Answer these

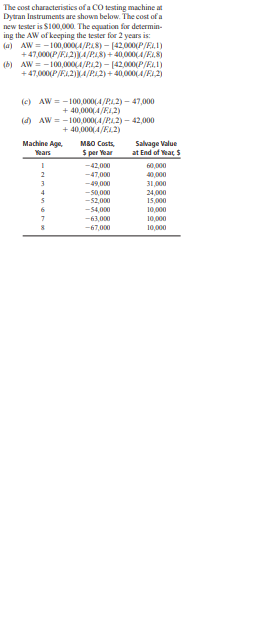

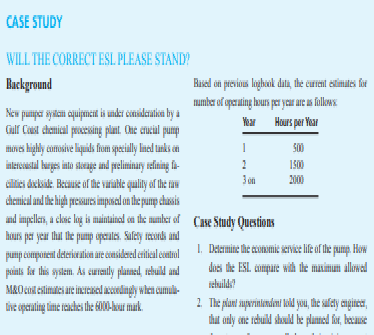

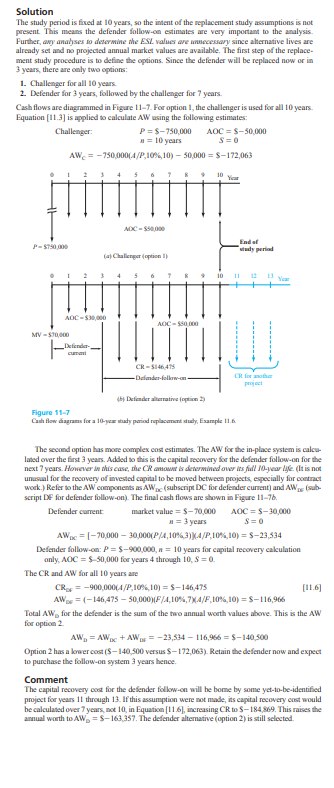

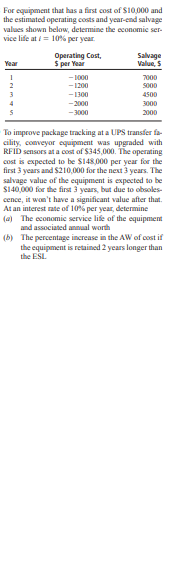

Keep or Replace the Kiln Case PE In Example 1 1.8, the in-place kiln and replacement killm (GH) were evaluated using a fixed study pe- riod of & years. This is a significantly shortened period compared to the expected 12-year life of the challenger. Use the best estimates available throughout this case to determine the impact on the capital recovery amount for the GH kiln of short- ening the evaluation time from 12 to 6 years. Nabisco Bakers currently employs staff to operate the equipment used to sterilize much of the mixing, baking, and packaging facilities in a large cookie and cracker manufacturing plant in lowa. The plant manager, who is dedicated to cutting costs but not sacrificing quality and hygiene, has the projected data shown in the table below if the current system were retained for up to its maximum expected life of 3 years. A contract company has proposed a turnkey sanitation system for $5 0 million per year if Nabisco signs on for 4 to 10 years, and $5.$ mil- ion per year for a shorter number of years. Retained AM, $ per Year Close.Down Expense, $ -3,000,000 -2,300,000 -2 500,000 -2,300,000 -2 000,000 -3,000,000 -1,000 00D -3,000,000 -1,000,000 -3 5001000 -500,000 (4) At a MARR = 8% per year, perform a re- placement study for the plant manager with fixed study period of 3 years, when it is an- ticipated that the plant will be shut down due to the age of the facility and projected tech- nological obsolescence. As you perform the study, take into account that regardless of the number of years that the current sanitation system is retained, a one-time close-downThe cost characteristics of a CO testing machine at Dytran Instruments are shown below. The cost of a new fester is $100,000. The equation for determin- ing the AW of keeping the tester for 2 years is: (a] AW = -100,1004/PAS) - [42,010(P/F,1) + 4700(P/F31 4/PS) +40,000(4/F,5) (8) AW = -100,000(4/P12) - [42000(P/F,1) + 47000(P/F12)](4/P13) + 4000(4/F 2) (C) AW = -100,000(4/242) - 47,000 () AW = -100,000(4/243) - 42,000 Machine Age, MBO Costs, Salvage Value Years $ per Year at End of Wear, $ -42,000 -47.0DO -49.000 31,000 -90,000 24,030 -52,000 15 030 -54,000 -63,000 -67,000CASE STUDY WILL THE CORRECT ESL PLEASE STAND? Background Based on previous logbook data, the current edimiles for number of operating hours per year are as follows New putiper ayala equipment is under consideration by a Gill Col chemical processing plant One crucial puny Hours per Year mines highly erosive liquids from specially lined tanks an SO Intercoastal barges into cleage and preliminary refining fa 1501 cilities docloude. Because of the variable quality of the raw chemical and the high pressures imposed on the pump chassis and impeller, a choc log to maintained on the number of Case Study Questions hours per year that the purtip operates. Safety records and pimp compareal deterioration are considered critical control I. Delermine the economic service life of the pump, How points for this salem. As curreally planned, rebuild and does the ESL compare with the maximumn allowed MRO call enlimited are increased accordingly when cumul cchuilder the operating time reaches the cook-hour mark. 1. The plant superintendent hold you, the safely anginca, that only one rebuild should be planned for, becauseSolution The study period is fixed at 10 years, so the intent of the replacement study assumptions is not present. This means the defender follow-on estimates are very important to the analysis. Further, any analyses to determine the ESL values are unnecessary since alternative lives are already set and no projected annual market values are available. The first step of the replace- ment study procedure is to define the options. Since the defender will be replaced now or in 3 years, there are only two options: 1. Challenger for all 10 years. 