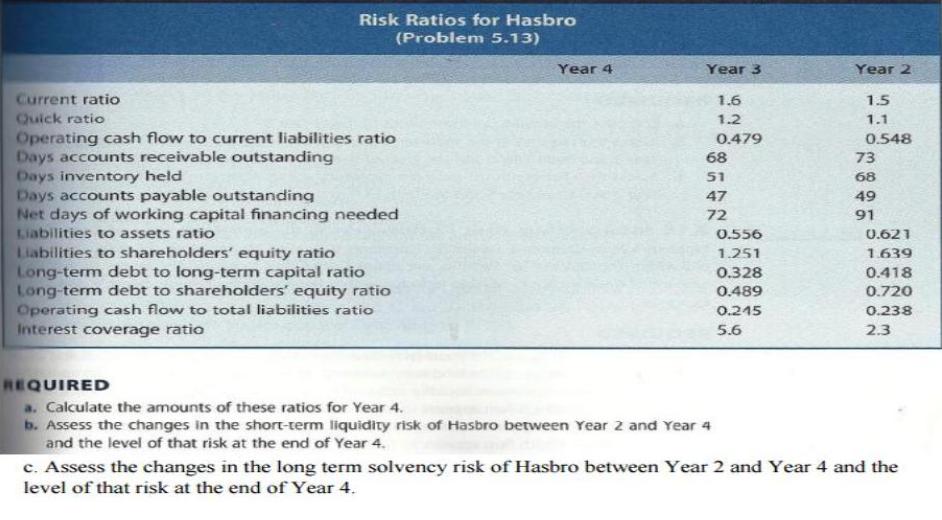

Risk Ratios for Hasbro (Problem 5.13) Year 4 Year 3 Year 2 Current ratio Quick ratio Operating cash flow to current liabilities ratio Days

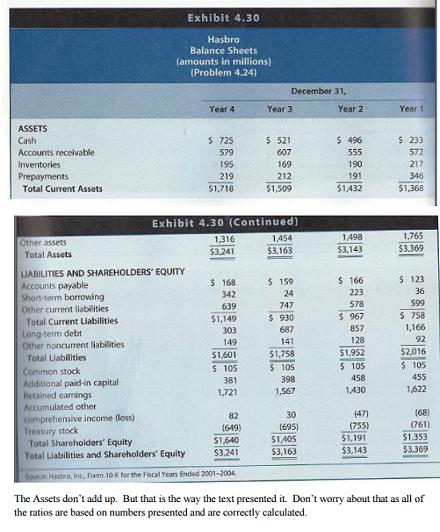

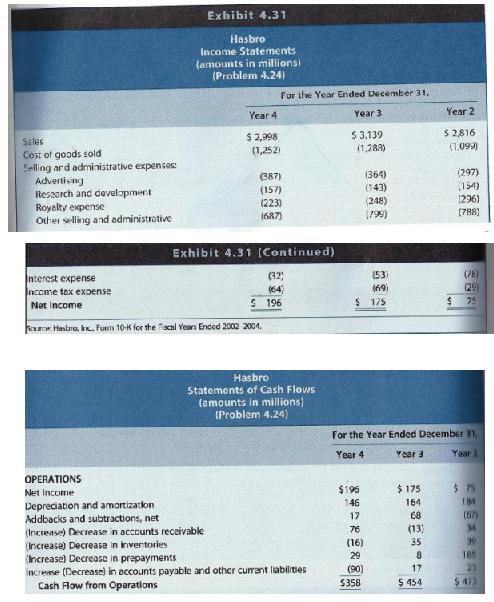

Risk Ratios for Hasbro (Problem 5.13) Year 4 Year 3 Year 2 Current ratio Quick ratio Operating cash flow to current liabilities ratio Days accounts receivable outstanding Days inventory held Days accounts payable outstanding Net days of working capital financing needed Liabilities to assets ratio Liabilities to shareholders' equity ratio Long-term debt to long-term capital ratio Long-term debt to shareholders' equity ratio Operating cash flow to total liabilities ratio Interest coverage ratio 1.6 1.5 1.2 1.1 0.479 0.548 68 73 51 68 47 49 72 91 0.556 0.621 1.251 1639 0.328 0.418 0.489 0.720 0.215 0.238 5.6 2.3 REQUIRED a. Calculate the amounts of these ratios for Year 4. b. Assess the changes in the short-term liquidity risk of Hasbro between Year 2 and Year 4 and the level of that risk at the end of Year 4. c. Assess the changes in the long term solvency risk of Hasbro between Year 2 and Year 4 and the level of that risk at the end of Year 4. Exhibit 4.30 Hasbro Balance Sheets (amounts in millions) (Problem 4.24) December 31, Year 4 Year 3 Year 2 Year 1 1111 ASSETS $ 496 $ 725 579 $ 233 572 217 Cash $ 521 Accounts recelvable 607 555 169 212 Inventories 195 190 346 $1,368 Prepayments 219 191 Total Current Assets $1,718 $1,509 $1,432 Exhibit 4.30 (Continued) 1,316 $3.241 1,765 $3,369 1454 1,498 Other assets $3,163 $3,143 Total Assets LIABILITIES AND SHAREHOLDERS' EQUITY Accounts payable Short-term borrowing Other current liabilities Total Current Liabilities Long-term debt Other noncurrent llabilities Total Liabilities Common stock Additional paid-in capital Retained earmings Accumulated other comprehensive income (loss) Treasury stock Total Shareholders' Equity Total Liabilities and Shareholders' Equity $ 168 $ 159 S 166 $ 123 342 24 223 36 639 747 578 599 $ 967 5 758 $1,149 303 $ 930 687 857 1,166 149 141 128 92 $1,601 $1,758 51,952 $2,016 $ 105 $ 105 $ 105 458 $ 105 381 398 455 1,721 1,567 1,430 1,622 (68) (761) $1,353 $3.369 82 30 (47) (755) $1,191 $3,143 (695) (649) 51,640 $3,241 $1,405 $3,163 Sce Hanbre, Inc. Fom 10K for the Fiscal Years Ended 2001-2004. The Assets don't add up. But that is the way the text presented it Don't worry about that as all of the ratios are bascd on numbers presented and are correctly calculated. Exhibit 4.31 Hasbro Income Statements (amounts in millions (Problem 4.24) For the Year Ended December 31, Year 3 Year 2 Year 4 $ 2,998 (1,252) $ 3,139 (1,288) $2,816 (1.09) Sales Cost of goods sold Selling ard administrative expenses: Advertising Ressarch and development (387) (364) (297) (157) (143) 154) (248) (799) 1296) (223) Royalty expense Other selling and administrative [788) (687) Exhibit 4.31 (Continued) (76) (29) 75 (53) Interest expense Income tex expense Net Income (32 (64) (69) S 196 175 Ka Haslara, k. Funn 10-K for the facal Years Ended 2002 2004. Hasbro Statements of Cash Flows (amounts in millions) (Problem 4.24) For the Year Ended December 31, Year 4 Year 3 Yar 1 OPERATIONS $ 175 $ 75 184 (67) Net income $195 146 164 Depreciation and amortization Addbacks and subtractions, net 17 68 (Inciease) Deciease in accounts receivable 76 (13) 30 185 23 $ 173 35 (Increasa) Decrease in invertories (Increase) Decrease in propayments ncreme (Cecrease) in accounts payable and other currant liabilities Cash Alow from Operations (16) 29 8 (90) 17 $358 $ 454

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Calculate the amounts of ratios for year 4 Risk ratios for Hasbro ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started