Answer these Questions

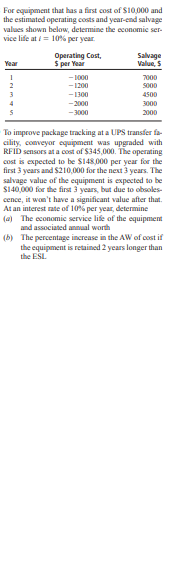

A pulp and paper company is evaluating whether it should retain the current bleaching process that uses chlorine dioxide or replace it with a proprie- tary "oxypure" process. The relevant information for each process is shown, Use an interest rate of 13% per year to perform the replacement study Current Process Oxypure Process Original cost 6 -450,000 years ago, 5 Investment cost -700,00D now, $ Current market 35 000 value, $ Annual operating - INI,OOD -7070OD Sahage value, $ 50,DOD Remaining life, YearsAn industrial engineer at a fiber-optic manufacture ing company is considering two robots to reduce costs in a production line. Robot X will have a first cost of $82,000, an annus and opera- tion (M.&Oj cost of $30,000, and salvage values of $50,000, $42,000, and $35,000 after 1, 2, and years, respectively. Robot Y will have a first cost of $97,000, an annual M&( cost of $27,000, and salvage values of $60,000, $51,000, and $42,000 after 1, 2, and 3 years, respectively. Which robot should be selected if a 2-year study period is speci- fied at an interest rate of 15% per year and replace- ment after I ye an option? A 3-year-old machine purchased for $140,000 is not able to meet today's market demands. The machine can be upgraded wow for $70,000 or sold to a sub- contracting company for $40,000. The current ma- chine will have an annual operating cost of $85,000 per year and a $30,000 salvage value in 3 years. If upgraded, the presently owned machine will be re- taimed for only 3 more years, then replaced with a machine to be used in the man facture of several other product lines. Th which will serve the company now and for at least years, will cost $220,000. Its salvage value will be $50 000 for years I through 4: $20,000 after 5 years; and $10,000 thereafter. It will have an estimated op- erating cost of $65,000 per year. You want to per- form an economic analysis at 15%% per year using a 3-year planning horizon. a) Should the company replace the presently owned machine now, or do it 3 years from now? [bj Compare the capital recovery requirements for the replacement machine (challenger) over the study period and an expected life of 8 years.\fFor equipment that has a first cost of $10 000 and the estimated operating costs and year-end salvage values shown below, determine the economic ser- vice life at f = 10% per year Operating Cost, Salvage Year $ per Year Value, $ - 1030 7000 - 1700 5000 - 1300 4500 -2000 3000 2000 To improve package tracking at a UPS transfer fa- cility, conveyor equipment was upgraded with RFID sensors at a cost of $345,000. The operating cost is expected to be $148 000 per year for the first 3 years and $210,000 for the next 3 years. The salvage value of the equipment is expected to be $140,000 for the first 3 years, but due to obsoles- cence, it won't have a significant value after that. At an interest rate of 10% per year, determine (al The economic service life of the equipment and associated annual worth (b) The percentage increase in the AW of cost if the equipment is retained 2 years longer than the ESL\f