1. Defender for 3 years, followed by the challenger for 7 years. Cash flows are diagrammed in Figure 11-7. For option I, the challenger is used for all 10 years. Equation [1 1.3] is applied to calculate AW using the following estimates: Challenger: P =$-750,000 AOC = $-50,000 # = 10 years S=0 AW, = -750,000(4/P,10%,10) - 507000 = $-172,063 10 ADC - $56000 End of study period fat Challenger |option IF 11 Year AOC -30 0U _Defender- current CR - 5146475 -Defender-fallow-an 4hy Defender alternative [option ?) Figure 11-7 Cash flow diagrams for a 10-year mudy period replacement study, Example II.6. The second option has more complex cost estimates. The AW for the in-place system is calcu- lated over the first 3 years. Added to this is the capital recovery for the defender follow-on for the next 7 years. However is this case, the CR amown is determined over its full 10-year Me. (It is not unusual for the recovery of invested capital to be moved between projects, especially for contract work.) Refer to the AW components as AWp (subscript DC for defender current) and AW (sub- script DF for defender follow-on). The final cash flows are shown in Figure 11-76. Defender current market value = $-70,000 AOC =$-30,000 a =3 years AWac = [-70,000 - 30,000(P/4, 10%,3) (4/P.10%,10) = $-23,534 Defender follow-on: P = $-900,000, a = 10 years for capital recovery calculation only, AOC = $-50,000 for years 4 through 10, 8 = 0. The CR and AW for all 10 years are CROF = -900,00014/P,10%%,101 = $-146,475 [11.6] AWDE =(-146,475 - 50,000)(F/4,10%,7)(4/F,10%,10) = $-116,966 Total AW, for the defender is the sum of the two annual worth values above. This is the AW for option 2 AW = AWac + AW = -23,534 - 116,956 =$-140,500 Option 2 has a lower cost ($-140,300 versus $-172,063). Retain the defender now and expect to purchase the follow-on system 3 years hence. Comment The capital recovery cost for the defender follow-on will be home by some yet-to-be-identified project for years 10 through 13. If this assumption were not made, its capital recovery cost would be calculated over 7 years, not 10, in Equation [1 1 6], increasing CR to $-184,869. This raises the annual worth to AW,, = $-163,357. The defender alternative (option 2) is still selected.For equipment that has a first cost of $10 000 and the estimated operating costs and year-end salvage values shown below, determine the economic ser- vice life at f = 10% per year Operating Cost, Salvage Year $ per Year Value, $ - 1030 7000 - 1700 5000 - 1300 4500 -2000 3000 2000 To improve package tracking at a UPS transfer fa- cility, conveyor equipment was upgraded with RFID sensors at a cost of $345,000. The operating cost is expected to be $148 000 per year for the first 3 years and $210,000 for the next 3 years. The salvage value of the equipment is expected to be $140,000 for the first 3 years, but due to obsoles- cence, it won't have a significant value after that. At an interest rate of 10% per year, determine (al The economic service life of the equipment and associated annual worth (b) The percentage increase in the AW of cost if the equipment is retained 2 years longer than the ESL