Answer these

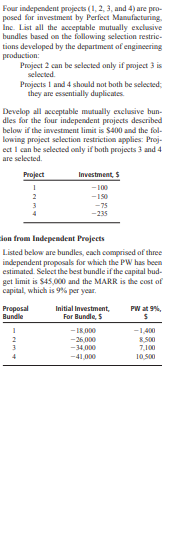

In our progressive example, B&T Enterprises is considering the replacement of a 2-year-old kiln with a new one to meet emerging market needs. When the current tunnel kiln was pur- chased 2 years ago for $25 million, an ESL study indicated that the minimum cost life was be- tween 3 and 5 years of the expected 8-year life. The analysis was not very conclusive because the total AW cost curve was flat for most years between 2 and 6, indicating insensitivity of the ESL to changing costs. Now, the same type of question arises for the proposed graphite hearth model that costs $38 million new: What are the ESL and the estimated total AW of costs? The Manager of Critical Equipment at B&T estimates that the market value after only 1 year will drop to $25 million and then retain 75% of the previous year's value over the 12-year expected life. Use this market value series and i = 15% per year to illustrate that an ESL analysis and marginal cost analysis result in exactly the same total AW of cost series.A pulp and paper company is evaluating whether it should retain the current bleaching process that uses chlorine dioxide or replace it with a proprie- tary "oxypure" process. The relevant information for each process is shown, Use an interest rate of 13% per year to perform the replacement study Current Process Oxypure Process Original cost 6 -450,000 years ago, 5 Investment cost -700,00D now, $ Current market 35 000 value, $ Annual operating - INI,OOD -7070OD Sahage value, $ 50,DOD Remaining life, YearsFour independent projects ( 1, 2, 3, and 4) are pro- posed for investment by Perfect Manufacturing Inc. List all the acceptable mutually exclusive bundles based on the following selection restric tions developed by the department of engineering production: Project 2 can be selected only if project 3 is selected. Projects 1 and 4 should not both be selected; they are essentially duplicates Develop all acceptable mutually exclusive bun- dles for the four independent projects described below if the investment limit is $400 and the fol- lowing project selection restriction applies: Proj- ect I can be selected only if both projects 3 and 4 are selected. Project Investment, $ -100 -75 -235 ion from Independent Projects Listed below are bundles, each comprised of three independent proposals for which the PW has been estimated. Select the best bundle if the capital bud- get limit is $45,000 and the MARK is the cost of capital, which is 9% per year. Proposal Initial Investment, Bundle For Bundle, $ -1,400 -36 000 8 50O -34 000 -41 000 10.500\f\f