Answer them all with explanation and I will upvote your answer if it was right. Thanks :D

Answer them all with explanation and I will upvote your answer if it was right. Thanks :D

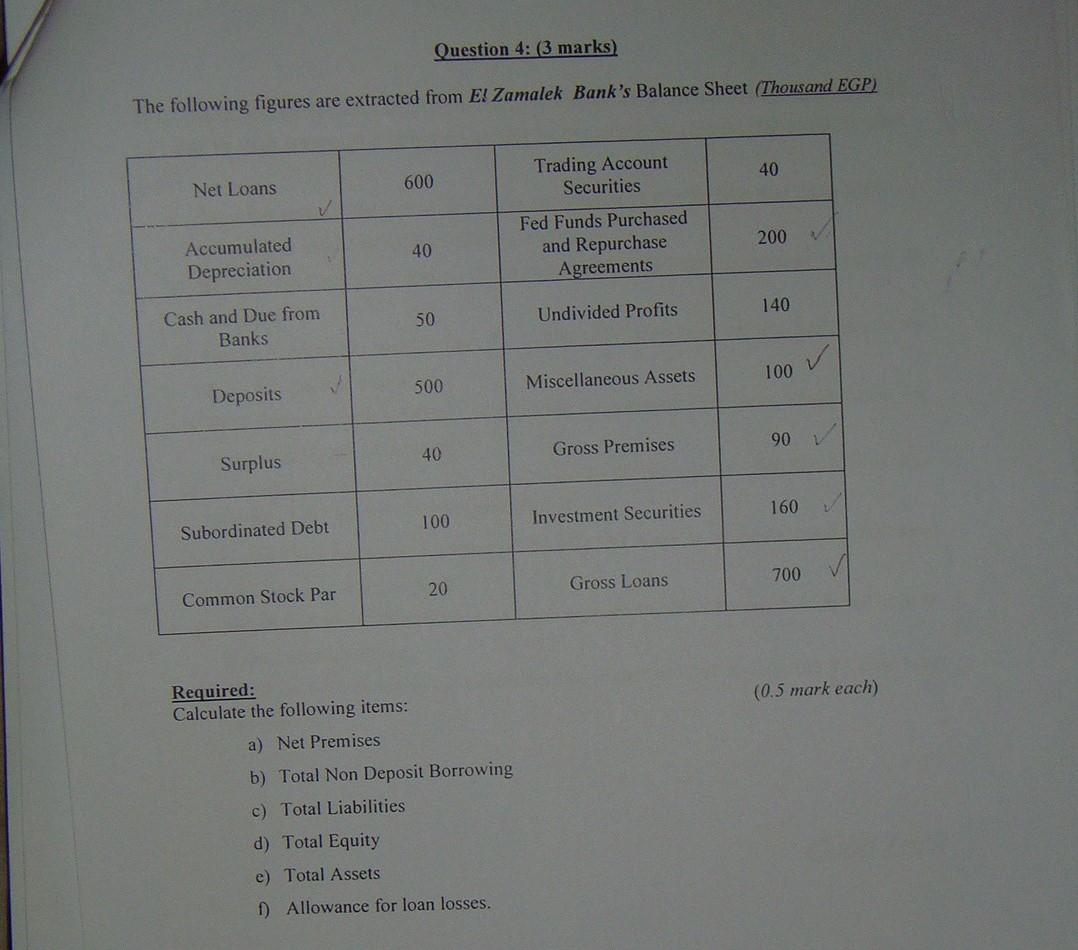

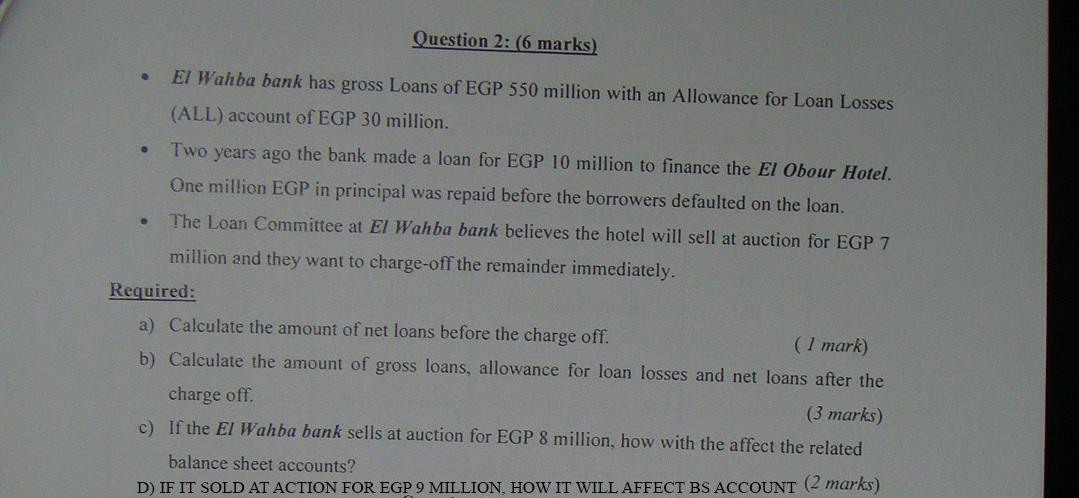

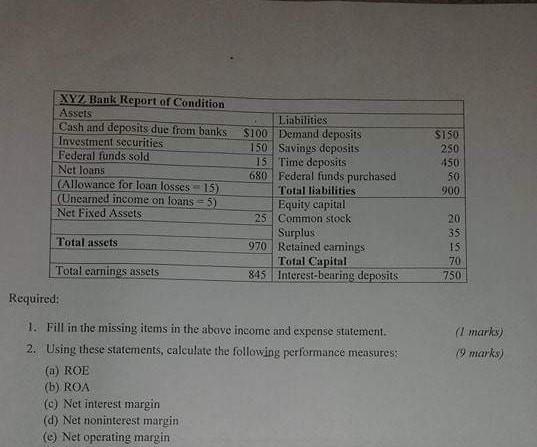

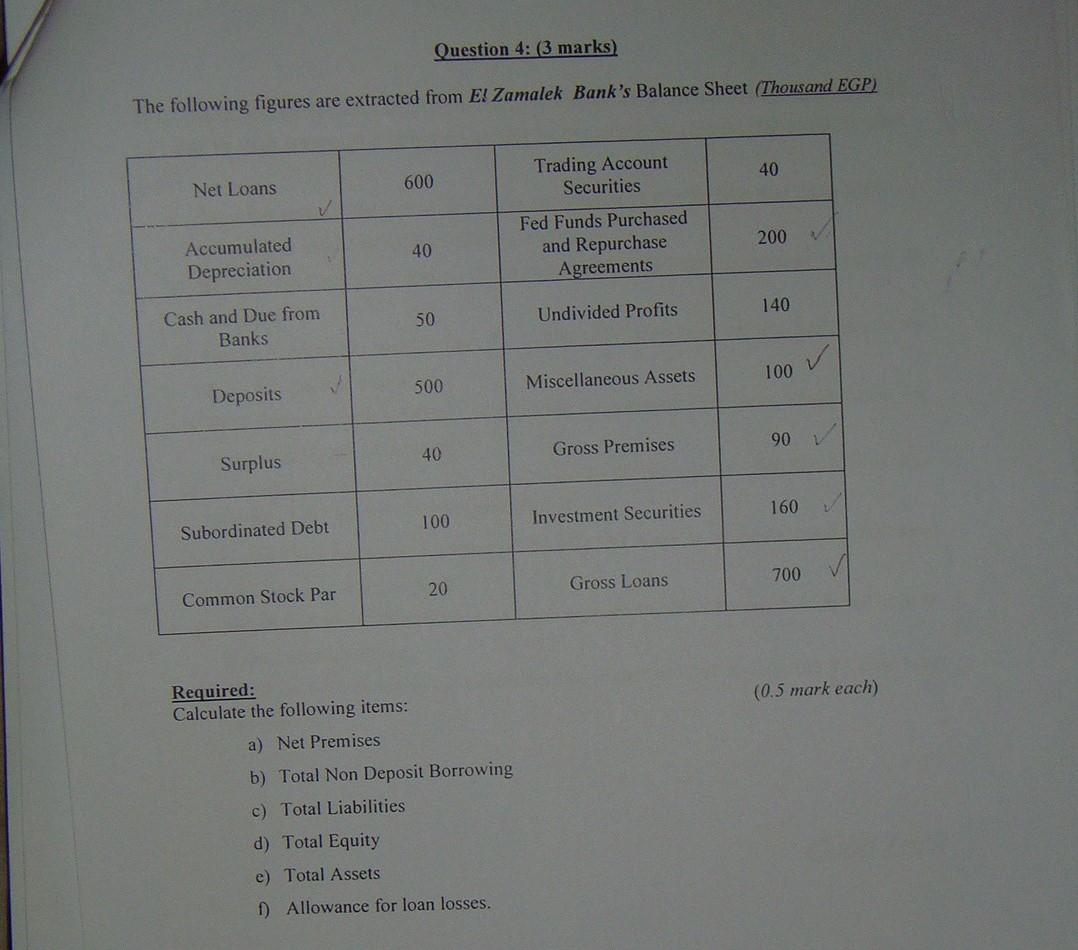

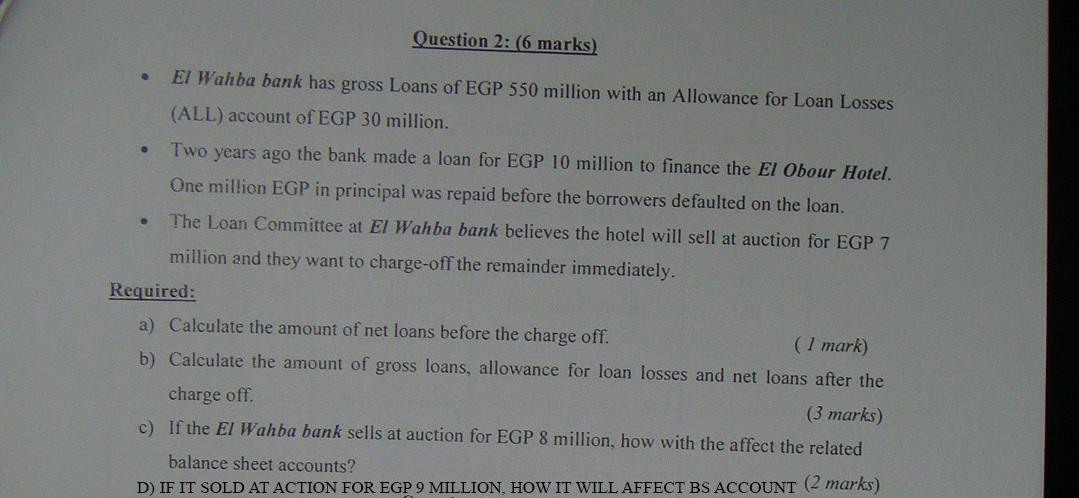

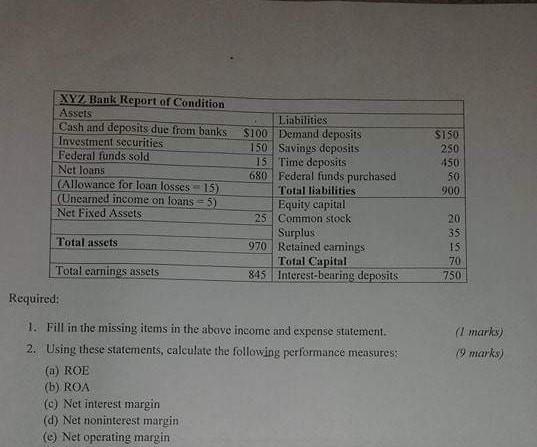

XYZ-Bauk Report of Condition Assets Cash and deposits due from banks Investment securities Federal funds sold Net loans (Allowance for loan losses 15 (Unearned income on loans = 5) Net Fixed Assets SISO 250 450 50 900 Liabilities $100 Demand deposits 150 Savings deposits 15 Time deposits 680 Federal funds purchased Total liabilities Equity capital 25 Common stock Surplus 970 Retained earings Total Capital 845. Interest-bearing deposits Total assets 20 35 15 70 750 Total earnings assets Required: 1. Fill in the missing items in the above income and expense statement. 2. Using these statements, calculate the following performance measures: (1 marks) 19 marks) (a) ROE (b) ROA c) Net interest margin (d) Net noninterest margin (O) Net operating margin Question 4: (3 marks) The following figures are extracted from El Zamalek