6D71" (1-08) =D9-E9 = $C$6'E7 Capital Install Cost (lighting) Install Cost (controls)" Contigency (10%) Total Capital Cost Initial Payment (15%) Total Financed =0.1012 = (SUMD12:014)) =D15'0.15 =D15-D16 -2000 -3000 Operations Annual Relamping" Ballast Replacement" Other Costs" Total Op Cost =SUM(D19:D21) = (SUM(E 19:E21 Loan Amount Interest Rate Period (term in months) Compounding periods (year) Monthly Payment =D17 = $C$2 120 12 =PMT(C26/C28,C27,-C25) End of month BAU (business as 2,100 2.3 2,100 Information Upgrade Interest Rate 6.33% Square Feet 20.000 Lighting Power Density (Witt) Hours of operation Energy cost (per kWh)" $ (0.11) Annual Energy used (kWh) Controls Savings (%)" Annual Energy Cost $ Annual Energy Cost Savings $ Year 0 2022 Year 1 2023 Year 2 2024 Year 3 2025 Year 4 2026 Year 5 2027 Year 6 2028 Year 7 2029 Year 8 2030 Year 9 2031 Year 10 Year 11 Year 12 Year 13 Year 14 Year 15 2032 2033 2034 2035 2036 2037 96,600 Cash Out Cash in Net Cash (10,626) 10,626 0 Year 0 2022 Year 1 2023 Year 2 2024 Year 3 2025 Year 4 2026 Year 5 2027 Year 6 2028 Year 7 2029 Year 8 2030 Year 9 2031 Year 10 Year 11 Year 12 Year 13 Year 14 Year 15 2032 2033 2034 2035 2036 2037 $ Install Cost (lighting) Install Cost (controls)" Contigency (104) Total Capital Cost Initial Payment (15%) Total Financed $ $ $ Cash Out S Cash in Net Cash - $ (2.000) (3,000) Annual Relamping" Ballast Replacement" Other Costs"" Total Op Cost $ - $ (5,000) Loan Amount $ Interest Rate Period (term in months Compounding periods Monthly Payment $ 6.33% 120 12 End of month BAU (business as usual) Upgrade Information 0.0633 20000 2.3 2100 2100 Assumptions Interest Rate Square Feet Lighting Power Density (Wift) Hours of operation Energy cost (per kWh) Annual Energy used (kWh) Controls Savings (%)" Annual Energy Cost Annual Energy Cost Savings -0.11 = $C$3"[04/1000)*D5 = $C$3 (E4/1000)'E5 = (C6D71" (1-08) =D9-E9 = $C$6'E7 Capital Install Cost (lighting) Install Cost (controls)" Contigency (10%) Total Capital Cost Initial Payment (15%) Total Financed =0.1012 = (SUMD12:014)) =D15'0.15 =D15-D16 -2000 -3000 Operations Annual Relamping" Ballast Replacement" Other Costs" Total Op Cost =SUM(D19:D21) = (SUM(E 19:E21 Loan Amount Interest Rate Period (term in months) Compounding periods (year) Monthly Payment =D17 = $C$2 120 12 =PMT(C26/C28,C27,-C25) End of month