Answered step by step

Verified Expert Solution

Question

1 Approved Answer

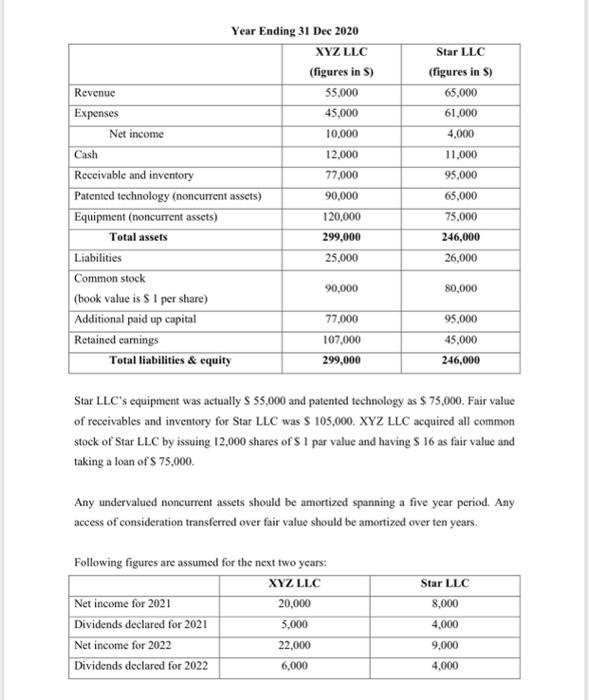

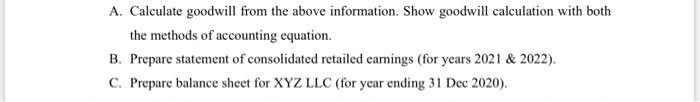

answer the questions Year Ending 31 Dec 2020 XYZ LLC (figures in ) Revenue 55.000 Expenses 45,000 Net income 10,000 Cash 12.000 Receivable and inventory

answer the questions

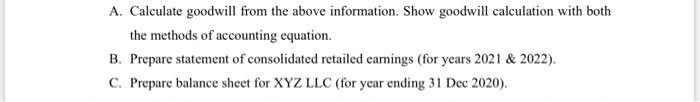

Year Ending 31 Dec 2020 XYZ LLC (figures in ) Revenue 55.000 Expenses 45,000 Net income 10,000 Cash 12.000 Receivable and inventory 77,000 Patented technology (noncurrent assets) 90,000 Equipment (noncurrent assets) 120.000 Total assets 299,000 Liabilities 25,000 Common stock 90,000 (book value is S1 per share) Additional paid up capital 77.000 Retained earnings 107,000 Total liabilities & equity 299,000 Star LLC (figures in ) 65,000 61,000 4,000 11,000 95,000 65,000 75,000 246,000 26,000 80,000 95,000 45.000 246,000 Star LLC's equipment was actually S 55,000 and patented technology as $ 75,000. Fair value of receivables and inventory for Star LLC was S 105,000, XYZ LLC acquired all common stock of Star LLC by issuing 12,000 shares of 1 par value and having $ 16 as fair value and taking a loan of's 75,000 Any undervalued noncurrent assets should be amortized spanning a five year period. Any access of consideration transferred over fair value should be amortized over ten years. Following figures are assumed for the next two years: XYZ LLC Net income for 2021 20,000 Dividends declared for 2021 5,000 Net income for 2022 22.000 Dividends declared for 2022 6,000 Star LLC 8,000 4,000 9,000 4,000 A. Calculate goodwill from the above information. Show goodwill calculation with both the methods of accounting equation. B. Prepare statement of consolidated retailed earnings (for years 2021 & 2022). C. Prepare balance sheet for XYZ LLC (for year ending 31 Dec 2020). Year Ending 31 Dec 2020 XYZ LLC (figures in ) Revenue 55.000 Expenses 45,000 Net income 10,000 Cash 12.000 Receivable and inventory 77,000 Patented technology (noncurrent assets) 90,000 Equipment (noncurrent assets) 120.000 Total assets 299,000 Liabilities 25,000 Common stock 90,000 (book value is S1 per share) Additional paid up capital 77.000 Retained earnings 107,000 Total liabilities & equity 299,000 Star LLC (figures in ) 65,000 61,000 4,000 11,000 95,000 65,000 75,000 246,000 26,000 80,000 95,000 45.000 246,000 Star LLC's equipment was actually S 55,000 and patented technology as $ 75,000. Fair value of receivables and inventory for Star LLC was S 105,000, XYZ LLC acquired all common stock of Star LLC by issuing 12,000 shares of 1 par value and having $ 16 as fair value and taking a loan of's 75,000 Any undervalued noncurrent assets should be amortized spanning a five year period. Any access of consideration transferred over fair value should be amortized over ten years. Following figures are assumed for the next two years: XYZ LLC Net income for 2021 20,000 Dividends declared for 2021 5,000 Net income for 2022 22.000 Dividends declared for 2022 6,000 Star LLC 8,000 4,000 9,000 4,000 A. Calculate goodwill from the above information. Show goodwill calculation with both the methods of accounting equation. B. Prepare statement of consolidated retailed earnings (for years 2021 & 2022). C. Prepare balance sheet for XYZ LLC (for year ending 31 Dec 2020)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started