Bank's Balance Sheet (Thousand EGP) 40 Trading Account Securities Net Loans 600 200 40 Accumulated Depreciation Fed Funds Purchased and Repurchase Agreements 140 50 Undivided Profits Cash and Due from Banks 100 500 Miscellaneous Assets Deposits 90 40 Gross Premises Surplus 160 100 Investment Securities Subordinated Debt 20 700 Gross Loans Common Stock Par (0.5 mark each) Required: Calculate the following items: a) Net Premises b) Total Non Deposit Borrowing c) Total Liabilities d) Total Equity e) Total Assets 1) Allowance for loan losses. Question 2: 6 marks) . EI Wahba bank has gross Loans of EGP 550 million with an Allowance for Loan Losses (ALL) account of EGP 30 million. Two years ago the bank made a loan for EGP 10 million to finance the El Obour Hotel. One million EGP in principal was repaid before the borrowers defaulted on the loan. The Loan Committee at El Wahba bank believes the hotel will sell at auction for EGP 7 million and they want to charge-off the remainder immediately. Required: a) Calculate the amount of net loans before the charge off. (1 mark) b) Calculate the amount of gross loans, allowance for loan losses and net loans after the charge off. (3 marks) c) If the El Wahba bank sells at auction for EGP 8 million, how with the