answer the questions using the information given

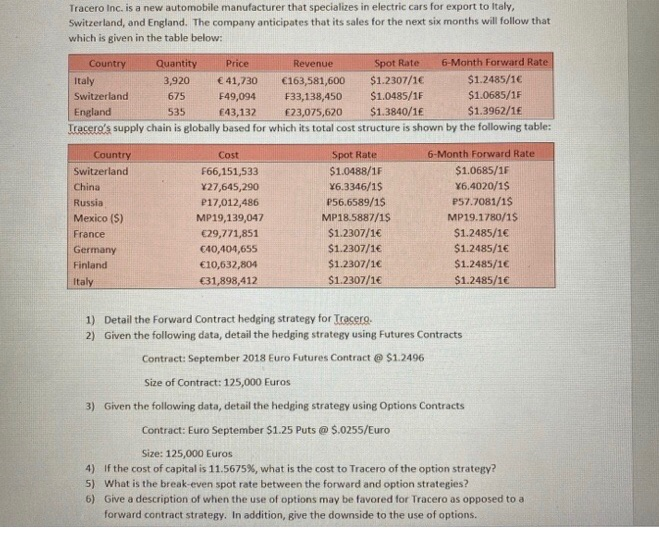

Tracero Inc. is a new automobile manufacturer that specializes in electric cars for export to Italy, Switzerland, and England. The company anticipates that its sales for the next six months will follow that which is given in the table below: Country Quantity Price Revenue Spot Rate 6 Month Forward Rate Italy 3,920 41,730 163,581,600 $1.2307/1 $1.2485/16 675 549,094 F33,138,450 $1.0485/1F $1.0685/1F England 43,132 23,075,620 $1.3840/18 $1.3962/16 Tracero's supply chain is globally based for which its total cost structure is shown by the following table: 535 Country Cost Switzerland China Russia Mexico (S) France Germany Finland Italy F66,151,533 Y27,645,290 P17,012,486 MP19,139,047 29,771,851 40,104,655 10,632,804 31,898,412 Spot Rate $1.0488/1F X6 3346/15 P56.6589/15 MP18.5887/19 $1.2307/1 $1.2307/1 $1.2307/1 $1.2307/1 6-Month Forward Rate $1.0685/16 26.4020/15 P57.7081/15 MP19.1780/15 $1.2485/16 $1.2485/1 $1.2485/10 $1.2485/1 1) Detail the Forward Contract hedging strategy for Tracero. 2) Given the following data, detail the hedging strategy using Futures Contracts Contract: September 2018 Euro Futures Contract @ $1.2496 Size of Contract: 125,000 Euros 3) Given the following data, detail the hedging strategy using Options Contracts Contract: Euro September $1.25 Puts @ 5.0255/Euro Size: 125,000 Euros 4) If the cost of capital is 11.5675%, what is the cost to Tracero of the option strategy? 5) What is the break-even spot rate between the forward and option strategies? 6) Give a description of when the use of options may be favored for Tracero as opposed to a forward contract strategy. In addition, give the downside to the use of options. Tracero Inc. is a new automobile manufacturer that specializes in electric cars for export to Italy, Switzerland, and England. The company anticipates that its sales for the next six months will follow that which is given in the table below: Country Quantity Price Revenue Spot Rate 6 Month Forward Rate Italy 3,920 41,730 163,581,600 $1.2307/1 $1.2485/16 675 549,094 F33,138,450 $1.0485/1F $1.0685/1F England 43,132 23,075,620 $1.3840/18 $1.3962/16 Tracero's supply chain is globally based for which its total cost structure is shown by the following table: 535 Country Cost Switzerland China Russia Mexico (S) France Germany Finland Italy F66,151,533 Y27,645,290 P17,012,486 MP19,139,047 29,771,851 40,104,655 10,632,804 31,898,412 Spot Rate $1.0488/1F X6 3346/15 P56.6589/15 MP18.5887/19 $1.2307/1 $1.2307/1 $1.2307/1 $1.2307/1 6-Month Forward Rate $1.0685/16 26.4020/15 P57.7081/15 MP19.1780/15 $1.2485/16 $1.2485/1 $1.2485/10 $1.2485/1 1) Detail the Forward Contract hedging strategy for Tracero. 2) Given the following data, detail the hedging strategy using Futures Contracts Contract: September 2018 Euro Futures Contract @ $1.2496 Size of Contract: 125,000 Euros 3) Given the following data, detail the hedging strategy using Options Contracts Contract: Euro September $1.25 Puts @ 5.0255/Euro Size: 125,000 Euros 4) If the cost of capital is 11.5675%, what is the cost to Tracero of the option strategy? 5) What is the break-even spot rate between the forward and option strategies? 6) Give a description of when the use of options may be favored for Tracero as opposed to a forward contract strategy. In addition, give the downside to the use of options