Answer these

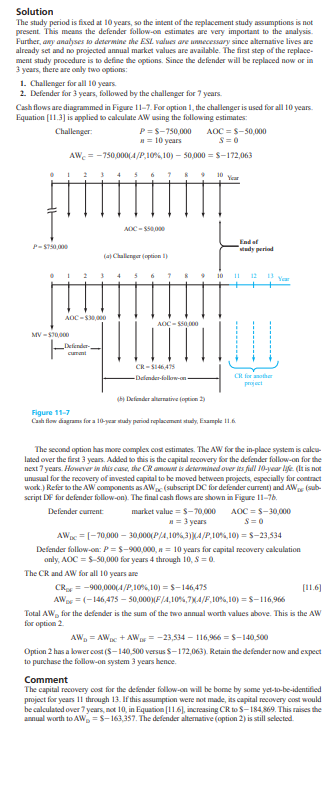

A pulp and paper company is evaluating whether it should retain the current bleaching process that uses chlorine dioxide or replace it with a proprie- tary "oxypure" process. The relevant information for each process is shown, Use an interest rate of 13% per year to perform the replacement study Current Process Oxypure Process Original cost 6 -450,000 years ago, 5 Investment cost -700,00D now, $ Current market 35 000 value, $ Annual operating - INI,OOD -7070OD Sahage value, $ 50,DOD Remaining life, YearsBinHealth, a biodevice systems leasing company, is considering a new equipment purchase to re- place a currently owned asset that was purchased 2 years ago for $250,000, It is appraised at a cur- rent market value of only $50,000. An upgrade is possible for $200,000 now that would be adequate for another 3 years of lease rights, after which the entire system could be sold on the international circuit for an estimated $40,000. The challenger, which can be purchased for $300,000, has an ex- pected life of 10 years and a $50,000 salvage value. Determine whether the company should up- grade or replace at a MARR of 12%% per year. As- summe the AOC estimates are the same for both alternatives. For the estimates in Problem 11.30, use a spreadsheet-based analysis to determine the first cost for the augmentation of the current system that will make the defender and challenger break even. Is this a maximum of minimum for the up- grade, if the current system is to be retained? Herald Richter and Associates, 3 years ago, pur- chased for $45,000 a microwave signal graphical plotter for corrosion detection in concrete struce bores. It is expected to have the market values and annual operating costs shown below for its rc- maining usefial life of up to 3 years. It could be traded now at an appraised market value of $8000. Market Value AOC at End of Year, $ $ per Year 6000 -50,000 4000 DOO'ES A replacement plotter with new Internet-based, digital technology costing $125,000 has an esti- mated $10,000 salvage value after its 3-year life and an AOC of $31,000 per year. At an interest rate of 15%% per year, determine how many more yearsSolution The study period is fixed at 10 years, so the intent of the replacement study assumptions is not present. This means the defender follow-on estimates are very important to the analysis. Further, any analyses to determine the ESL values are unnecessary since alternative lives are already set and no projected annual market values are available. The first step of the replace- ment study procedure is to define the options. Since the defender will be replaced now or in 3 years, there are only two options: 1. Challenger for all 10 years. 1. Defender for 3 years, followed by the challenger for 7 years. Cash flows are diagrammed in Figure 11-7. For option I, the challenger is used for all 10 years. Equation [1 1.3] is applied to calculate AW using the following estimates: Challenger: P =$-750,000 AOC = $-50,000 # = 10 years S=0 AW, = -750,000(4/P,10%,10) - 507000 = $-172,063 10 ADC - $56000 End of study period fat Challenger |option IF 11 Year AOC -30 0U _Defender- current CR - 5146475 -Defender-fallow-an 4hy Defender alternative [option ?) Figure 11-7 Cash flow diagrams for a 10-year mudy period replacement study, Example II.6. The second option has more complex cost estimates. The AW for the in-place system is calcu- lated over the first 3 years. Added to this is the capital recovery for the defender follow-on for the next 7 years. However is this case, the CR amown is determined over its full 10-year Me. (It is not unusual for the recovery of invested capital to be moved between projects, especially for contract work.) Refer to the AW components as AWp (subscript DC for defender current) and AW (sub- script DF for defender follow-on). The final cash flows are shown in Figure 11-76. Defender current market value = $-70,000 AOC =$-30,000 a =3 years AWac = [-70,000 - 30,000(P/4, 10%,3) (4/P.10%,10) = $-23,534 Defender follow-on: P = $-900,000, a = 10 years for capital recovery calculation only, AOC = $-50,000 for years 4 through 10, 8 = 0. The CR and AW for all 10 years are CROF = -900,00014/P,10%%,101 = $-146,475 [11.6] AWDE =(-146,475 - 50,000)(F/4,10%,7)(4/F,10%,10) = $-116,966 Total AW, for the defender is the sum of the two annual worth values above. This is the AW for option 2 AW = AWac + AW = -23,534 - 116,956 =$-140,500 Option 2 has a lower cost ($-140,300 versus $-172,063). Retain the defender now and expect to purchase the follow-on system 3 years hence. Comment The capital recovery cost for the defender follow-on will be home by some yet-to-be-identified project for years 10 through 13. If this assumption were not made, its capital recovery cost would be calculated over 7 years, not 10, in Equation [1 1 6], increasing CR to $-184,869. This raises the annual worth to AW,, = $-163,357. The defender alternative (option 2) is still selected.\f\f