Answer these

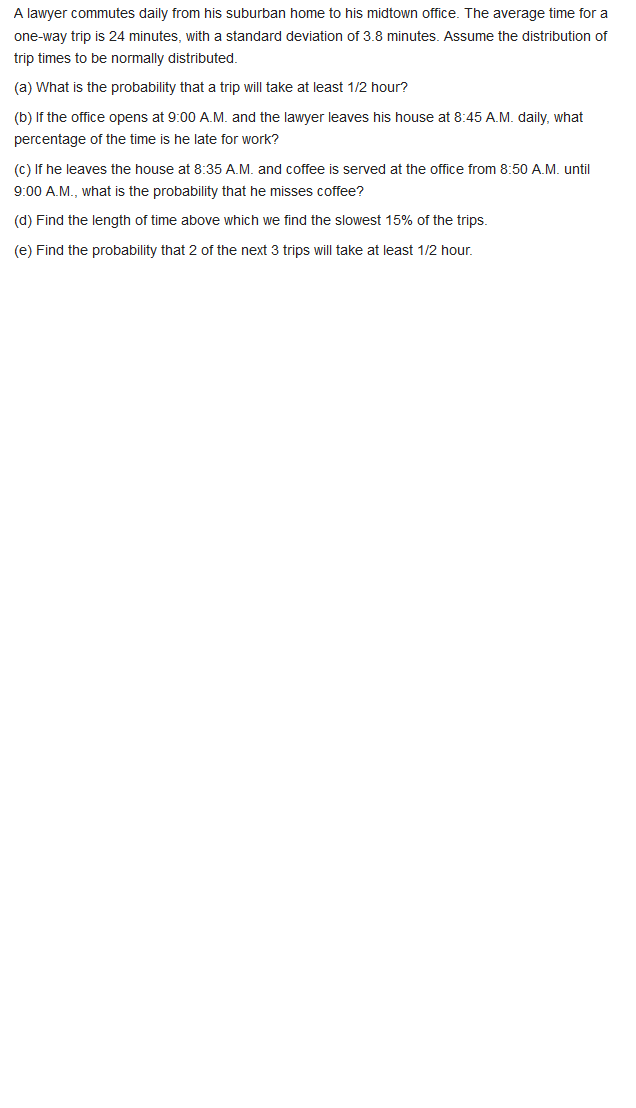

In the opportunity cost approach to replacement analysis, what does the opportunity refer to? State what is meant by the cash flow approach in replacement analysis, and list two reasons why it is not a good idea to use this method. icement Study over a Specified Study Period ABB Communications is considering replacing equipment that had a first cost of $300,000 five years ago. The company CBD wants to know if the equipment should be replaced now or at any other time over the next 3 years to minimi the cost of producing mis sors. Since the pic it or the proposed equipment can be used for any or all of the 3-year period, one of the company's industrial engineers produced AW cost information for the defender and challenger as shown below. The values repre- sent the annual costs of the respective equipment if used for the indicated number of years. Determine when the defender should be replaced to minimize the cost to ABB for the 3-year study period using an interest rate of 10%6 per year. AW If Kept Stated Number of Number of Years, $ per Year Years Kept Defender Challenger -22,DOD -29,000 -24,DOD -27,DOD -25,000Hydrochloric acid, which flames at room tempers- tures, creates a very corrosive work environment, causing steel tools to must and equipment to fail prematurely. A distillation system purchased 4 years ago for $80,000 can be used for only 2 more years, at which time it will be scrapped with no value. Its operating cost is $75,000 per year. A more corrosion-resistant challenger will cost $220,000 with an operating cost of $49,000 per year. It is expected to have a $30,000 salvage value after its 6-year ESI. At an interest rate of 10%% per year, what minimum replacement value now for the present system will render the chal- longer attractive? Engine oil purifier machines can effectively re- move acid, pitch, particles, water, and gas from used oil. Purifier A was purchased 5 years ago for $90 000. Its operating cost is higher than expected, to if it is not replaced ly be used for only 3 more years. Its operating cost this year will be $140,000, increasing by $2000 per year through the end of its useful life, at which time it will be donated for its recyclable scrap value. A more ef- ficient challenger, purifier B, will cost $130,000 with a $50,000 salvage value after its &-year ESL. Its operating cost is expected to be $82,000 for year 1, increasing by $500 per year thereafter. What is the market value for A that will make the two purifiers equally attractive at an interest rate of 12%% per year?We continue with the progressive example of possibly replacing a kiln at B&T Enterprises. A marketing study revealed that the improving business activity on the west coast implies that the revenue profile between the installed kiln (PT) and the proposed new one (GH) would be the same, with the new kiln possibly bringing in new revenue within the next couple of years. The president of B&T decided it was time to do a replacement study. Assume you are the lead engineer and that you previously completed the ESL analysis on the challenger (Exam- ple 11 3) It indicates that for the GH system the ESL is its expected useful life. Challenger: ESLA = 12 years with total equivalent annual cost AW= $-12.32 million The president asked you to complete the replacement study, stipulating that, due to the rapidly rising annual operating costs (AOC), the defender would be retained a maximum of 6 years. You are expected to make the necessary estimates for the defender (PT) and perform the study at a 15%% per year retum.The annual worth values for a defender, which can be replaced with a similar used asset, and a chal. lenger are estimated. The defender should be re- placed: [a) Now (b) I year from now (c) 2 years from now () 3 years from now Number of AW Value, $ per Year Years Retained Defender Challenger -14,000 -21,000 OnC'EI- -16,900 -13,100 -17,000 -15 600 -18,000 - IT SOO\f