Answer these

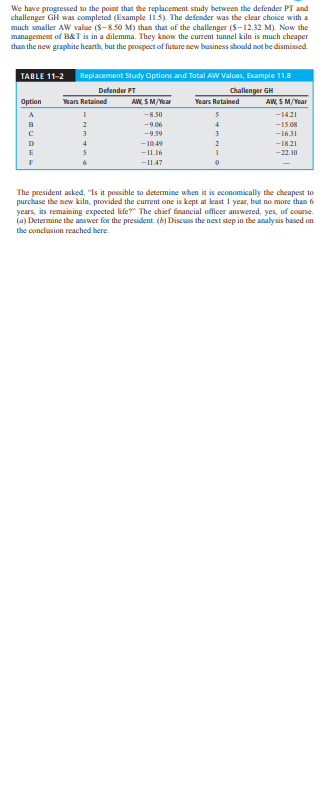

Keep or Replace the Kiln Case PE In Example 1 1.8, the in-place kiln and replacement killm (GH) were evaluated using a fixed study pe- riod of & years. This is a significantly shortened period compared to the expected 12-year life of the challenger. Use the best estimates available throughout this case to determine the impact on the capital recovery amount for the GH kiln of short- ening the evaluation time from 12 to 6 years. Nabisco Bakers currently employs staff to operate the equipment used to sterilize much of the mixing, baking, and packaging facilities in a large cookie and cracker manufacturing plant in lowa. The plant manager, who is dedicated to cutting costs but not sacrificing quality and hygiene, has the projected data shown in the table below if the current system were retained for up to its maximum expected life of 3 years. A contract company has proposed a turnkey sanitation system for $5 0 million per year if Nabisco signs on for 4 to 10 years, and $5.$ mil- ion per year for a shorter number of years. Retained AM, $ per Year Close.Down Expense, $ -3,000,000 -2,300,000 -2 500,000 -2,300,000 -2 000,000 -3,000,000 -1,000 00D -3,000,000 -1,000,000 -3 5001000 -500,000 (4) At a MARR = 8% per year, perform a re- placement study for the plant manager with fixed study period of 3 years, when it is an- ticipated that the plant will be shut down due to the age of the facility and projected tech- nological obsolescence. As you perform the study, take into account that regardless of the number of years that the current sanitation system is retained, a one-time close-downDetermine the breakeven point for each plant. Estimate the minimum revenue per hundredweight required for next year if breakeven values and variable costs remain constant, but fixed costs increase by 10%% During this year, the French plant sold 950 units in Europe, and the U.S. plant sold $50 units. Deter- mine the year's profit (loss) for each plant. Hambry's president has a goal of $1 million profit next year at each plant with no revenue or fixed most increases Determine the decreases in dollar amounts and percewages in variable cost neces- sary to meet this goal, if the wamber of units sold is the same as this year.We have progressed to the point that the replacement study between the defender PT and challenger GH was completed (Example 11.$). The defender was the clear choice with a much smaller AW value ($-8 50 M) than that of the challenger ($-12.32 M). Now the management of B&T is in a dilemma. They know the current tunnel kiln is much cheaper than the new graphite hearth, but the prospect of future new business should not be dismissed. TABLE 11-2 Replacement Study Options and Total AW Values, Example 11.8 Defender FT Challenger GH Option Wears Retained AW, 5 M/Year Years Retained AW, 5 M/Year A -8.50 S -14.21 W N -1.06 -15.08 -9 59 1691- -10.49 -18.21 -II.16 -22.10 -11.47 The president asked, "Is it possible to determine when it is economically the cheapest to purchase the new kiln, provided the current one is kept at least I year, but no more than & years, its remaining expected life?" The chief financial officer answered, yes, of course. (a) Determine the answer for the president. (bj Discuss the next step in the analysis based on the conclusion reached here.\f\f