affect the related balance sheet accounts? D) IF IT SOLD AT ACTION FOR EGP 9 MILLION, HOW IT WILL AFFECT BS ACCOUNT (2 marks) XYZ-Bauk Report of Condition Assets Cash and deposits due from banks Investment securities Federal funds sold Net loans (Allowance for loan losses 15 (Unearned income on loans = 5) Net Fixed Assets SISO 250 450 50 900 Liabilities $100 Demand deposits 150 Savings deposits 15 Time deposits 680 Federal funds purchased Total liabilities Equity capital 25 Common stock Surplus 970 Retained earings Total Capital 845. Interest-bearing deposits Total assets 20 35 15 70 750 Total earnings assets Required: 1. Fill in the missing items in the above income and expense statement. 2. Using these statements, calculate the following performance measures: (1 marks) 19 marks) (a) ROE (b) ROA c) Net interest margin (d) Net noninterest margin (O) Net operating margin Question 4: (3 marks) The following figures are extracted from El Zamalek Bank's Balance Sheet (Thousand EGP) 40 Trading Account Securities Net Loans 600 200 40 Accumulated Depreciation Fed Funds Purchased and Repurchase Agreements 140 50 Undivided Profits Cash and Due from Banks 100 500 Miscellaneous Assets Deposits 90 40 Gross Premises Surplus 160 100 Investment Securities Subordinated Debt 20 700 Gross Loans Common Stock Par (0.5 mark each) Required: Calculate the following items: a) Net Premises b) Total Non Deposit Borrowing c) Total Liabilities d) Total Equity e) Total Assets 1) Allowance for loan losses. Question 2: 6 marks) . EI Wahba bank has gross Loans of EGP 550 million with an Allowance for Loan Losses (ALL) account of EGP 30 million. Two years ago the bank made a loan for EGP 10 million to finance the El Obour Hotel. One million EGP in principal was repaid before the borrowers defaulted on the loan. The Loan Committee at El Wahba bank believes the hotel will sell at auction for EGP 7 million and they want to charge-off the remainder immediately. Required: a) Calculate the amount of net loans before the charge off. (1 mark) b) Calculate the amount of gross loans, allowance for loan losses and net loans after the charge off. (3 marks) c) If the El Wahba bank sells at auction for EGP 8 million, how with the affect the related balance sheet accounts? D) IF IT SOLD AT ACTION FOR EGP 9 MILLION, HOW IT WILL AFFECT BS ACCOUNT (2 marks)

Answer them all with explanation and I will upvote your answer if it was right. Thanks :D

Answer them all with explanation and I will upvote your answer if it was right. Thanks :D