Answer these

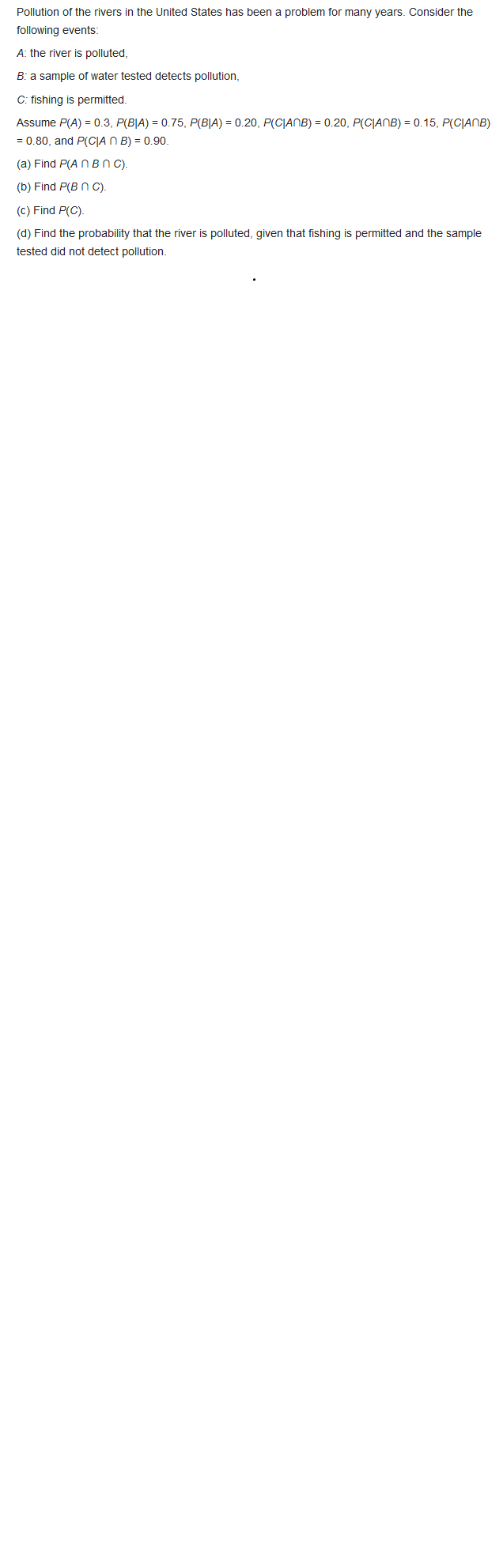

In planning a plant expansion, MedImmune has an economic decision to make-upgrade the existing controlled-environment rooms or purchase new ones. The presently owned ones were purchased 4 years ago for $250,000. They have a current "quick sale" value of $20,000, but for an investment of $100,000 now, they would be adequate for another 4 years, after which they would be sold for $40,000. Alternatively, new controlled-environment rooms could be purchased at a cost of $270,000. They are expected to have a 10-year life with a $50,000 sal- vage value at that time. Determine whether the company should upgrade or replace. Use a MARR of 20% per year. Three years ago, Will Gas Controls purchased equipment for $80,000 that was expected to have a useful life of 3 years with a $9000 salvage value. Increased demand necessitated an upgrade costing $30,000 one year ago. Technology changes now re- quire that the equipment be upgraded again for an- other $25,000 so that it can be used for 3 more years. Its annual operating cost will be $47,000, and it will have a $22,000 salvage after 3 years. Allema- tively, it can be replaced with new equipment that will cost $68 000 with operating costs of $35,000 per year and a salvage value of $21,000 after 3 years. If replaced now, the existing equipment will he sold for $9000. Calculate the annual worth of the defender at an interest rate of 10%% per yearKeep or Replace the Kiln Case PE In Example 1 1.8, the in-place kiln and replacement killm (GH) were evaluated using a fixed study pe- riod of & years. This is a significantly shortened period compared to the expected 12-year life of the challenger. Use the best estimates available throughout this case to determine the impact on the capital recovery amount for the GH kiln of short- ening the evaluation time from 12 to 6 years. Nabisco Bakers currently employs staff to operate the equipment used to sterilize much of the mixing, baking, and packaging facilities in a large cookie and cracker manufacturing plant in lowa. The plant manager, who is dedicated to cutting costs but not sacrificing quality and hygiene, has the projected data shown in the table below if the current system were retained for up to its maximum expected life of 3 years. A contract company has proposed a turnkey sanitation system for $5 0 million per year if Nabisco signs on for 4 to 10 years, and $5.$ mil- ion per year for a shorter number of years. Retained AM, $ per Year Close.Down Expense, $ -3,000,000 -2,300,000 -2 500,000 -2,300,000 -2 000,000 -3,000,000 -1,000 00D -3,000,000 -1,000,000 -3 5001000 -500,000 (4) At a MARR = 8% per year, perform a re- placement study for the plant manager with fixed study period of 3 years, when it is an- ticipated that the plant will be shut down due to the age of the facility and projected tech- nological obsolescence. As you perform the study, take into account that regardless of the number of years that the current sanitation system is retained, a one-time close-downWe continue with the progressive example of possibly replacing a kiln at B&T Enterprises. A marketing study revealed that the improving business activity on the west coast implies that the revenue profile between the installed kiln (PT) and the proposed new one (GH) would be the same, with the new kiln possibly bringing in new revenue within the next couple of years. The president of B&T decided it was time to do a replacement study. Assume you are the lead engineer and that you previously completed the ESL analysis on the challenger (Exam- ple 11 3) It indicates that for the GH system the ESL is its expected useful life. Challenger: ESLA = 12 years with total equivalent annual cost AW= $-12.32 million The president asked you to complete the replacement study, stipulating that, due to the rapidly rising annual operating costs (AOC), the defender would be retained a maximum of 6 years. You are expected to make the necessary estimates for the defender (PT) and perform the study at a 15%% per year retum.Providing restrooms at parks, zoos, and other city- owned recreation facilities is a considerable ex- pense for municipal governments. City councils usually opt for permanent restrooms in larger parks and portable re smaller ones. The cost of renting and servicing a portable restroom 15 57300 per year. In one northeastern municipal- ity, the parks director informed th that the cost of constru restroom is $218,000 and the is $12,000. He remarked that the rather high cost is due to the necessity to use c e materials that are tailored to minimize damage from vandalism that often oc- curs in unattended public facilities. If the useful life of a permanent restroom is assumed to be 20 years, how many portable restrooms could the city afford to rent each year and break even with the cost of one permanent facility? Let the interest rate be 6% per year.\f