Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer these questions please, it is from derivative module 7. In a one stage binomial tree, using CRR assumptions, what is the risk neutral probability,

answer these questions please, it is from derivative module

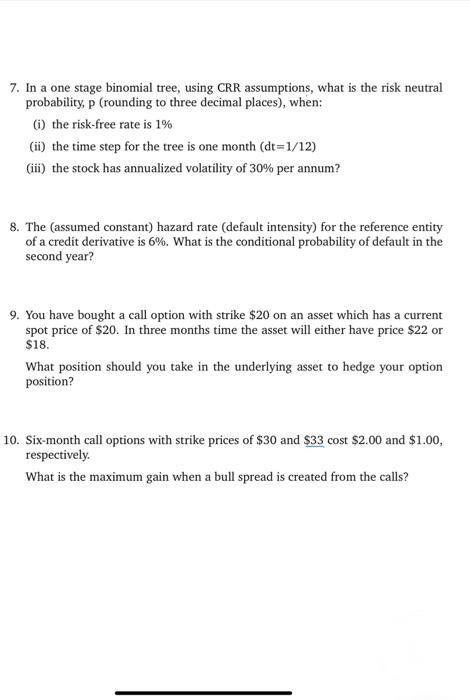

7. In a one stage binomial tree, using CRR assumptions, what is the risk neutral probability, p (rounding to three decimal places), when: (i) the risk-free rate is 1% (ii) the time step for the tree is one month ( dt=1/12) (iii) the stock has annualized volatility of 30% per annum? 8. The (assumed constant) hazard rate (default intensity) for the reference entity of a credit derivative is 6%. What is the conditional probability of default in the second year? 9. You have bought a call option with strike $20 on an asset which has a current spot price of $20. In three months time the asset will either have price $22 or $18. What position should you take in the underlying asset to hedge your option position? 10. Six-month call options with strike prices of $30 and $33 cost $2.00 and $1.00, respectively. What is the maximum gain when a bull spread is created from the calls

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started